Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

Ethereum recently found a bullish base, climbing $ 1847 after dropped below $ 1,750 towards the end of April. This rebound follows a period of volatility, the price movements fluctuating between $ 1,740 and $ 1,847 in the last seven days.

Related reading

In the midst of uncertainties In the wider crypto market, Ethereum’s ability to recover higher terrain seems Align with investor behavior changeIn particular on centralized exchanges, where a notable number of ether has been removed in the last seven days.

$ 380 million in ethics from exchanges as the accumulation trend increases

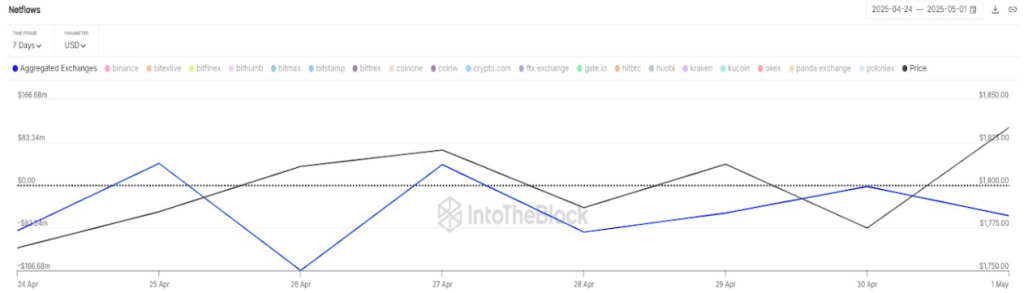

According to In IntotheblockLast week saw more than $ 380 million from Ethereum withdrawn centralized trading platforms. This net outing shows an increasing wave of accumulation among cryptographic investors. These investors move their assets in self-works, which is often a sign of long-term conviction.

The table of data that accompanies it underlines this momentum, highlighting five consecutive days of negative Netflows exchanges on aggregated platforms covering 19 exchanges of crypto.

In particular, the last time that these exchanges saw a positive influx of Ethereum was on April 27, with $ 50 million from ETH. Interestingly, barely 24 hours earlier, these aggregated scholarships experienced a negative value of 166.68 million flows of Ethereum. Such dynamics of exchange flows bringing the idea that Ethereum investors can be Prepare for a rally.

The major exchange outputs are known to precede the notable optimistic advances, and the current of behavior reflects the action of previous prices where the decrease in exchange sales acted as a precursor for sustained rallies. In particular, the current trend of withdrawal coincides with the Ethereum price which pushes Back above the $ 1,800 bar.

Image of X: Intotheblock

Crucial Ethereum support area at $ 1,770

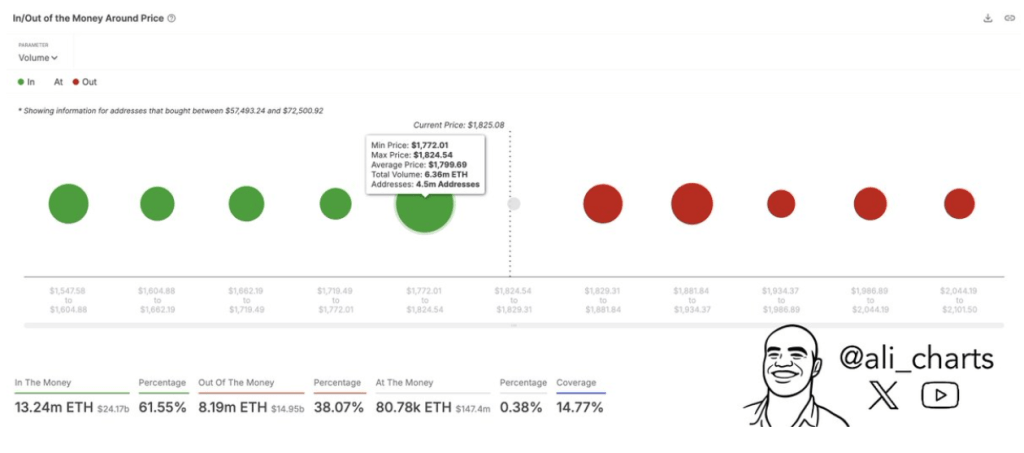

The current accumulation is also supported by Crypto Analyst Ali Martinez, who recently underlined a level of crucial Ethereum support. According to Martinez, the region of $ 1,770 is currently the most significant level for Ethereum in the short term, citing the data of the model “in / out of the money around the price” of intotheblock.

The in / out model of the silver model around prices shows a high concentration of portfolios (around 4.5 million addresses) having acquired 6.36 million ETH between $ 1,772 and $ 1,824. These holders are now “in money” after Ethereum’s return to $ 1,845, which makes this area a psychological bastion.

The involvement of this support area is clear. If Ethereum is supported above this request cluster, the probability of more ascending movement increases. However, any retraction less than $ 1,770 could invalidate the current upward structure and expose Ethereum to volatility downwards.

Image of X: @ali_charts

For the moment, the net flows of the exchanges indicate that Ethereum could be able to hold the ground To this level of $ 1,770. Less Ethereum available on exchanges, less the sale pressure. On the other hand, the next resistance group to be reached in the short term is $ 1,881.

Related reading

At the time of writing this document, Ethereum is negotiated at $ 1,845, up 1% in the last 24 hours.

Felash star image, tradingView graphic