The data on the chain show that Ethereum’s offer on the scholarships plunged to a new hollow of all time, investors, investors continued to remove the ETH.

Ethereum Supply on Bchanges continued its recently reduced trend

In a new article on X, the Santiment Channel Analysis Society discussed the latest tendency of supply on exchanges against Ethereum. The supply of exchange “refers to an indicator which measures, as its name already suggests, the percentage of the total supply of ETH which is currently in the portfolios attached to centralized exchanges.

When the value of this metric increases, this means that investors exceed a net number of tokens to these platforms. As one of the main reasons why holders can transfer their parts to exchanges is for purposes linked to sale, this type of trend can have a lower impact on the price of the room.

On the other hand, the lowering indicator implies that the diet leaves the exchanges. Generally, investors remove their parts from self-cuscuse portfolios when they plan to hold them in the long term, so that such a trend can be optimistic for cryptocurrency.

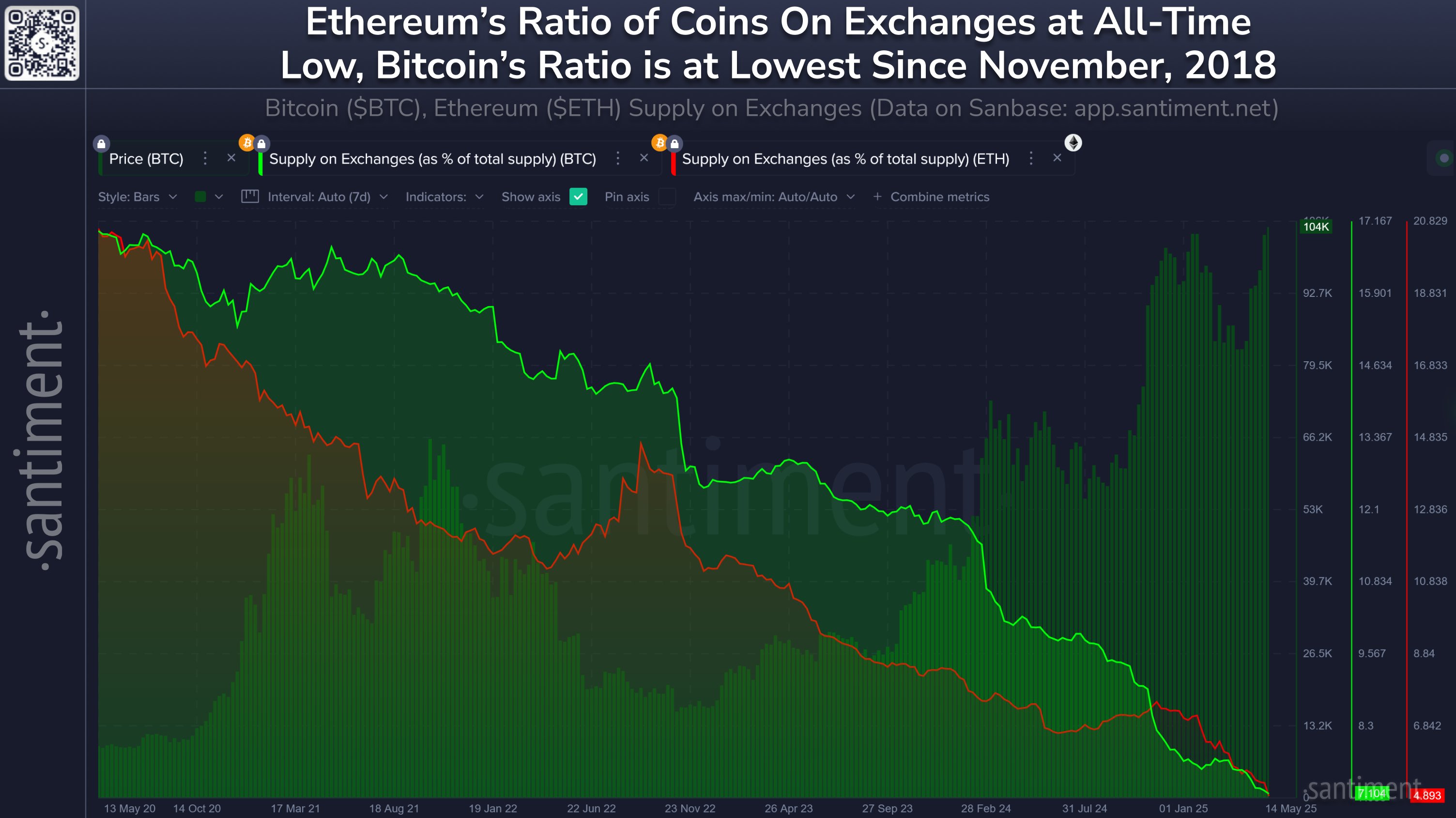

Now here is the graph shared by the analytical company which shows the tendency of supply on exchanges against Ethereum in recent years:

The value of the metric appears to have been following a downward trajectory for a while now | Source: Santiment on X

As displayed in the above graph, the Ethereum offer on exchanges has shown a long-term trend, but there have been periods of temporary deviation.

Such a phase occurred at the time of the bull towards the end of 2024, a potential sign that certain investors decided to leave the ETH during the profitable opportunity.

During the months following the peak, however, the indicator returned to the downward trajectory, suggesting that the holders resumed their accumulation. Today, metric is located at 4.9%, which is the lowest value ever recorded.

In the same graph, Santiment has also attached food data on Bitcoin exchanges. It would seem that the number one cryptocurrency has also experienced a trend in net outings in recent years and unlike ETH, there have been no notable deviation instances.

Over the past five years, investors have withdrawn 1.7 million BTCs from trade. This drop brought the value of metric to 7.1%, which has been the lowest since November 2018. During the same period, ETH holders withdrew 15.3 million token from these platforms.

Something to keep in mind is that if the exchanges played a central role on the market years ago, this is no longer strictly the case. The emergence of the funds negotiated on the stock market (ETF) means that there is now another major gateway in the sector, so that exchange outings may no longer have the same impact as before.

Ethn price

At the time of writing the editorial staff, Ethereum floats around $ 2,500, down more than 2% last week.

Looks like the price of the coin hasn't moved much recently | Source: ETHUSDT on TradingView

Dall-e star image, Santiment.net, TradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.