Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

Ethereum finally crossed a level of key resistance, trading above $ 1,900 after exceeding the longtime barrier of $ 1,850. This decision marks the start of an escape that many hoped – but few people should arrive so early. After weeks of hesitation, bearish pressure and uncertain dynamics, the ETH shows renewed force, as is the broader market feeling begins to change.

Related reading

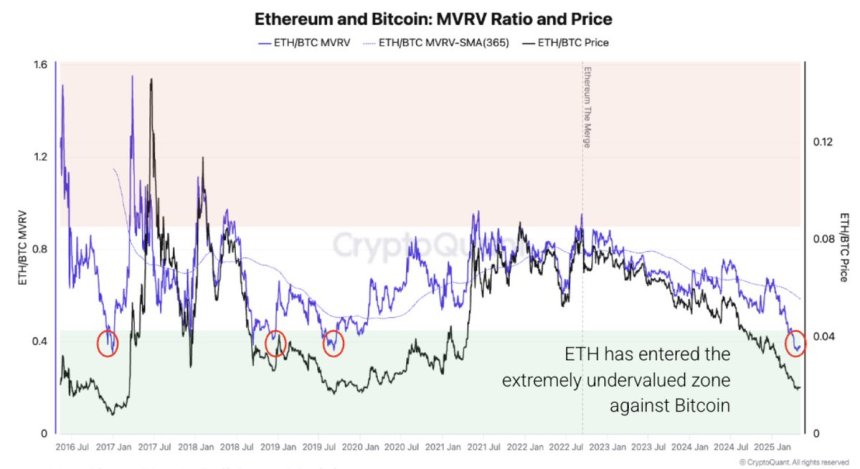

By adding weight to break, new cryptocurrencies reveal that Ethereum is now extremely undervalued compared to Bitcoin, the first time since 2019. Historically, such levels of ETH / BTC undervaluation preceded periods of high overpection of Ethereum. While the price action opens the way, data on the chain strengthen the bullish case, indicating that ETH can enter a favorable phase in its cycle.

This renewed advantage occurs in the middle of weak expectations and the large skepticism, which makes it even more impactful. While the ETH is negotiated over $ 1,900, traders and investors watch closely for the follow-up and potential continuation around $ 2,000 and beyond. If history is a guide, the recent move of Ethereum is perhaps not only a short -term peak – it could be the beginning of a more important trend reversal, especially since the ETH / BTC evaluation gap begins to close.

Ethereum flirts with $ 2,000 as a spark sub-assessment of Haussiers hopes

Ethereum is now approaching the critical bar of $ 2,000, a level which, if it were recovered and maintained, would confirm a technical break and potentially inaugurate a wider bullish phase. After weeks of slow movement and down pressure, the ETH grows and shows signs of force both for prices and chain measures. A fence greater than $ 2,000 would mark a major change of feeling, reporting renewed confidence among investors and merchants.

However, risks remain. The current tensions between the United States and China continue to inject uncertainty into the world markets, and the American federal reserve has shown no signs of pivot. Interest rates that should remain high and quantitative tightening (QT) still in force, the macroeconomic backdrop remains a headwind. If these geopolitical and monetary factors facilitate ease, the rupture of Ethereum could gain a sustained traction.

According to Cryptochant, the Ethereum-Bitcoin MVRV report (market value / value achieved) emphasizes that ETH is now extremely undervalued compared to the BTC-the first time that has happened since 2019. Historically, such conditions have led to strong periods of overput Ethereum.

However, the upward configuration faces an internal friction. Pressure of supply, weak demand on the chain and flat network activity could stall the momentum if the feeling of the market does not improve more. Although Ethereum’s current thrust is encouraging, confirmation will only make movements supported above the resistance and stronger fundamentals. Until then, the ETH remains at a critical moment, with the potential to direct the following leg of the cryptographic rally or to go up in consolidation if the external and internal pressures persist.

Related reading

ETH price analysis: technical details

Ethereum is negotiated at $ 1,933 after a strong escape above the resistance zone of $ 1,900, marking its highest level since early April. On the 4 -hour table, ETH went from around $ 1850 with an increased volume, breaking a consolidation range of several weeks. This decision confirms the bullish momentum and clearly puts the psychological level of $ 2,000 in sight.

The escape is also supported by the price now trendy well above the EMA of 200 periods ($ 1,791) and the SMA of 200 periods ($ 1,700). These long -term mobile averages had previously acted as resistance but have now been returned to a potential dynamic support. The strength of this gathering indicates a renewal of the purchase interest and a potential change in the feeling of the market.

However, the next challenge lies in maintaining this ascending dynamic. Ethereum must keep above the level of $ 1,900 to $ 1,920 to avoid a false and confirm this escape as durable. A clear push through $ 2,000 would validate the upward structure more and open the door to higher targets.

Related reading

Overall, the graph reflects a decisive technical break, supported by volume and structure. If the bulls remain in control and the macro-conditions remain stable, the ETH could prepare for a continuation of stronger trend in the days to come.

Dall-e star image, tradingview graphic