Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

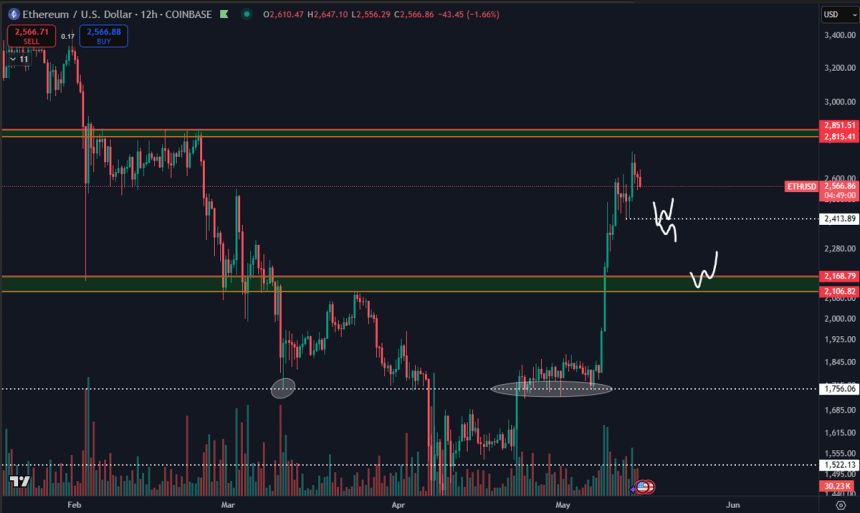

After several days of intense purchase pressure and strong bullish dynamics, Ethereum finally interrupted his rally, finding resistance around the $ 2,740 bar. This decision comes after ETH erased the key resistance levels without $ 2,000 and $ 2,200, marking one of its highest short -term performance for months. While excitement accumulates on the wider cryptography market, Ethereum’s next decision could define the strength and sustainability of this escape.

Related reading

The price is now blocked, analysts believe that a consolidation period is likely – and perhaps even necessary – before the next higher leg. The best analyst Daan shared a technical view suggesting that the level of $ 2,400 will be crucial in the coming days. He believes that it is logical to retest this local support, which would provide a healthier structure for more upwards.

However, Daan also notes a warning signal: extremely high levels of interest open in the ETH derivative market. It currently avoids long positions until part of this lever effect is eliminated, reducing the risk of a clearer decline. For the moment, Ethereum bulls must maintain more than $ 2,400 to confirm the force and maintain the intact rise trend, while traders expect cleaner conditions for a potential return.

Ethereum’s overvoltage faces a crucial retain around $ 2.4,000

Ethereum has increased by more than 50% since last week, recovering momentum after months of high sales pressure. ETH shows a strong force for the first time since the end of December, fueling the optimism that the wider Altcoin market could be the next. Many analysts are calling for a season in allus, and the rupture of Ethereum is considered to be a potential catalyst for a wider movement through the altcoins which have seriously underperformed in recent years.

However, after such a clear decision, a period of consolidation or correction would not be unusual and could even be healthy. According to Daan, the level of $ 2,400 will be a key support area to monitor. He thinks it is logical that Price tests this area before continuing the pursuit. DAAN is currently having no interest in grasping long positions until some of the billions of open interests are rinsed from the system. How Ethereum reacts around $ 2.4,000 to probably set the tone in the next phase.

If ETH sweeps $ 2.4,000 and bounces quickly, Daan expects a local range to train between $ 2.4,000 and $ 2.7,000. However, if the price decisively loses this level, the next major support is at $ 2.1,000. Slow bleeding in this area could point out a weakness, while a rapid flush could have a short -term purchase opportunity.

Despite short -term risks, Daan notes that even a decline at $ 2.1,000 would still leave ETH to around 20% compared to the previous week. In his opinion, the largest commercial range for the moment is between $ 2.1,000 and $ 2.8,000 – an area that could define the next major trend in Ethereum if the bulls can hold key levels and resume impetus. For the moment, the rally is alive, but the next test will be critical.

Related reading

Price consolidation takes place in the middle of optimism

Ethereum (ETH) is currently negotiated at around $ 2,565, following a clear break in its recent local summit nearly $ 2,740. After a powerful rally that pushed ETH above both the 200-day exponential mobile average (EMA) and the simple mobile average (SMA), the price is now consolidated just below the SMA from 200 days to $ 2,702.93. This level acted as a resistance in the last sessions, capping Ethereum’s attempt to continue its momentum upwards.

The volume has slightly decreased, reflecting market indecision after last week rupture. If the bulls can defend EMA of 200 days almost $ 2437 and maintain hollows higher than $ 2,500, the structure would remain optimistic. However, a failure to hold these levels could lead to a deeper decline, with $ 2,400 and $ 2,200 as potential supports.

The recent price action suggests that Ethereum constitutes a short-term range between $ 2,400 and $ 2,700, which could persist up to a clear eruption above the 200-day SMA. Holding above $ 2,500 is crucial to maintain bullish momentum, especially since the eyes of the Altcoin market win.

Related reading

If the ETH can push over $ 2,700 with a strong volume, it would confirm a renewed force and open the path to the resistance zone from $ 3,000 to $ 3,100. Until then, consolidation and prudence dominate the short-term perspectives.

Dall-e star image, tradingview graphic

(Tagstotranslate) ETH (T) Ethereum (T) Ethereum Analysis (T) Ethereum Breakout (T) Ethereum News (T) Ethereum Prix (T) Ethereum Price Analysis (T) Ethereum Retest (T) Ethusdt

Source link