Join our Telegram Channel to stay up to date on the coverage of information on the breakup

Ethereum’s validator’s output queue has jumped over 890K ETH worth $ 4 billion, which raises concerns about potential sales pressure.

According to data From Validatorqueue, there are 893,599 ETH waiting to have died at 1 h 07 hne. The price of the ETH located at $ 4,488.22, the dollars value of these tokens totals more than $ 4.01 billion.

The mounting backwards, associated with whales, suggests that the market could face additional sales pressure while withdrawals are not gradually clear.

More than 2 weeks for the queue queue of the Ethereum validator to erase

Jalling is the process where the Crypto holders lock their tokens to secure a blockchain, in particular the networks which use the consensus mechanism of proof of bet (POS). However, these network participants can unlock their tokens at any time.

The tokens are generally unlocked in times of uncertainty on the market.

The Ethereum network limits the quantity of ETH which can be unlocked at any time to ensure the stability of the network and prevent the outings of mass validator which could disrupt the consensus of the blockchain.

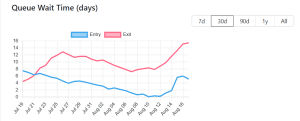

During the last month, there was a peak in the quantity of ETH pending in the queue of the Validator exit, pushing the total waiting times at around 15 days and 11 hours.

This wave saw the amount of ETH while waiting to be devoid of 255,584 ETH on July 19 at its current levels. He hit 743,989 ETH on July 25, before entering a downward trend until August 7, when he reached 417,461 ETH.

The number of queues of the exit of exit and Ethereum entry in the past month (source: validator))

Since then, the quantity of ETH in the queue queue of the Ethereum validator has turned again.

It was then that the price of the leader of Altcoin went to a striking distance from the ATH of $ 4,891.70, it set itself on November 16, 2021. Although it seemed that the ETH community would finally celebrate a new record, the hopes of traders were destroyed when the larger cryptography market would undergo a strong record.

As a result, the ETH is now more than 8% of its 2021 peak.

The timing creates a problematic dynamic: while the validators who came out during the ETH rally remains locked up, the order book suggests that billions of Eth could be regularly released in the coming weeks. Coupled with whales that are already selling, this increases the pressure potential of the sustained market as the queue.

Whales are retreating, including the ETH ICO participant

While the validators are waiting for the exit queue to depart, the whales began to sell their assets in the Altcoin, even if it causes a loss.

According to data on the Arkham Intelligence channel cited by Lookonchain, such an important investor whose address begins with “0x2ac9” exchanged 4,242.4 marked Ethereum (STETH) for 4,231 ETH worth $ 18.74 million.

A total of 893,599 $ ETh(3.96 billion dollars) is in queue for disconnection.

But the whale 0x2ac9 could not wait – it exchanged 4,242.4 $ Steth For 4,231 $ ETh ($ 18.74 million) directly and the deposit #Kraken Sell, take a loss of 11.4 $ ETh($ 50.5,000). pic.twitter.com/ggby1obo60

– Lookonchain (@lookonchain) August 17, 2025

This ETH was then transferred to the Crypto Exchange, Kraken, and sold, resulting in a loss of 11.4 ETH, or about $ 50.5,000.

Not all whales are selling at a loss. A large investor who bought during ICO ETH has achieved a profit of more than $ 1.4 million since their early adoption.

According to an anterior X job By Lookonchain, the ICO participant “0x61b9” transferred all of his 334.7 million Eth after more than 10 years of dormancy.

“He only invested $ 104 in ICO and received $ 334.7 from ETH – worth $ 1.48 million, a return of 14,269x,” noted Lookonchain in the position.

Related items:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup