Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

Ethereum is now trading at a central stadium after days of constant sales pressure that has lowered the price by more than 12% since last Tuesday. Currently oscillating around the brand of $ 2,400, ETH has trouble maintaining bullish momentum, and many analysts warn that a deeper correction could follow if the bulls do not defend this crucial support area. The recent decrease reflects a broader uncertainty of the market, with an increase in the confidence of investors shaking just like the ETH seemed ready to join a broader escape from Altcoin.

Related reading

Despite this weakness, there is growing optimism in certain corners of the market. The best TED analysts shared a technical analysis showing that a golden cross was confirmed on the table of 12 hours of Ethereum – a signal traditionally considered as a precursor of major bull movements. This crossing, which occurs when the mobile average of 50 periods crosses the mobile average of 200 periods, often marks the start of an extended rise.

If the bulls manage to maintain the current levels and recover a higher resistance almost $ 2,600, the golden cross could become a turning point. Until then, the next few days will be essential to determine if Ethereum can rebound or sink into a longer consolidation phase.

Volatility hits Ethereum in the middle of the golden cross signal

Ethereum experienced strong volatility over the weekend, exceeding $ 2,550 before reversing quickly and falling back into the $ 2,400 area in a few hours. This sudden decision has aroused renewed uncertainty, while analysts become cautious about the bullish discoloration and the increase in sales pressure. While ETH remains one of the strongest artists on the wider Altcoin market, it is still down 36% compared to its December summit of around $ 4,100. This leaves the bulls with a clear challenge: maintain the current levels and regain control by pushing the prices above $ 2,800 to light a sustained rally.

The level of $ 2,400 is now acting as a critical support zone. A break below could trigger a deeper retirement, probably causing Ethereum in a consolidation range or even towards lower support levels. However, the technical signals offer a glimmer of hope.

According to pillows, Ethereum recently confirmed a golden cross on the 12 -hour table – a bullish scheme that occurs when the mobile average of 50 periods crosses the mobile average of 200 periods. Historically, these signals have preceded solid upward movements, and Pillow thinks that it could open the way to Ethereum to reach $ 3,000 in the short term.

However, for this to happen, buyers must intervene decisively. The volume has decreased and the feeling seems fragile after last week rupture. If the bulls can defend the region of $ 2,400 and quickly recover higher resistance, the golden cross could mark the start of the next stage of Ethereum. Until then, the market remains in moderate mode, looking at if the Haussier signal can prevail over the growing pressure of the sellers.

Related reading

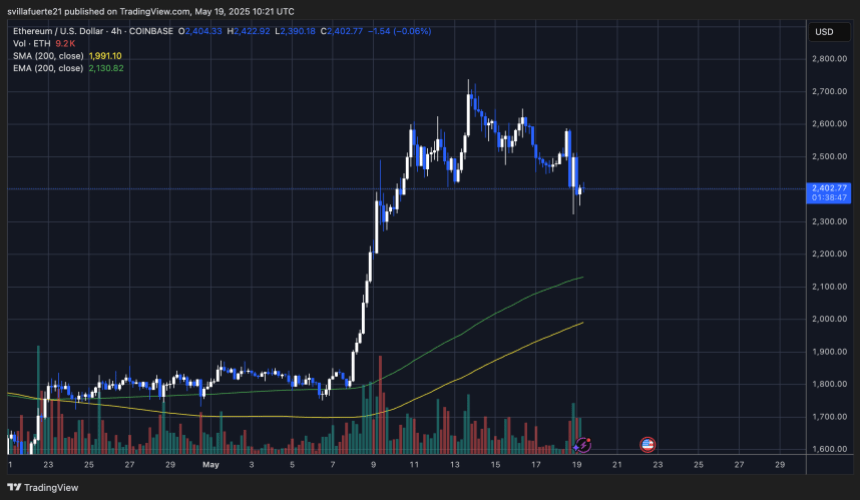

ETH tests key support after falling local summits

Ethereum is negotiated at $ 2,402 after a net Sunday sale, where the price increased to $ 2,670 before trace more than 10% in less than 24 hours. As the 4-hour table shows, the ETH is now consolidated just above the $ 2,390 zone at $ 2,400, a level that turns out to be critical for the bulls to hold. This area coincides with a previous consolidation area and could act as a short -term support base.

The EMA of 200 periods on the 4h graph is currently $ 2,130, and the 200 SMA is close to $ 1,991 – the two are significantly lower from the current price and offer long -term support on trends. However, the volume profile shows an activity peak on the sale during the decline, which suggests that short -term traders lock the profits. If the price is broken down below $ 2,390, a deeper retirement to the range of $ 2,200 to $ 2,300 becomes likely.

Related reading

Uplining, ETH must recover $ 2,550 to restore momentum. Not doing it could confirm a local high. Price action is clearly undecided, and this structure linked to the beach could persist unless the bulls reaffirm strength with a decisive movement above $ 2,600. Until then, the level of $ 2,400 remains a battlefield between buyers and sellers in the midst of high volatility.

Dall-e star image, tradingview graphic

(Tagstotranslate) Eth (T) Ethereum (T) Ethereum Analysis (T) Ethereum Golden Cross (T) Ethereum News (T) Ethereum Price Analysis (T) Ethereum Technical Charts (T) Ethusdt

Source link