Main to remember

- The Ethereum Foundation allocated 45,000 ETH worth around $ 120 million in four DEFI protocols.

- Vitalik Buterin remains the only decision -maker during the Ethereum Foundation restructuring process.

Share this article

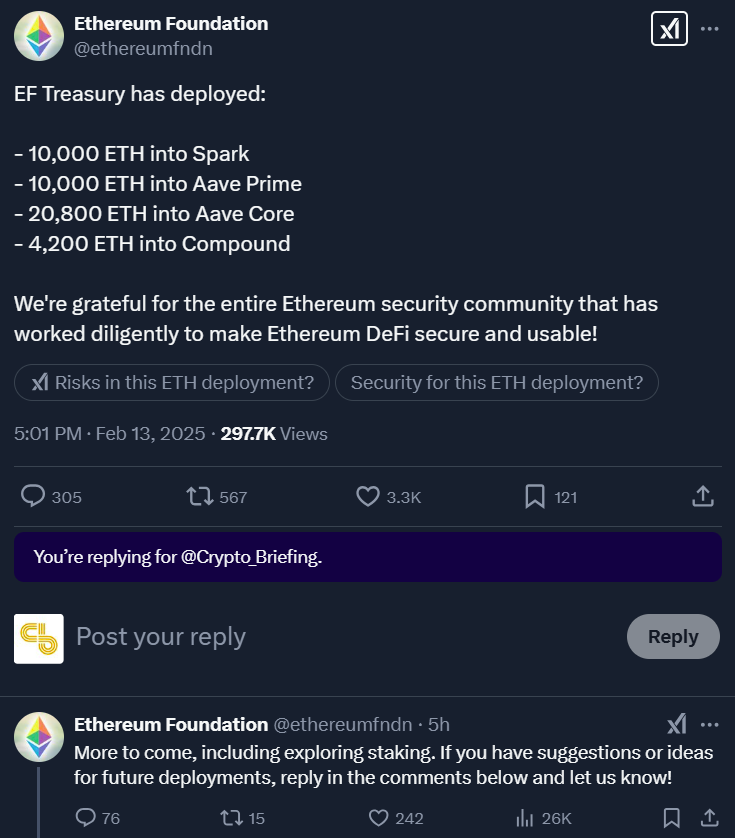

The Ethereum Foundation suggested the exploration of the implementation after having deposited 45,000 ETH in several DEFI protocols.

On Thursday, the Foundation distributed around $ 120 million ETH on four main DEFI platforms, Aave Core receiving the largest share at 20,800 ETH. The entity also sent 10,000 ETH to Spark and Aave each, and 4,200 ETH to compose.

EF’s commitment with DEFI follows an intense decline in the cryptographic community concerning their frequent ETH sales for operational costs and the lack of involvement of ecosystems. The members of the community had previously urged the Foundation to consider harming its ashs in ETH or to participate in the DEFI ecosystem for financial management.

Responding to criticism, Vitalik Buterin explained that the EF had indeed examined these options.

However, Buterin noted that maintaining neutrality during the controversial rigorous forks remains a key challenge. The clearing would intrinsically align the EF with a side of a fork, compromising this neutrality. The co-founder of Ethereum also rejected suggestions for managing forks or shifts, citing the reduction mechanism and the limited and impractical withdrawal rate.

In short, after the debate surrounding the management of the Treasury of the EF, Hsiao-wei Wang, a key member of the EF research team, announced that the EF had created a certain number of multisig portfolios and allocated to 50,000 ETH to these wallets.

Ethereum Foundation’s Treasury Update

The Ethereum Foundation (@ethereumfndn) has set up a new @on Multi-5 portfolio on 5.

The portfolio address is 0x9fc3dc011b461664c835f2527ffb1169b3c213e

A PO has been initiated to send 50,000 ETH, but be patient; Due to signature delays, etc. pic.twitter.com/sikalh8rof

– hww.eth (@icebearhww) January 20, 2025

The cryptographic community reacted positively to Thursday’s allowance, calling it to make a big blow of the EF.

This is the path. EF makes great movements. Aave as a modular infrastructure and spark liquidity layer can provide the management of advanced liquidity for the EF treasure.

Defi will win.

– Stani.eth (@stanikulechov) February 13, 2025

30,800 ETH deployed by the Ethereum Foundation in Aave.

The largest DEFI allowance by EF.

Defi will win.

– Stani.eth (@stanikulechov) February 13, 2025

They deployed:

– 10,000 ETH in Aave with a different logo

– 10,000 ETH in Aave

– 20,800 ETH in AaveThe rest for diversity.

Just use Aave.

– Marc “Billy” Zeller 👻 🦇🔊 🦇🔊 🦇🔊 🦇🔊 🦇🔊 🦇🔊 🦇🔊 (@lemiscate) February 13, 2025

A few years late but happy that these noobs finally determined how to use DEFI. The number one USP that has done Ethereum what it is today, and why in the long term I see the chain win on the adoption of smart contracts in the wider world of finance.

– alξx (@crosschainaplex) February 13, 2025

In addition to the management of the Treasury, the EF was also faced with internal pressures concerning its leadership management.

Buterin said he would maintain the only decision -making authority on the EF until the organization ends its restructuring process to establish appropriate leadership.

Share this article