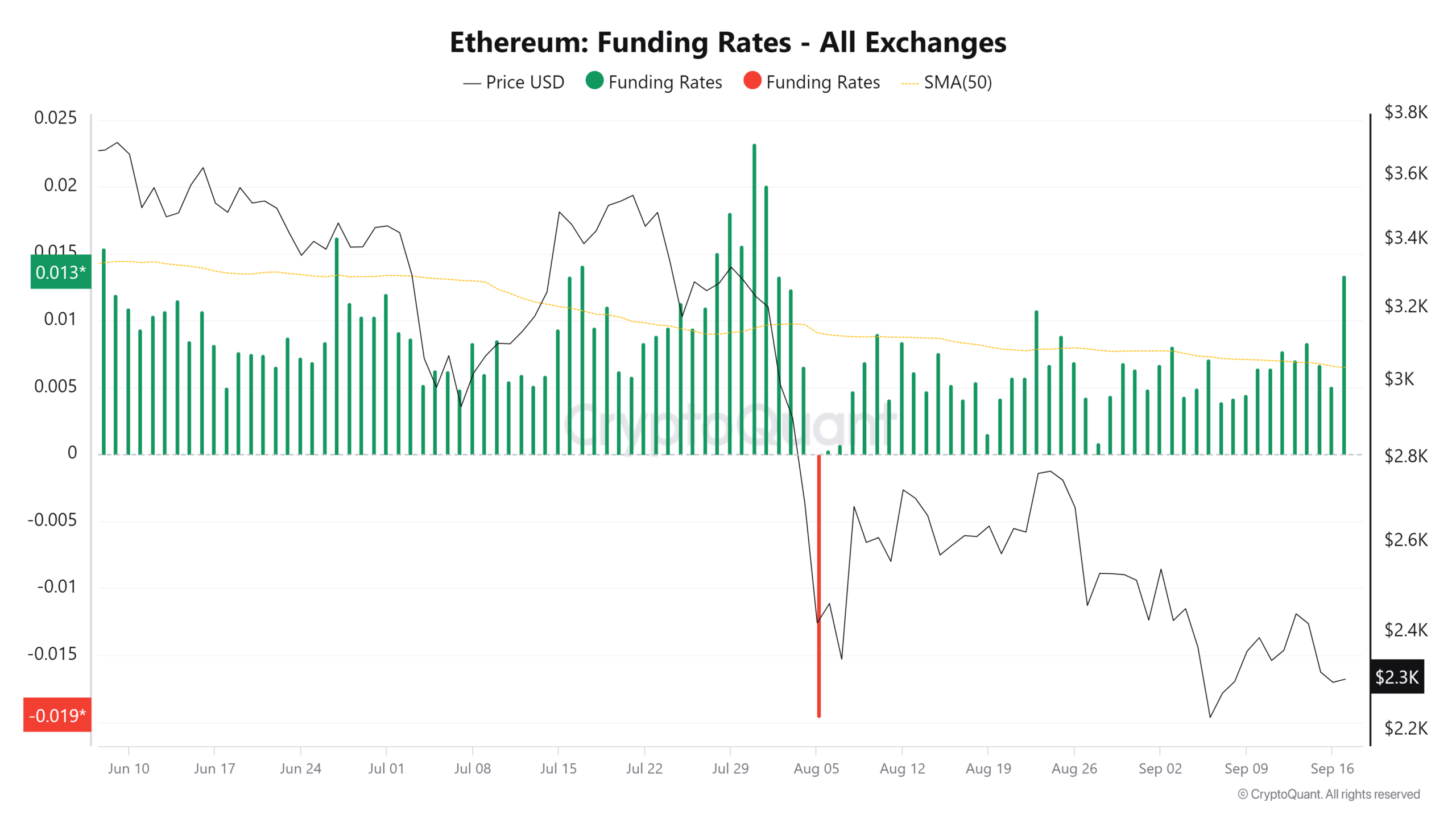

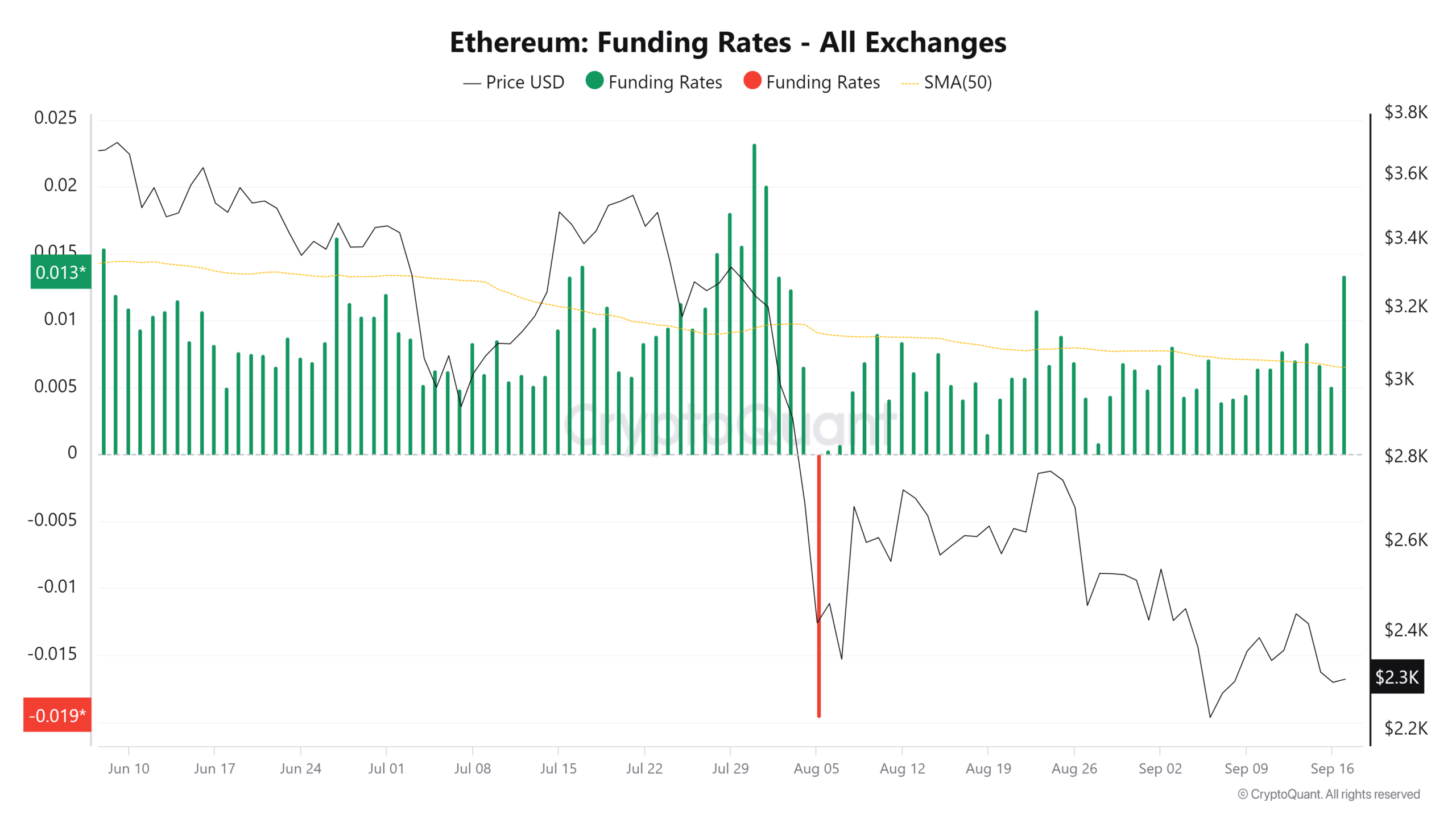

- ETH saw its lowest funding rate of the year.

- ETH is trading around the $2,300 price level.

Ethereum (ETH) saw a notable decline in its derivatives market, signaling a potential shift in market sentiment.

However, the interpretation of this decline may lead to different conclusions depending on the evolution of other factors, such as spot volume.

Ethereum funding rate drops

Recent data from CryptoQuant revealed that Ethereum’s funding rate has hit its lowest point of the year, signaling a sharp decline in buying interest from derivatives traders.

The funding rate is a key indicator used in futures markets to measure the cost of holding long (buy) or short (sell) positions.

A negative funding rate means that short sellers are paying long position holders to keep their positions open, suggesting bearish sentiment.

ETH’s funding rate has fallen to its lowest level this year, reflecting a decline in demand for leveraged Ethereum purchases via derivatives. This could be a bearish sign for the price in the short term.

Source: CryptoQuant

The decline in the funding rate indicates a lack of enthusiasm among traders in the derivatives market, which could put further pressure on Ethereum’s price.

A risk of short squeeze on Ethereum

With fewer traders willing to take long positions, Ethereum’s downtrend could continue unless spot buyers step in to absorb the selling pressure.

However, while the low funding rate suggests bearish sentiment, it also sets the stage for a potential short-term liquidation cascade. The negative funding rate could quickly reverse if enough cash buyers enter the market.

This forces short sellers to close their positions, leading to forced buying (short squeeze), which can increase the price.

How ETH’volume followed a trend

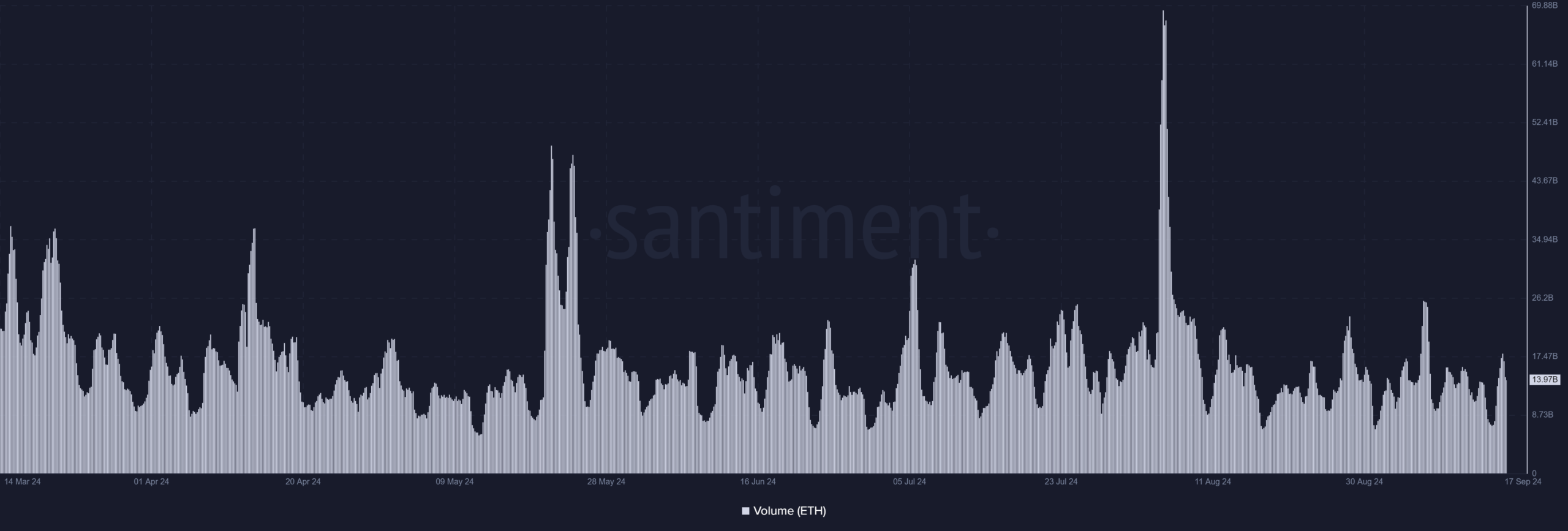

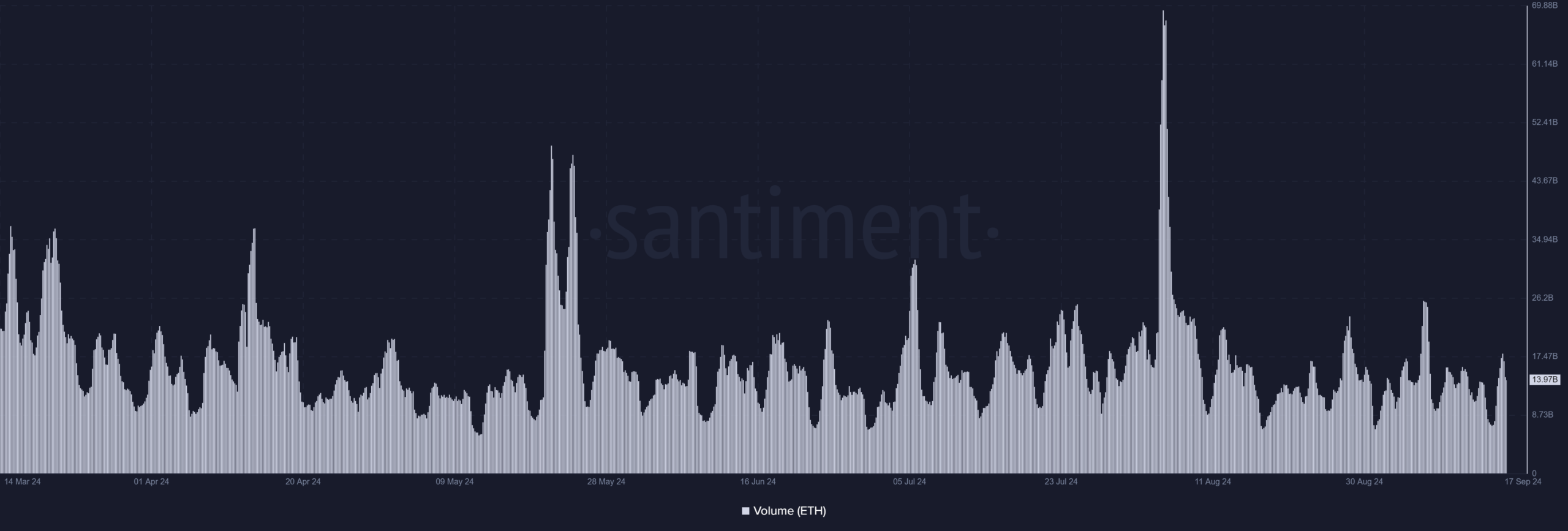

Analysis of Ethereum spot volume on Santiment showed that the current average volume has remained stable at around $14 billion over the past few weeks.

This consistent volume is crucial to maintaining price stability, especially as Ethereum’s funding rate has fallen to its lowest level of the year.

Source: Santiment

Ethereum spot volume has remained relatively stable, averaging $14 billion. This consistent volume likely helped ETH avoid a more severe price drop.

This is despite the bearish sentiment among derivatives traders, reflected in the negative funding rate.

Additionally, if spot volume falls below this $14 billion range, Ethereum could face increased downward pressure.

Read Ethereum (ETH) Price Prediction 2024-25

With the funding rate already at historically low levels, a drop in spot volume would reduce buying interest. Buying interest is needed to counteract negative sentiment in the derivatives market.

The current low funding rate indicates that short positions dominate the derivatives market. If spot volume declines, there may not be enough demand to absorb the selling pressure, leading to lower prices.