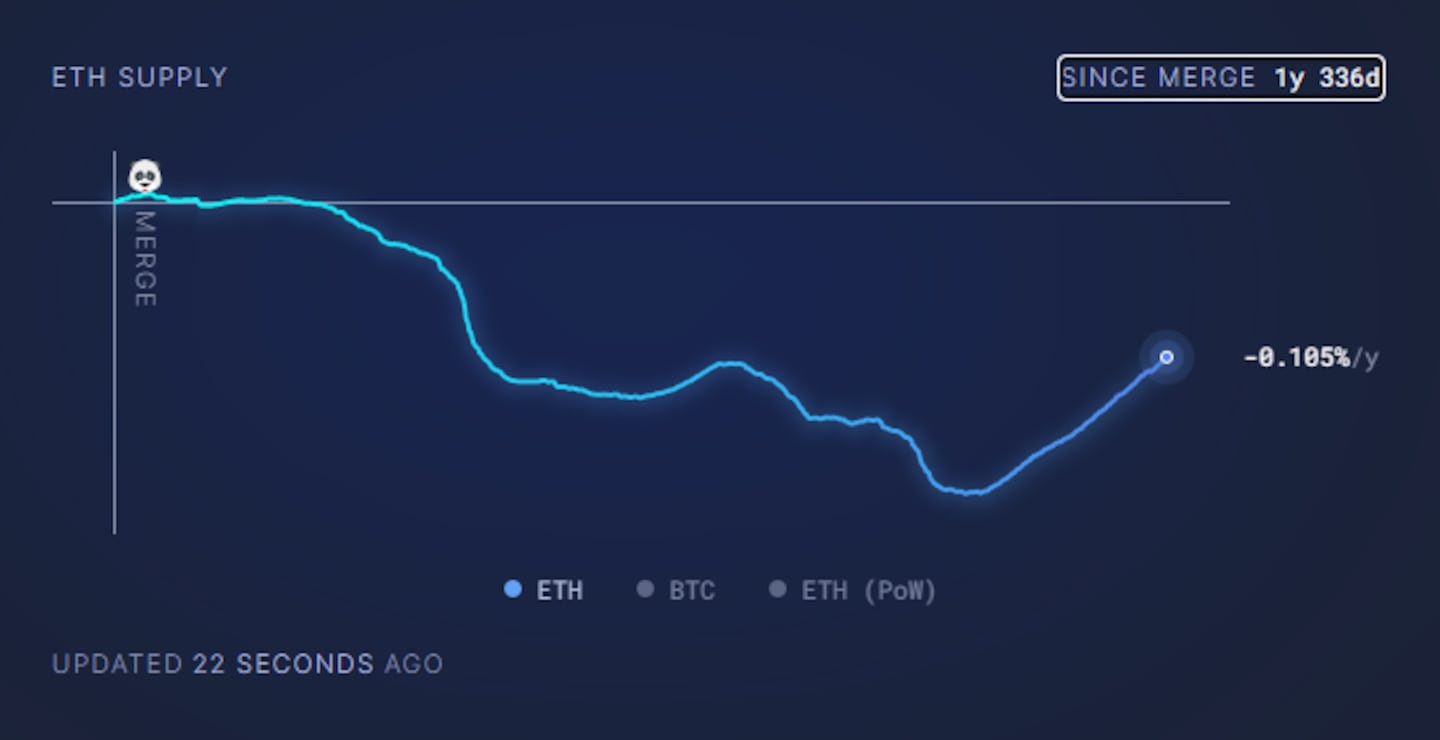

- Ether supply has been increasing since mid-April.

- This is a result of lower transaction costs on Layer 2 networks.

- Ethereum loyalists are spared the problem.

The extreme transaction fees that plagued the Ethereum blockchain are now a thing of the past.

In recent weeks, fees on the network have dropped to just one gwei – about $0.06 – for a simple transaction.

Some say it came at a price.

The extremely low fees mean that Ethereum no longer destroys — or “burns” — more Ether tokens than it creates. In other words, its economy is now inflationary — a dirty word among cryptocurrency users who often despise the money printing embedded in the traditional financial system.

Yet some Ethereum developers don’t see it that way.

“I’m very confused that people think that Ethereum’s low gas fees are a problem,” said Marius van der Wijden, a core Ethereum developer. DL News.

“That’s what we’re working towards. In my opinion, combustion was never meant to be an economic indicator.”

These conflicting views reveal the different priorities of Ethereum stakeholders.

Join the community to receive our latest stories and updates

Developers are happy that the network can now handle many more transactions without charging high fees to users.

Some investors, on the other hand, see economic inflation as hurting their investment in Ether, the volatile token used to pay for Ethereum transactions.

Money for ultrasound?

When users send Ethereum transactions, the Ether they pay for is destroyed or burned.

If the amount burned from transaction fees is greater than the amount of new Ether rewarded to validators for processing those transactions, the total supply decreases and becomes deflationary.

This situation, often referred to as Ether being “ultra-healthy money,” is beneficial to the network because it rewards those who contribute to its operation without inflating the supply of Ether.

However, if users do not spend enough Ether on transactions, as is currently the case, the supply of Ether will increase indefinitely, breaking the network’s economic model.

“The ‘ultrasonic money’ meme is broken,” said Ethereum lead developer Preston Van Loon DL News.

Van Loon said this is all due to a March upgrade that made running Layer 2 Ethereum networks like Coinbase’s Base or Offchain Labs’ Arbitrum much cheaper.

Layer 2s are separate blockchains built on top of Ethereum. In recent years, much of Ethereum’s activity has left the mainnet and moved to comparatively cheaper and faster layer 2s.

Some fear that the move to Layer 2 means Ethereum will never be deflationary again.

“Layer 2s will constantly maneuver around each other to avoid creating a high fee environment for themselves,” 0xbreadguy, a pseudonymous DeFi developer, said in a widely circulated X-rated post.

The result? Fees on Ethereum will remain low unless the network dramatically increases demand for transactions.

Van Loon said he was “not totally convinced” by that argument.

He said he believes that as Ethereum grows through Layer 2 networks, more activity will eventually funnel to the Ethereum mainnet.

“The mainnet will become the settlement layer and a place where end users can hold their assets for long-term storage, while Layer 2 will become the user activity layer,” he said.

Making Ethereum Deflationary Again

Among those who believe low transaction fees are a problem, there is a popular solution: incentivize more users to transact on the Ethereum mainnet.

“You need to balance scaling through Layer 2s while keeping your power users on mainnet, without indiscriminately pushing them to one of the dozen ecosystems,” 0xbreadguy said.

This might be a tough sell. No matter how Ethereum balances demand, layer 2 transactions will always be cheaper.

Martin Köppelmann, founder of Ethereum sidechain Gnosis, said that one way to increase mainnet usage is to increase the network’s gas limit.

This would increase the transaction capacity of the Ethereum mainnet and reduce fees. But it also risks increasing operational costs for validators, the people who run the software that processes transactions on the network.

Ethereum co-founder Vitalik Buterin also suggested increasing the gas limit during an “Ask Me Anything” session in January on the online forum Reddit.

Whatever solution the community chooses, it must do so quickly.

As more DeFi protocols and users move to Layer 2, it becomes less likely that they will want to move back.

Tim Craig is DL News DeFi correspondent based in Edinburgh. Feel free to share your tips with us at tim@dlnews.com.