- ETH violated multi -year critical support, encouraging dormant whales to relax

- The MVRV report has reversed negative areas, from historically signaling of undervaluation and potential accumulation

Ethereum (ETH) is under pressure at the moment, long -term holders (LTH) continuing to unload their assets. In fact, after three years of dormancy, “another” Ethereum OG liquidated 7,974 ETH at a price of $ 1,479, totaling $ 11.8 million.

Now, while the decrease in daily prices of ETH has followed the closer market from the market, its monthly performance has revealed a deeper weakness. A sharp decline of 17.52% seemed to highlight the impact of these large sales, which made the ethn the weakest active.

The catalyst?

Well, ETH violated its multi -year support, recently plunged below $ 1,500 – an invisible level in two years. In response, the dormant whales have unrolled the positions, disintegers and the frontal advantages of compression down on their beneficiary margins.

According to Ambcrypto, their output strategy reflects a strategic distribution model. These whales are unloaded in phases, selling strategically in payments rather than unloading in one go.

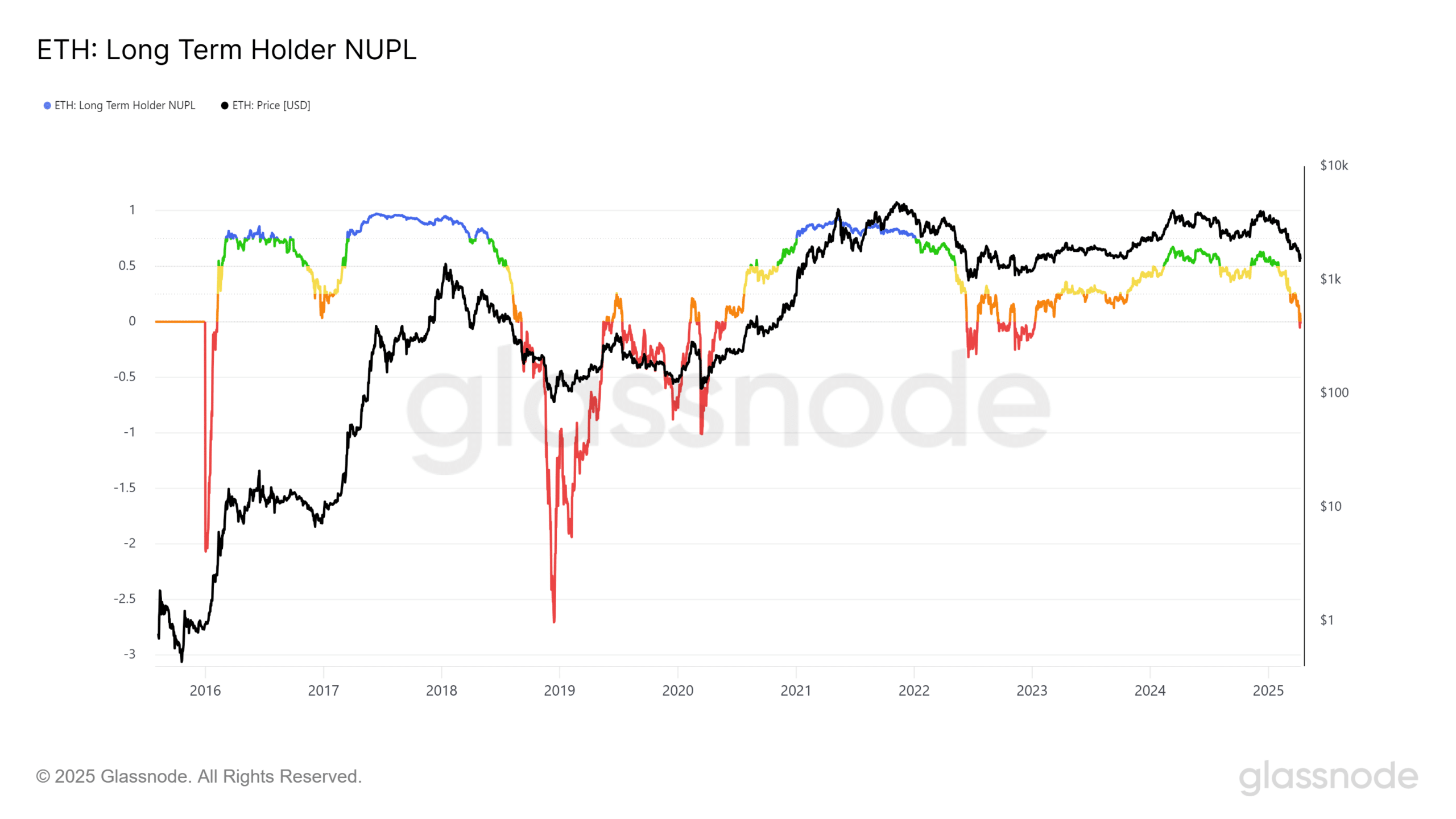

This trend can be highlighted by the graph below.

Source: Glassnode

The LTH Nupl of Ethereum (net profit not made and loss) also entered the red zone for the first time in three years.

The last occurrence took place in 2022 when the whales of ETH entered the capitulation – a brief phase triggered while the ETH broke below $ 1,500 on June 10.

Therefore, ETH fell to $ 883 on the graphics in the next 30 days.

With Ethereum again taking off on this critical support, the probability of a large -scale capitulation event increases. Is it a sleeping of dollar whales of $ 11.8 million just the first domino to die for?

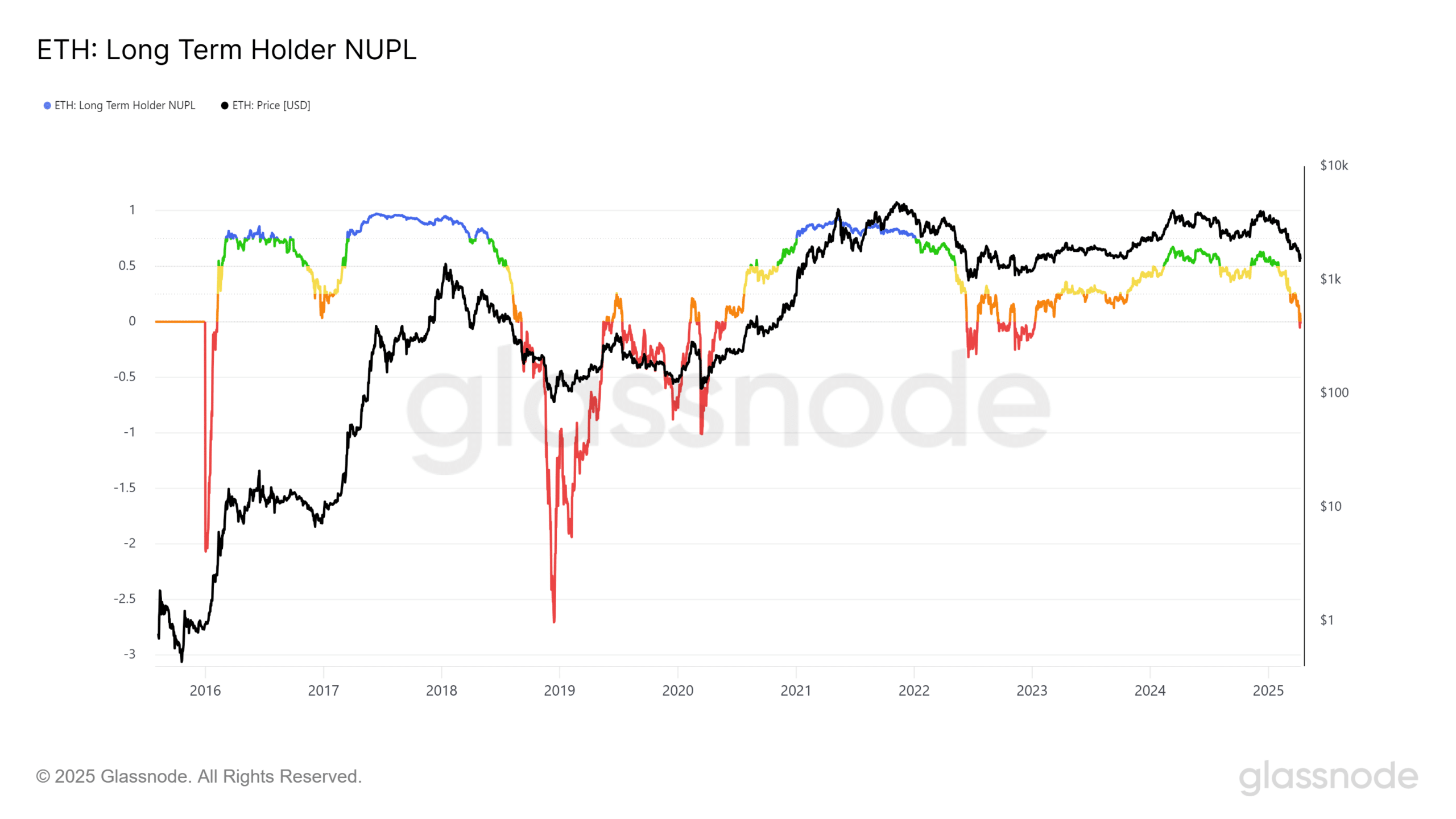

Undervaluation of metric chain flashes

At the time of writing the time of the editorial staff, the Ethereum / value market ratio made (MVRV) was 0.76. This meant that the price of the press market of the $ 1,549 was negotiated at 76% of its global value achieved. Simply said, ETH was negotiated at a 24% discount compared to the average acquisition price of all parts.

This suggests that in average, ETH holders are underwater. Historically, these undervaluation zones have preceded solid recovery.

Even in 2022, a consolidation of one month in July experienced an ETH rally of 85% at $ 2,020 on August 13.

Source: Glassnode

However, the market Fud remains a major variable this time. In April alone, Ethereum’s reserves saw net entries of approximately 2 million ETH through punctual exchanges, highlighting the reluctance of investors to buy the decline.

Without reversal in this accumulation trend, Ethereum remains vulnerable to deeper corrections less than $ 1,400. Especially since the dormant whales continue to relax their positions.

In fact, with the long -term holders of the fragile market disintegration and liquidity, the structure of Ethereum now reflects its failure of 2022. This increases the risk of another capitulation event on graphics.