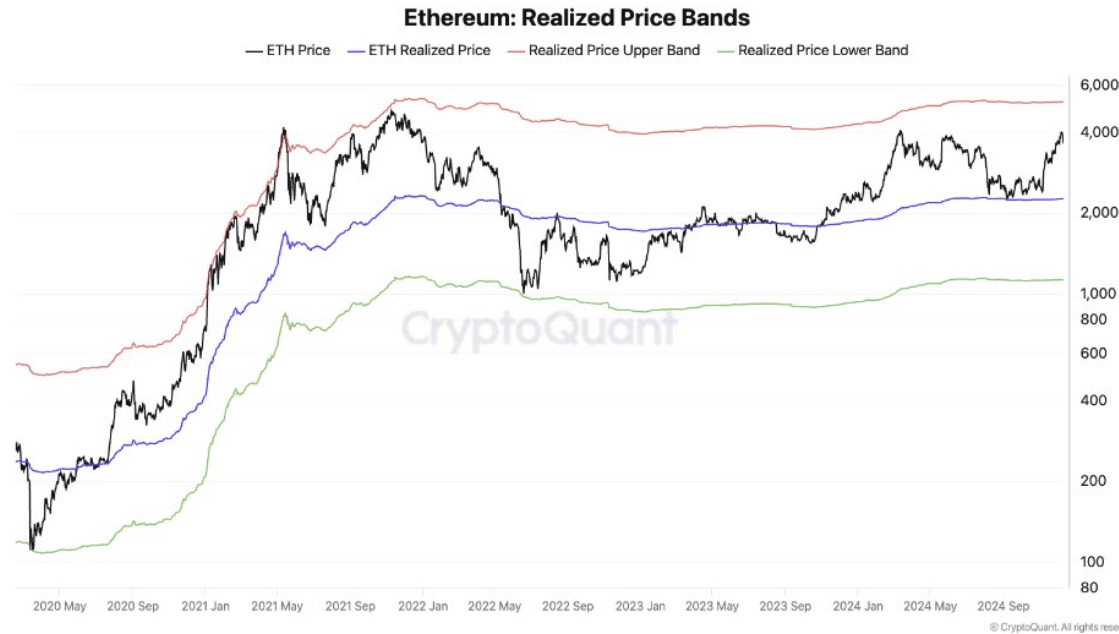

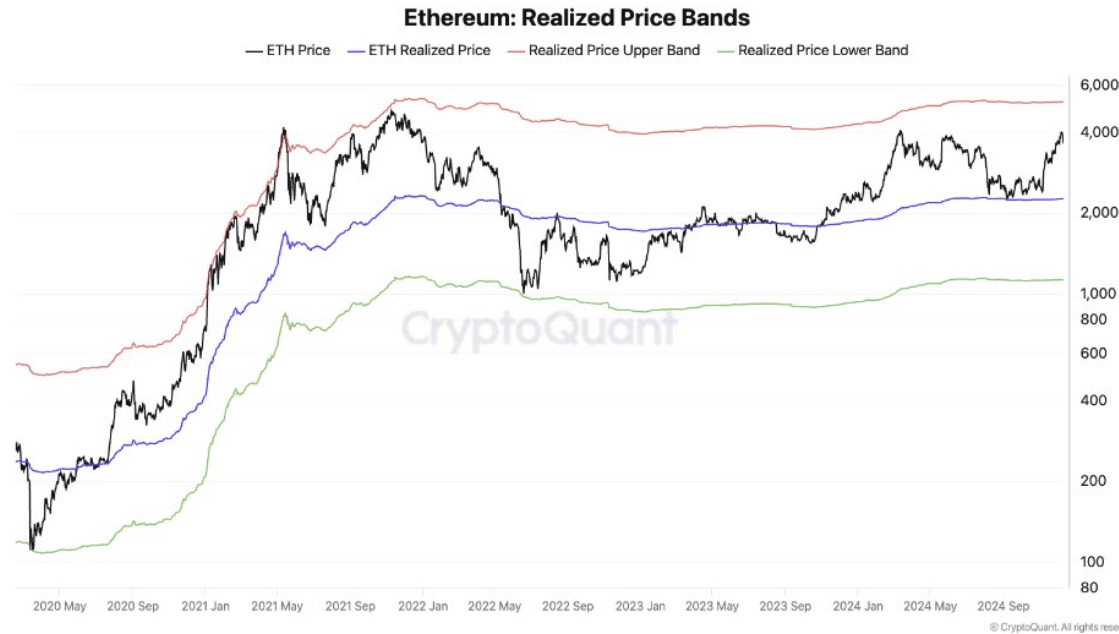

- Ethereum’s upper realized price band at $5.2k reflects levels seen during the 2021 bull market peak, increasing breakout expectations.

- Increased FX flows and increased activity suggest the possibility of profit-taking.

Ethereum (ETH) is on the verge of a major breakout, with its upper realized price band reaching $5.2k – mirroring levels last seen during the 2021 bull market peak.

On-chain metrics indicated strong demand, fueling hopes of a rally beyond $5,000.

But as market dynamics shift, investors are wondering: Is Ethereum poised to return to its former glory, or are conditions fundamentally reshaping its trajectory?

How the realized price will affect this current cycle

Source: CryptoQuant

The upper band of Ethereum’s realized price, at $5.2K at press time, is a key marker for understanding potential market movements.

This metric, which tracks the average price at which each unit of ETH last moved, plays a central role in identifying market trends.

According to AMBCrypto’s review of CryptoQuant data, the current price alignment reflects the peak of the 2021 bull run, when the upper band of realized price coincided with a meteoric rise.

Historically, these upper band levels have signaled overheated conditions or strong bullish momentum, often preceding significant price movements.

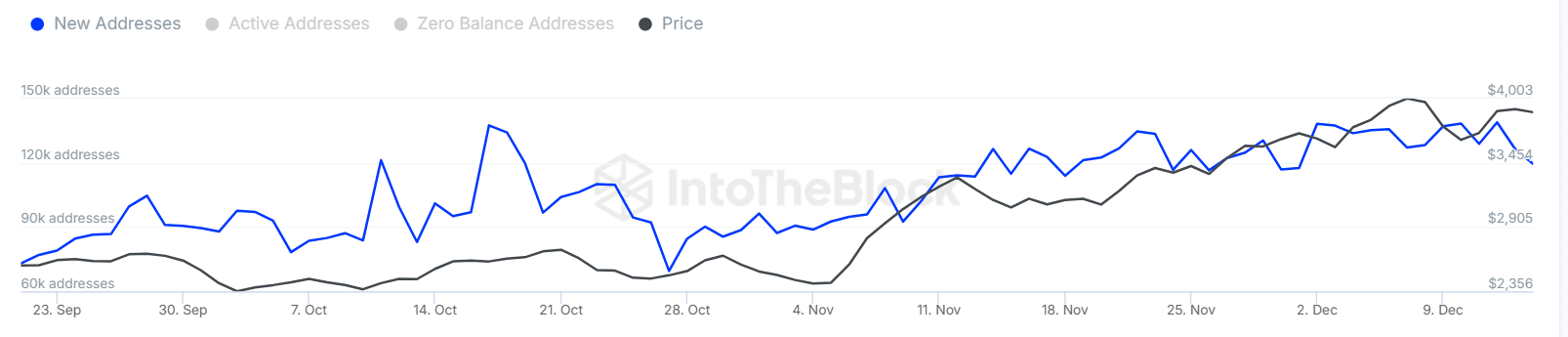

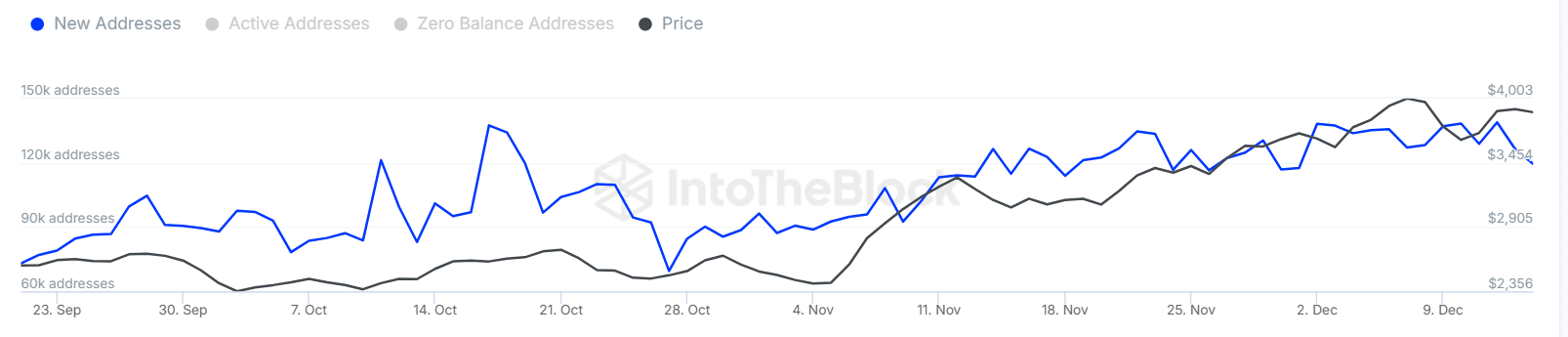

Profit taking in sight?

Source: TradingView

The market is showing mixed signals. The active addresses chart reveals a 10-15% increase in user engagement over the past week, indicating increased network activity and investor participation.

Simultaneously, trading volumes increased by almost 20%, reflecting increased liquidity and trading momentum.

However, rising foreign exchange flows, up 25%, are raising concerns about possible profit-taking.

Source: In the block

Historically, such spikes in inflows indicate that investors may be positioning their assets for sales, particularly when associated with increased activity.

This trend aligns with previous market highs, where increased engagement coincided with short-term corrections.

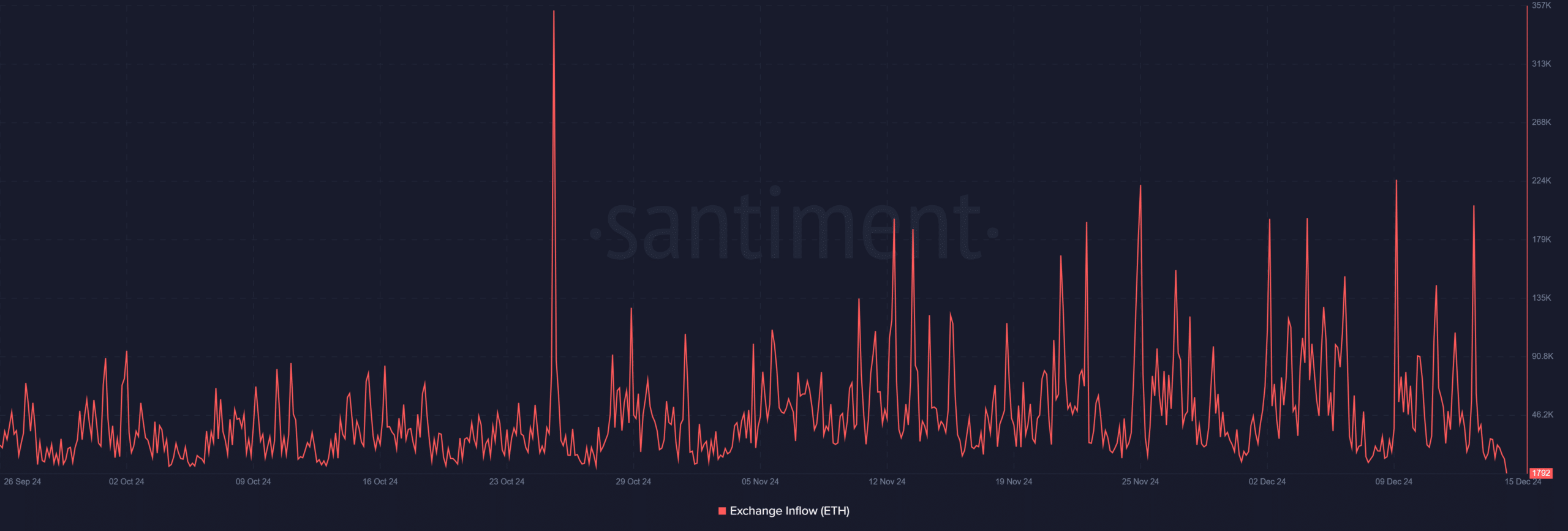

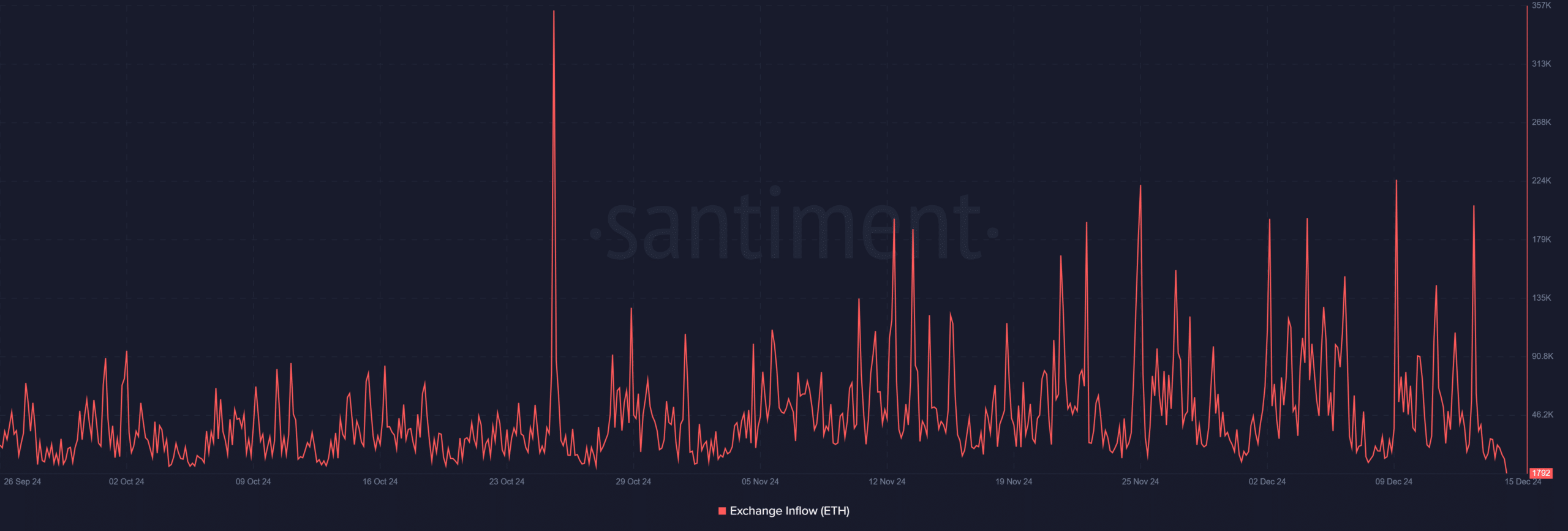

Source: Santiment

The data highlights a delicate balance: while high participation and strong trading volumes signal optimism, inflows suggest caution. If inflows continue, watch for potential downward pressure.

Whether the market consolidates or faces a correction will depend on the price resilience of the coming sessions and broader sentiment changes.

Market sentiment and the way forward

Recent data reveals a shift in sentiment as Ethereum approaches pivotal levels. The increase in new addresses is offset by increased FX flows, indicating that investors could capitalize on their gains.

Read Ethereum (ETH) Price Prediction 2024-25

With price volatility increasing, a deeper correction could ensue if market participants begin exiting positions at these high levels.

As Ethereum faces key technical resistance, understanding whether this rise is a sustainable rally or a final push before a larger pullback will be critical to assessing market stability.