According to data from CoinMarketCap, the price of Ethereum has fallen by 10.23% over the past seven days, in line with the general negative movement in the market. This slowdown in the crypto market has been attributed to several factors, including heightened geopolitical tensions in the Middle East and increased liquidations of long positions.

Although Ethereum saw some rebound over the past day, gaining 3.21%, investors remain uncertain of a full price recovery with bearish sentiments taking over the market. Notably, an Ethereum ICO participant has now sold a substantial amount of ETH, intensifying fears of a prolonged downtrend.

Ethereum Wallet ICO Continues to Sell Spree and Unloads 40,000 ETH in Two Weeks

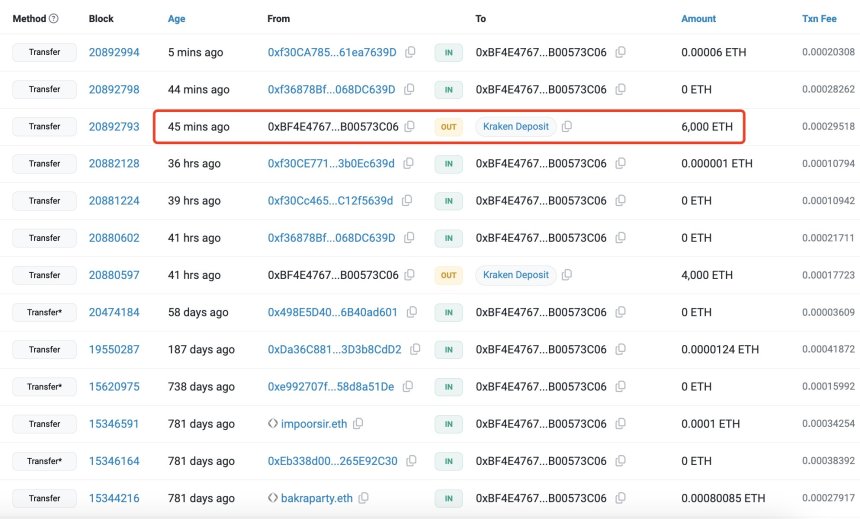

According to data from blockchain analytics company Lookonchain, an Ethereum wallet with the address “0xBF4” transferred 6,000 ETH worth $14.11 million to the Kraken exchange on Friday. So far, the address has been identified as one of the early Ethereum investors who acquired 150,000 ETH worth $368 million during the Ethereum’s initial coin offering (ICO). active in 2014.

Lookonchain data highlights that this is the second sale of ETH by “0xBF4” in the past week after the ICO participant initially sold 19,000 ETH, valued at $47.54 million on Wednesday and THURSDAY. Notably, this ETH whale has transferred 40,000 ETH worth $101 million since September 22, holding a balance of 99,500 ETH valued at $238 million.

Typically, massive token offloads by large holders, e.g. whales, are interpreted as bearish signals as they indicate a lack of confidence in the long-term profitability of the asset. Sales such as those seen on “0xBF4” could trigger panic selling by small investors, inducing greater downward pressure on the price of Ethereum.

Related Reading: Crypto Capo Returns After 2 Months To Predict Ethereum Drop To $1,800, Is It Time To Go Long?

108,000 ETH transferred to exchanges in 24 hours

Besides the “0xBF4” wallet address, other investors have recently sold large amounts of ETH. According to analyst Ali Martinez, 108,000 ETH worth $259.2 million was transferred to exchanges over the last day. This massive selling activity indicates increased sentiment in the ETH market.

Currently, Ethereum is trading at $2,399 following its recent price rally. However, its daily trading volume decreased by 17.48% and is valued at $14.61 billion. If bearish sentiments persist, ETH could fall back to around $2,200, where its next significant price level lies. However, amid massive selling pressure, the altcoin could trade as low as $1,600.

With a market capitalization of $291.40 billion, Ethereum continues to rank as the second largest cryptocurrency, with a market dominance of 13.47%.

Featured image from NullTX, chart from Tradingview