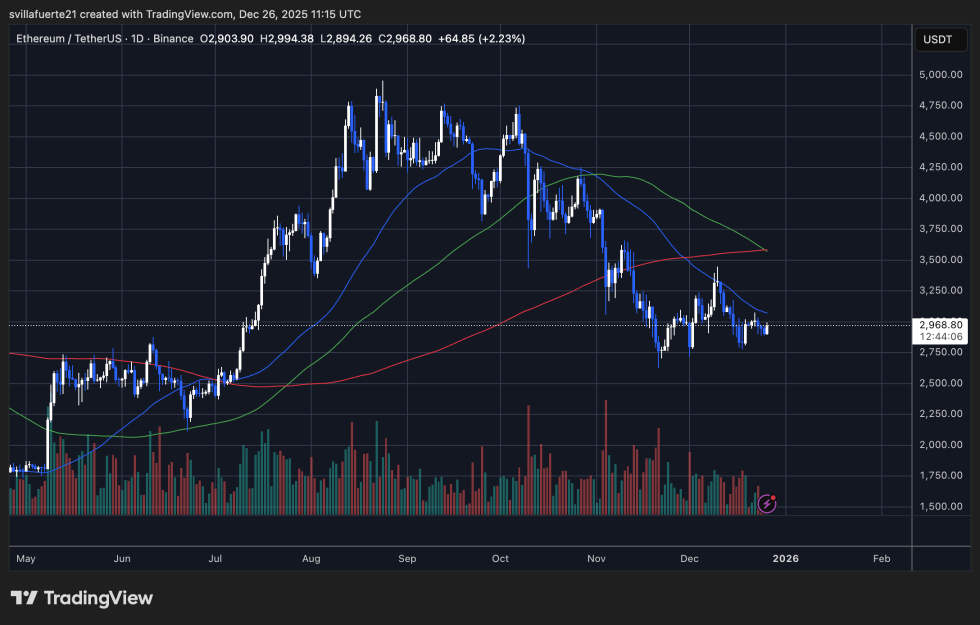

Ethereum is trading below the $3,000 mark as it attempts to push higher and reclaim key structural levels needed to signal the start of a recovery. So far, these efforts have failed. The price remains capped by persistent resistance and market sentiment continues to deteriorate.

Although short-term rebounds have appeared, most analysts and investors expect the broader downtrend to continue, arguing that Ethereum lacks the demand and momentum to support a significant reversal. Sentiment has become deeply pessimistic, with traders increasingly positioned for further decline rather than recovery.

On-chain and technical data reinforce this cautious outlook. A recent CryptoQuant report shows that after Ethereum’s sharp decline from its high of $4,800, the price remained stuck in a tight range centered around the $2,800 level for almost a month. This area has effectively transformed into a commercial purgatory. The bulls were unable to generate the conviction needed to reclaim higher highs, while the bears repeatedly failed to force a decisive break below support.

The result is a prolonged phase of volatility compression. Price action has tightened, signaling widespread indecision among market participants and a lack of directional commitment. Historically, such a squeeze often precedes a sharp move, but the direction remains uncertain.

Muted Layer 2 Flows Reflect Ethereum Deadlock

A recent report from CryptoOnchain highlights that Ethereum’s price stagnation is closely reflected in on-chain behavior. Weekly net ETH flows on Arbitrum, one of Ethereum’s most prominent Layer 2 networks and a common proxy for smart money positioning and DeFi activity, remain subdued and highly volatile.

Rather than showing a clear trend of inflows or outflows, the data reflects a market operating without strong conviction, reinforcing the idea that the biggest players are choosing to stay on the sidelines.

This lack of directional flow suggests that capital is not aggressively entering or exiting the ecosystem. Instead, investors appear to be waiting for clearer macroeconomic signals or a definitive change in market structure before committing.

In previous cycles, sustained expansion of Arbitrum net flows has often coincided with periods of renewed risk appetite or decisive trend shifts. Current inactivity stands in stark contrast to these environments.

The alignment between compressed price action around key support levels and dormant on-chain activity indicates a build-up of latent energy within the market. Ethereum is indeed rolling up. Although this balance may persist for long periods of time, it rarely resolves quietly. When balance is disrupted, movements tend to be quick and powerful.

Arbitrum netflow is now a critical metric to monitor. A sudden, sustained expansion in flows could serve as an early signal that this prolonged phase of indecision is about to resolve, paving the way for Ethereum’s next major move.

Ethereum stabilizes near $3,000 as bearish pressure persists

Ethereum is trading near the $2,970 level on the daily chart, attempting to stabilize after a prolonged decline from highs of $4,800 recorded earlier this cycle. Even if recent candles demonstrate modest attempts at recovery, the structure as a whole remains fragile. ETH continues to print lower highs and lower lows, signaling that bearish momentum has not yet been invalidated despite short-term relief bounces.

Technically, the price remains below its major daily moving averages. The faster moving average has reversed sharply and is acting as immediate resistance, while the 111-day and 200-day simple moving averages converge in the $3,300-$3,600 range. This cluster forms a significant overhead supply zone, limiting the likelihood of a sustained upward move unless volume and momentum increase significantly.

The recent rebound from the $2,800 to $2,900 area has helped Ethereum avoid a deeper breakdown for now. However, this development occurred on relatively moderate volume, suggesting a lack of conviction on the part of buyers. On the other hand, the initial decline was accompanied by strong selling pressure, reinforcing the idea that the dominant trend remains downward.

From a structural perspective, the $2,800 level remains critical support. A decisive break below this zone would likely accelerate the losses and confirm the continuation of the decline. Conversely, for Ethereum to change momentum, the price must recover to between $3,200 and $3,300 and hold above its falling daily averages.

Featured image from ChatGPT, chart from TradingView.com

Editorial process as Bitcoinist focuses on providing thoroughly researched, accurate and unbiased content. We follow strict sourcing standards and every page undergoes careful review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance and value of our content to our readers.