The combined open interest of the best altcoins has recently seen recovery, Ethereum contributing to most of the swing.

Ethereum, XRP, Solana and Dogecoin have seen an increase in open interest

In a new article on X, the Glassnod chain analysis company has spoken of the trend in the open interest of four top altcoins: Ethereum (ETH), Dogecoin (DOGE), XRP (XRP) and Solana (soil).

The open interest in the long term refers here to a metric which maintains a trace of the total amount of the events of the term market linked to an asset or a given group of assets which are currently open on all the exchanges of centralized derivatives. It takes into account shorts and long.

When the value of metrics increases, this means that investors open up new positions on the market. Such a trend can be a sign that the speculative interest in the medal increases. On the other hand, the indicator recording a drop suggests that holders swivel to disintegrate or liquidate themselves by their platform.

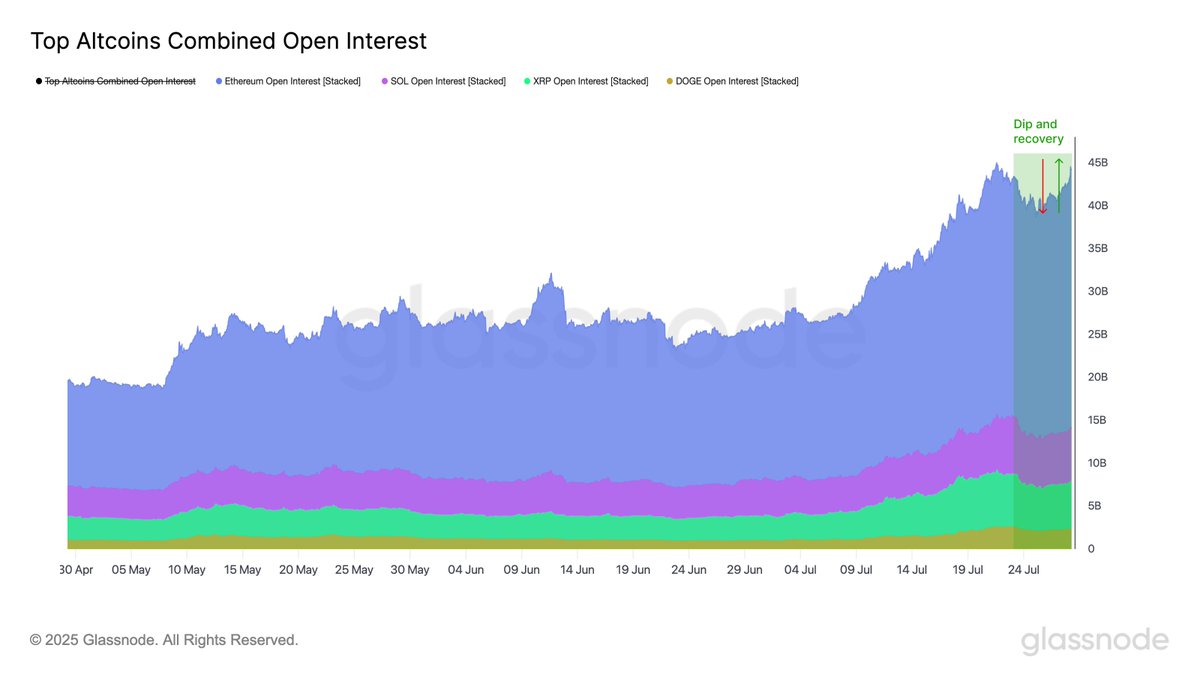

Now, here is the graphic shared by Glassnode which shows the trend in the open interest in the term for Ethereum, Solana, XRP and Dogecoin in recent months:

The market seems to have seen fresh positioning in recent days | Source: Glassnode on X

As displayed in the above graph, combined term contracts open up interest in these best altcoins reached a summit of $ 45 billion last week, but speculative interest has cooled and metrics had a decline.

This week, merchants seem to be back in force because the indicator has almost completely restored, reaching $ 44.5 billion after a net rebound. It is also visible in the table that Ethereum saw most of the swing, while Solana and XRP were more stable. Dogecoin has more or less avoided the roller coaster entirely with an almost flat trend.

Generally, an increase in open interest in the long term can be an index that the market could be about to become more volatile. Since Ethereum has seen the strongest increase in speculative interest, it can be more inclined to see a violent lever effect.

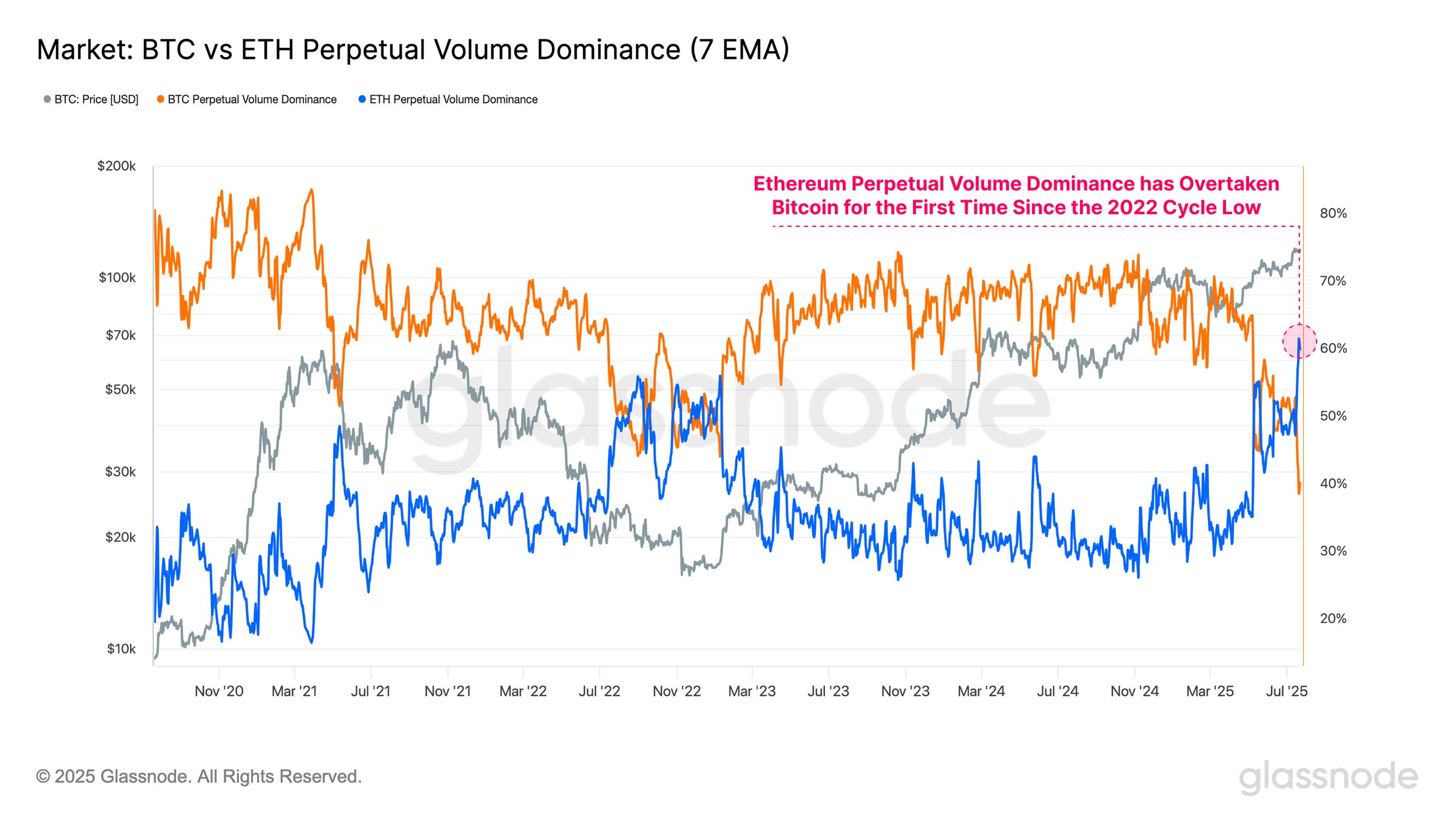

In related news, Ethereum dominates the perpetual market in the long term, as the analysis company stressed in another X post.

The Perp Volume share of Bitcoin and Ethereum compared over the last few years | Source: Glassnode on X

As Glassnode underlined in the graph, the domination of the volume of perpetual future of Ethereum recently exceeded Bitcoin for the first time since the cycle of the 2022 cycle. “This change confirms a significant rotation of the speculative interest in the Altcoin sector”, notes the analysis company.

BTC price

Bitcoin continued its recent movement trend laterally because its price is still negotiated around the level of $ 118,900.

Looks like the price of the coin has been stuck in consolidation recently | Source: BTCUSDT on TradingView

Dall-E star image, Glassnode.com, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.