The latest data from crypto asset manager CoinShares has shown a notable return to the cryptocurrency market. In its latest “Digital Asset Fund Flows Weekly Report,” the asset manager revealed that last week saw a significant uptick in investor sentiment, with digital asset investment products seeing inflows of $176 million.

According to James Butterfill, head of research at CoinShares, this increase in flows signals strong and “unanimous” positive sentiment across the board, with particular attention paid to Ethereum-based funds.

Related Readings

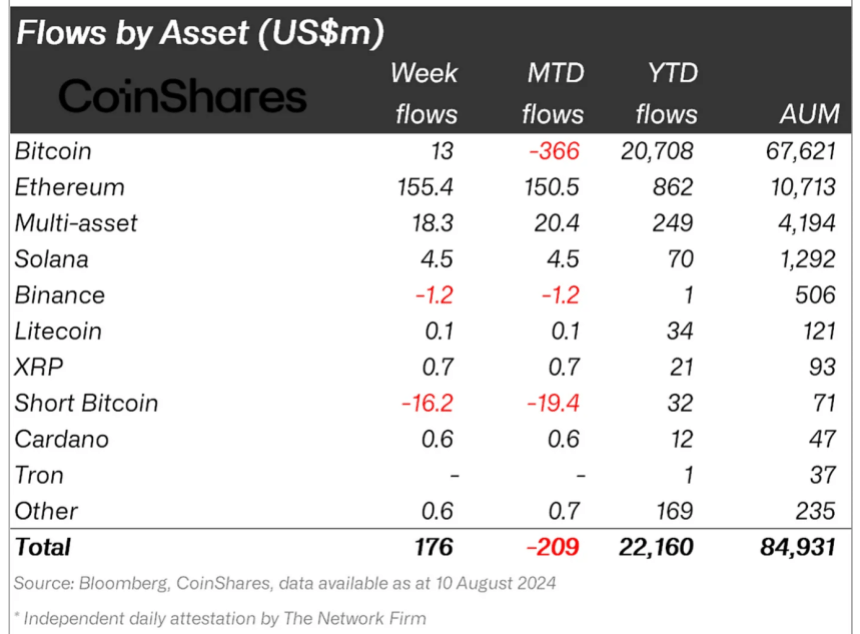

Crypto Fund Flow Analysis

Looking at the report, Butterfill revealed that Ethereum products “clearly” stood out, attracting $155 million of the total inflows, the highest year-to-date inflow since 2021.

The influx underscores renewed market interest in Ethereum, particularly with the recent introduction of Ethereum spot exchange-traded funds (ETFs) in the United States, according to Butterfill.

It is worth noting that the success of live trading of these funds has not only strengthened Ethereum’s position in the global cryptocurrency market, but also appears to have played a central role in the overall increase in its market capitalization and investment product offerings.

As for Bitcoin, Butterfill revealed in the report that despite capital outflows earlier in the week, Bitcoin could still end the week with a total positive inflow of around $13 million.

On the other hand, Short Bitcoin ETPs, as reported, “saw their largest outflows since May 2023, totaling $16 million (23% of AuM), reducing AuM for short positions to their lowest level since the beginning of the year, indicating a substantial outflow by investors.”

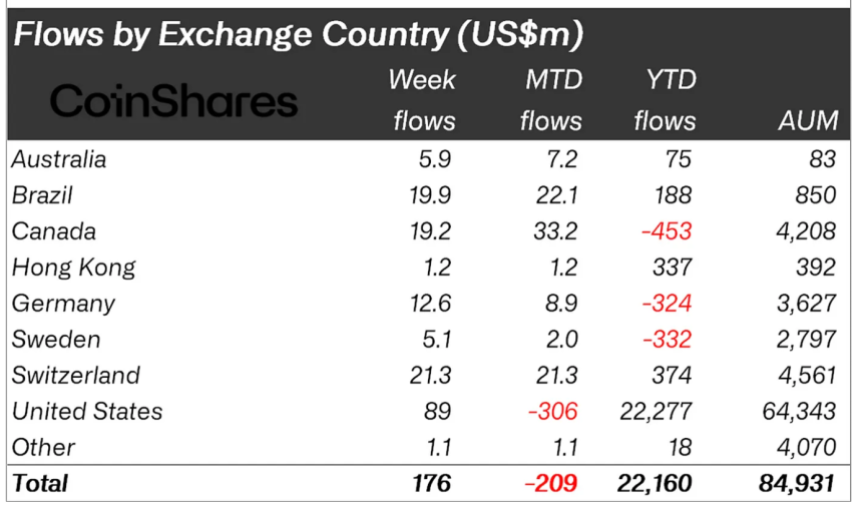

Coinshares also revealed that despite the initial volatility, overall market sentiment has been “overwhelmingly” positive. The report highlights that the inflows were not just isolated incidents, but were part of a broader, global positive reception to digital assets.

The United States, Switzerland, Brazil and Canada in particular were the first to inject substantial capital into the market. It is worth noting that this global participation in inflows highlights a collective bullish outlook despite the major declines recorded previously.

Market Performance: ETH and BTC

Bitcoin and Ethereum are struggling to overcome the bears, with both assets still maintaining their prices above major key levels.

Related Readings

For exampleEthereum is still trading above $2,500 at the time of writing, with a current trading price of $2,689. This price comes amid a notable increase in the asset of over 11% over the past week and an extended increase of 1.6% over the past day.

Bitcoin has also seen a strong surge over the past week, increasing by 11.4%. Although the asset has seen a 0.4% decline over the past day, it is still holding its price below $60,000.

Featured image created with DALL-E, chart by TradingView