Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

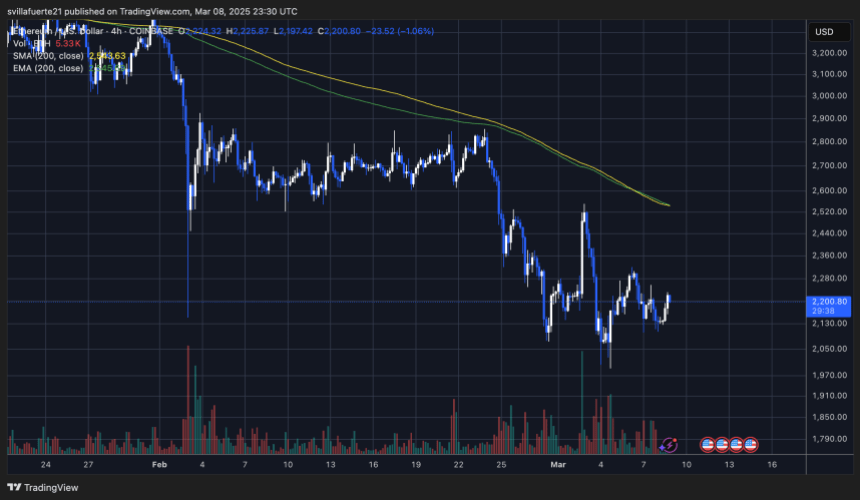

Ethereum (ETH) had difficulties around the level of $ 2,200, with bulls unable to recover higher prices despite several attempts. The feeling of the market remains down, because ETH continues to deal with the sales pressure even after the announcement of the American Bitcoin Strategic Reserve, which many expected to strengthen global confidence in the cryptography sector.

Related reading

While the ETH hovers near critical demand levels, analysts believe that next week will be crucial to determine its short -term management. If the bulls can defend key support areas, Ethereum may have a chance to resume the momentum. However, non-compliance with these levels could cause new downward pressure.

The superior analyst Carl Runefelt shared a technical analysis on X, stressing that Ethereum leaves a model that often signals a potential escape. If ETH follows this configuration, it could push in higher resistance areas and recover key price levels above $ 2,500. However, confirmation of this break is necessary, because market volatility remains high.

Ethereum Bulls hope for a recovery

Ethereum has undergone a sharp decline, losing more than 50% of its value since the end of December, triggering the fear and sale of panic throughout the market. Formerly a leader in previous bull cycles, ETH now finds it difficult to resume momentum, bringing many analysts to wonder if the long -awaited allusivity will occur this year. With Ethereum and most of the altcoins unable to recover upward structures, the market remains under lowering control, keeping prudent investors.

Despite the negative feeling, there is still hope for a recovery when Ethereum addresses the main technical levels that could determine its next movement. Runefelt’s remarks reveal that ETH exceeds a descending triangle model, a configuration that often signals a trend reversal. However, confirmation is crucial, because many past escapes have turned into false, trapping traders in other decline movements.

For Ethereum to consolidate an upward break, it must push above and close above $ 2,300. This level is a key resistance area, and overthrowing it in support would indicate a renewed purchasing force, potentially opening the door for a thrust around $ 2,500 and higher price targets.

Related reading

Until this confirmation occurs, Ethereum remains at risk of cooling if the sellers regain control. Traders and investors look closely if ETH can maintain its attempted breakthrough or if it will face another rejection, extending its downward trend in the coming weeks.

ETH key levels to monitor

Ethereum is currently negotiating above the level of support of $ 2,000, a final line of crucial defense for bulls hoping to see solid performances this year. Holding this level is essential, because a ventilation of less than $ 2,000 could further trigger the descent, strengthening the lowering feeling on the market.

Despite this, the bulls had trouble recovering higher prices, leaving investors frustrated by the lack of momentum of ETH. The recent price action has been jerky and indecisive, each attempt to break quickly encountered a sale pressure. This kept ETH stuck in a tight range, preventing a clear change in the feeling of the market.

Related reading

However, a decisive recovery of $ 2,300 could mark a turning point. If ET pushes above and keeps this level, it would probably open the door for a movement around $ 2,500, strengthening the case for a recovery gathering. Until then, traders remain cautious, because the struggle of Ethereum to gain ground continues to weigh on the wider Altcoin market.

Dall-e star image, tradingview graphic