Join our Telegram channel to stay up to date with the latest news

Ethereum price edged up more than 1% in the past 24 hours to trade at $2,963.47 as of 11:57 a.m. EST, with trading volume up 24% to $15.7 billion.

This comes as Jack Yi, founder of Trend Research, announced on

Trend Research再准备10亿美金,在此基础上继续增持买入ET H,Chinese:

– JackYi (@Jackyi_ld) December 24, 2025

The move comes amid considerable institutional confidence in Ethereum’s future growth and could have a significant impact on Ethereum’s market dynamics. As a result, it attracts attention amidst ongoing investment strategies and market volatility.

The decision to invest in ETH aims to strengthen the company’s substantial holdings. Jack Yi highlighted the company’s commitment to Ethereum, warning against short selling, which aligns with Trend Research’s current strategy of buying ETH during price declines.

These substantial investments reflect the confidence of many institutions in the long-term value of the token, boosting the confidence of other institutional investors and potentially stabilizing prices.

At the same time, this move could herald a broader trend of institutional interest in ETH, potentially affecting market structure and regulatory prospects.

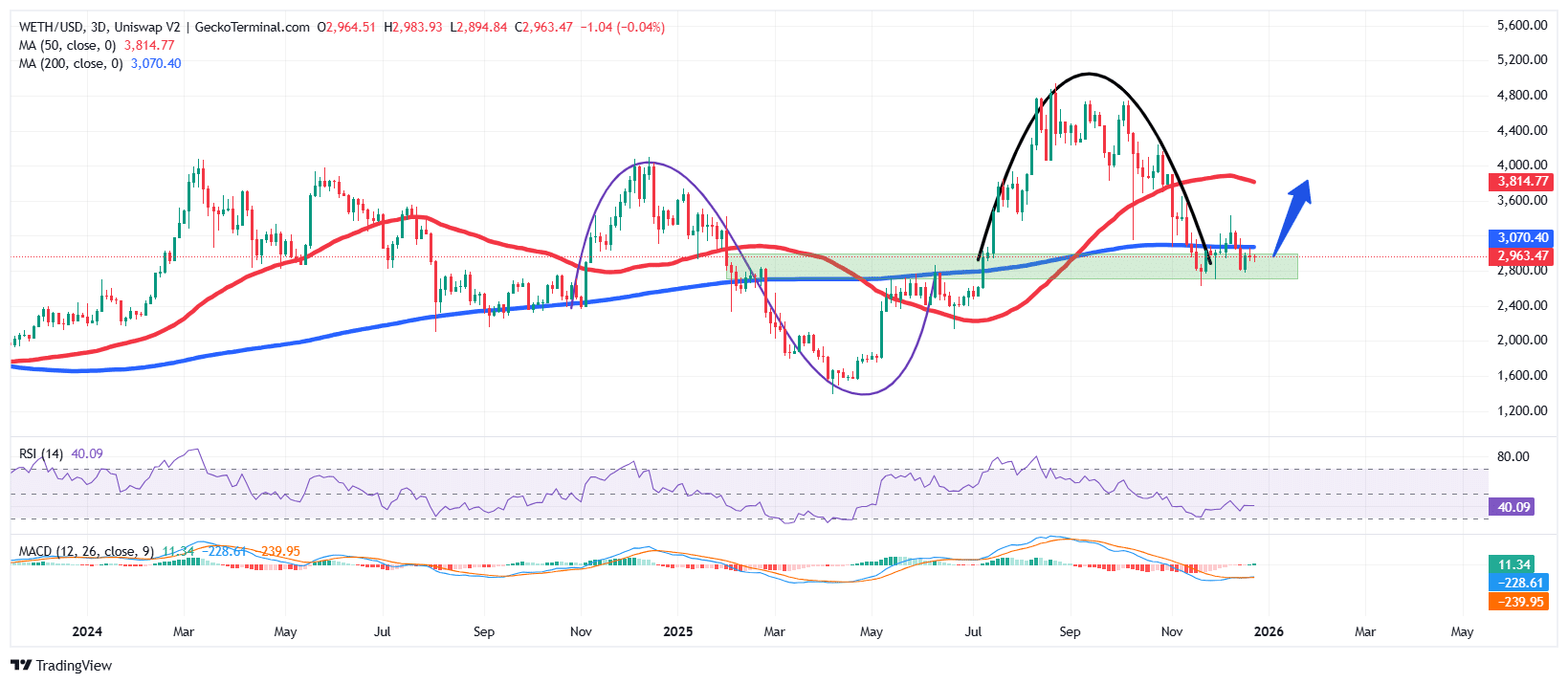

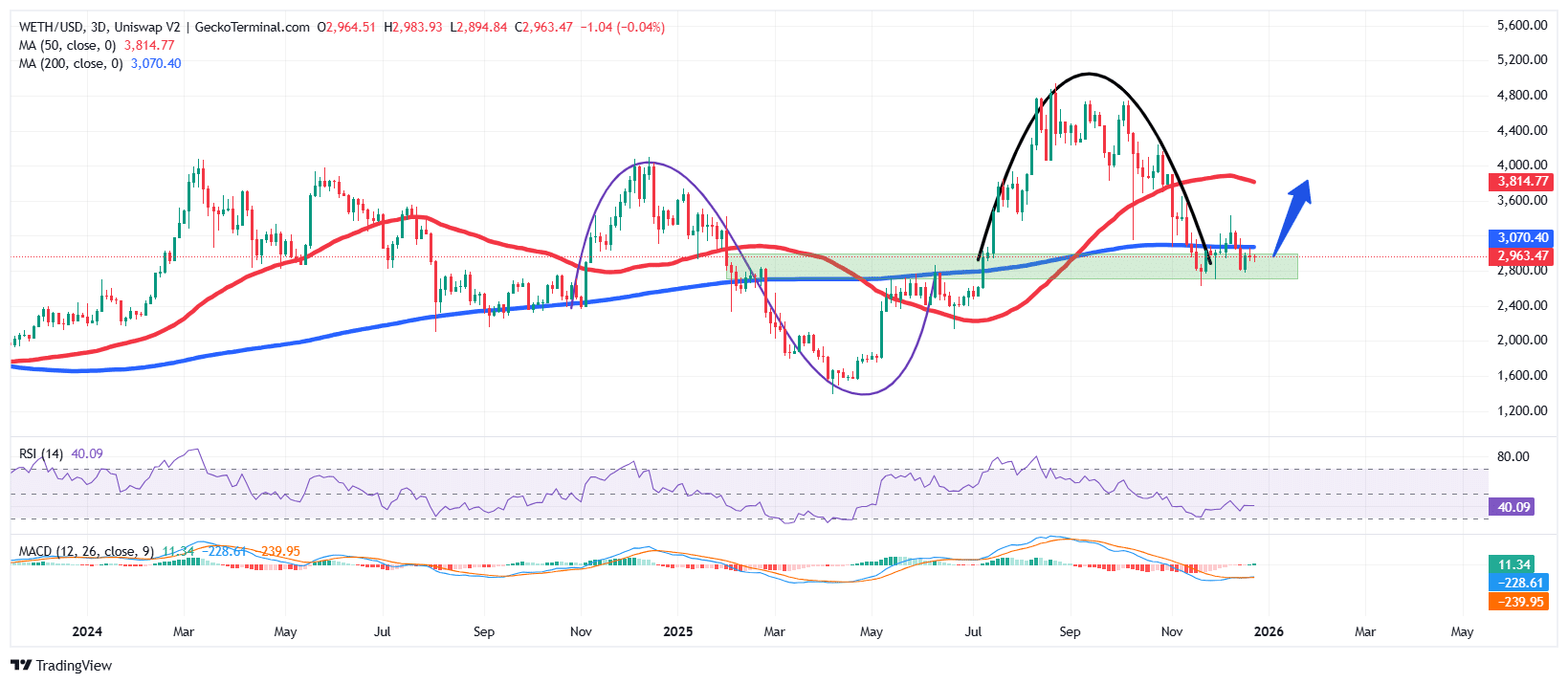

Ethereum price struggles to find direction as key indicators signal indecision

THE ETH Price The stock moved into a corrective phase after staging a strong recovery from the mid-2024 support region near $2,100.

This surge propelled Ethereum price towards a cycle peak around $4,900, where buying momentum began to fade and profit-taking emerged.

After the rejection at the highs, Ethereum entered an extended pullback, creating a rounded upper pattern and falling back towards its long-term trend support. This retracement took the price below the 50-day and 200-day simple moving averages (SMA), which now act as immediate resistance levels.

Meanwhile, the Relative Strength Index (RSI) is hovering around 40, suggesting moderate momentum without reaching oversold conditions. This level reflects a balance between buyers and sellers, reinforcing the idea that Ethereum is consolidating rather than trending aggressively in either direction.

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator continues to trade below the zero line, but the downward momentum is weakening. The histogram bars are contracting, signaling that bearish pressure is losing strength.

Although no decisive bullish crossover has yet formed, this behavior often precedes a stabilization phase or short-term relief rebound.

ETH prices in a decision zone

Based on the ETH/USD chart on the highest time frame, the ETH price is at a decisive level. The confluence of the 200 MA and horizontal support between $2,900 and $3,050 forms a critical demand zone that bulls must defend.

A clean break below this support region could expose Ethereum price to a deeper move towards the next major demand area near $2,700, with extended weakness likely to revisit the broader base around $2,100 to $2,200.

Conversely, if buyers successfully defend the 200-day SMA and momentum stabilizes, ETH price could attempt to rebound towards the previous consolidation range, around $3,400-$3,600.

A sustained push above this region would put the 50-day SMA back near $3,800 as the next resistance hurdle.

To add to the bullish scenario, crypto analyst Ali Martinez claims that active ETH addresses have almost doubled in a week, which is a signal of investor lock-in.

Ethereum $ETH network activity almost doubled in a week, with active addresses increasing from 496,000 to 800,000. pic.twitter.com/c0espgmwr9

– Ali Charts (@alicharts) December 25, 2025

Related news:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news