- Ethereum exchange reserves remain in historic stockings, potentially signaling an increase in prices focused on supply.

- The low prolonged reserves could result in short -term price pressure.

Ethereum (ETH) still seems to be lagging behind despite the broader optimistic feeling of the cryptography market.

While Bitcoin (BTC) again created another level of all time, last week, ETH continues to fight to exceed major resistance.

However, when writing the editorial staff, the asset is up 4% during the last day with a press negotiation price of $ 3,195.

In the midst of all this, a significant factor influencing the movements of Ethereum prices is reserve levels on punctual exchanges.

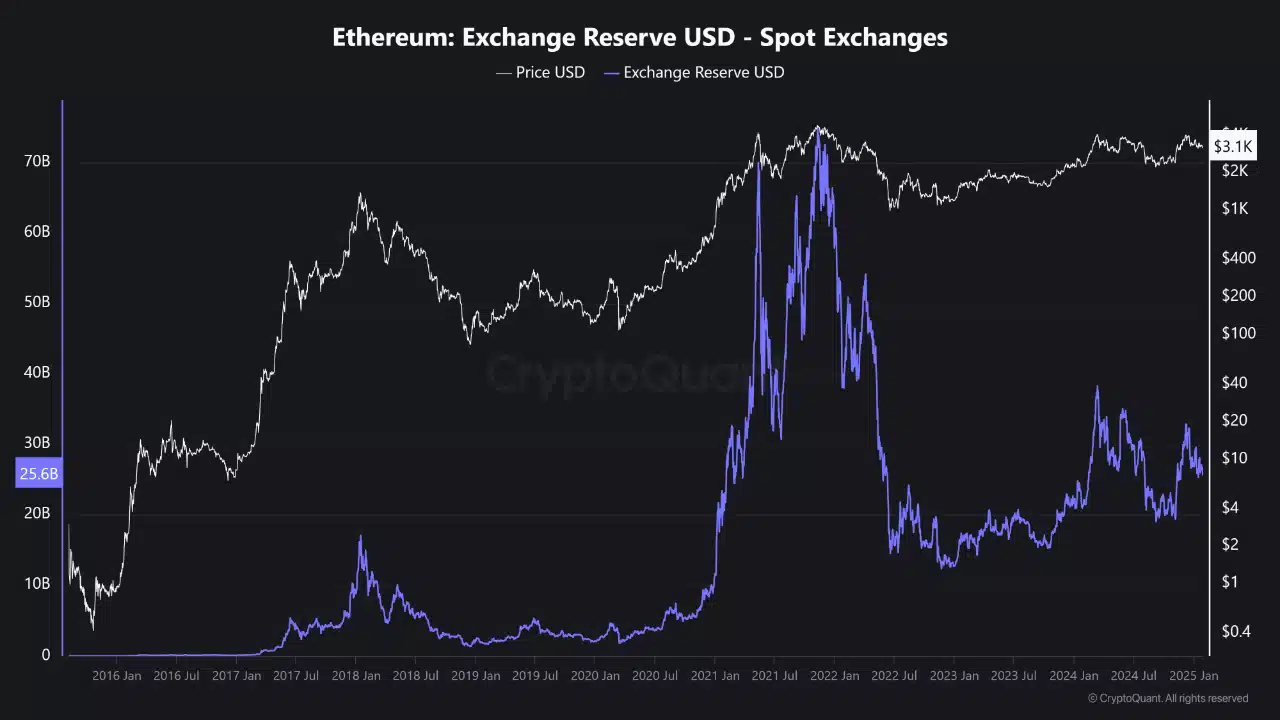

According to an analysis published on the Cryptoker Quicktake platform, Ethereum reserves have exposed Notable historical trends.

Follow -up of Ethereum reserves over time

The analyst described how Ethereum reserve levels have changed over the years, highlighting their potential price on the price.

During the 2017-2018 Haussier market, reserves have regularly increased, reaching a peak in early 2018. This wave coincided with increased interest in Ethereum and related projects.

With the rise of decentralized finances (DEFI) in 2020 and 2021, Ethereum’s reserves saw another significant boost while users poured assets in protocols and platforms built on the Ethereum network.

Source: cryptocurrency

However, as the market matured, the end of 2021 marked the start of a significant drop in reserves. Large-scale withdrawals of exchanges have prepared the land against constantly low reserve levels in 2023 and beyond.

These historically low reserve levels have important implications for the price of Ethereum.

The continuous decline suggests that many market players prefer to move their Ethereum assets on exchanges, potentially for long -term storage.

This behavior often indicates confidence in the value of Ethereum as a long -term active.

Current trends and market implications

In 2024, Ethereum’s reserves on the exchanges of points remain near historic stockings. This limited offer on scholarships could contribute to pricing pressure, as fewer parts are easily available for trading.

Over time, such conditions can lead to stronger price movements if demand increases.

Although the current price of Ethereum remains lower than the critical resistance levels, the reserve reserve environment can open the way for a new bullish trend.

For the moment, it is worth monitoring other chain measures to better understand the potential short -term trajectory of Ethereum.

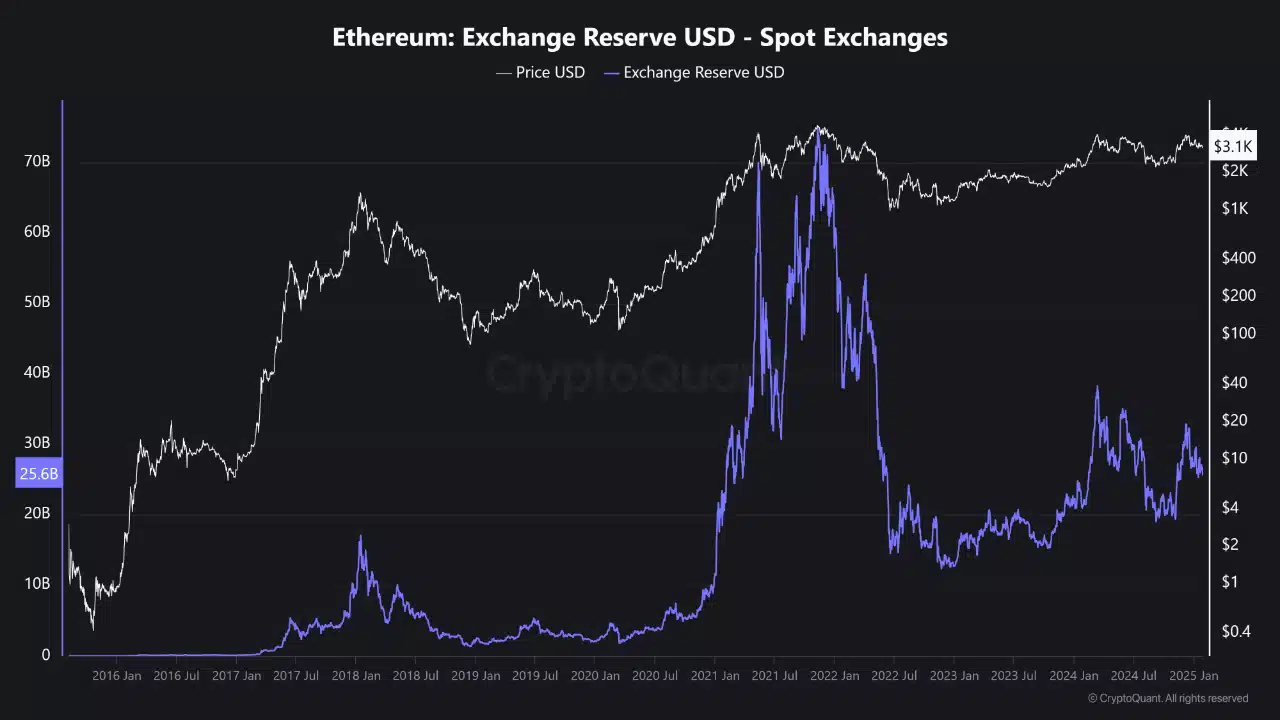

For example, data Cryptoquant indicated a recent increase in a particular metric of 0.58 on January 15 to 0.63 on January 18, followed by a slight decrease to 0.61 on January 27.

Source: cryptocurrency

Read the price forecast of Ethereum (ETH) 2025-2026

This fluctuation suggests a period of consolidation, where market players adjust their positions in response to changing conditions.

If the metric continues to hold above certain thresholds, it could indicate growing confidence between investors and potentially pave the way for upward price movements.