Ethereum undergoes one of the most important resets in more than a year, caused by its price below $ 4,000. This retest was most visible in the long -term open interests, where billions of dollars in posts have been destroyed in large exchanges. This rapid relaxation came as a correction movement to weeks of excessive lever effect during ascending trends that had pushed the activity of derivatives at unsustainable levels.

Related reading

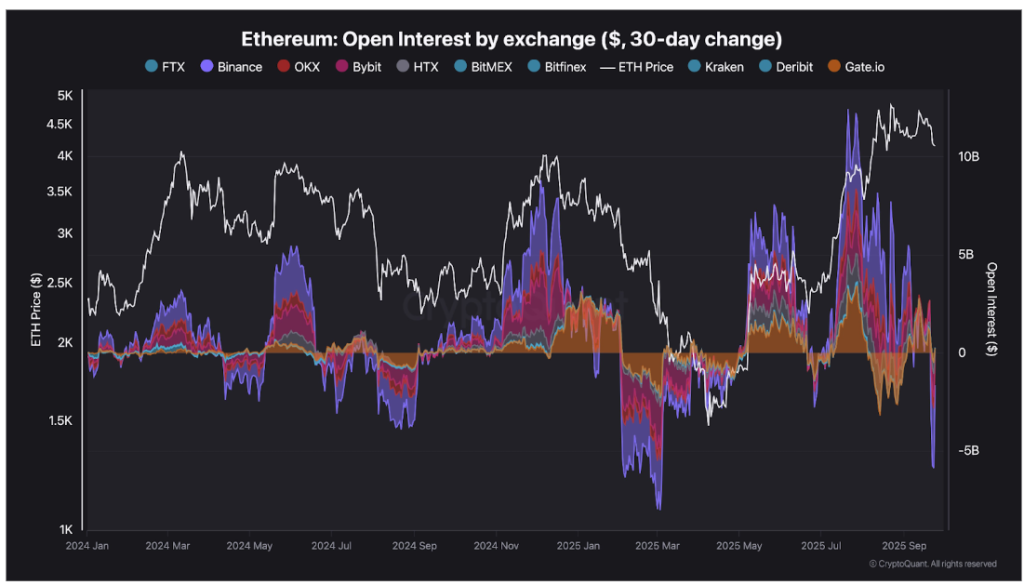

Massive open interest light on the main exchanges

The correction of the most recent Ethereum prices was a wider reset of the market rather than a simple drop, with leverage traders confronted with the weight of losses. The data show that Ethereum’s open interest experienced a steep fall during the week that has just concluded on several exchanges of cryptography. According to data from The cryptocurrency chain analysis platform, billions of Ethereum posts were wiped out last week, Binance leading the slowdown with the most steep monthly decrease.

Ethereum’s slide below $ 4,000 turned out to be the breakdown for Suforate traders. This decision launched a wave of liquidations on the derivative markets, making up the sales pressure.

The data shows that more than $ 3 billion was erased on September 23 through Binance, followed by more than a billion dollars a day later. Bybit also lost $ 1.2 billion in posts, while OKX recorded a decrease of $ 580 million. The strong reduction is visible in a global open interest, which has dropped to its lowest level since the beginning of 2024.

As the data of the graph show, the long -term lever and the open interest was closely linked to the price rally in July and August, and at the same time, it has decreased locking with the price.

Ethereum open of interest by exchange

ETHEREUM SPOT ETF outputs add to the market strain

The rupture of Ethereum below $ 4,000 and the drop in open interest coincides with a week of heavy outings of ETHEREUM in the United States. According to to data from Farside investors, 795.56 million dollars circulated over five days of negotiation last week, which is the largest weekly exodus since the launch of the products.

THE Intensified saddler Towards the end of the week, Thursday with Thursday $ 251.2 million in outings, followed by an additional $ 248.4 million on Friday. The participation of the decreasing institutions contributed massively to the pressure of the sale, investors showing caution in the midst of uncertainty as to whether the regulators made it possible to establish characteristics in these ETFs. This synchronized outing of derivatives and institutional products amplified volatility, creating a convergence of pressure through the Ethereum commercial ecosystem.

Related reading

After diving as low as $ 3,845, ETH The bulls managed to hold Above $ 3,800. At the time of writing the editorial staff, Ethereum is traded at $ 4,002. Despite this attempt to regain stability, the Altcoin Leader is still down approximately 10% in a weekly time, since it was negotiated about $ 4,490 last week. The Haussier scenario now lies in the question of whether Eth can recover and maintain a movement above $ 4,000.

Felash star image, tradingView graphic

(Tagstotranslate) Altcoins

Source link