- The ETH funding rate has also increased in recent days.

- In the event of a correction, ETH could fall again to $3.3k.

As the king of altcoins, Ethereum (ETH)just a few steps away from the $3.7k mark, it reached a remarkable milestone. One of the main metrics derived from ETH has reached an all-time high. But is this a bullish signal or will it have a negative impact on ETH price action?

Ethereum record high could attract bears

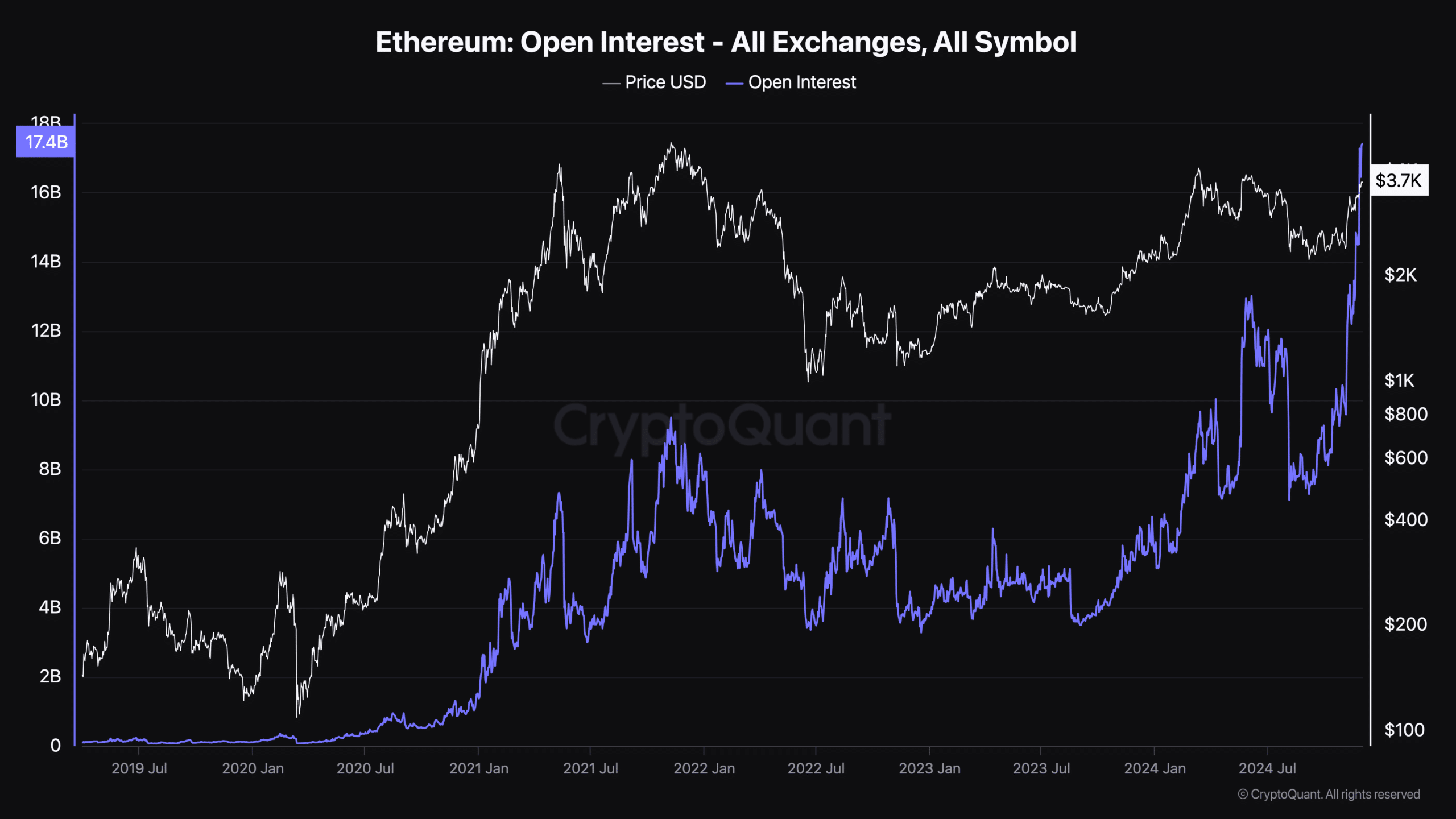

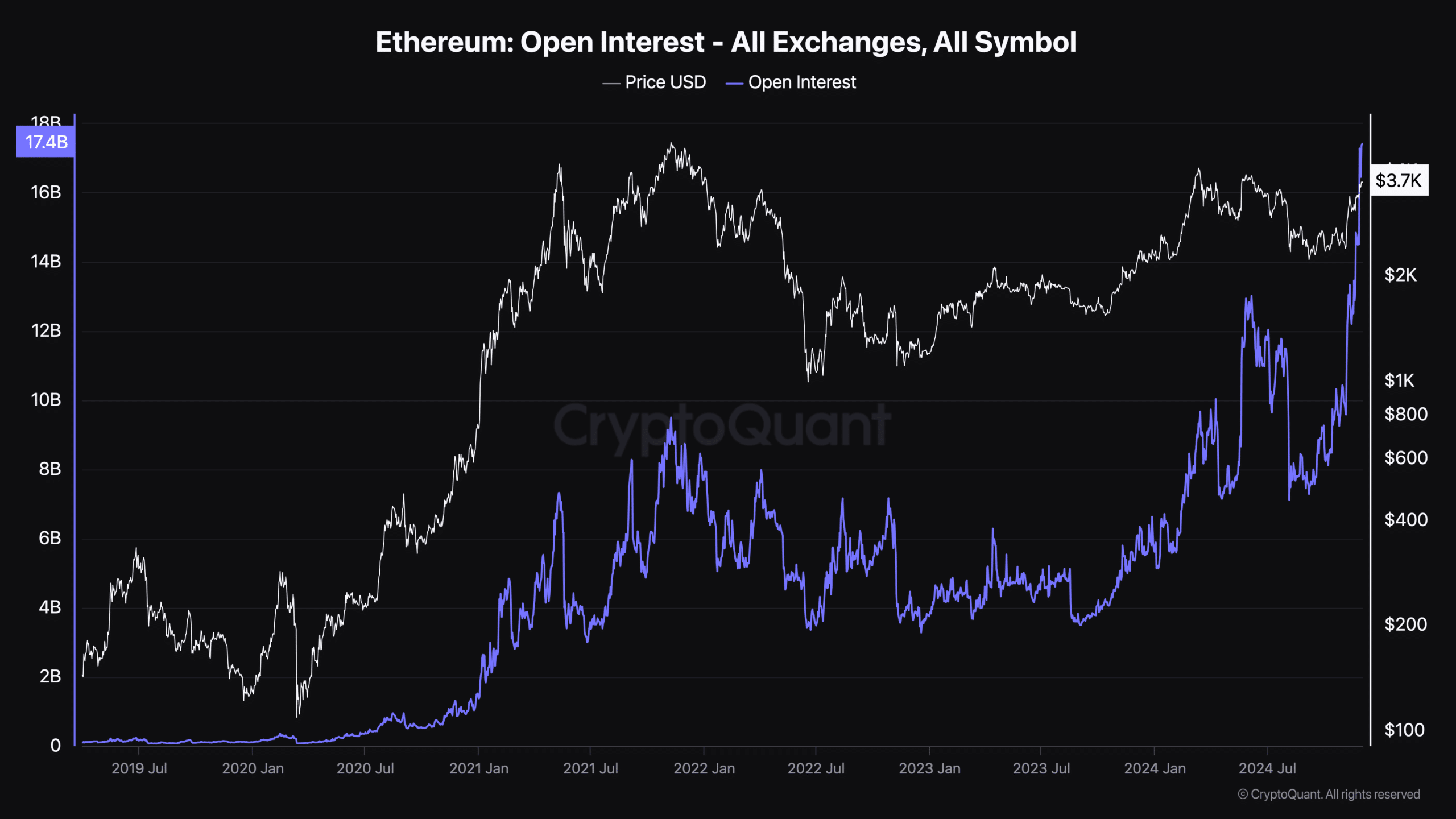

Ethereum Open Interest (OI) has reached an all-time high of over $17 billion. An increase in OI means more traders are taking positions in a futures or options contract, and more money is likely entering the market.

Source: CryptoQuant

In fact, another derivatives indicator, the funding rate, has also seen a considerable rise in recent days. A rise in the metric is bullish because it generally indicates an optimistic market, where traders are willing to pay more to maintain their long positions.

Although at first glance this might give the impression of a continued rise in prices, the reality could be different. As the chart above shows, every time open interest rose sharply, it was followed by price corrections.

Such episodes occurred in November 2021 and June 2024. On both occasions, the rise in OI somehow marked a market top.

Will history repeat itself?

To check whether ETH was at the top of the market, AMBCrypto dug deeper into the token’s on-chain data. According to our analysis of CryptoQuant datathe ETH exchange reserve was increasing, a sign of increasing selling pressure.

Moreover, its stochastic was also in the overbought zone, suggesting a rise in the event of a sell-off, which often leads to price corrections.

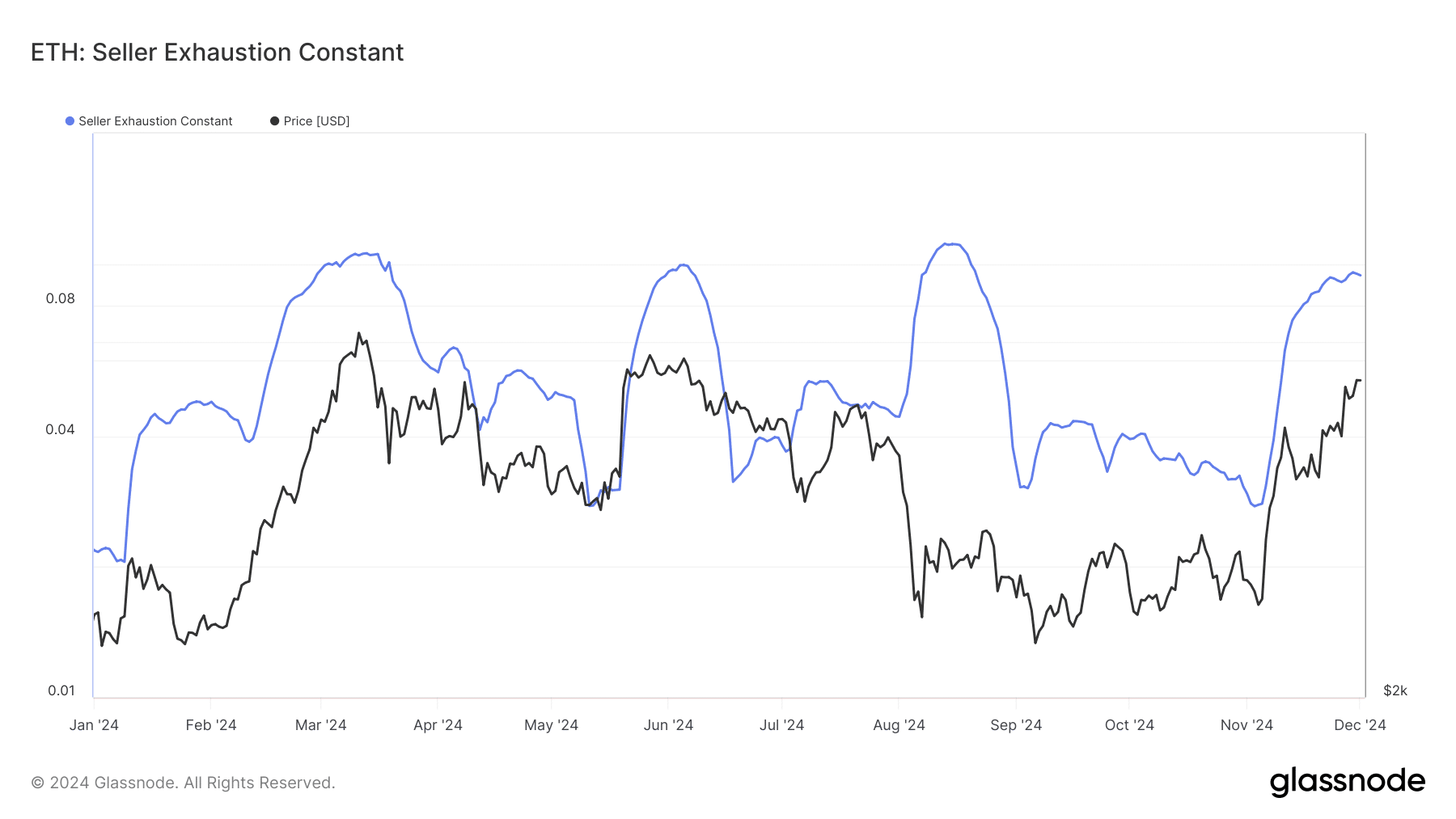

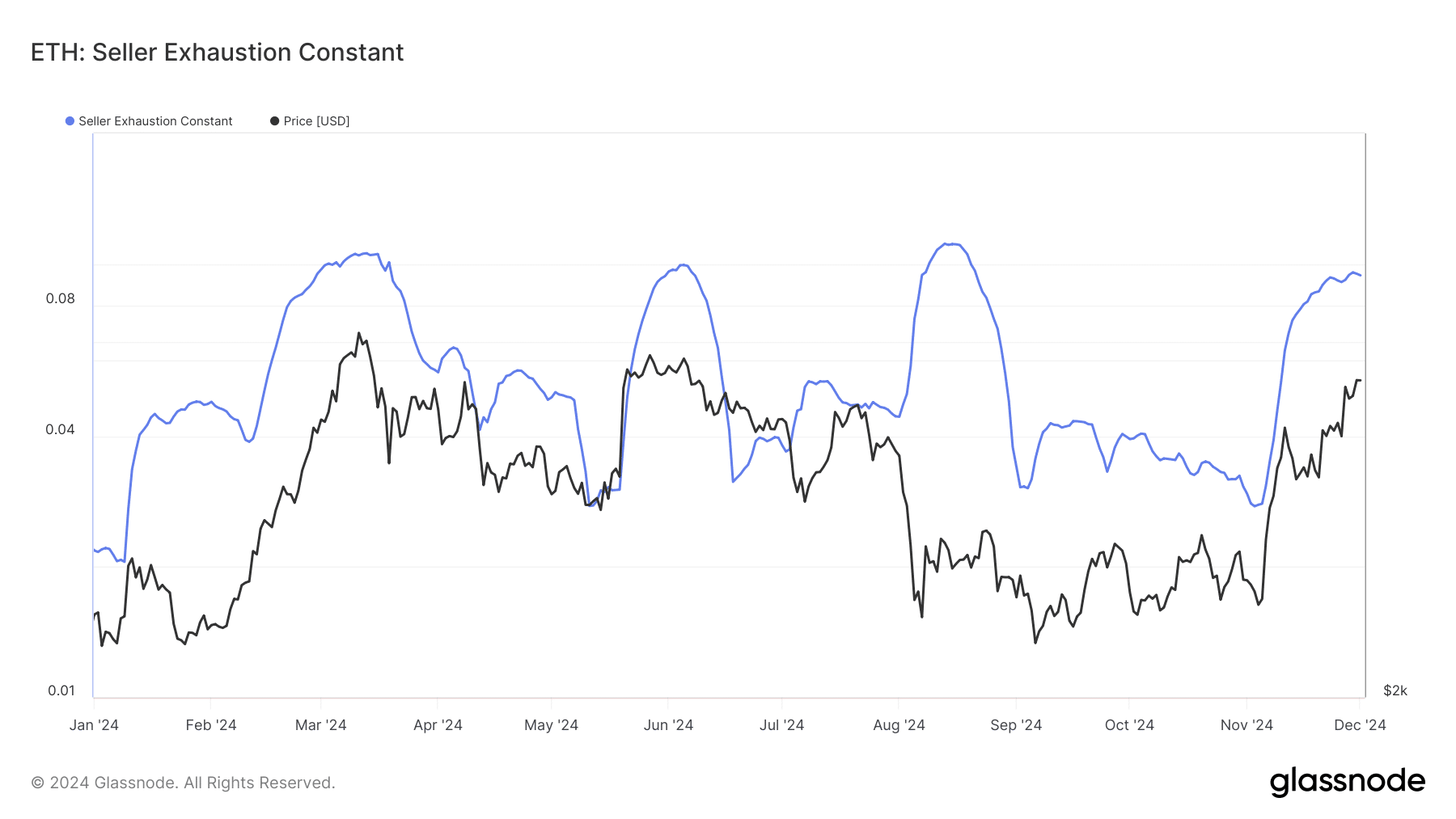

Apart from this, we also saw that the constant exhaustion of ETH sellers has reached a peak. It is clear from the chart that every time the metric peaks, the price of ETH drops significantly in the following days.

Source: Glassnode

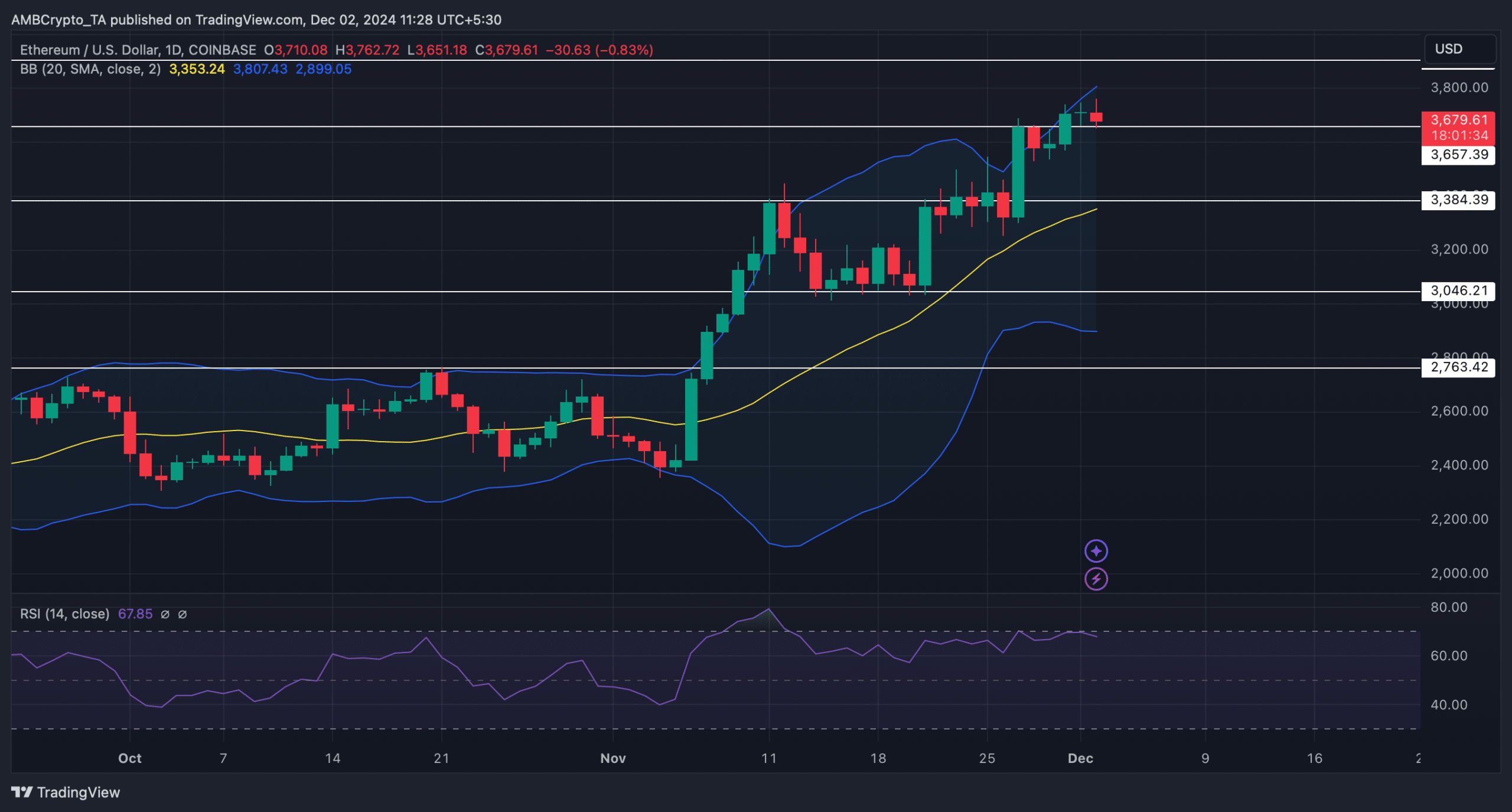

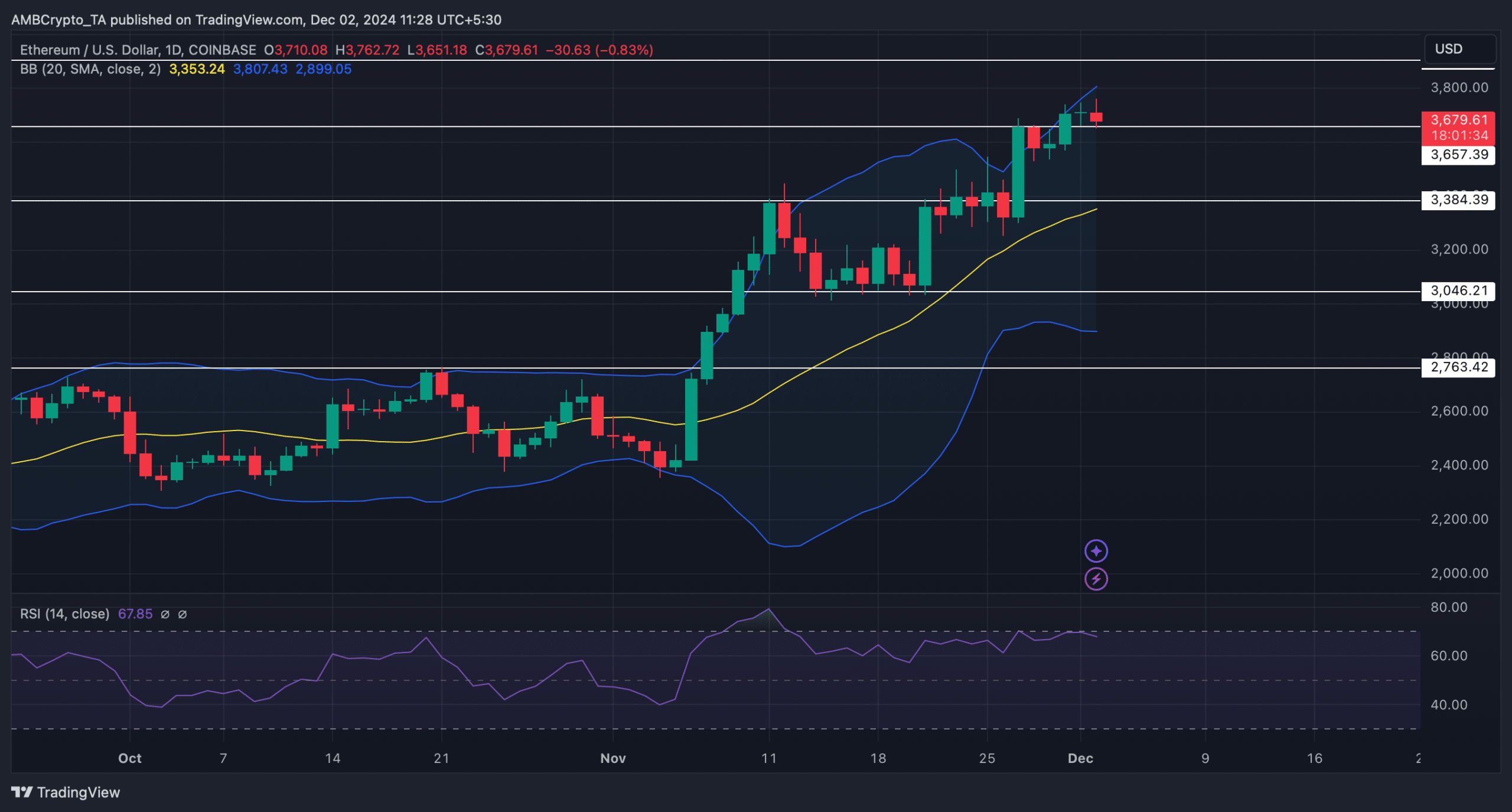

However, it was interesting to note that the Relative Strength Index (RSI) had not yet entered an overbought position. This suggests that there is still room for more buying, which can help Ethereum maintain bullish momentum.

At the time of writing, the altcoin king was testing support. If the RSI is to be believed, Ethereum could then successfully test the level and continue moving north.

Read Ethereum (ETH) Price Prediction 2024-2025

However, if the massive increase in OI and funding rate leads to a drop in prices, like what happened in history, then ETH could fall to its lower support.

To be specific, a decline from the current price level could initially push ETH down to $3.38K.

Source: TradingView