Ethereum price performance has been quite disappointing in the last weeks of 2024, in difficulty under $ 3,500. This end -of -year blues sank into the action of Altcoin in the first month of 2025, because it failed to create a serious momentum in the first 30 days of the year.

Unsurprisingly, this slow price action led to the panic of several Ethereum investors, with part of the reflective market if to sell their tokens. A popular crypto analyst on the social media platform X presented an in-depth analysis of the ETH Prize in the coming months.

What does the future contain for the ETH price?

In an article of January 31 on X, the expert Crypto Ali Martinez tried to respond to “Is it time to sell Ethereum and move on?” Question while decomposing its recent price action and its chain movement. According to the analyst, the future seems somewhat dark for the price of the ETH, because it is at the risk of a short term correction.

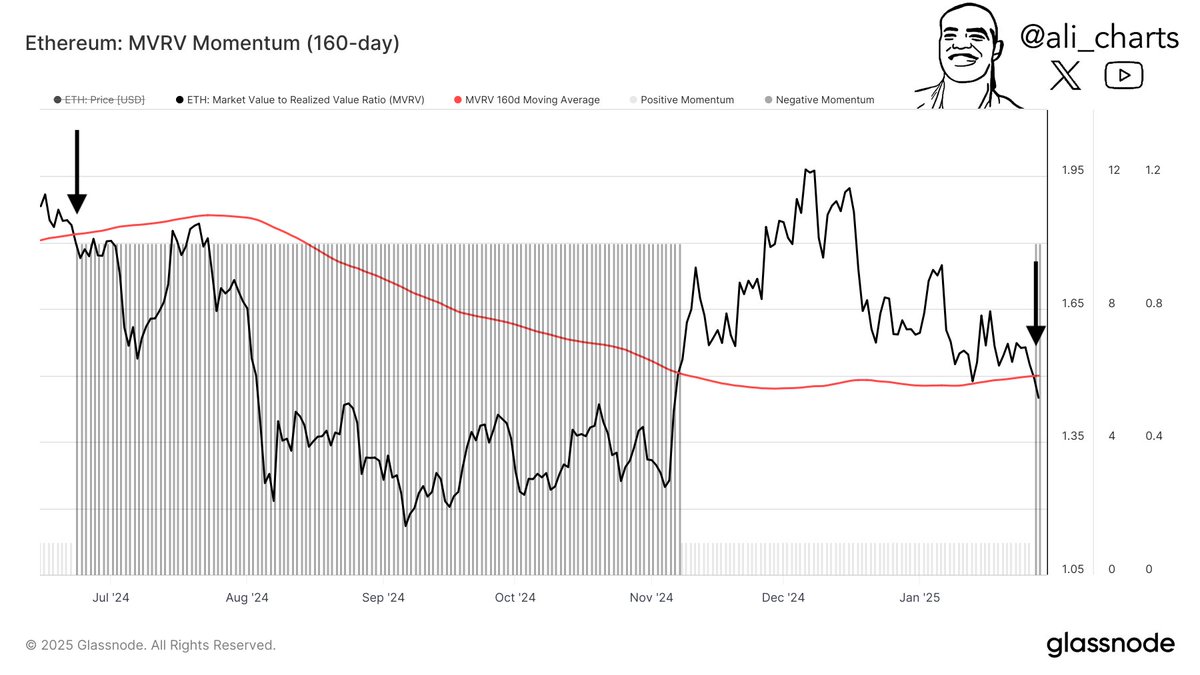

This is based on the MVRV report (Mobile average at 160 days), which follows the ratio between the market capitalization of a room and the ceiling carried out. It helps to assess whether a cryptocurrency (Ethereum, in this scenario) is overvalued. According to Martinez, the price of the ETH recently fell under the MVRV (160D-MA), an event which led to a correction of 40% the last time.

Source: Ali_charts/X

The potential of a severe price decline has led to a change in the feeling of investors, a particular cohort of investors showing a certain level of anxiety on the market. Glassnode data show that long -term Ethereum holders are starting to sell some of their parts, strengthening the chances of pricing.

In the case of a correction, certain price levels on chain could be crucial for long -term health of the price of the ETH. One of these price regions is between $ 2,230 and $ 2,610 (where nearly 12 million portfolios bought 62.27 million ETH)This could act as a major support area against additional decline.

From the point of view of the analysis of technical prices, the price of the ETH seems to form a reversal head and shoulder model, with a major level of support between $ 2,800 and $ 3,000. According to Martinez, the Ethereum price could make A game for the neck of the reason at $ 4,000 if this support region holds.

Source: Ali_charts/X

While the level of $ 4,000 acted as a major resistance level for four years, the recent accumulation of whales increases the chances of Ethereum to break this crucial region. The latest chain data show that WHales bought more than 100,000 ETH (worth more than $ 340 million) in the last days.

Martinez noted that if the Ethereum price successfully reaches the $ 4,000 mark, it could travel up to $ 6,770 on the basis of MVRV price strips. This would represent a rally of more than 100% compared to the current price.

Ethereum Prize at a glance

To date, the price of Ethereum amounts to around $ 3,315, reflecting more than 2% in the last 24 hours.

The Ethereum price loses the $3,300 level on the daily timeframe | Source: ETHUSDT chart on TradingView

Istock star image, tradingview graphic