Este Artículo También is respondable in Español.

Ethereum Price action in The last seven days have led to the creation of a capitulation candle that could send it to another wave In the next eight to twelve weeks. This capitulation candle drew the attention of the cryptographic analyst Ted Oreads, who noted an interesting repetitive capitulation model for Ethereum.

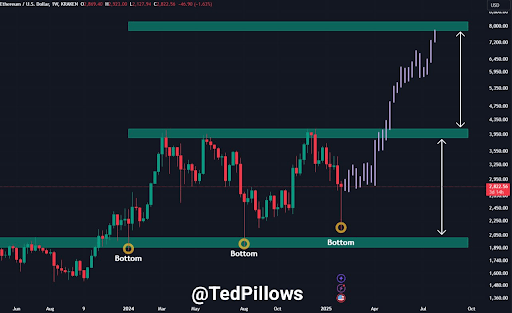

According to TED OREADS’s technical analysis, Ethereum printed a capitulation candle in early 2025, as in the first quarter of 2024 and in the third quarter of 2023.

Capitulation candles and Ethereum historical models

Tedpillow analysis That the Ethereum Prize has undergone three main capitulation events in the past two years, which has led to significant price rebounds. In particular, these capitulations took place within the weekly candlestick period, where the Ethereum price experienced intense sales pressure throughout the week. However, the presentation of historic prices shows that these capitulations have often marked the bottom before a massive price rally.

Related reading

The first of these capitulations occurred in T1 2024 and finally led to a 100% rally in the next three months, the Ethereum price reaching $ 3,950. The second capitulation took place in the third quarter of 2024, leading to a similar recovery. Ethereum is now experiencing another moment of capitulation at the beginning of 2025, the analyst suggests that the model is ready to repeat. He believes that Ethereum again forms a background of the market, preparing the way For an aggressive ascending movement.

Overvoltage at 100% Ethereum and the potential peak

If Ethereum follows its previous trajectory, the following eight to twelve weeks could lead to a significant increase in prices, even if the Altcoin Leader currently has difficulties around $ 2,700. A pump of 90% to 100% after the recent capitulation would increase the Ethereum price Resistance levels of past keys And above its top of all time today.

Related reading

Tedpillows’ analysis suggests that Ethereum’s ultimate price objective after this capitulation could reach $ 8,000. However, it is likely to encounter significant resistance almost $ 3,950, a level that has historically triggered refusals in past capitulation cycles. If Ethereum has trouble unraveling this barrier again, a temporary withdrawal could be on the horizon before any movement supported above.

Meanwhile, ETHEREUM SPOT ETF attract heavy entrances Despite the slowdown in Ethereum prices. Institutional investors seem to capitalize on the decline and increase their assets in ETH in anticipation of a wider market rebound.

Identify FNB ETFs have recorded $ 513.8 million in entries in the last six days of negotiation, Blackrock leading the price by acquiring $ 424.1 million in ETH. This regular accumulation of institutional holders suggests growing confidence in the long -term potential of Ethereum and could lay the basics of overvoltage at 100% planned over the next eight to twelve months.

At the time of writing this document, Ethereum is negotiated at $ 2,725, down 4% in the last 24 hours.

Felash star image, tradingView.com graphic