This article is also available in Spanish.

Ethereum price could face some turbulence, as Justin Sunthe founder of Tron (TRX), has released a whopping $209 million to Lido Finance, a liquid decentralized staking platform for Ethereum. Compared to major cryptocurrencies like Bitcoin (BTC) and Dogecoin (DOGE)Ethereum price performed relatively subdued, climbing to $4,000 before consolidating and struggling to rise. With the possibility of additional sales, Ethereum could see its price fall if Sun decides to throw more coins.

Justin Sun abandons ETH

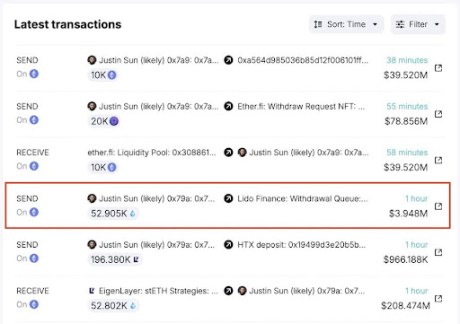

New reports from Spot On Chain, an AI-powered crypto platform, revealed that Sun recently requested the withdrawal of a staggering 52,905 ETH tokens worth approximately $209 million. Financing of the Lido. According to on-chain data, this mass withdrawal was part of the ETH reserve that Sun allegedly accumulated between February and August 2024.

Spot On Chain revealed that the total amount of Ethereum Sun purchased during this period, 392,474 ETH tokens, valued at $1.19 billion. All of these tokens were purchased through three wallet addresses at an average price of $3,027. Currently, the total profit made by the Tron founder since his purchase stands at $349 million, which represents a 29% increase from his purchase price.

Interestingly, on October 24, Sun had unlocked 80,251 ETH tokens, worth over $131 million, from Lido Finance. Four days later, he transferred the entire amount to Binancethe largest crypto exchange in the world. This notable move came just before the Ethereum price fell sharply by 5% in mid-October, which could have resulted in a loss for Sun.

Unsurprisingly, this isn’t the first time Sun has abandoned Ethereum. Spot On Chain revealed earlier this month that the founder of Tron had been cash out your Ethereum assets during the market rally.

In November, Sunday filed 19,000 ETH worth $60.83 million to HTX, a crypto exchange. Furthermore, he transferred 29,920 ETH valued at $119.7 million at HTX after its price surpassed $4,000 over the past week. These are just a few transactions the Tron founder has made with ETH over the past month.

Given Sun’s history of large-scale asset movements, further sales could impact the already fragile Ethereum market. Nonetheless, the question remains whether the Tron founder will continue his tenure. Ethereum dumping spree.

Ethereum Price Crash Coming?

Although Sun has not publicly commented on his recent Large-scale Ethereum withdrawalsthe size and timing of these transactions could pose a problem for the altcoin’s future trajectory. Historically, large ETH liquidations have triggered a price crash due to increasing sales pressures.

Related reading

The price of Ethereum is still unstable and aiming for a stronger bullish recoveryfurther large-scale ETH dumps could exacerbate market volatility, especially if other investors or whales follow suit. For now, the price of Ethereum appears to be efficientrecording an increase of more than 7% over the past seven days and a 28% increase over the past month, according to CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com