Join our Telegram channel to stay up to date with the latest news

The price of Ethereum plunged 2% in the past 24 hours to trade at $4,013 as of 3:33 a.m. EST on trading volume that fell 28% to $41.6 billion.

Tom Lee’s BitMine Immersion Technologies took the opportunity to buy the dip, scooping up 104,336 ETH worth around $417 million from Kraken and BitGo, according to on-chain data from Lookonchain.

This new acquisition follows last week’s $828 million purchase of the company.

It looks like Bitmine(@BitMNR) just bought 104,336 more $ETH($417 million).

In the last 7 hours, 3 new wallets received 104,336 $ETH($417 million) #Kraken And #BitGo.

Despite Crypto Market Crash, Tom Lee Still Predicts $ETH will reach $10,000 by the end of the year. pic.twitter.com/Vn5b9ijP2Z

– Lookonchain (@lookonchain) October 16, 2025

“The crypto sell-off over the past few days has led to a decline in the price of ETH, which BitMine has benefited from,” said Lee, BitMine President. “Volatility creates deleveraging, which can cause assets to trade at prices significantly lower than their fundamentals. »

Meanwhile, according to recent data from Bitwise, almost all of the Ethereum accumulated by public companies to date occurred in a three-month window between July and September.

95% of all ETH held by public companies was purchased in the last quarter alone.

Watch this space.

Enterprise Adoption of ETH, Q3 2025 Edition pic.twitter.com/9hDARuo9vQ

– Bitwise (@BitwiseInvest) October 15, 2025

Of the 4.63 million ETH held on public company balance sheets as of September 30, about 4 million were added during the third quarter, it says.

Joseph Chalom, co-CEO of Sharplink Gaming said On Wednesday, he is “optimistic” about Ethereum because it is “the best choice for institutions.”

“It’s decentralized, secure, and its network keeps growing,” Chalom said.

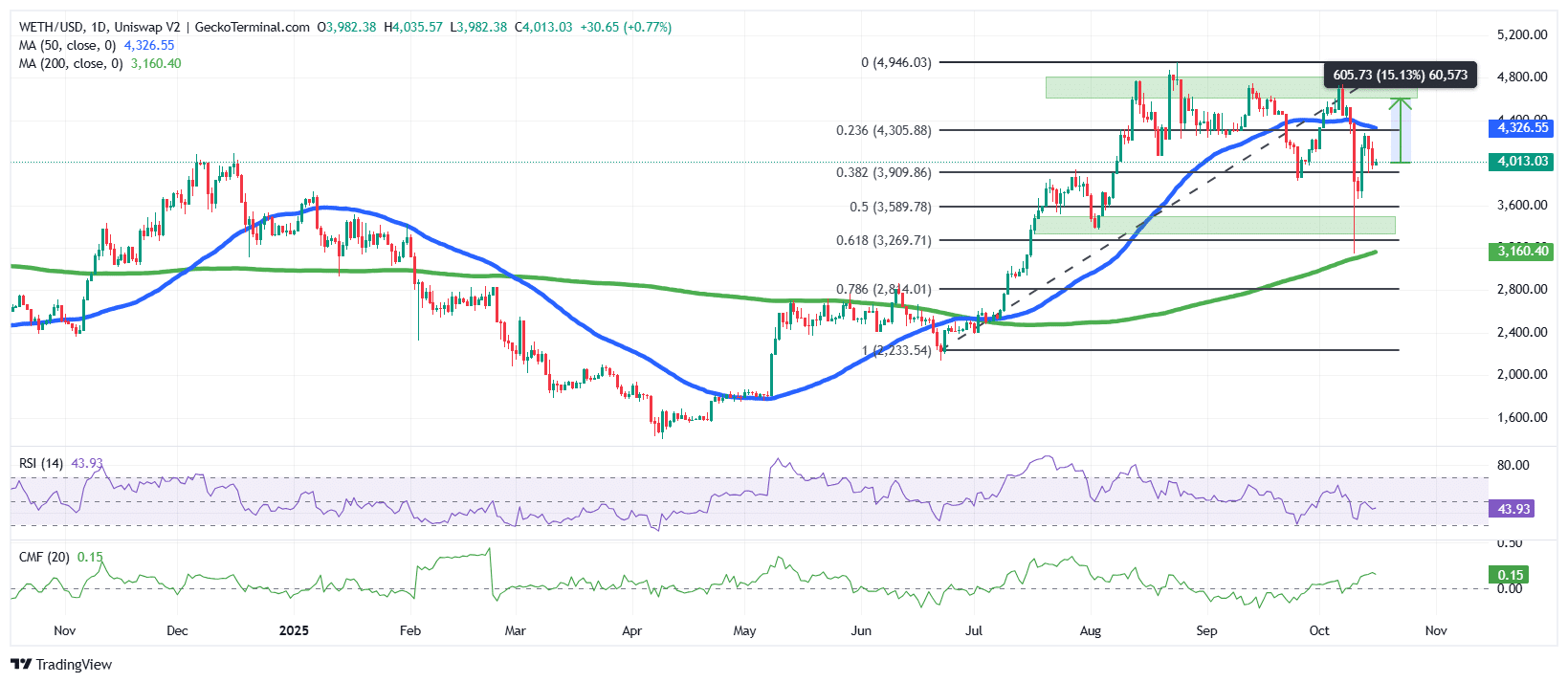

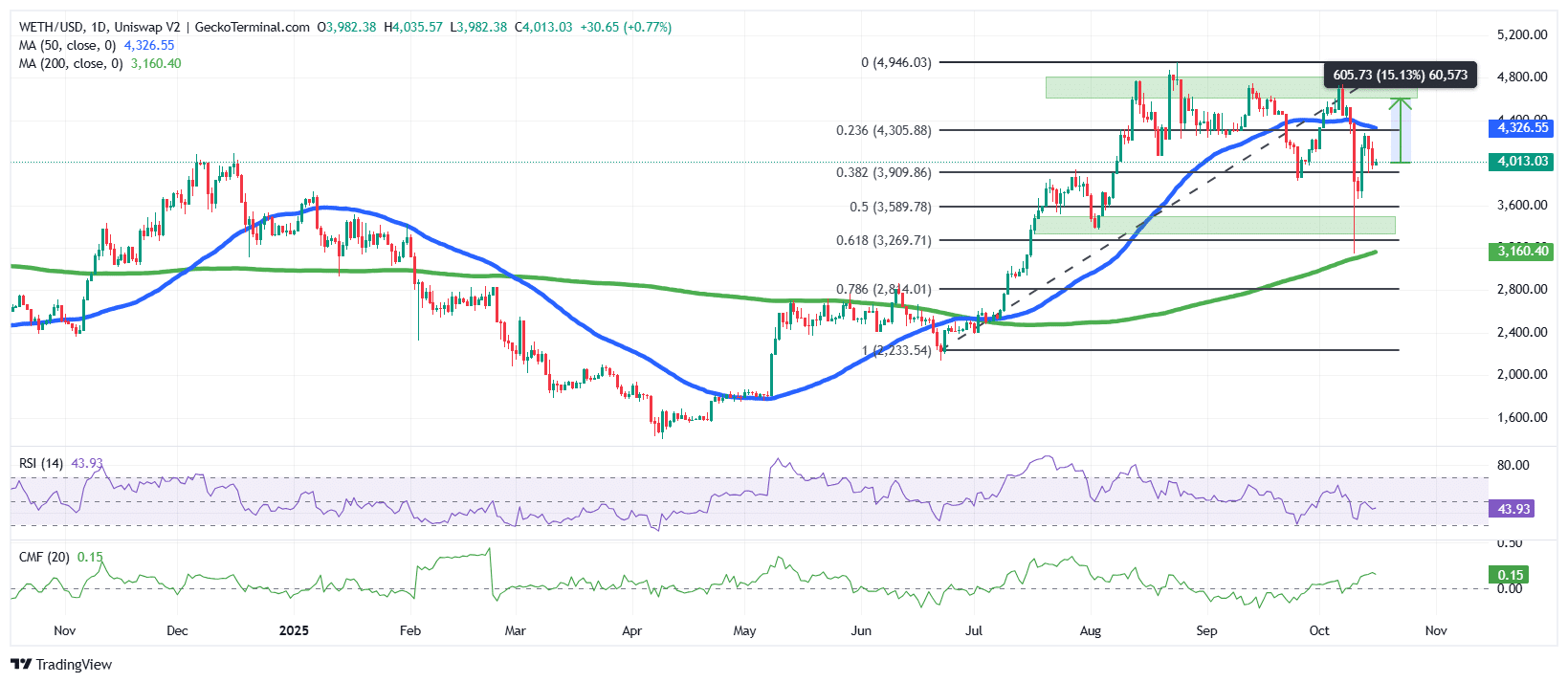

Ethereum price regains footing after strong correction

THE ETH Price recently found stability after a volatile period that tested the $3,600 support zone.

The daily Ethereum price chart shows that ETH is now trading around $4,013, recovering steadily after falling below its short-term support at the 0.382 Fibonacci retracement level ($3,909). This strong rebound from this region indicates strong buying interest, especially around the mid-Fibonacci zone between 0.382 and 0.5.

At the same time, the broader structure reflects a bullish recovery as part of a medium-term uptrend, although recent ETH price fluctuations have introduced near-term uncertainty.

The 50-day simple moving average (SMA) at $4,326 is currently acting as dynamic resistance, while the 200-day SMA near $3,160 provides a solid base of long-term support. The 50-day SMA remaining above the 200-day SMA suggests that the trend remains positive, even as Ethereum price tests crucial resistance levels.

The Relative Strength Index (RSI) currently sits at 43.93, suggesting that the market is emerging from slightly oversold conditions. This level often precedes recovery phases when accompanied by favorable price action.

Additionally, the Chaikin Money Flow (CMF) indicator reads +0.15, reflecting a resumption of capital inflows after a brief period of outflows. A positive CMF generally indicates that buying pressure is increasing, consistent with the recent price stabilization above $4,000.

ETH targets $4,600 as bulls regain confidence

ETH appears poised for a potential retest of the $4,600-$4,900 zone, representing a 15% upside from current prices. Sustained momentum above the 50-day MA would confirm the continuation of the broader bullish pattern.

However, if Ethereum price fails to hold support above $3,900, a retest of $3,600 or even the 0.618 Fibonacci level near $3,270 remains possible.

This bearish sentiment is supported by crypto analyst Ali Martinez, who claims that Ethereum price is on the verge of a MACD crossover.

Ethereum $ETH is on the verge of a bearish crossover in the MACD on the weekly chart. The last two times the price fell 43% and 61%. pic.twitter.com/RRIjFeR63k

– Ali (@ali_charts) October 16, 2025

Overall, the trend remains cautiously bullish. A break above $4,326 would mark a new uptrend, potentially setting the stage for a retest of yearly highs near $4,946.

Related news:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news