Ethereum just had one of those moments that forces you to check the chart. A veteran whale moved around $543 million in ETH to Binance.

Analysts are already warning that if key support levels break, ETH could see a potential decline of 40%.

Key takeaways

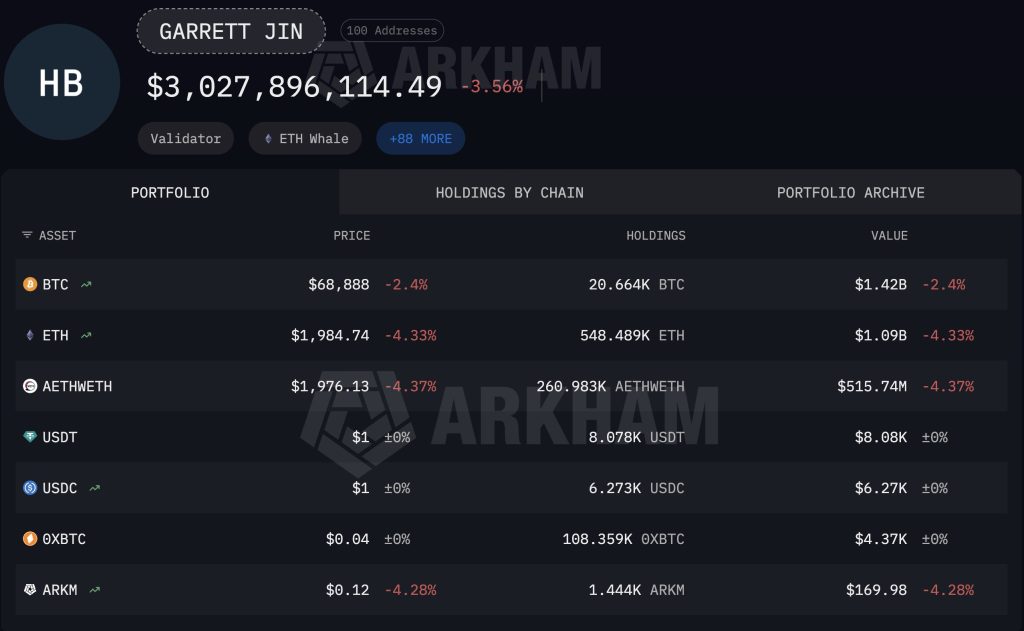

- Whale wallet “Garrett Jin” deposited 261,024 ETH on Binance in rapid tranches.

- Technical indicators show a bearish pennant formation targeting a decline to $1,200.

- Bears need a confirmed break below $1,950 to trigger the 40% downward move.

Is a massive sell-off starting?

Data shows that a wallet linked to early investor Garrett Jin transferred exactly 261,024 ETH to Binance in three large batches. When this type of size reaches a centralized exchange, traders assume one thing. Either a major cover or a sale.

The whale still controls over $1.6 billion in assets, so it’s not a total exit. But even a fraction of that supply hitting the market could shake things up.

Sentiment is already fragile after weak earnings across the sector and broader price weakness. If this whale begins to unload on limited liquidity, order books could dry up.

Ethereum Price Path to $1,200

The picture seems tense, without a doubt. Ethereum price turns into a classic bearish pennant on a daily basis.

This trend often deviates from the previous movement, namely the decline from $2,800 to the $1,900 area at the beginning of the month.

A break below $1,950 would technically open the door towards the $1,200 zone.

But here’s the problem. Flags are compression models. And when price wraps up this tightly, the eventual breakout can be explosive in either direction.

If Ethereum can defend the $1,950 area and push back above the pennant’s upper trendline, it could trap late shorts and trigger a relief rally.

Ethereum Price Faces 40% Crash Risk as Legendary Whale Dumps $543 Million in ETH – What Happens Next? appeared first on Cryptonews.