Join our Telegram channel to stay up to date with the latest news

Ethereum price fell 3.4% over the past 24 hours to trade at $2,847 as of 3:50 a.m. EST, representing a 31% increase in trading volume to $90.9 billion.

This drop in ETH price comes as Ark Invest continues to buy the dip by accumulating more shares in leading Ethereum treasury company BitMine Holdings.

Ark purchased BitMine shares worth $10.56 million in three ETFs (exchange-traded funds), adding to the $17 million acquired on Monday.

BitMine slipped 6.6% on Wednesday to close at $29.32, down about 24% over the past five days.

Cathie Wood loves buying Bitmine for under $30!

ARK Invest purchased 360,232 Bitmine shares today!

😏😏😏$ETH / $BMNR pic.twitter.com/ycy80niqJS

– Kodi (BMNR) 📌 (@SweatyKodi) December 18, 2025

Ark Invest’s continued accumulation reflects CEO Cathie Wood’s bullish stance. She anticipates a “real breakout” in inflation next year, which could favor high-growth, innovation-focused assets like crypto stocks.

BitMine President Tom Lee echoed this optimism, highlighting the company’s weekly ETH purchases even amid the market crisis. He also cited improving regulatory clarity in Washington and stronger institutional participation as reasons why the “best days for crypto” are yet to come.

Ethereum price sees strong support

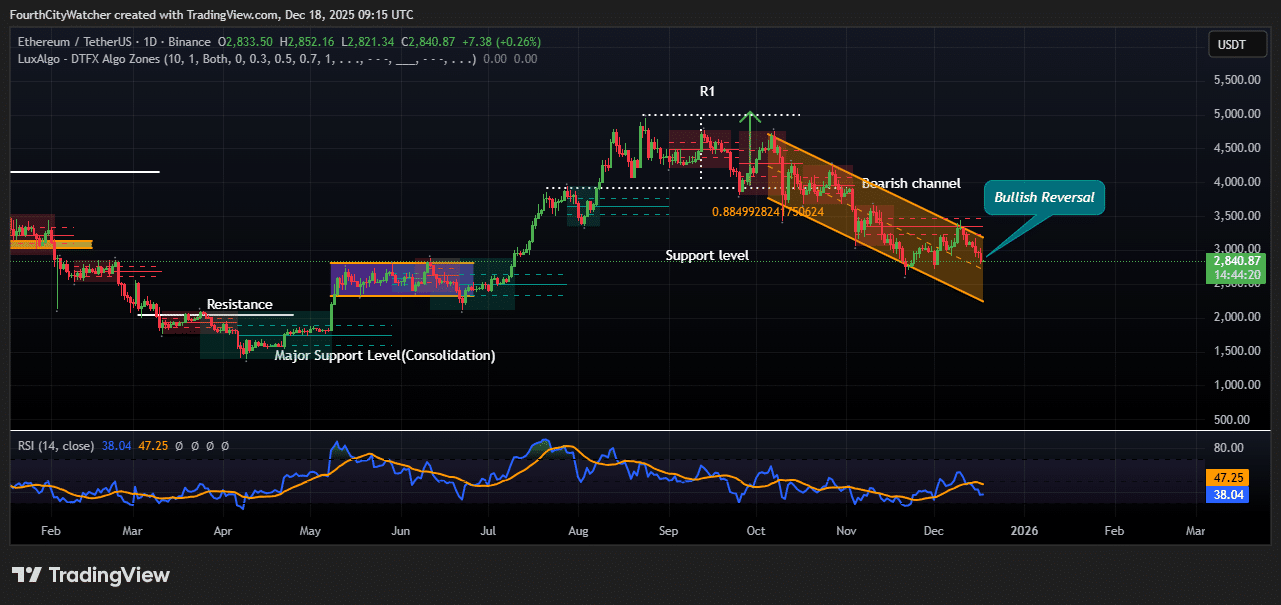

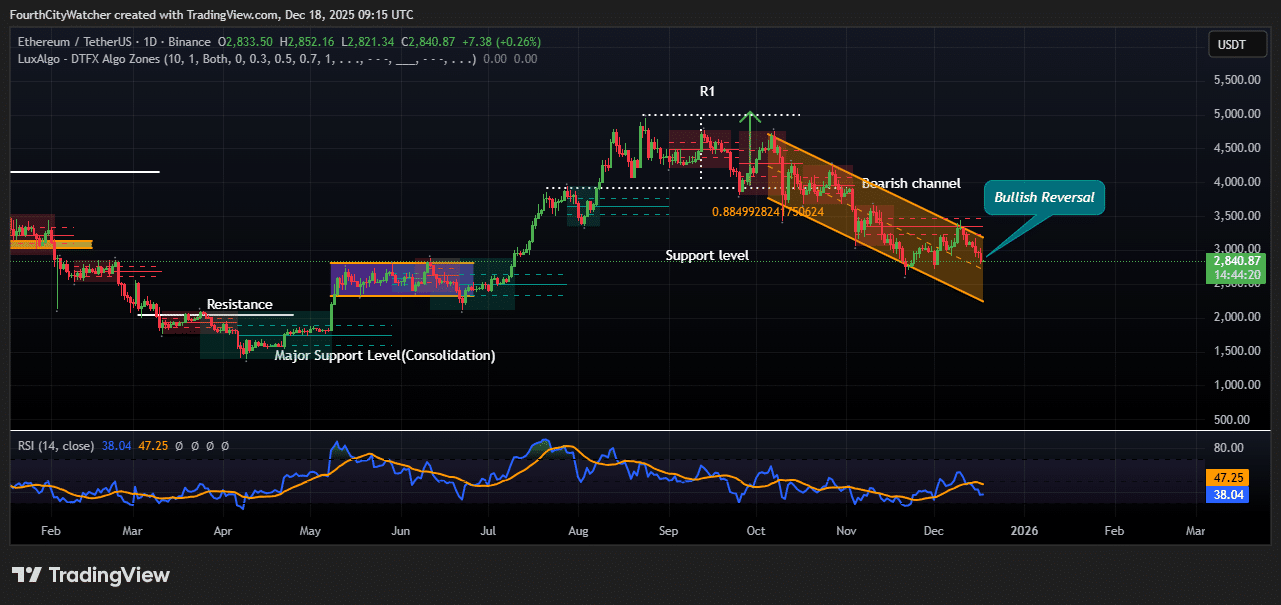

Ethereum price is trading at the $2,847 level, support after an extended bearish move. On the daily timeframe, ETH remains in a descending (bearish) channel that has guided price action lower since the September high near the $4,800-$5,000 region.

However, recent candles suggest a potential bullish reversal attempt from the lower boundary of this channel.

The ETH trading pair peaked near the R1 resistance zone, where strong selling pressure appeared. This rejection marked the start of a steady downward trend characterized by lower highs and lower lows.

The bearish channel clearly defines this trend, with price repeatedly respecting both the upper resistance line and the lower support line, thus reinforcing its technical validity.

Currently, ETH is bouncing off the lower channel support, which also aligns with a key horizontal support level between $2,800 and $2,850. This confluence reinforces the area as an area of significant demand. Historically, similar reactions from such confluence zones have led to a resumption of relief in the short to medium term.

ETHUSDT analysis source: Tradingview

The Fibonacci retracement taken from the major low to the recent high highlights the 0.886 retracement level as a critical support zone. The price is holding just above this level, which is often a last defense for bulls in a correction phase.

Sustained holding above this zone increases the likelihood of a reversal rather than a continued breakout.

The RSI (14) is currently around 38-40, which is below the neutral level of 50 but above heavily oversold conditions. This indicates that the bearish momentum is weakening rather than accelerating. Additionally, the RSI has begun to flatten and curl slightly upward, often an early signal that selling pressure is fading.

A bullish confirmation would require ETH to break through and close above the midline and upper boundary of the bearish channel, followed by reclaiming the $3,100-$3,300 resistance zone.

A successful breakout could open the door for a move towards $3,500, where previous support turned into resistance.

On the other hand, failing to sustain the price above $2,800 would invalidate the bullish reversal pattern and expose ETH to greater losses towards $2,500 and potentially $2,200.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news