Ethereum price has been a focal point in recent analysis, with many asking the question – could it reach $8,000 in 2025?

Factors such as anticipated regulatory advancements in decentralized finance (DEFI) and the potential approval of Ethereum-based exchange-traded funds (ETFs) contribute to this optimistic outlook.

Meanwhile, Plutochain ($Pluto) could expand Bitcoin’s overall utility by adding smart contracts to its secure network.

It aims to merge the security of Bitcoin with the flexibility of Ethereum, making it a project worth watching in the following weeks.

Can Ethereum cross $8,000? Experts weigh in on its future in a growing challenge landscape

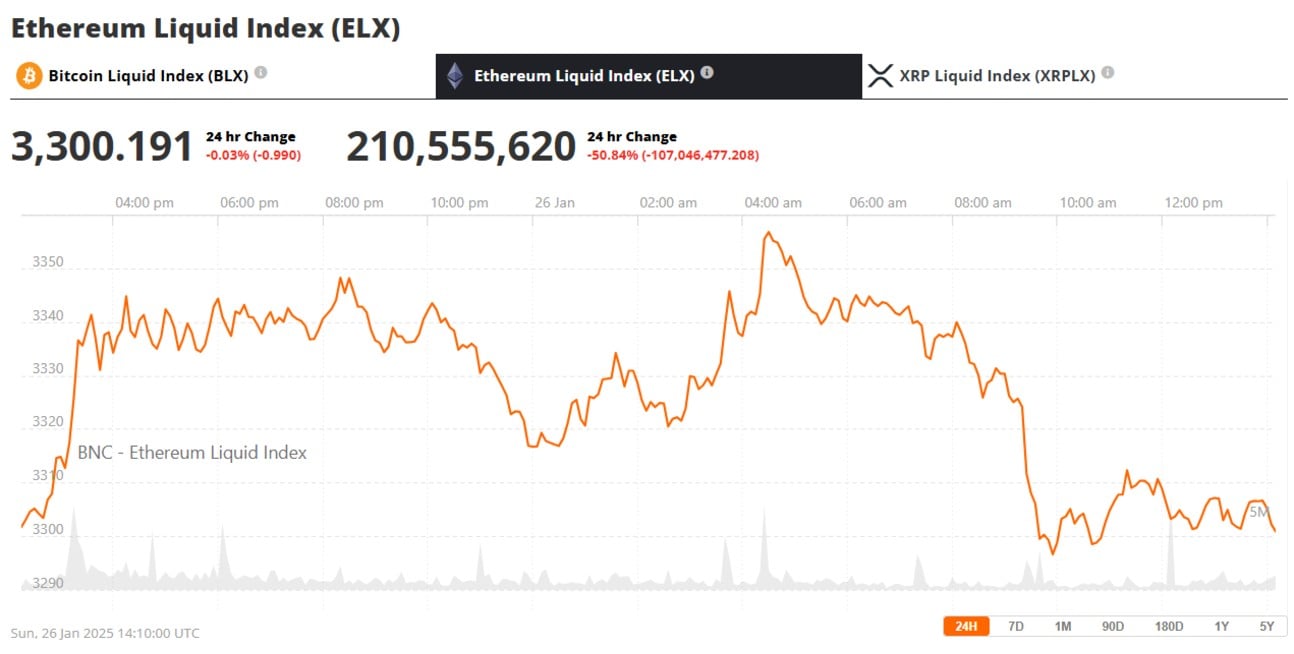

Ethereum (ETH) is currently trading at around $3,300. To reach $8,000, it would need to more than double its current value.

ETH Price Source: Brave New Coin Ethereum Liquid Index

Analysts have varied predictions:

- Standard Chartered’s Geoff Kendrick predicts that ETH could reach $8,000 by the end of the year, citing growing interest from institutional investors.

- Vijay Pravin Maharajan, CEO and founder of BitsCrunch, maintains a similar price target saying:

“Looking forward to 2025, $8,000 is a reasonable target, given how Ethereum has underperformed in this bull market, compared to bitcoin. However, Ethereum’s price trajectory will depend on whether it successfully addresses the network’s long-standing fragmentation problem, which has been exacerbated by the treadmill belt of Layer 2 solutions entering the market. »

The decentralized finance industry (DEFI), primarily built on Ethereum, has seen significant growth. The Ethereum Foundation’s recent commitment of 50,000 ETH to support Defi projects highlights this momentum.

However, reaching the $8,000 mark would require favorable market conditions, continued technological advancements, and increased adoption of Ethereum-based solutions.

Although ambitious, this target is within the realm of possibility if these factors align.

Plutochain May Be Ready to Lead the Charge in Bitcoin-Based Blockchain Innovation

Bitcoin has long been a digital titan, but its role as a simple store of value may soon change.

Plutochain’s innovative layer 2 solution could redefine the purpose of Bitcoin, introducing smart contracts, Defi and Dapps on its blockchain.

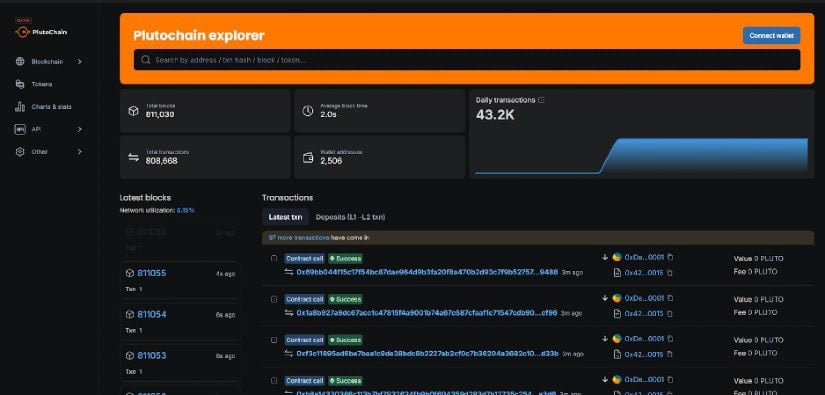

This project could significantly scale Bitcoin’s infrastructure, delivering an average block time of two seconds thanks to its layer 2 solution which could reduce costs and increase efficiency.

This could be a huge difference from what Bitcoin is currently dealing with – a 10 minute block time.

Key features like Ethereum Virtual Machine (EVM) compatibility can allow developers to easily migrate Ethereum applications to Bitcoin, potentially merging the flexibility of Ethereum with the security of Bitcoin.

This feature could open the door to a thriving Bitcoin Defi ecosystem, an area where currently 0.13% of Bitcoin’s market cap is locked – a stark contrast to Ethereum’s 10%.

Plutochain’s governance could put users in control of the project’s future, fostering a community-driven ecosystem.

Its impressive testnet processed 43,200 daily transactions, proving its readiness for real-world use.

Of course, security remains paramount with audits from Solidproof, Quillaudits and Assure Defi.

By enabling fast transactions, low costs, and diverse applications, Plutochain could be an interesting blockchain project to watch closely.

It’s not just about connecting networks – Plutochain could help Bitcoin grow from a simple store of value into a base of decentralized applications.

Last words

Ethereum continues to be the center of speculation, and many seem to believe that a target of $8,000 is not unrealistic.

Still, achieving this will require a lot to go right, but Ethereum appears to be up for the challenge.

Meanwhile, Plutochain ($Pluto) could attract even more attention with its hybrid layer 2 solution for bitcoin.

Plutochain could combine EVM compatibility with the security of Bitcoin, potentially enabling smart contracts and Defi on its network.

Please remember that this article is not financial or business advice. All cryptocurrencies are volatile and past performance is not a guarantee of future results. Always do your own research and/or consult experts before making crypto-related decisions. Trade responsibly. Forward-looking statements are uncertain and may not be updated.

This article is sponsored content. All information is provided by the sponsor and Brave New Coin (BNC) does not endorse or take responsibility for the content presented, which is not part of BNC editorial. Investing in crypto assets involves significant risk, including potential loss of capital, and readers are strongly encouraged to do their own due diligence before engaging with any company or product mentioned. Brave New Coin assumes no responsibility for any damage or loss resulting from reliance on the content provided in this article.