Join our Telegram channel to stay up to date with the latest news

Ethereum price rose 0.65% in the last 24 hours to trade at $3,865.10 as of 11:00 p.m. EST, on a 52% drop in trading volume to $16.52 billion.

ETH benefited from another purchase by Tom Lee’s BitMine, which picked up 7,660 ETH worth $29 million from Galaxy Digital on October 31 via its OTC desk. Such large private transactions are usually executed to avoid impacting the price.

🔥 NOW: Tom Lee’s Bitmine bought 7,660 $ETH of Digital Galaxy. pic.twitter.com/Jtcvhbn7bg

– Cointelegraph (@Cointelegraph) November 1, 2025

BitMine’s goal is clear: accumulate up to 5% of Ethereum’s supply under its “5% Alchemy” plan. It now holds 3.3 million ETH, or 2.745% of its supply, worth $12.8 billion, according to CoinGecko.

While institutions are busy accumulating, retail traders appear more cautious. Kalshi’s data shows that the chances of ETH reaching $5,000 before the end of the year have fallen sharply to just 34%.

Despite this, many analysts remain positive about Ethereum’s mid-term prospects, given its strong fundamentals and growing interest from professional buyers.

An increase in institutional buying means less ETH is available for sale on crypto exchanges. As tokens move into wallets held by long-term investors, short-term selling pressure decreases.

If the trend continues, supply could tighten further, thus encouraging prices to rise. Such initiatives by BitMine and other large companies often lead to rebounds that attract small investors back into the market.

Ethereum price: On-chain signals show accumulation

Blockchain data confirms that BitMine received ETH from its latest purchase in two batches from Galaxy Digital wallets. Analytics platforms like Arkham and Whale Alert tracked both the movement and destination of this ETH, verifying the timing and size of the transaction. These transfers add to a long list of institutional purchases that have become more common for Ethereum in 2025.

The sentiment on the channel is changing. Long-term holders transfer coins from exchanges to secure wallets. Addresses holding more than 1,000 ETH have increased steadily this quarter. Ethereum staking is also increasing, with more tokens locked in validator contracts, signaling strong confidence in the future of the network.

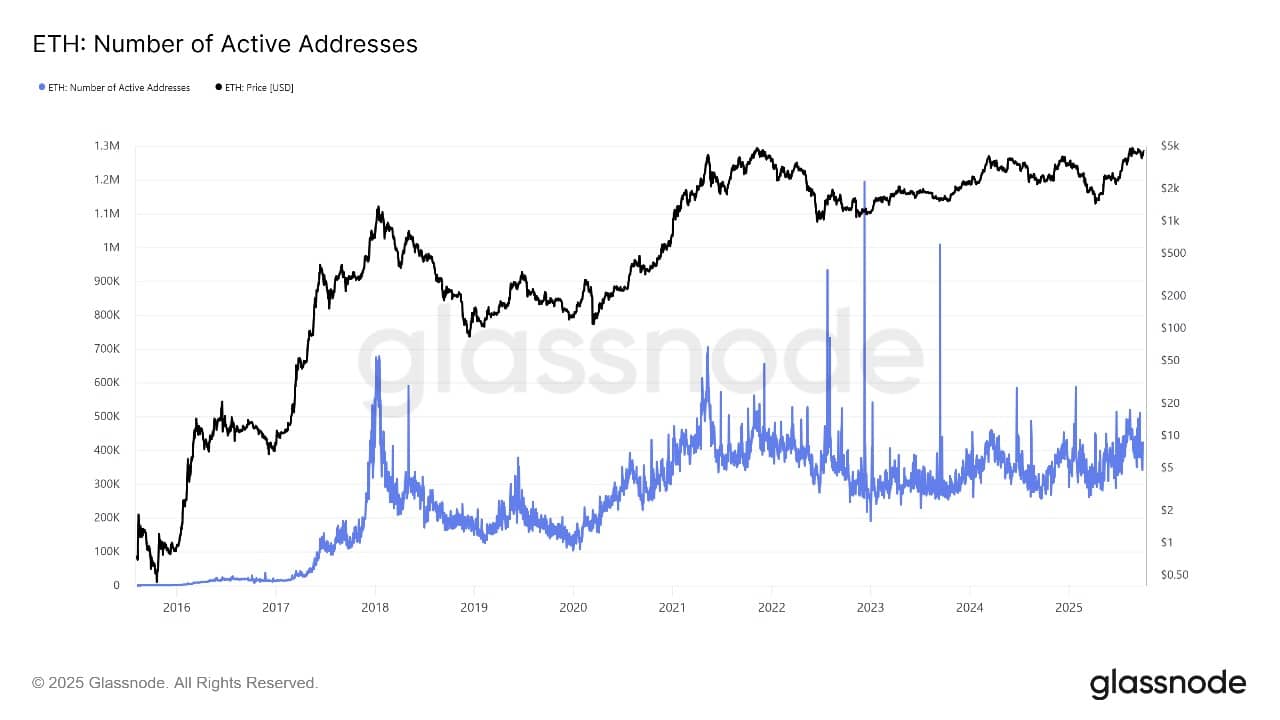

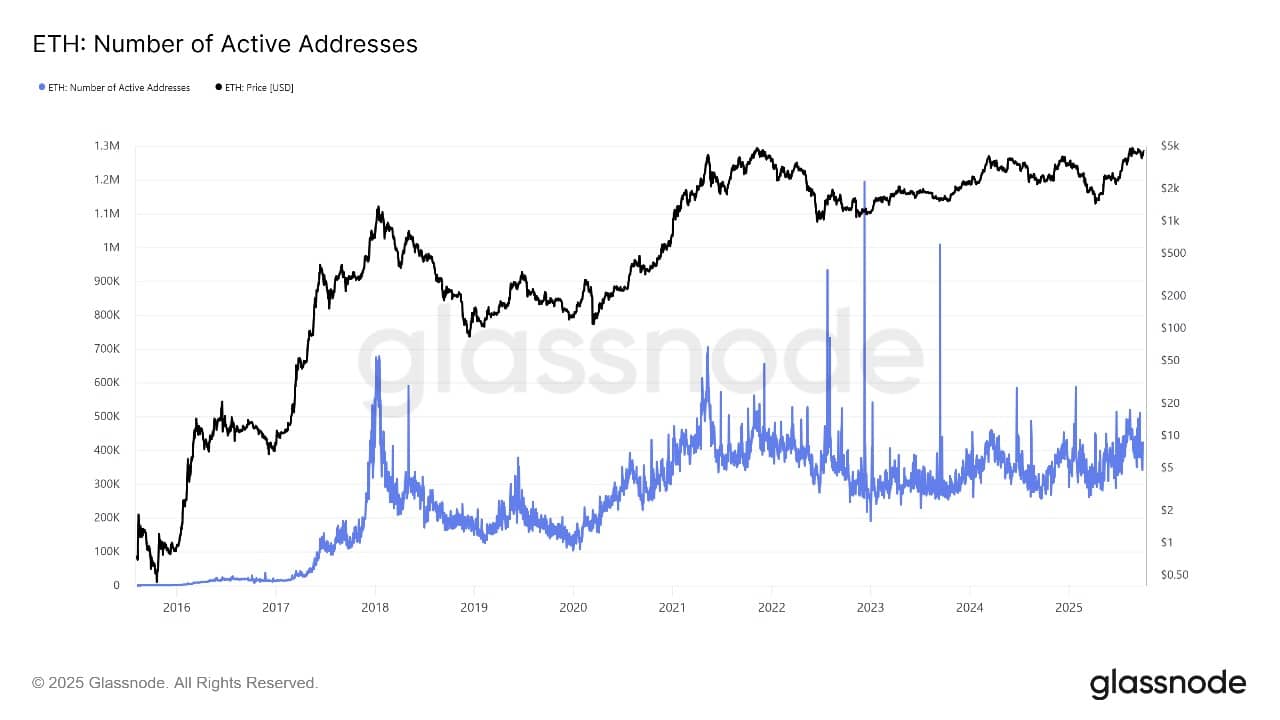

ETH active addresses Source: Glassnode

Market observers say this combination of less exchange supply, increasing wallet accumulation, and swelling staking balances creates fertile ground for ETH price to rise. Participants show that they want to hold their securities for the long term, thereby reducing the risk of sudden sales.

Technical traders point out that when institutions lead the way, retail buyers often follow.

Technical analysis and ETH price prediction

ETH/USD technical analysis shows ETH price is trading just below the 50-day simple moving average at $4,164, while remaining well above the 200-day average at $3,352, according to the latest TradingView chart. Key support now lies between $3,350 and $3,800. This is an area where traders watch for further rebounds if prices fall.

Currently, the market is facing strong resistance near $4,164, where the 50-day SMA brings sellers together. If ETH price manages to rise above this zone, the next target is the high of $4,955 marked earlier in the year.

The chart shows the possibility of ETH price rising in the coming weeks if buyers remain active and break resistance. Otherwise, the coin could fall back to test the $3,352-$3,350 support region.

ETHUSD Analysis source: Tradingview

Technical indicators are mixed but point to a market ready to move. The Relative Strength Index (RSI) signals neutral momentum at 43.90. The MACD is slightly bullish at 1.87, with histogram bars starting to rise.

The ADX indicator is only reading 17.95, showing that ETH price is consolidating, but any strong push could trigger a breakout or breakdown.

ETH price could see a surge in November, with new forecasts setting average targets around $4,240 and peaking at $4,632 if the rally continues. If the price rises above $4,164, Ethereum could quickly test the $4,595 and $4,955 resistance zones.

If sellers force a decline, the $3,350-$3,870 area will likely attract new buyers looking for discounted entries.

With BitMine and other large players accumulating ETH, upside targets could reach $4,600 or more this month if institutional buying continues and retail sentiment follows. However, traders should monitor whether ETH price can break above $4,164 for further gains, or whether lower support remains firm on a decline.

Either way, growing institutional demand helps keep Ethereum’s prospects bright in terms of near-term recovery and long-term growth.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news