Join our Telegram channel to stay up to date with the latest news

The price of Ethereum jumped 4% in the past 24 hours to trade at $2,947 as of 4 a.m. EST, representing a 41% increase in trading volume to $36 billion.

The Ethereum price increase comes as low US inflation sparks positive market sentiment, even as the Bank of Japan (BOJ) raised interest rates. The US consumer price index (CPI) rose 2.7% in the 12 months through November, up from 3% in September, surprising analysts and signaling a slowing in price pressures.

🚨BREAKING: The US CPI remained below expectations at 2.7% versus 3.1% expected.

This shows that inflation is cooling.

The FED now has greater room to reduce rates and ease monetary policy.

This is really optimistic for the markets. pic.twitter.com/ZWrzqwNBaA

– Bull Theory (@BullTheoryio) December 18, 2025

Lower costs of hotels, milk, clothing and accommodation, as well as holiday discounts, have boosted investor confidence. This means that lower inflation increases the likelihood of a rate cut from the US Federal Reserve, fueling optimism towards cryptocurrencies like Ethereum and Bitcoin.

Although some risks remain, due to past tariffs and labor shortages in sectors such as agriculture, hospitality and construction, the market has reacted strongly to the slowdown in the CPI, showing that US economic signals continue to have an outsized impact on cryptocurrency sentiment.

Don’t fight the BOJ: the explicit policy is to maintain real rates. $JPY at 200, and $BTC to a thousand. pic.twitter.com/PdZh87ruVI

-Arthur Hayes (@CryptoHayes) December 19, 2025

Despite this, the BoJ raised interest rates by 25 basis points to 0.75%, the highest in 30 years, marking its second hike this year. Governor Kazuo Ueda has indicated that further increases could follow in 2026, even if real rates remain negative, keeping Japanese financial conditions accommodative.

The yen weakened to around 156 per dollar, reducing the immediate risks of a carry trade unwinding. Bitcoin has shown volatility in response to the BOJ hike, with past rate increases historically triggering declines of 23-31%. U.S. 10-year Treasury yields rose to 4.14% and the Dollar Index (DXY) hit 98.52.

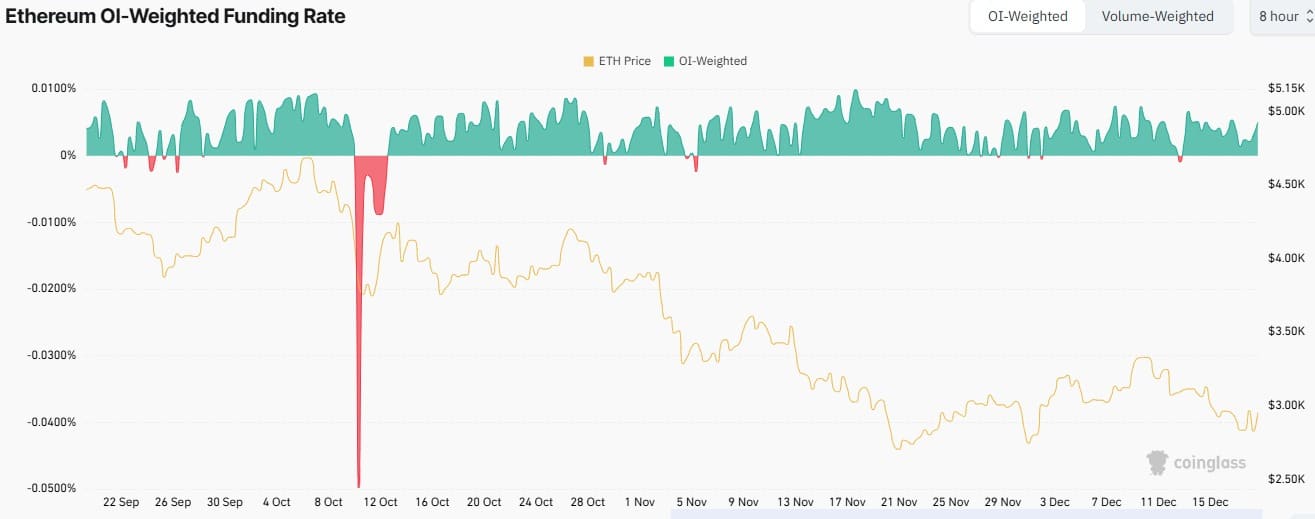

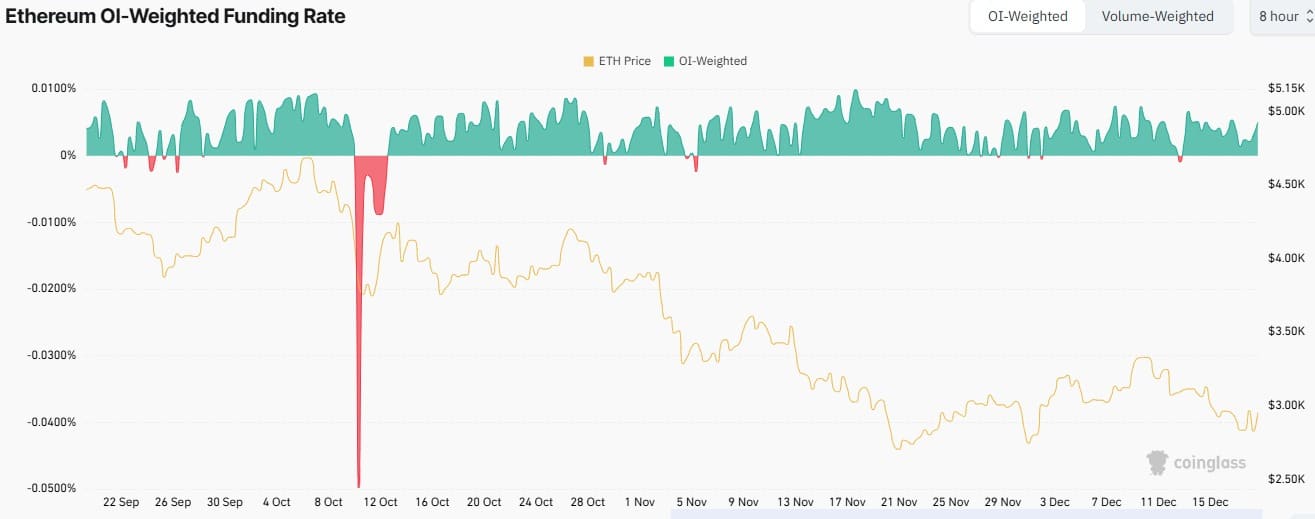

Ethereum Bearish, OI Weighted, Funding Spikes, Market Stabilizes

The OI-weighted funding rate of Ethereum price, indicating what traders are paying or earning on their positions, was mostly positive. However, there are brief negative spikes between October 10 and 12, indicating short-term bearish pressure.

Despite these fluctuations in funding rates, the price of ETH has generally been on a downward trend, aligning with periods of negative funding rates and showing that short-term downward pressure has contributed to the decline.

The funding rate has stabilized near zero, implying a balanced market between long and short positions. Although slight positive spikes continue, they have not translated into strong upward price momentum, underscoring cautious or neutral sentiment.

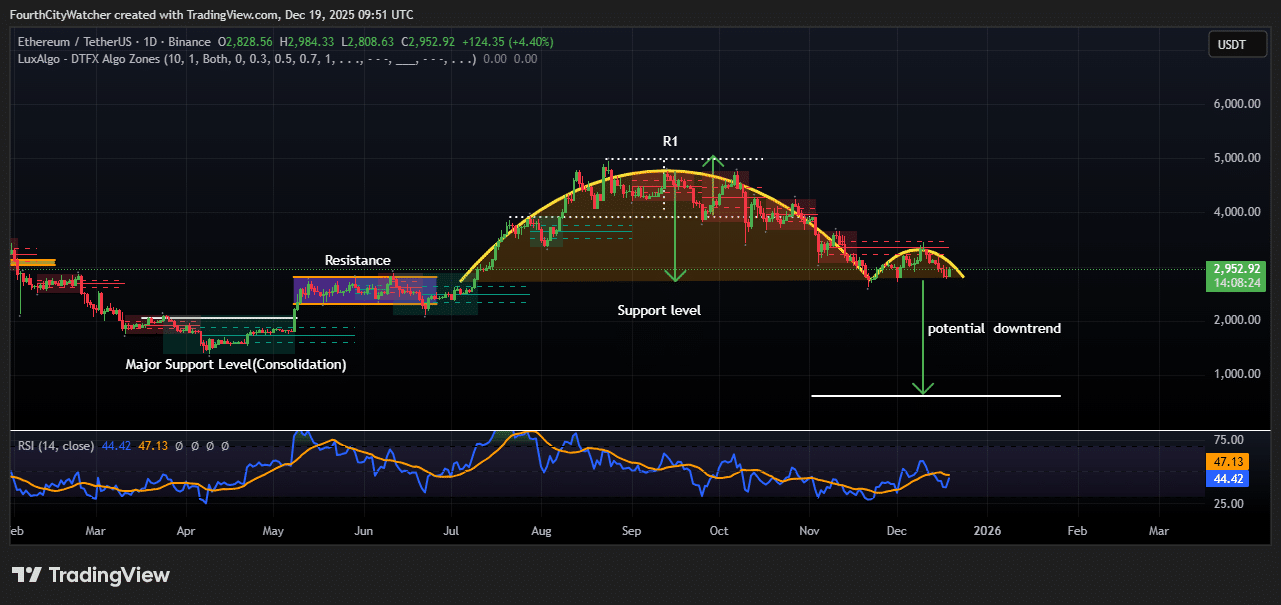

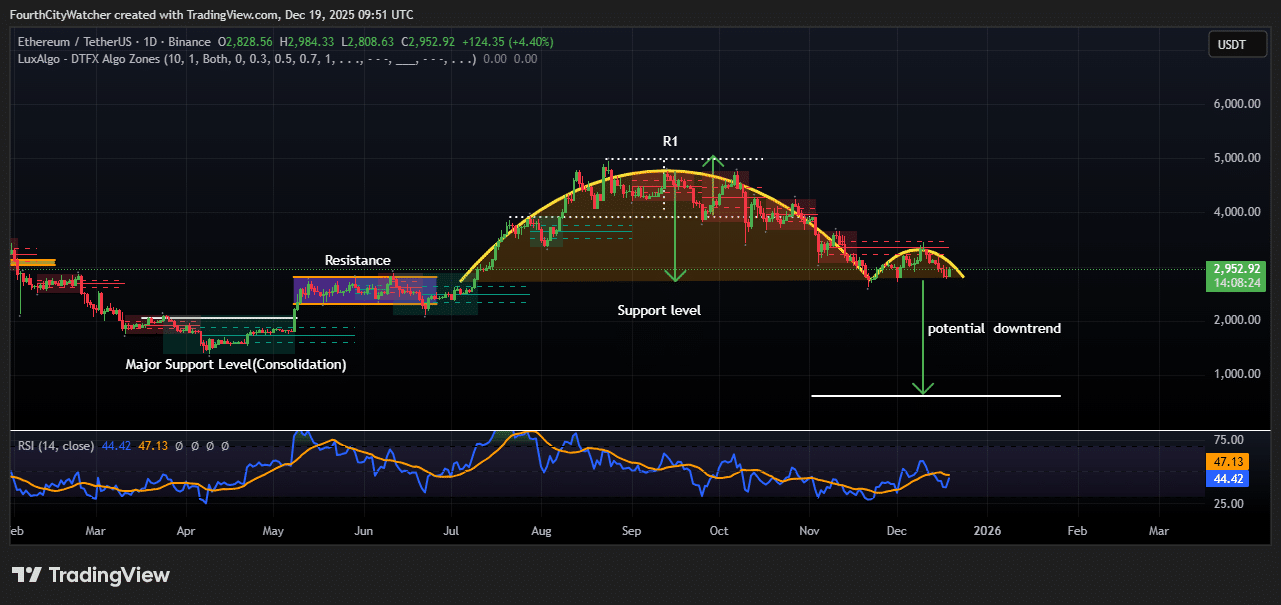

Ethereum price faces downside risk as $2,800 support tested

The daily ETH/USDT price action shows a clear transition from consolidation to a possible downtrend between the beginning of 2025 and December 19, 2025. From February to April, ETH traded in a tight range and built strong support around the $2,000 level.

During this phase, the price remained stable as buyers and sellers remained balanced, creating a solid foundation for the subsequent rally.

In May, ETH broke out of this consolidation and moved higher, but quickly ran into resistance. Price action slowed and began moving sideways again, showing hesitation among traders and increasing selling pressure as buyers struggled to push the price higher.

Between June and September, ETH saw a strong bullish rally that took the price towards the $5,000 resistance zone. However, the momentum faded near this level and the chart formed a rounded top that peaked in early September.

Previous support in the uptrend failed, causing prices to decline. Although there were minor rebound attempts, they were weak and failed to surpass previous highs, maintaining the overall negative trend.

The RSI indicator (14) supports this view, as it has fallen below the 50 level, showing weakening buying momentum and a higher risk of further decline.

Currently, ETH is trading around $2,957, just below a minor resistance zone. If the key support near $2,800 breaks, ETH could continue lower and retest the previous major support zone around $1,000-1,200.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news