Ethereum investors appear to be reversing course as they double down on the leading altcoin despite its price struggling to produce another significant upward move. This renewed buying pressure from major investors is demonstrated by the recent increase in the number of coins acquired by accumulation wallet addresses.

Behind Ethereum’s Slow Price Momentum

Ethereum price may be performing sluggishly on the surface, but beneath the market noise there is a noticeable change in investor sentiment. Currently, ETH investors are showing up at a rapid pace in the volatile crypto environment.

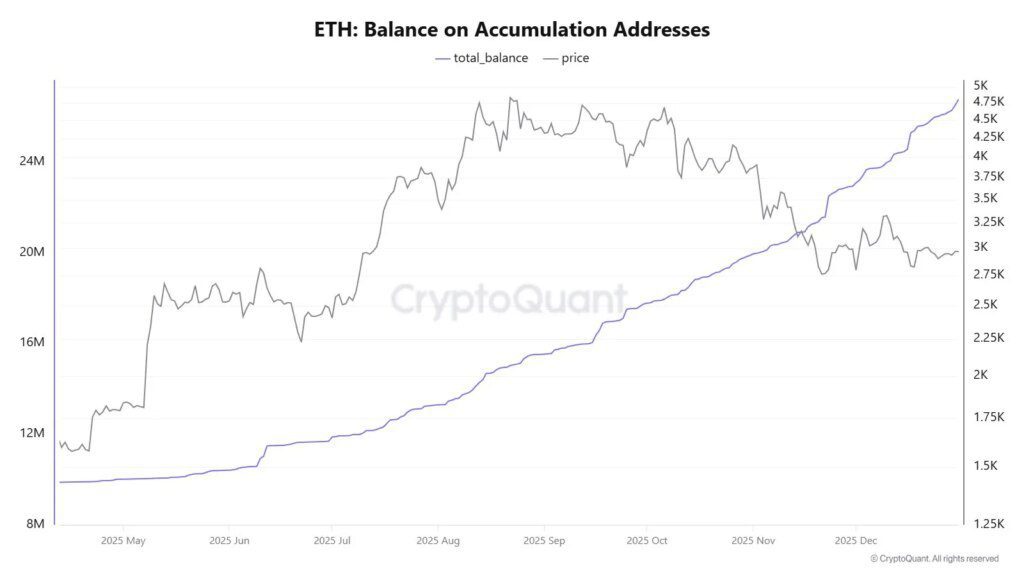

CW, a crypto analyst and data analyst, has reported an uptick in purchasing activity, as evidenced by the increase in the ETH balance metric on accumulation addresses, which is historically linked to long-term holding behavior. Investor activity running counter to price action is an indication of growing conviction among patient players. Furthermore, this divergence indicates a maturing stage of strategic accumulation, even as broader sentiments point to continued caution.

Since the altcoin’s price reached around $2,800, CW highlights that the number of ETH held by accumulation addresses has seen a sharp increase, increasing by 5.2 million ETH. The chart shows that the cumulative number of coins held by investors increased to over 27 million ETH.

Following the decline of the price of EthereumBuying activity from large investors or whale holders accelerated, bringing their total holdings to 26.78 million ETH. Such an increase in whale accumulation suggests that the cohort is showing renewed conviction in the altcoin’s long-term action.

CW said the buying activity is a positive signal for the Ethereum market. This action is currently being seen in the broader crypto market as massive accumulation is taking place across other partslike Bitcoin. As a result, the expert is convinced that the market is still in its bullish phase.

Large holders double down on ETH

Large holders are making an obvious move toward Ethereum stacking the leading altcoin, as market expert Milk Road reports. Milk Road determined this action within the cohort by examining the ETH balance by holder value.

Milk Road’s searches are primarily focused on wallet addresses holding between 10,000 ETH and 100,000 ETH. Data from the metric shows that accumulation of the group has gone parabolic in recent days. This change implies that strategic players could position themselves ahead of a larger market movement despite the suppression of short-term price movements.

After years of steady decline, the expert noted that these portfolios are climbing rapidly again and are now near all-time highs. Simply put, the greatest Ethereum Whales are returning to the market and aggressively increasing their reserves. If this accumulation continues, it could provide the foundation for ETH’s next significant trend.

Featured image from Getty Images, chart from Tradingview.com

Editorial process as Bitcoinist focuses on providing thoroughly researched, accurate and unbiased content. We follow strict sourcing standards and every page undergoes careful review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance and value of our content to our readers.