Ethereum is under pressure at spot rates. As of September 12, the second most valuable cryptocurrency has struggled to find momentum and has remained below $2,400. The daily chart shows that ETH is selling off steadily and the area between $2,400 and $2,800 is proving to be a solid liquidation zone.

Ethereum revenue drops to May 2020 levels

Beyond the price action, something is emerging. According to observers, not only is the price of ETH falling, but also a noticeable drop in revenues accompanying the sale. At the time of going to press, the daily revenue generated by the smart contract platform is at the levels of May 2020.

To clarify, the term “revenue” refers to the fees paid to validators when they approve a transaction or execute smart contracts on the chain. While this is concerning, some analysts are optimistic, saying that Ethereum’s future, despite revenue challenges, is bright.

This confidence stems from various developments. At the top of the list is the insistence that gas fees on Ethereum are decreasing and are not as high as many believe. Over the years, several implementations have been made to make transactions on the mainnet cheaper.

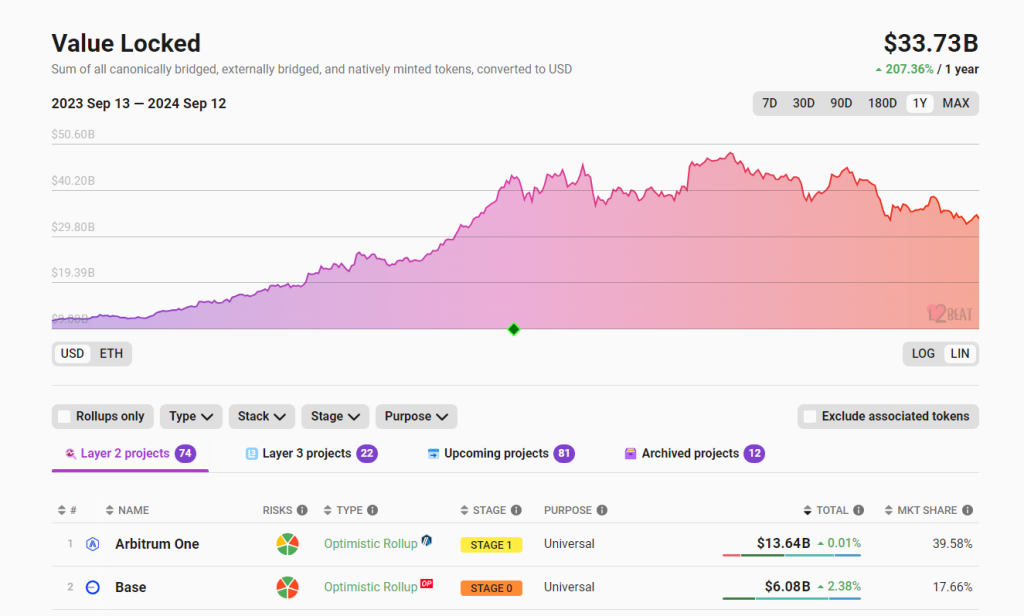

Following congestion during the last bull run of 2020-2021 that pushed gas fees to record highs, Ethereum developers have been pushing for Layer 2 solutions. Platforms like Arbitrum, OP Mainnet, and Base now command billions of dollars in total value locked (TVL), looking at L2Beat data and earning user trust.

More importantly, although these solutions route transactions off-chain, no major hacks have discouraged participation and called their security into question.

Due to their popularity, major tech companies and cryptocurrency exchanges like Sony and Coinbase have been active. Coinbase already supports Base, while Sony plans to launch a layer 2, Soneium.

Successful scaling, continuous building and refinement

The rapid adoption of Ethereum layer 2 solutions to reduce the load on the base layer could explain the drop in fees. Additionally, the Dencun upgrade has further reduced layer 2 gas fees, making these platforms even cheaper.

It is this success that Ethereum has had in terms of scalability that observers believe promises a bright future for the platform. Before Layer 2, Ethereum struggled to retain its users, as most of them could not afford the high gas fees, forcing them to turn to alternatives like Solana, Tron, and Avalanche.

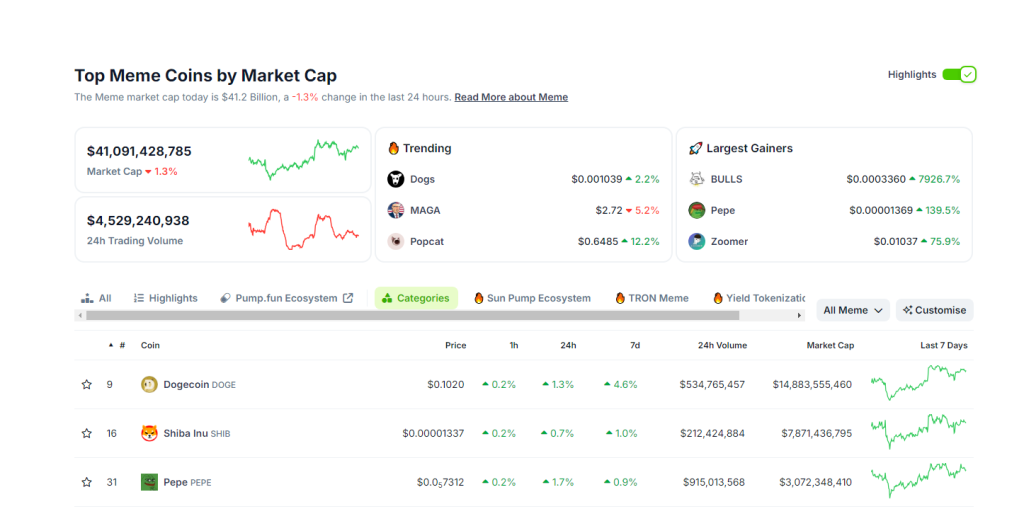

As a benchmark for success, meme activity on Ethereum remains decent even as it declines on Solana and shifts to Tron. According to Coingecko, some of the most valuable meme coins, Pepe and Floki, reside on Ethereum, while others, like Brett, reside on Base, part of the network’s ecosystem.

The platform is also under development. After the transition to proof-of-stake after The Merge, the immediate goal is to scale on-chain.

Ethereum co-founder Vitalik Buterin said this would happen in stages, from Purge to Splurge. At the end, the platform would have implemented Sharding, which would allow it to process millions of transactions every second without off-chain methods.