Market sentiment shows slight improvement today, with the Fear and Greed Index hitting 30 after spending much of the last two weeks in the low 20s and briefly touching extreme fear levels that had caused many participants to adopt a defensive positioning.

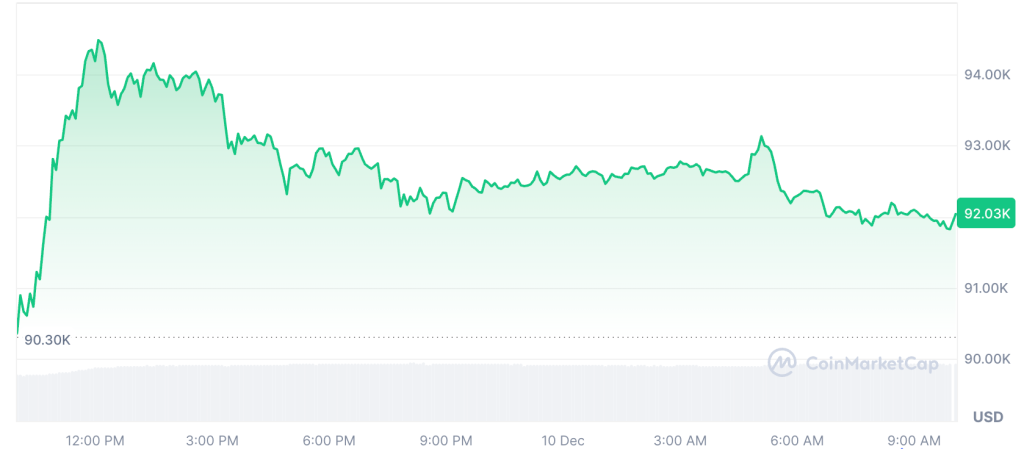

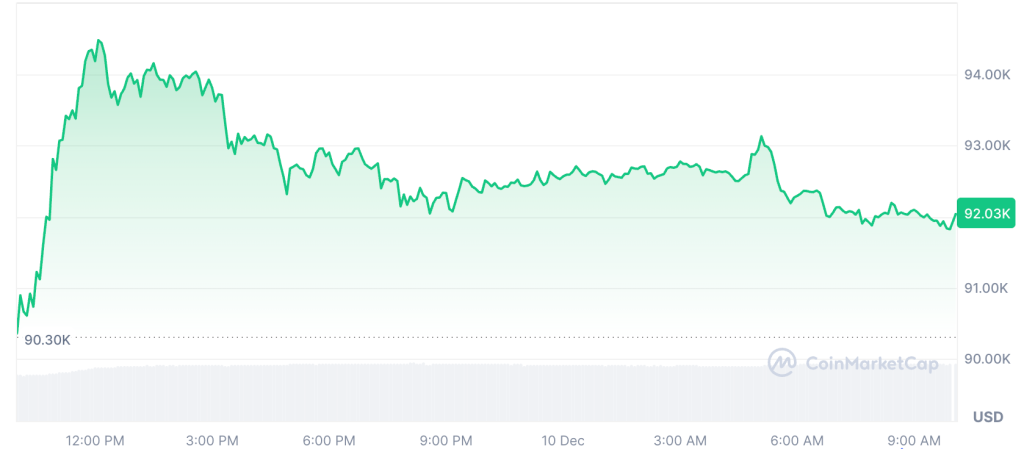

Bitcoin is trading near $92,000 after a period of patchy activity that began in late November, and the more stable tone around the largest asset has created a context in which a small group of altcoins can advance without relying on abrupt, flow-driven bursts.

Bitcoin Price (Source: CoinMarketCap)

Ethereum is at the center of this shift, as its performance often determines expectations for the level of risk the market is willing to take.

Ethereum extends its climb towards a firmer market structure

Ethereum (ETH) is currently trading around $3,330, up around 7% over 24 hours, and this increase is supported by improved spot and derivatives participation, with larger books and more stable auctions in ranges that previously struggled to hold during last week’s retreat.

Activity on major platforms indicates that traders who had reduced their exposure during the November pullback are gradually re-entering their positions, not because sentiment has changed dramatically, but because the daily use of the asset and continued demand for block space provides some degree of stability even as the broader environment remains cautious.

This model allows Ethereum to function as an early indicator of the sustainability of the current relief, as its liquidity and scale often gives it the ability to recover before smaller assets regain enough confidence to follow.

Monero gains as privacy demand remains stable

Monero (XMR) is trading near $404, up about 12% in 24 hours, and the rise corresponds to periods in which privacy-focused tokens receive renewed attention from communities that maintain consistent usage regardless of broader shifts in opinion.

The depth of several exchanges shows more orderly conditions than last week, with a supply distribution that implies consistent interest rather than isolated purchases, which is notable because privacy assets often strengthen when markets seek tokens with established user bases and trustworthiness rather than speculative catalysts.

Mantle Tracks Layer 2 Engagement as Liquidity Improves

Mantle (MNT) is trading near $1.20, up about 7% in 24 hours, supported by consistent throughput and engagement in the Layer 2 ecosystem that underpins its value.

The token has climbed back above ranges that came under pressure during last week’s downturn, and turnover is now significantly higher than levels seen during the most severe part of the recent sell-off.

This behavior aligns with the tendency of infrastructure and scaling tokens to recover sooner than many smaller assets when sentiment begins to subside, as they rely on live activity and measurable network growth rather than short-term narrative fluctuations.

Altcoin season still out of reach despite signs of relief

Today’s rising market sentiment and scattered gains between Ethereum, Monero, and Mantle demonstrate that the market is ready to experiment with selective positioning, but the structure of flows suggests that a broad altcoin season remains distant.

Bitcoin continues to anchor sentiment around $92,000, and most major coins remain confined within tight ranges as participants wait for clearer macroeconomic signals, more stable global liquidity conditions, and confirmation that the recent improvement will not fade with the next change in funding or stocks.

For now, the recovery looks like an initial attempt at stabilization rather than an altcoin season ripe for broad rotation, although the presence of consistent activity in a few established networks shows that the market has not completely retreated from exposure to altcoins, even if caution remains the dominant influence.

The post Ethereum Rises as Altcoin Season Fear Eases and Some Tokens Join the Movement appeared first on Cryptonews.