Data shows that Ethereum Open Interest increased by more than 4% following the cryptocurrency’s sharp drop in price.

Ethereum saw a pullback over the past day

The cryptocurrency sector as a whole saw a dip at the start of the new month, with Bitcoin and Ethereum both down more than 5% in the last 24 hours. ETH is back at the low level of $2,800, having essentially retraced the recovery it made during the last week of November.

The sudden price drop triggered a wave of liquidations on derivatives exchanges, leading to the liquidation of $158 million worth of Ethereum-related contracts. Of these, $140 million in liquidations involved only long positions.

Below is a heat map from CoinGlass that details the liquidation figures related to different digital asset symbols.

Interestingly, even though notable liquidations have occurred, derivatives investors have still not become discouraged.

Open interest in ETH has increased since the decline

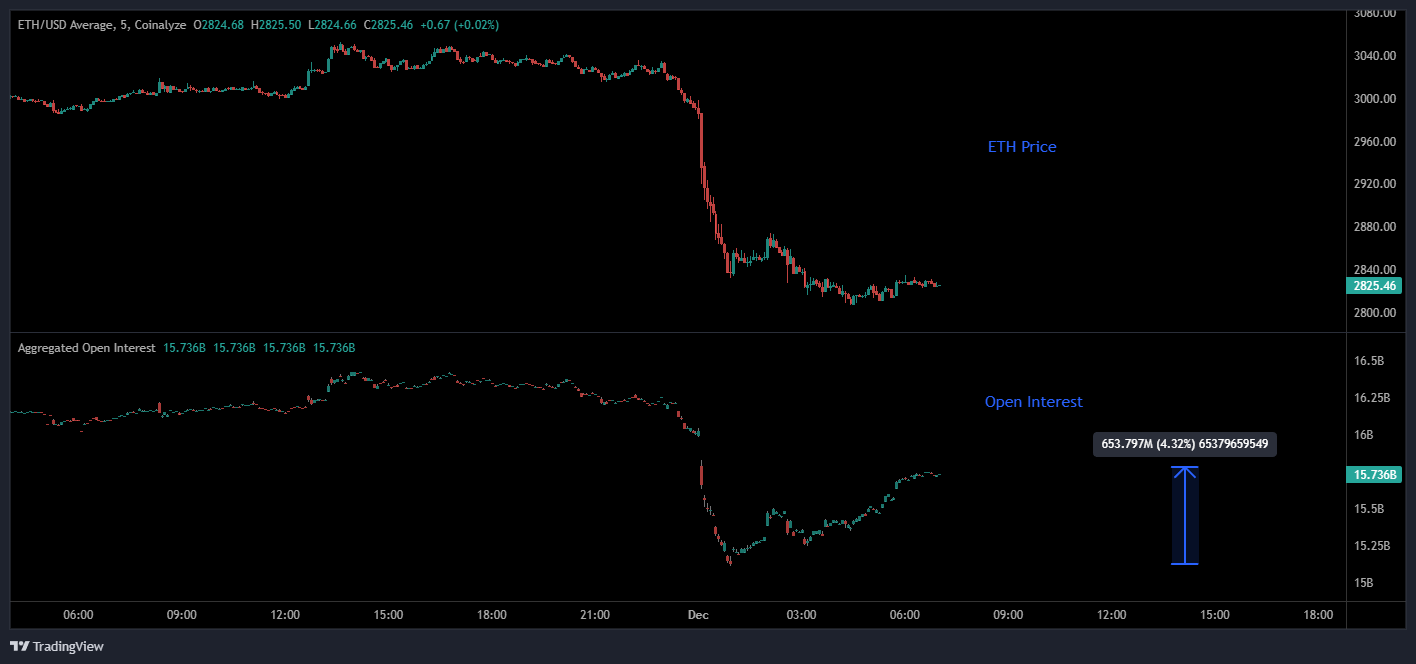

As CryptoQuant community analyst Maartunn pointed out in an article, Ethereum Open Interest saw a sharp rise after the price drop. “Open Interest” here refers to an indicator that measures the total amount of ETH-related positions that are currently open across all centralized derivatives platforms.

Here is the graph shared by Maartunn which shows the trend of this metric over the last few days:

As seen in the chart above, Ethereum Open Interest initially collapsed alongside the price decline as long positions suffered forced closures. However, as ETH’s bearish momentum subsided and the price stabilized at a sideways pace, the metric saw a gradual reversal in direction, indicating that speculators began to open new positions.

Since the drop, ETH Open Interest has increased by almost $654 million, which equates to a 4.3% increase. “Looks like the players are back for another round,” the analyst noted.

Historically, a high value of the metric has generally led to volatility for the cryptocurrency. Indeed, an extreme number of positions implies the presence of high leverage in the sector. Under these conditions, any strong variation in assets can induce a large number of liquidations on the market. These liquidations only reflect on the price movement that caused them, making it more intense.

An example of this pattern was already observed the day before. As Ethereum Open Interest rises again, it remains to be seen whether more volatility will follow.