- ETH has seen low investor interest compared to BTC and SOL.

- Per crypto hedge fund, ETH could see renewed interest in 2025.

Ethereum (ETH) has struggled in this cycle amid record FUD, and investor attention has shifted elsewhere.

According to Zaheer Ebtikar of crypto hedge fund Split Capital, ETH is lagging behind others due to “middle child syndrome.”

“$ETH struggles a lot with middle child syndrome. The asset is not in vogue with institutional investors, the asset has fallen out of favor in crypto private capital circles, and retail is nowhere to be seen offering anything of this size.

Investors abandon ETH

Among crypto majors, ETH has only offered investors 8% on a year-to-date basis, compared to double digits seen in 2017. Bitcoin (BTC) And Solana (SOL).

Ebtikar linked the underperformance to investor attention on BTC and other ETH competitors like SOL and Sui (SUI).

The executive noted that there are three sources of capital in the crypto space: institutional (via ETFs/futures), private capital (liquid funds, VC) and finally retail. But only the first two mattered at the moment.

He added that institutional capital was heavily focused on BTC (via ETFs). ETH ETFs saw net negative flows of $546 million since their debut in July, highlighting the low interest rate.

On the other hand, Ebtikar said private equity saw ETH as overvalued and redirected towards other ETH competitors perceived as undervalued, such as SOL, Celestia (TIA), and SUI.

“$ETH is too big for native capital to support while still being able to support other index assets like $SOL and other large caps like $TIA, $TAO, and $SUI.”

Coinbase analysts too echoes the sentiment above in their September report.

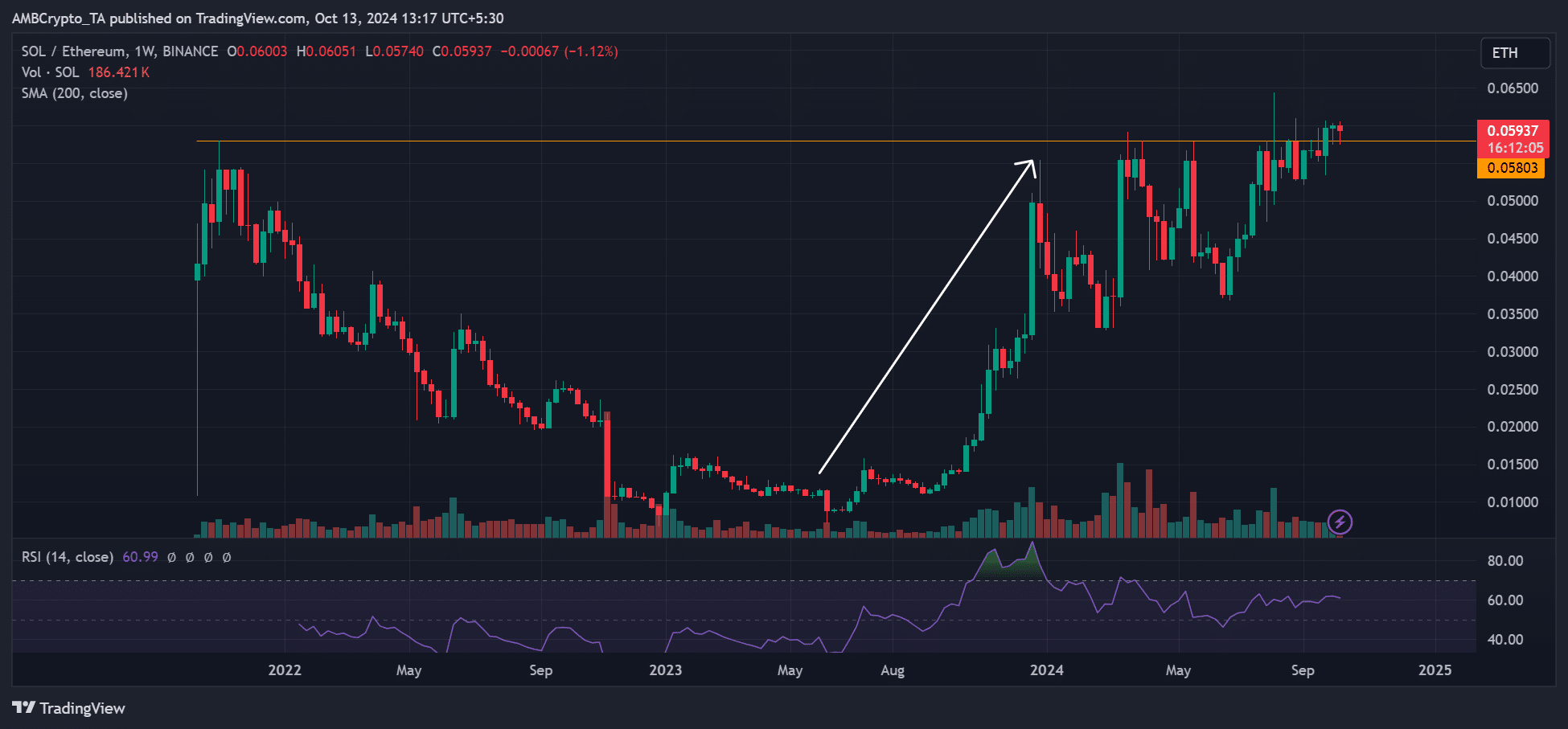

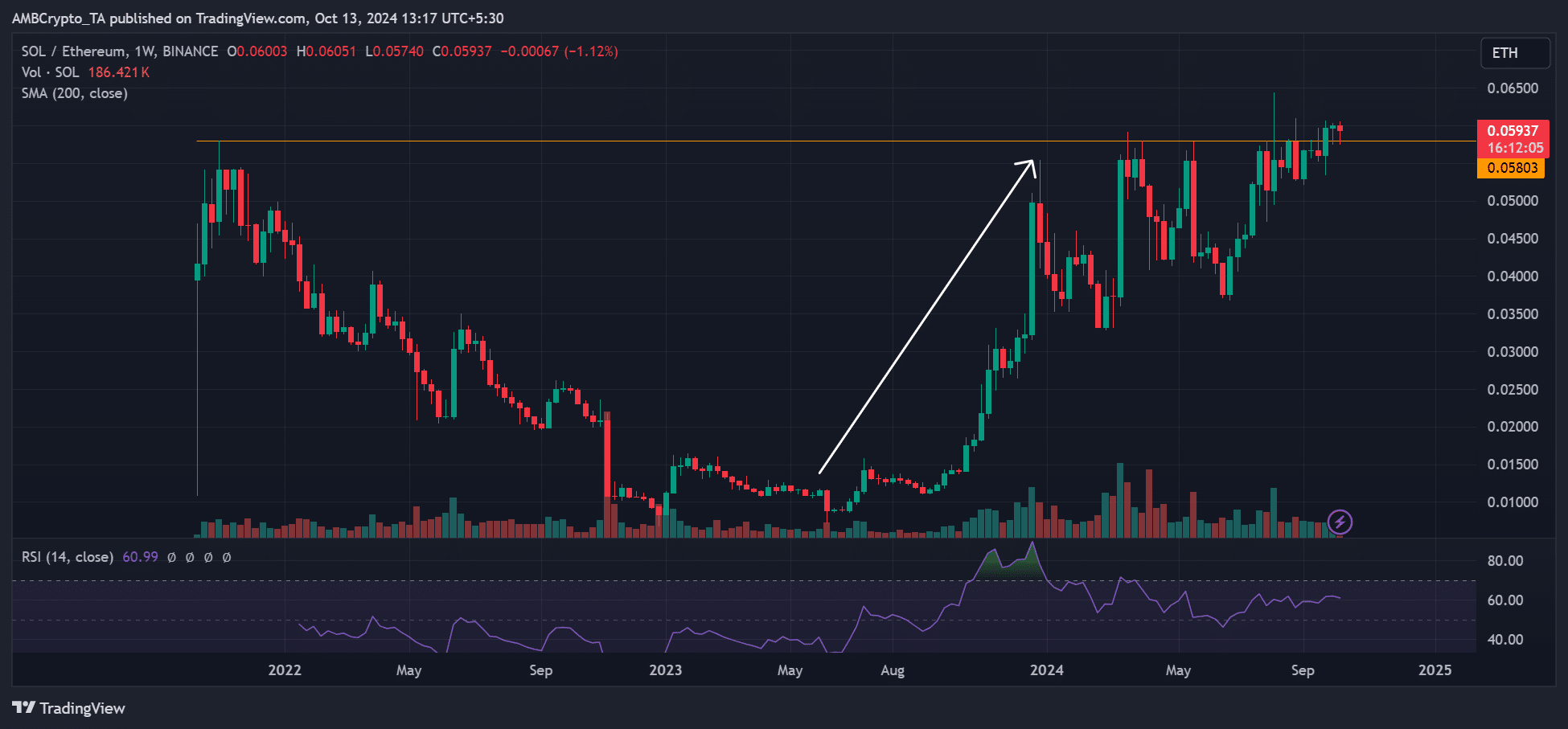

Source: SOLETH ratio, TradingView

The SOLETH ratio, which tracks the value of SOL relative to ETH, has exploded since last year, reinforcing Ebtikar’s thesis that investors could have switched from ETH to SOL.

That said, Ebitaker also acknowledged that ETH is the only altcoin with an approved ETF in the United States.

As such, he predicts that the asset could experience renewed interest, particularly from institutional investors, from 2025.

He cited likely increased demand from ETF buyers, changes at the Ethereum Foundation and Trump’s victory.

At press time, ETH was valued at $2.4k and has been consolidating between $2.3k and $2.5k since early October.

Source: ETH/USDT, TradingView