- Ethereum leads active addresses with 43% dominance.

- ETH surged 3.74% over the past week.

Since hitting a local low of $2,379, Ethereum (ETH) has seen significant gains on the price charts.

The altcoin also attempted to erase previous losses to reach a high of $2,721.

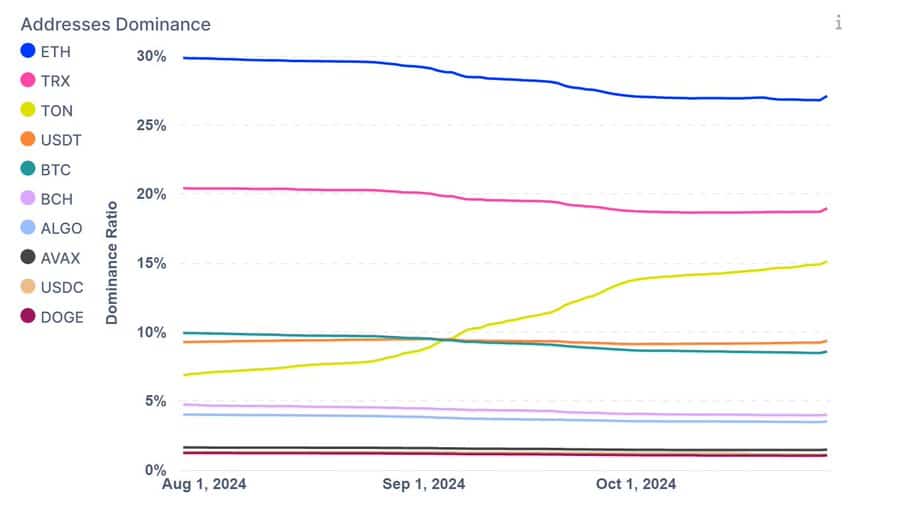

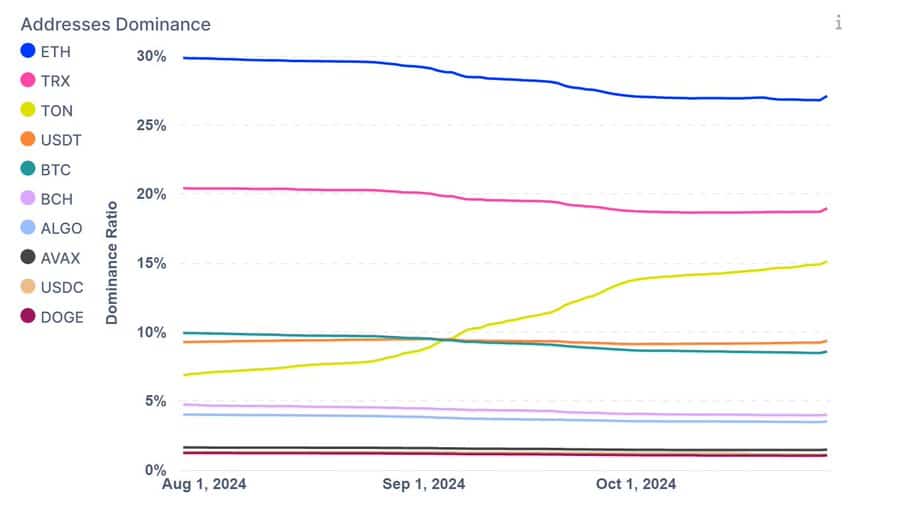

The recent uptrend could be driven by increased on-chain activity, according to IntoTheBlock. As such, ETH has increased the number of addresses, surpassing most other altcoins.

Ethereum leads in active addresses

According to IntoTheBlock, Ethereum is currently leading in terms of address dominance. As such, the altcoin leads active addresses by 43%.

Source:

Amid this growth, Tron comes second with 27% address dominance, which also indicates its growing user base.

Other coins like USDT and Tether’s Toncoin follow with significant trading engagement.

Ethereum’s dominance is a reflection of strong network activity and adoption, which are key to further price rises. Usually, prices rise as market fundamentals strengthen.

This analysis indicates that Ethereum is currently the most active blockchain in dApps, DeFi and NFTs, suggesting sustained demand and interest.

Can ETH finally recover?

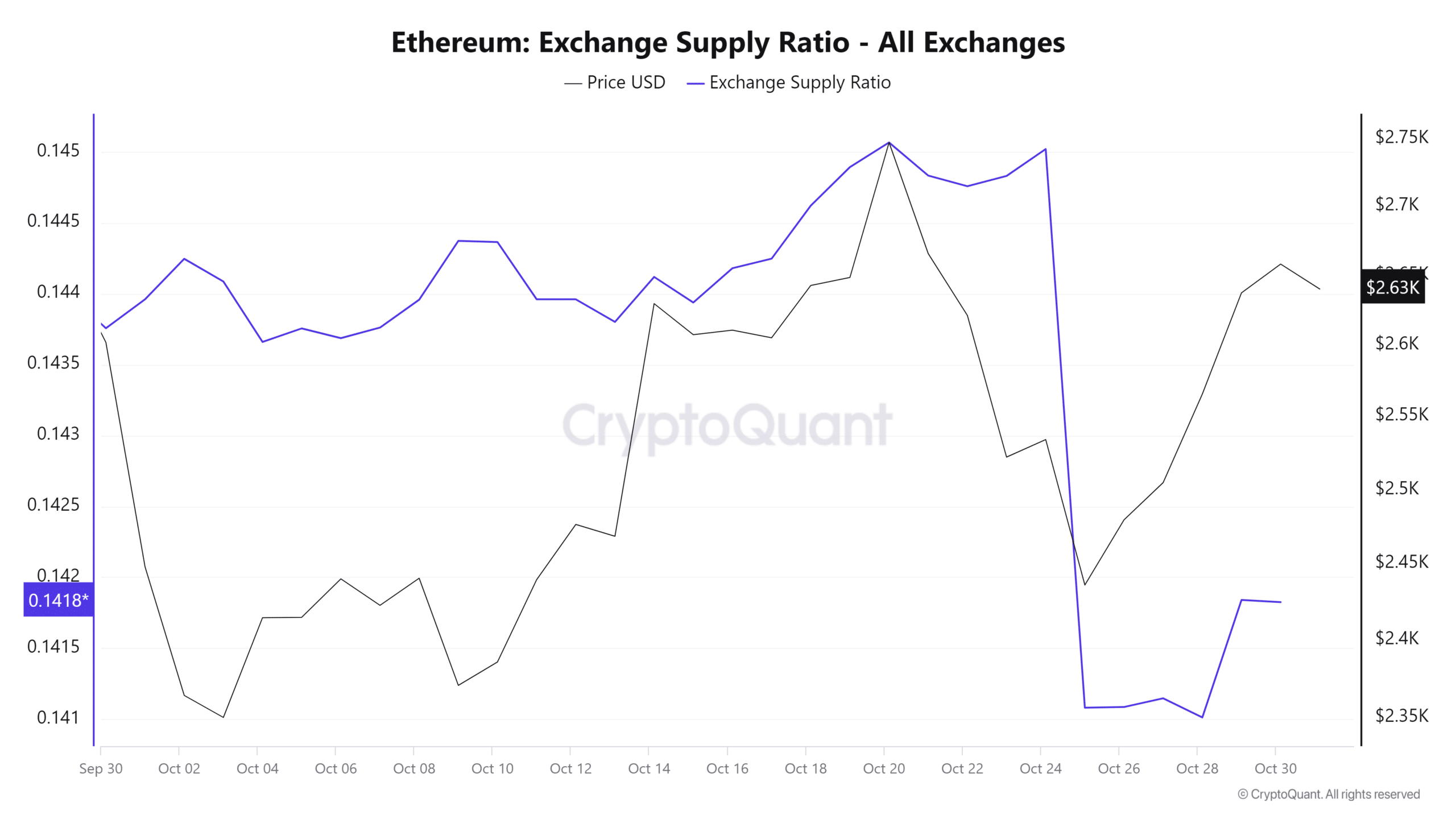

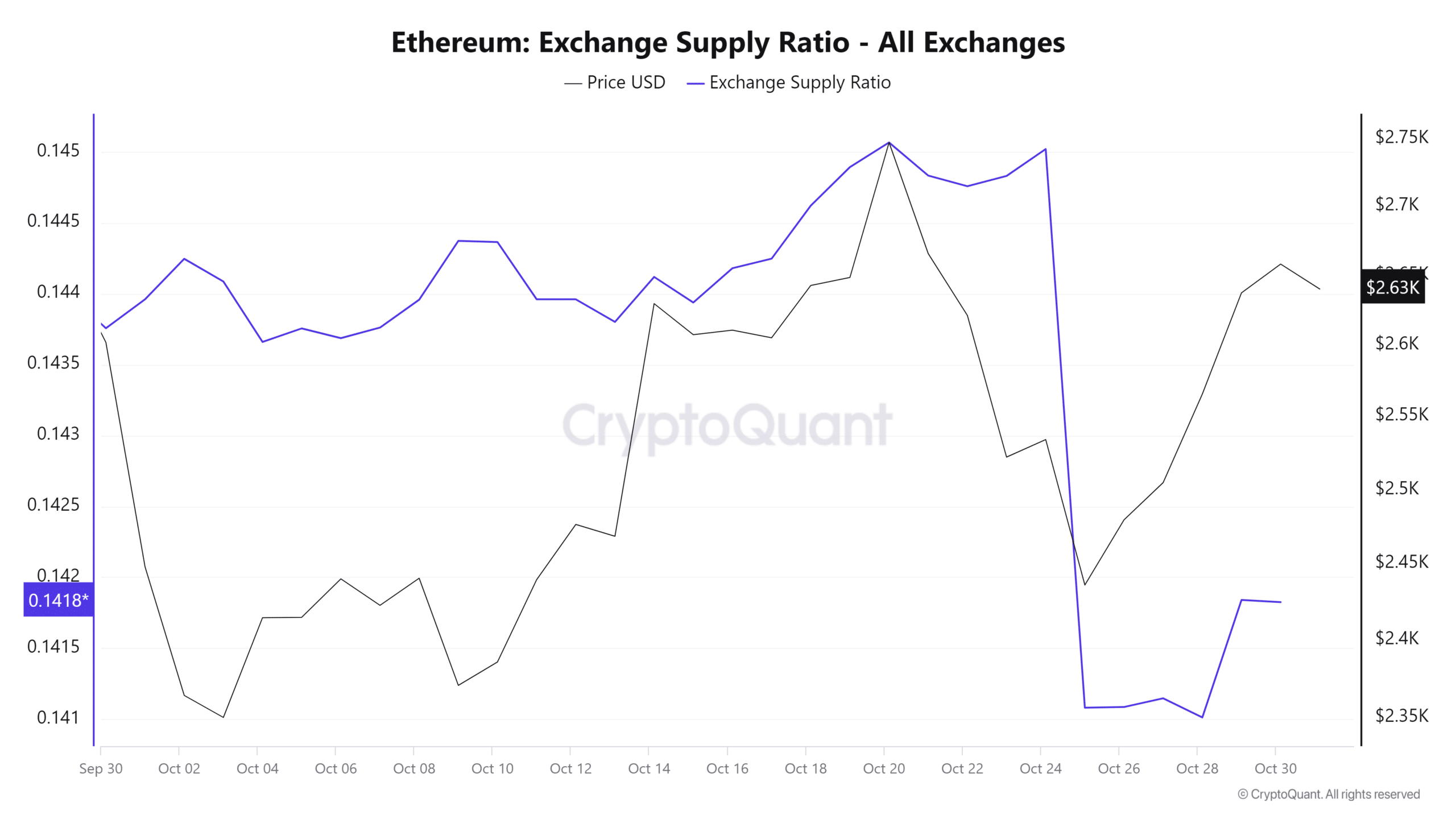

In most cases, an increase in the number of active addresses leads to higher prices. This has been observed over the past week. As such, current market conditions could allow ETH to make more gains on the price charts.

Source: Cryptoquant

For starters, Ethereum’s exchange supply ratio declined to its monthly low last week. This figure fell from a high of 0.145 to 0.141, signaling increased accumulation.

Thus, investors withdraw their assets from stock exchanges to store them in cold wallets, a sign of market confidence.

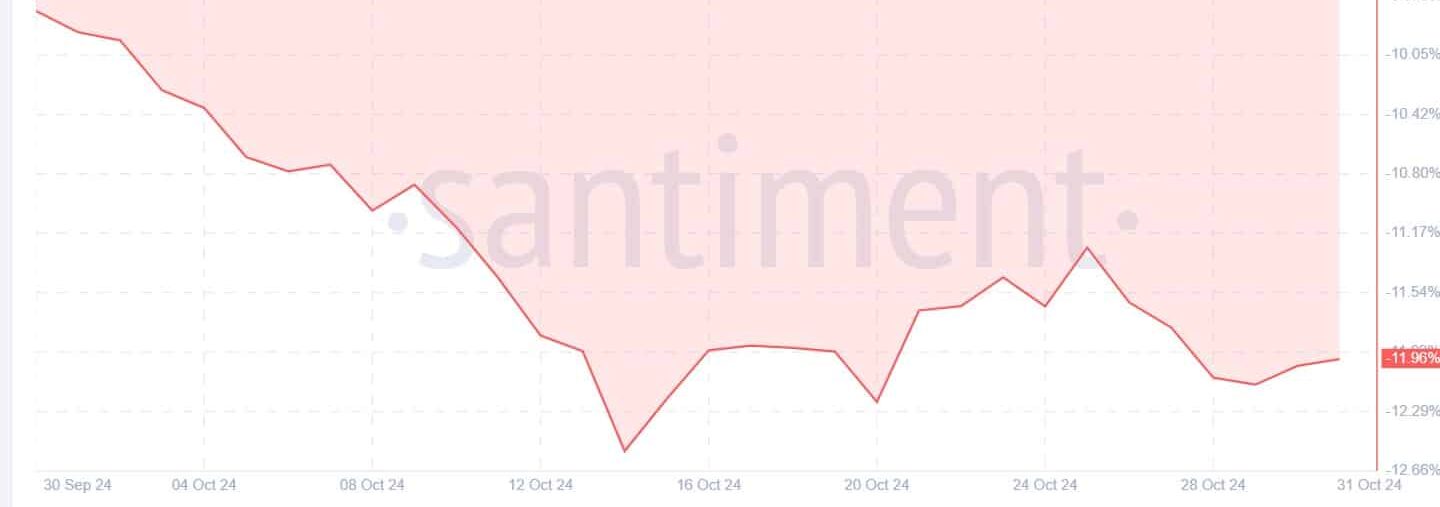

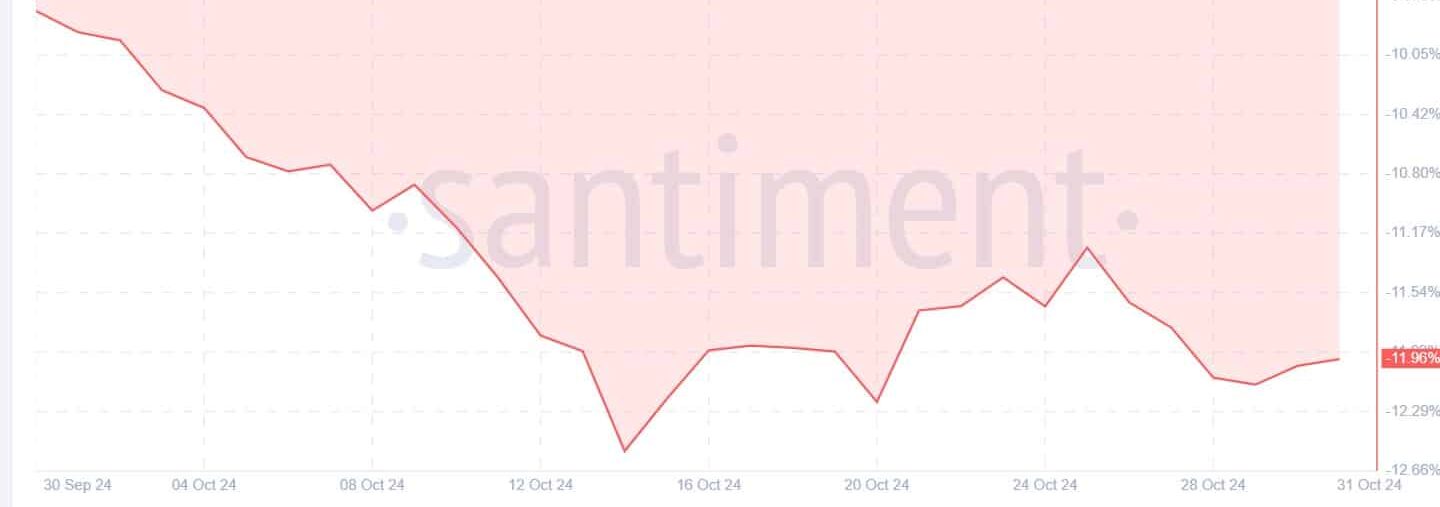

Source: Santiment

Additionally, Ethereum’s MVRV Long/Short differential has remained negative over the past week.

This not only shows that long-term holders are confident in the altcoin’s prospects, but also signals the accumulation phase.

What next for Ethereum

According to AMBCrypto analysis, Ethereum was currently building strong bullish momentum.

This strong upward trend is highlighted by a falling ADX, while +DI had risen to 26.

Source: Tradingview

In fact, at the time of writing, Ethereum was trading at $2,643. This represents an increase of 3.74% over the past week.

Read Ethereum (ETH) Price Forecast 2024-2025

As expected, an increase in active addresses shows increased demand for the altcoin. As such, if they continue to grow, they are strengthening their fundamentals. ETH will see more gains.

Therefore, with a strong uptrend, Ethereum is well positioned to challenge the $2,800 resistance level.