Join our Telegram channel to stay up to date with the latest news

SharpLink co-CEO Joseph Chalom predicted that the total value locked (TVL) on Ethereum will increase 10 times in 2026.

In a December 26 threadChalom pointed to the growing market segments of stablecoins, tokenized RWAs (real world assets), and predictions as the catalysts for this expected surge.

Stablecoin Space to Reach $500 Billion by End of 2026

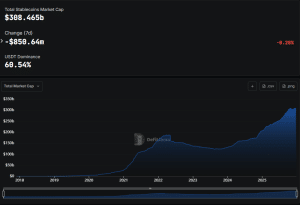

Stablecoins have seen substantial growth this year, with the market capitalization of these tokens surpassing $300 billion for the first time this year.

Stablecoin market capitalization (Source: ChallengeLlama)

The stablecoin space’s momentum was boosted after U.S. President Donald Trump signed the GENIUS Act in July, providing the space with long-awaited regulatory clarity.

Chalom expects the stablecoin space to continue its growth and reach a market capitalization of $500 billion by the end of 2026. This could lead to an increase in value towards the Ethereum blockchain, which holds more than 53% of the stablecoin market.

“Global stablecoin use cases, including cross-border remittances, retail payments and institutional transactions, will continue to increase with Ethereum establishing itself as the fundamental settlement layer for the movement of value,” the co-CEO said.

“From stablecoin issuers JPM and PayPal to Japan and South Korea announcing their local currency versions – and EU banks being allowed to issue – big players will enter the scene in 2026,” Chalom added.

He then added that the adoption of stablecoins would lay the foundation in every institution for broader crypto adoption.

Tokenized RWA Market to Explode as Prediction Markets and On-Chain AI Agents Go Mainstream

Along with stablecoins, Chalom predicted that the market for tokenized assets would grow 10 times next year. He said a range of assets would be tokenized on-chain, from individual funds, stocks and bonds to “full fund complexes”.

2/ Tokenized RWAs will reach $300 billion in 2026.

Tokenized assets will grow 10x in assets under management in 2026, moving from the tokenization of individual funds, stocks and bonds to full fund complexes.

With Goldman Sachs and BNY Melon collaborating on tokenized money market and liquidity funds on blockchain…

–Joseph Chalom (@joechalom) December 26, 2025

Chalom then mentioned the efforts of Goldman Sachs and BNY Mellon to tokenize money market and liquidity funds on blockchain tracks. He also noted that Franklin Templeton and BlackRock had expressed intentions to take similar steps.

The SharpLink co-CEO then turned his attention to prediction markets and on-chain AI agents, two sectors that he believes will “go mainstream” and generate “significant activity on Ethereum.”

The assets of sovereign funds will increase by 5 to 10 times

According to Chalom, sovereign wealth funds should also increase their ETH holdings by 5 to 10.

“As on-chain activity booms, we will see sovereign wealth funds’ ETH holdings increase as they gain exposure to the ‘trustware’ asset that secures Ethereum, where the majority of innovation is concentrated,” he said.

3/ ETH holdings and tokenization by sovereign funds will increase by 5 to 10 times.

As on-chain activity booms, we will see sovereign wealth funds’ ETH holdings increase as they gain exposure to the “trustware” asset that secures Ethereum, where the majority of…

–Joseph Chalom (@joechalom) December 26, 2025

He noted that pensions, endowments and one of the world’s largest sovereign wealth funds gained access to crypto through ETFs (exchange-traded funds) and spot purchases for the first time this year. “In 2026, this will amplify significantly as competitive dynamics take hold,” Chalom predicted.

SharpLink generates 460 ETH in staking rewards

SharpLink is the second largest enterprise ETH holder in the world with 863.02K tokens on its balance sheet, according to data from StrategicETHReserve. At current prices, these holdings are valued at approximately $2.53 billion.

Earlier this week, the company announcement that it generated 460 ETH in staking rewards last week. This pushed SharpLink’s total cumulative staking rewards to 9,701 ETH since the company launched its treasury.

Related articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news