- Whales purchased 340,000 ETH in the last 3 days, worth over $1 billion.

- ETH may have completed its correction as the long-term trend directions are strongly bullish.

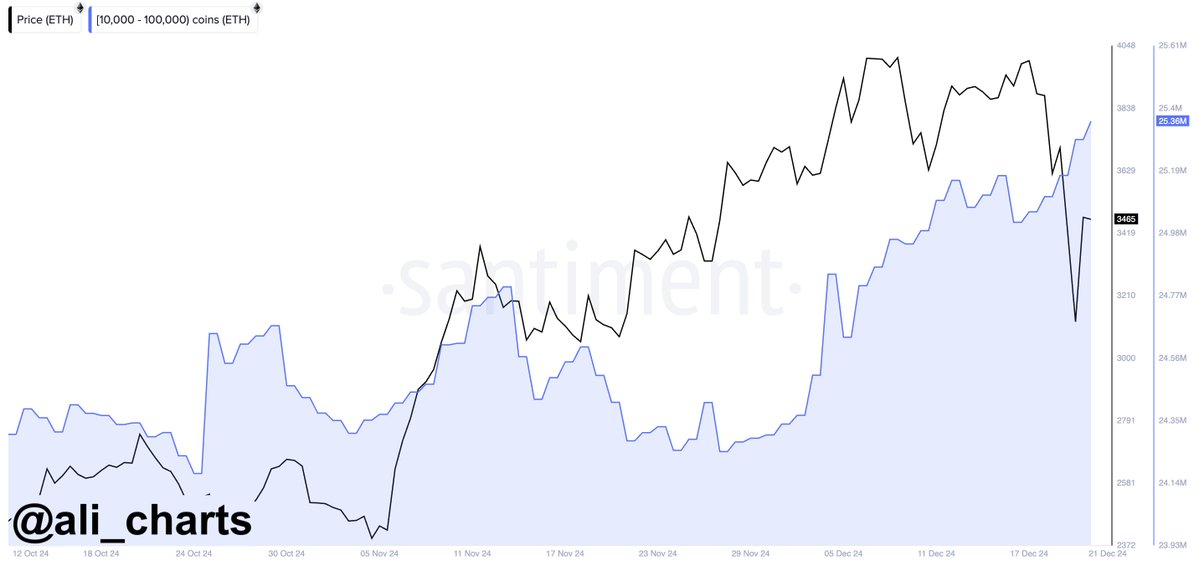

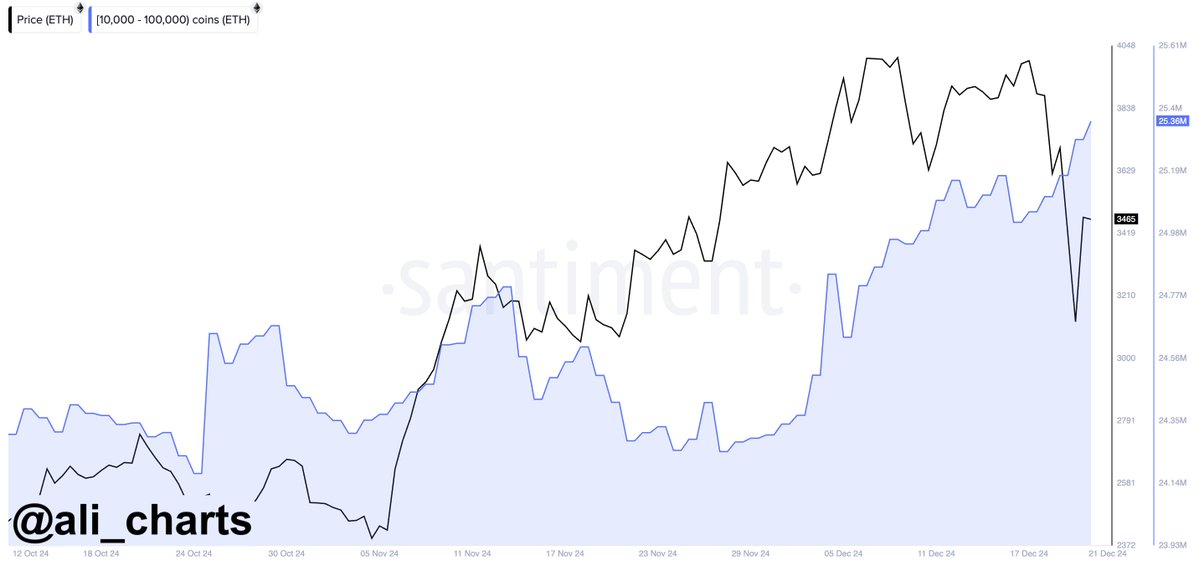

Ethereum (ETH) whale activity contrasted with its price, showing significant buying during the downturn.

In three days, whales acquired 340,000 ETH, worth over $1 billion, suggesting strategic bulk purchases during times of falling prices.

This trend, amid widespread crypto decline, has sparked speculation about a potential market rebound.

Source: Ali/X

Activity has aligned with historical patterns where substantial buying often precedes market rallies. This suggests that ETH could soon see a price increase if this trend continues.

Is the correction over in the context of long-term trends?

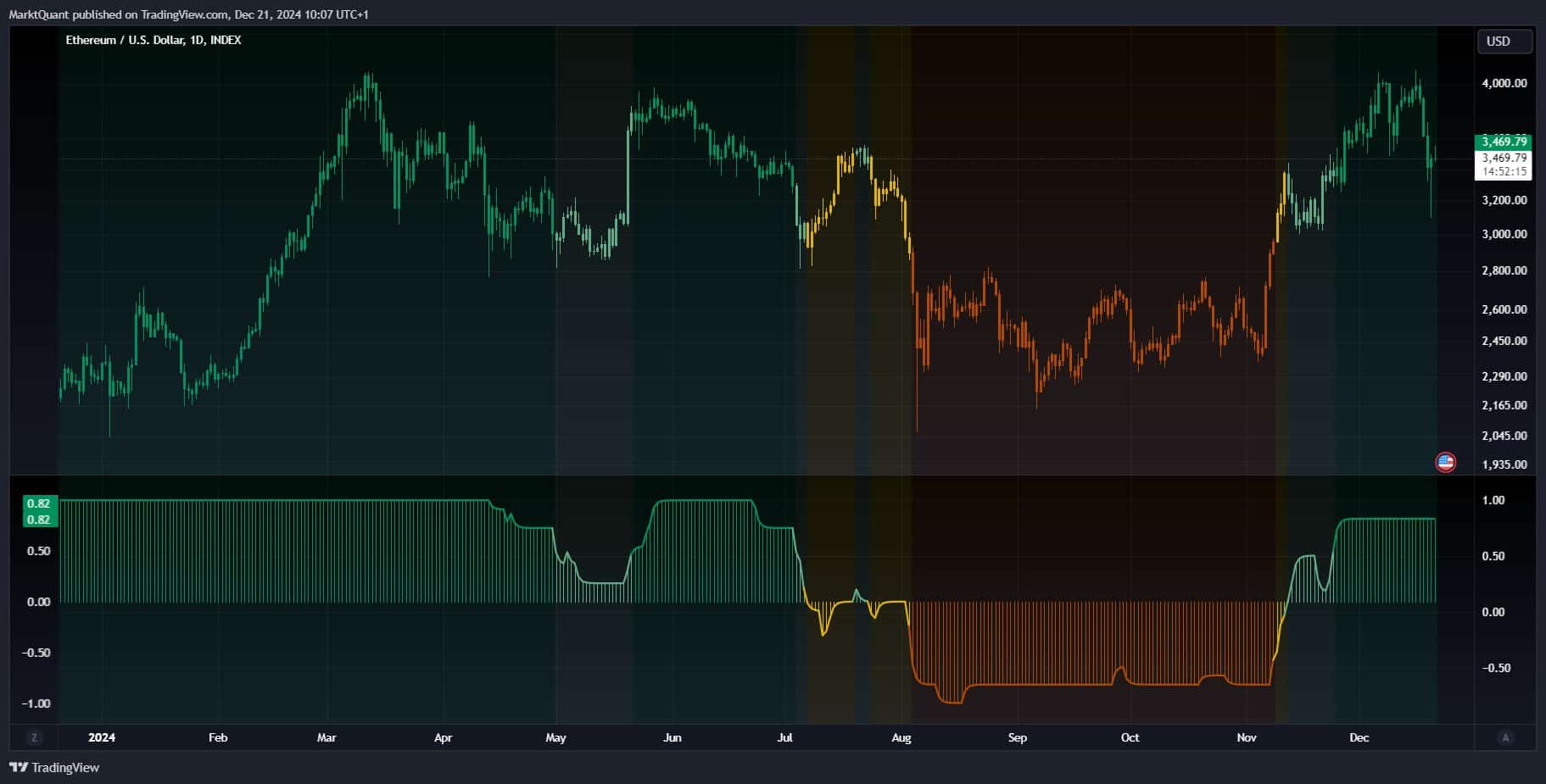

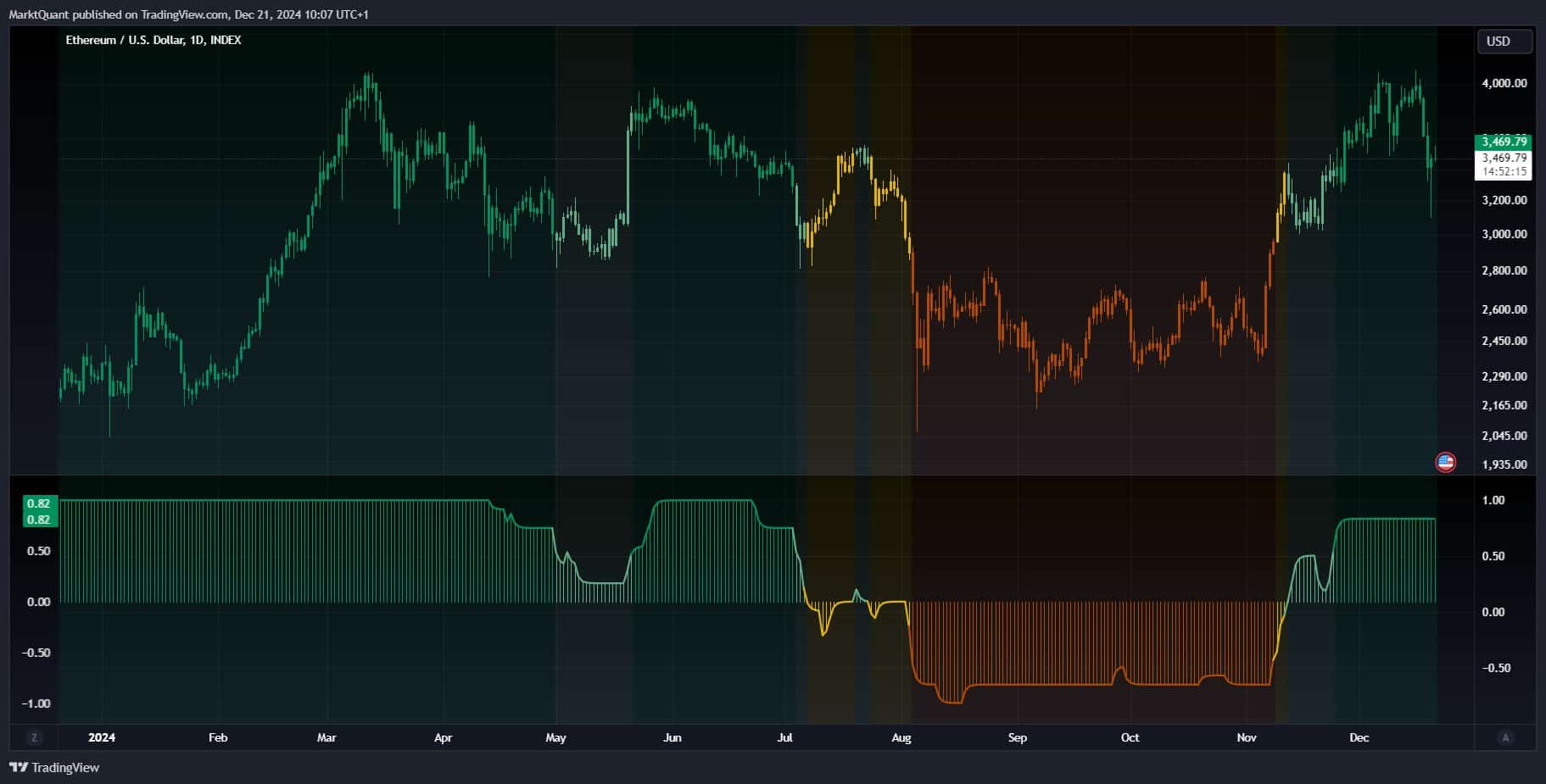

Ethereum’s weekly chart indicated the potential completion of its correction.

The price successively retested the Tenkan and Kijun lines of the Ichimoku Kinko Hyo indicator, suggesting stabilization.

Further signs of support appeared when ETH interacted with the Kumo Cloud’s Senkou Span A, seen as early resistance turned support.

Source: Crypto/X Titan

Additionally, the delay occurred up to its Tenkan line, reinforcing the resilience of current price levels. Despite these bullish signals, caution remains in order with a possible retest of the Senkou Span B of the Kumo Cloud.

If Ethereum price approaches this line, it would likely mean a critical test of market sentiment and strength.

Once again, the Long-Term Trend Directions (LTTD) score for the year could end at a strong bullish level of 0.82, suggesting a positive long-term outlook.

Despite a brief mid-year decline, LTTD returned to bullish territory.

Ethereum began a steady rise, coinciding with the LTTD score remaining above 0.5, indicating sustained buyer interest.

Source:

The sharp drop in the LTTD score in July corresponded to a drop in prices, indicating a short-term bearish phase.

However, LTTD’s rapid recovery in October and corresponding price rise suggest that the correction phase is over and ETH is resuming its long-term uptrend.

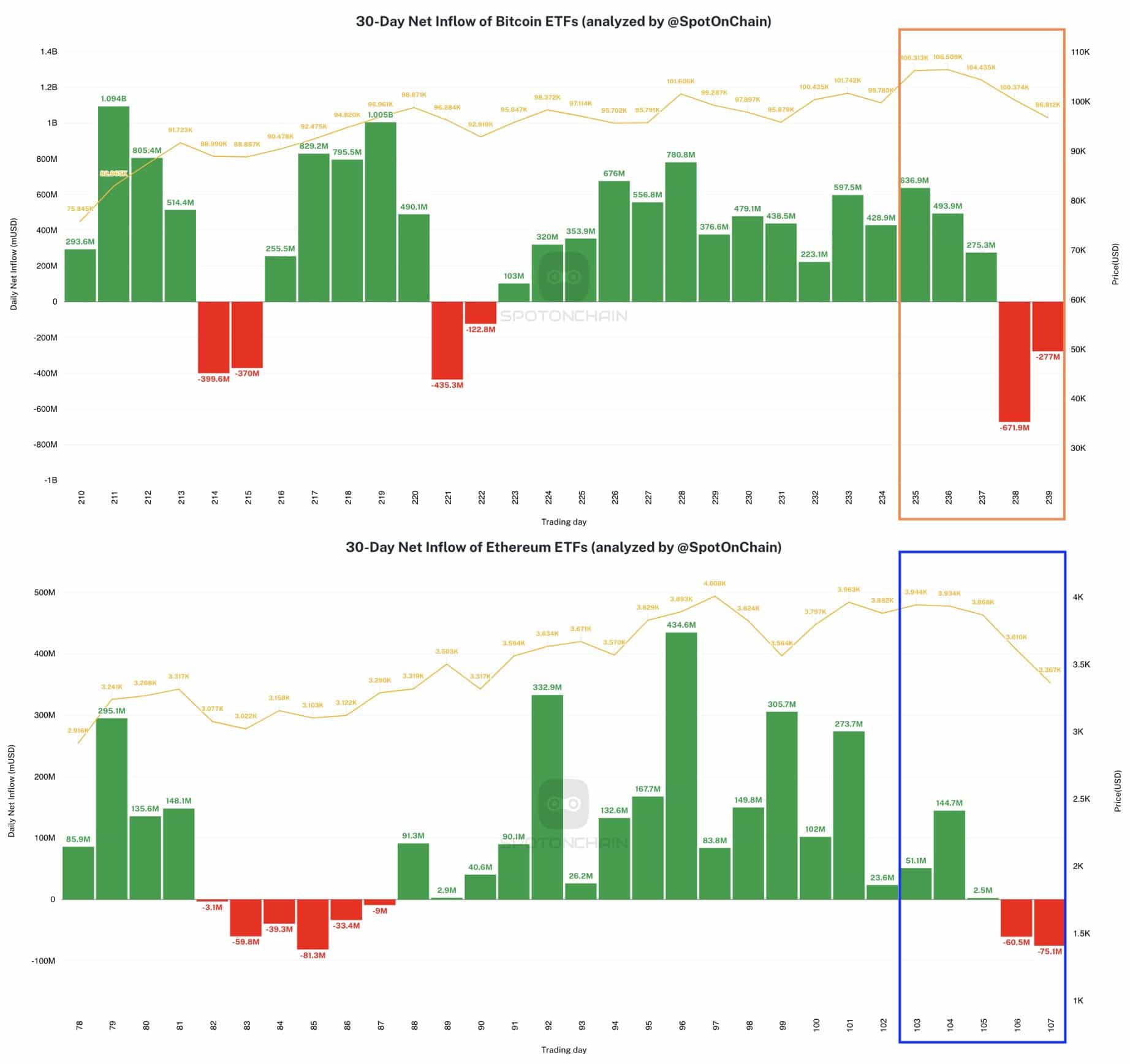

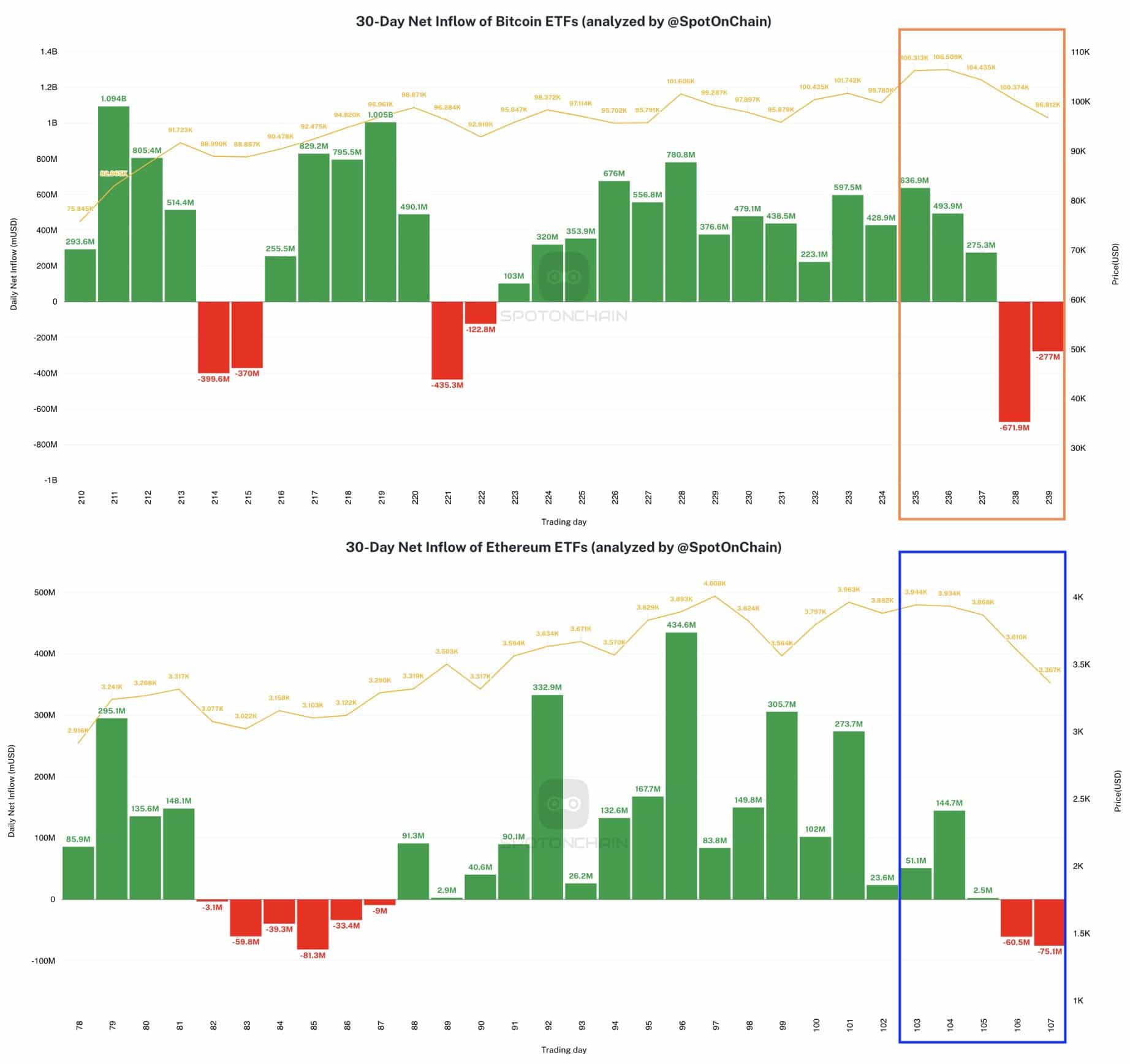

Spot ETH ETF Feeds

However, Ethereum ETFs saw notable outflows, with BlackRock’s ETHA seeing the largest ever, around $103.7 million, in a week marked by market declines.

In contrast, Bitcoin ETFs also saw their largest outflow since their inception, totaling approximately $671.9 million.

This reversal ended two straight weeks of inflows for Bitcoin and Ethereum ETFs.

Source: SpotOnChain

Notably, despite capital outflows, BlackRock accumulated substantial positions, adding 13.7k BTC valued at $1.45 billion and 33.9k ETH worth $143.7 million.

These moves indicate significant changes in ETF dynamics, reflecting broader market sentiments and potentially setting the stage for future cryptocurrency investment trends.