Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

Ethereum is negotiated around the level of $ 1,600 after several days of unsuccessful attempts to recover higher prices. The bulls show signs of life, but their momentum remains low because the downward pressure continues to dominate the market. Despite a brief rebound in recovery last week, the wider structure of Ethereum still reflects a clear decrease trend.

Related reading

The cryptography market remains in the shadow of macroeconomic uncertainty, because the current tensions between the United States and China weigh heavily on global financial feeling. No resolution or agreement between the two economic giants has been announced, leaving prudent investors and opposite to risk.

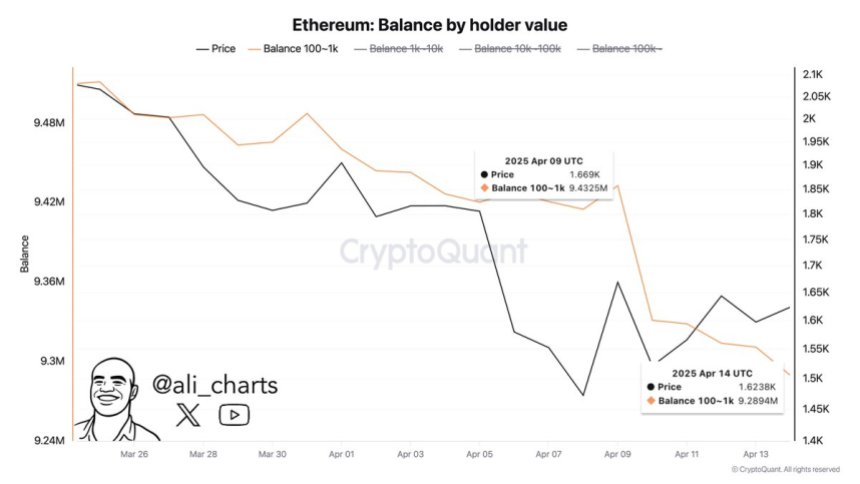

Adding to the negative feeling, cryptocurrencies show that Ethereum whales have dropped around 143,000 ETH in last week. This large -scale distribution strengthens fears of the additional decline, with long -term supports and large wallets choosing to reduce exposure rather than accumulate.

While some analysts still see potential for a turnaround if key levels are recovered, the current market environment remains fragile. Unless Ethereum can be found and hold over the short-term resistance levels, the threat of another leg has remained very real. Merchants are now looking closely at pricing for signs of a change – but for the moment, prudence continues to show the way.

Ethereum faces the sale of whale pressure

Ethereum is confronted with a critical test because the action of prices continues to lack clarity and that the levels of support remain fragile. Despite brief rebound attempts, ETH failed to establish a clear background and the decrease structure remains intact. The market is struggling to define a solid demand zone, which makes it difficult for bulls to maintain an upward momentum. As a sales pressure frame, analysts warn that Ethereum can continue to slide towards lower demand levels in the absence of strong purchase interest.

Larger macroeconomic conditions continue to weigh heavily on risk assets like Ethereum. Global trade tensions, in particular the unresolved tariff deadlock between the United States and China, have created uncertainty in the financial markets. Combined with fears of a slowdown in the world economy and the lack of coordinated tax support, the cryptographic markets remain under pressure.

Adding to the bearish feeling, the best analysts Ali Martinez shared data on the chain revealing that the whales have unloaded around 143,000 ETH in last week. This large -scale distribution by influential holders has considerably weakened the prospects of Ethereum, strengthening the concerns that intelligent money is preparing for a deeper drop.

Since the end of December, the ETH has remained in an extended downward trend, each attempt to take over being respected by the renewed sale. Unless the bulls recover the main technical levels and do not change the feeling of the market, Ethereum can continue to slide more.

Related reading

ETH price stuck in a volatile fork

Ethereum is currently negotiated at $ 1,600 after lasting days of massive volatility and macroeconomic uncertainty. Despite brief rebounds, ETH remains locked in a lower structure, unable to generate lasting momentum. For the bulls to regain control, recovery of the resistance level of $ 1,850 is essential. This level aligns for the 200 mA of 4 hours and EMA around $ 1,800, making it a key area to monitor confirmation of a short -term trend reversal.

Holding above these mobile averages would signal a renewed force and may mark the start of a recovery gathering. However, the action of prices continues to fight under them, and not to push over these indicators would confirm a persistent weakness. In this case, Ethereum can retain the level of $ 1,500 or even dive below if the sales pressure is intensifying.

Related reading

The current environment is shaped by global tensions and macro uncertainty, without clear catalysts to drive a break in both directions. As long as the ETH remains below its key mobile averages, the risk of another declining leg remains high. The bulls must act quickly to return the feeling and avoid a deeper correction to the long -term demand levels.

Dall-e star image, tradingview graphic

(Tagstotranslate) Eth (T) Ethereum (T) Ethereum Down Trend (T) Ethereum News (T) Ethereum Price (T) Ethereum Lels (T) Ethereum Whales (T) Ethusdt

Source link