- Whales have accumulated over 950,000 ETH, a sign of strong confidence in their long-term potential.

- ETH’s key support at $3,044 remained firm as analysts eyed $5,000 as the next major price target.

Ethereum (ETH) has continued to attract significant interest from major investors, with whales accumulating over $1 billion in ETH in recent months.

This influx of capital has supported Ethereum’s price recovery, but the crucial question remains: can this accumulation drive ETH towards a $5,000 price target?

Ethereum Whale Accumulation Sparks Bullish Sentiment

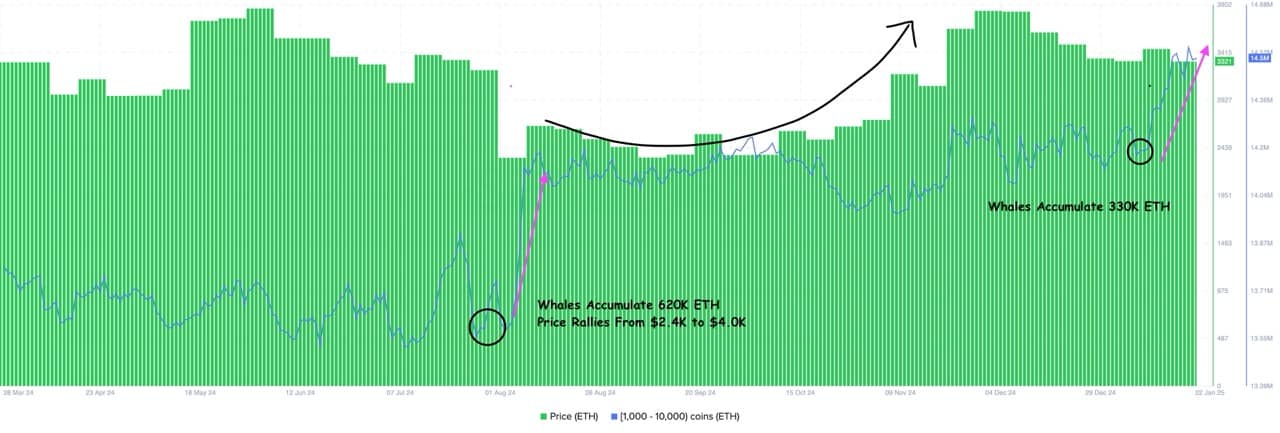

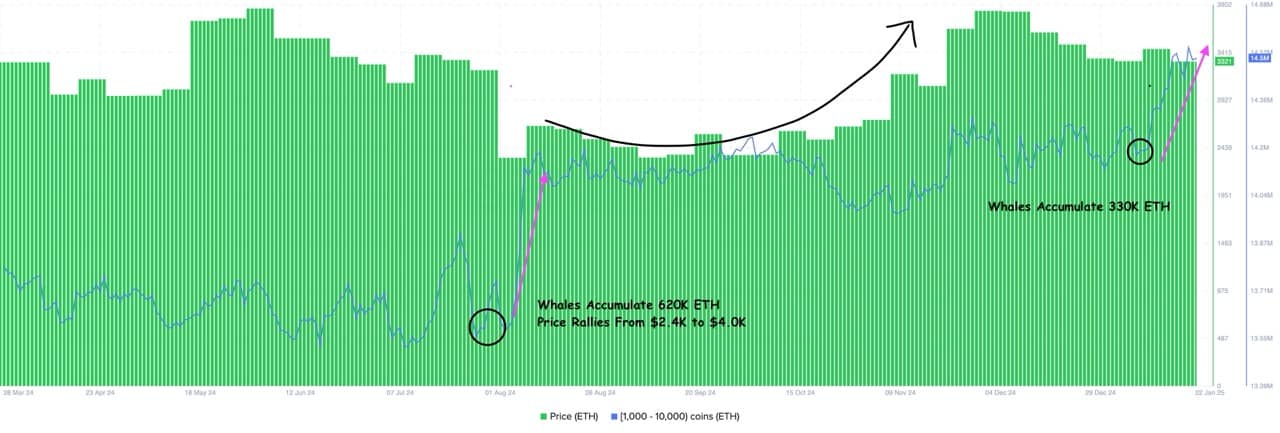

According to a recent analysis by Santiment, there has been a clear trend of whale activity in the Ethereum market.

Over the past six months, addresses holding between 1,000 and 10,000 ETH accumulated a total of 620,000 ETH between late July and early August, coinciding with Ethereum’s price rise from $2,400 to $4,000.

Source: MAXPAIN on

Most recently, another accumulation phase saw whales collect another 330,000 ETH, strengthening their position as they traded around $3,193.

The chart highlighted a consistent pattern: whale accumulation often precedes significant price increases. This buying behavior suggests growing confidence in the long-term potential of ETH.

Network growth and activity show mixed signals

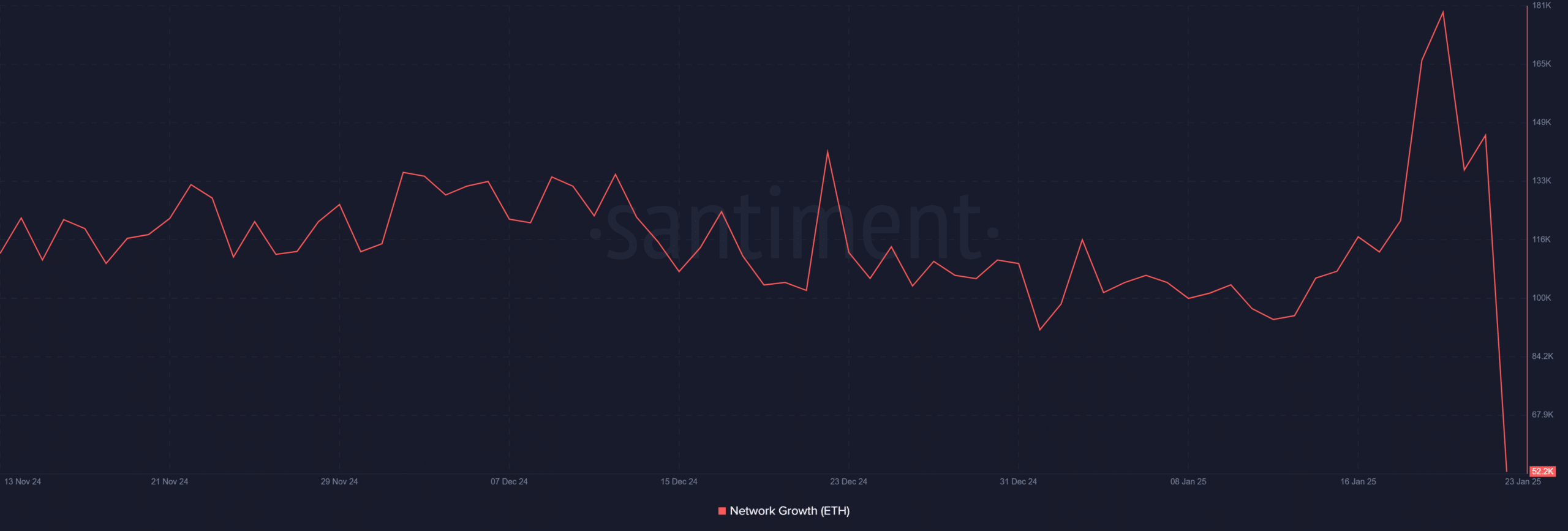

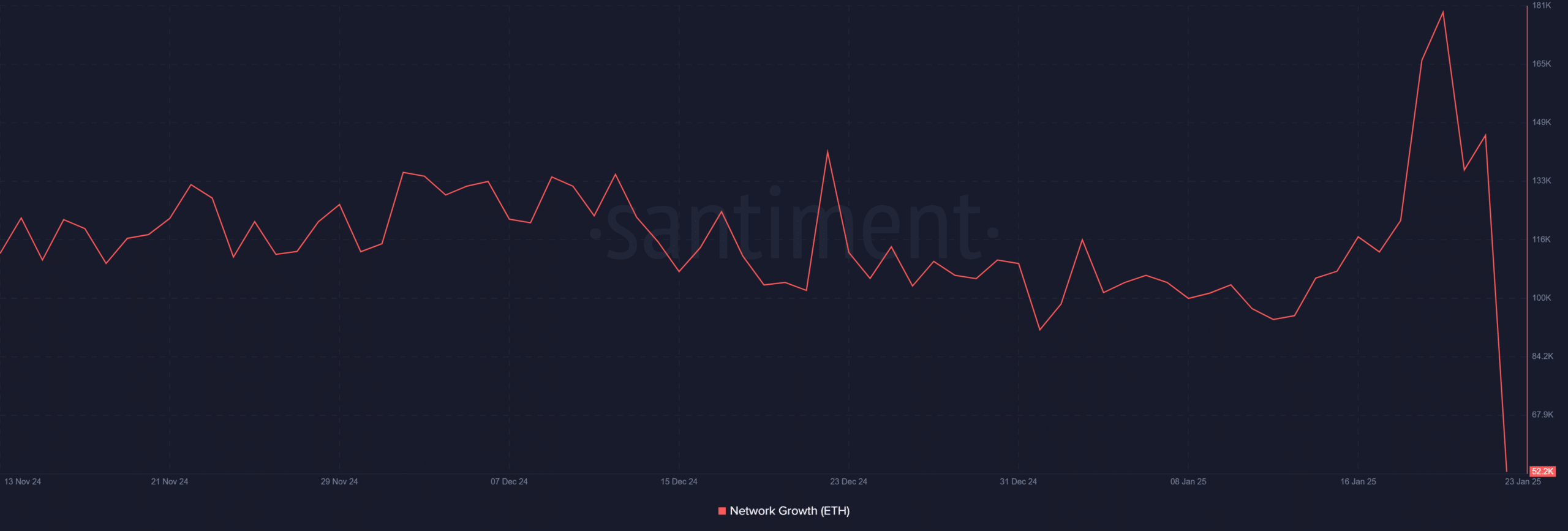

Analysis of the growth of the Ethereum network shows fluctuations in the number of new addresses interacting with the blockchain.

While growth peaked in December, reaching 181,000 new addresses, a sharp drop to 52,200 addresses on January 23 indicates slowing adoption.

This drop raises questions about ETH’s ability to maintain momentum amid broader market uncertainties.

Source: Santiment

Despite the decline in new addresses, overall ETH network activity remains strong, supported by whale interest and strong on-chain fundamentals.

However, sustained network growth will be crucial if Ethereum aims to achieve higher price targets.

Ethereum Technical Analysis: Key Levels to Watch

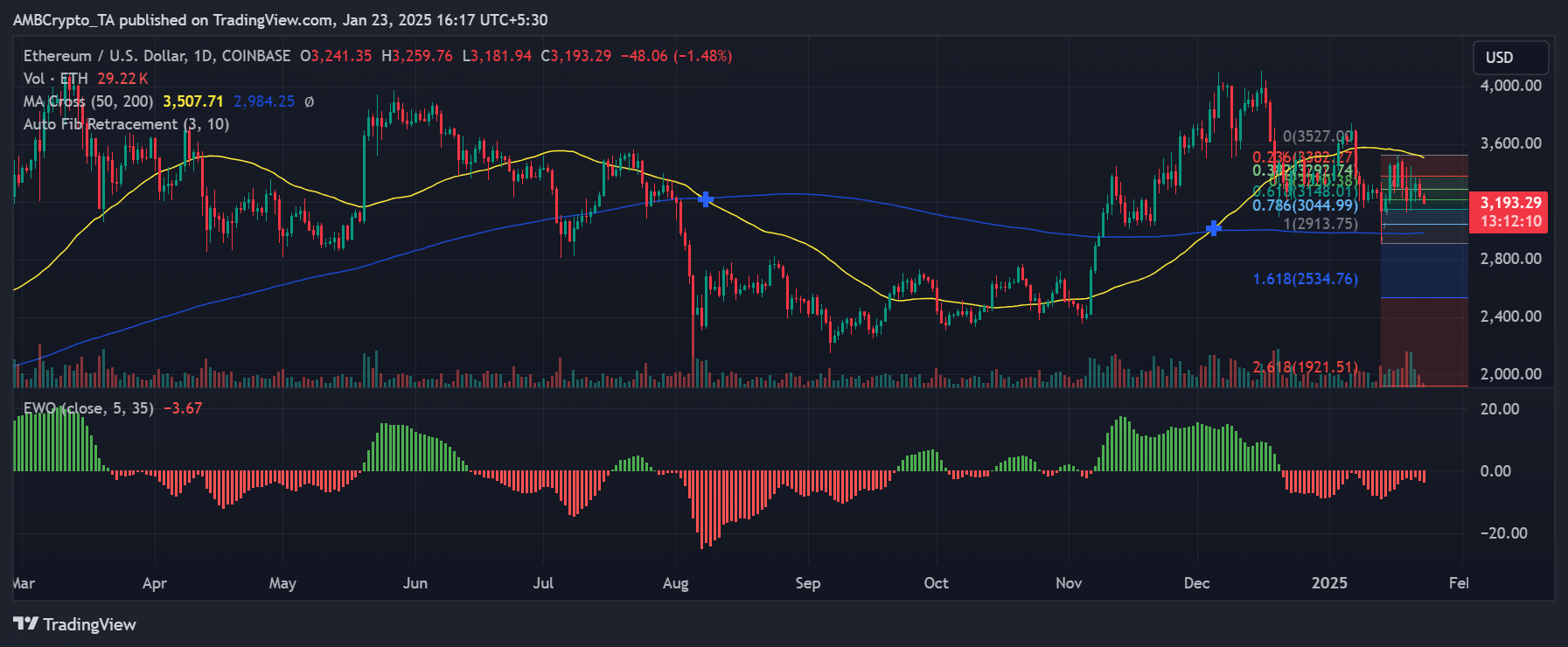

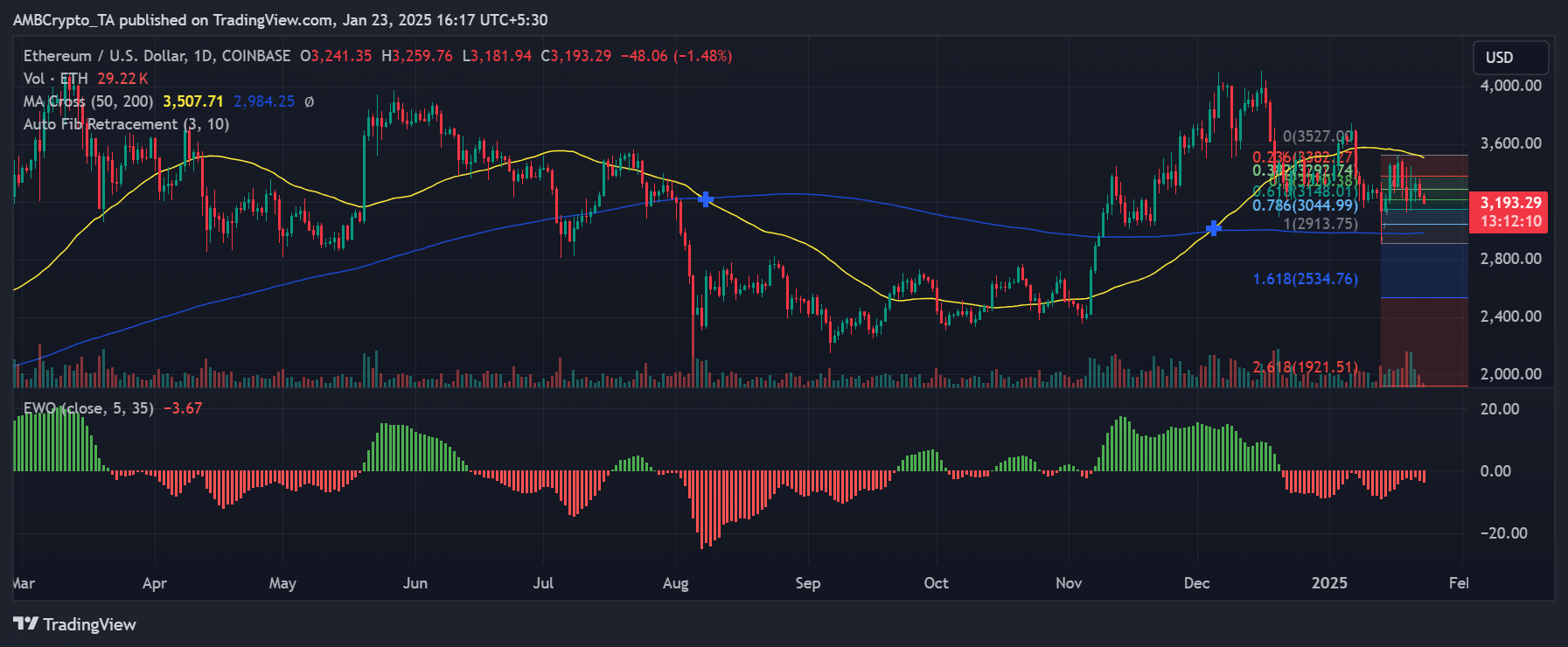

AMBCrypto also looked at Ethereum price action and key technical levels.

Trading at $3,193 at present, ETH saw a 1.48% decline over the last session, testing the 0.786 Fibonacci retracement level at $3,044.99 as critical support .

The 50-day moving average of $3,507.71 has been a major resistance level, while the 200-day moving average of $2,984.25 offers strong support.

A break above the $3,507 level could pave the way for a test of the $4,000-$4,200 zone, with $5,000 remaining a long-term target.

Source: TradingView

The Elliot Wave Theory indicator reflected mixed signals, sitting at -3.67 at press time, suggesting slight bearish momentum in the near term.

However, as whales continue to accumulate ETH, the overall trend remains bullish, provided Ethereum maintains its current support levels.

Can Ethereum reach $5,000?

Ethereum’s path to $5,000 will depend on several factors, including continued whale activity, network growth, and broader market conditions.

The significant accumulation of over 950,000 ETH over the past few months is a powerful vote of confidence in the future of Ethereum.

However, challenges such as slowing network growth and resistance at key technical levels could delay Ethereum’s climb to $5,000.

Read Ethereum (ETH) Price Prediction 2025-26

Investors will also need to monitor macroeconomic factors and market sentiment, which could influence ETH’s trajectory.

As Ethereum consolidates around $3,193, its ability to surpass resistance levels and maintain whale interest will determine whether it can aim for the coveted $5,000 mark in the coming months.