- ETH exchanged in a channel that falls as active and MVRV address flashed the accumulation signals.

- Whales and OGs discharged, but the metrics suggest a potential market.

Ethereum (ETH) Long-term holders have officially entered the territory of “capitulation”, the metric of the LTH-NUPL plunging in red for the first time in months. This change reflects growing losses among experienced holders and often signals the final phase of a lower cycle.

At the time of the press, Ethereum was negotiated at $ 1,591.63, showing an increase of 7.32% in the last 24 hours.

In other words, even with prolonged drop pressure, the action of short -term prices now leaves a possible change of momentum.

Action of ETH prices, user activity and stress of the MVRV signal market

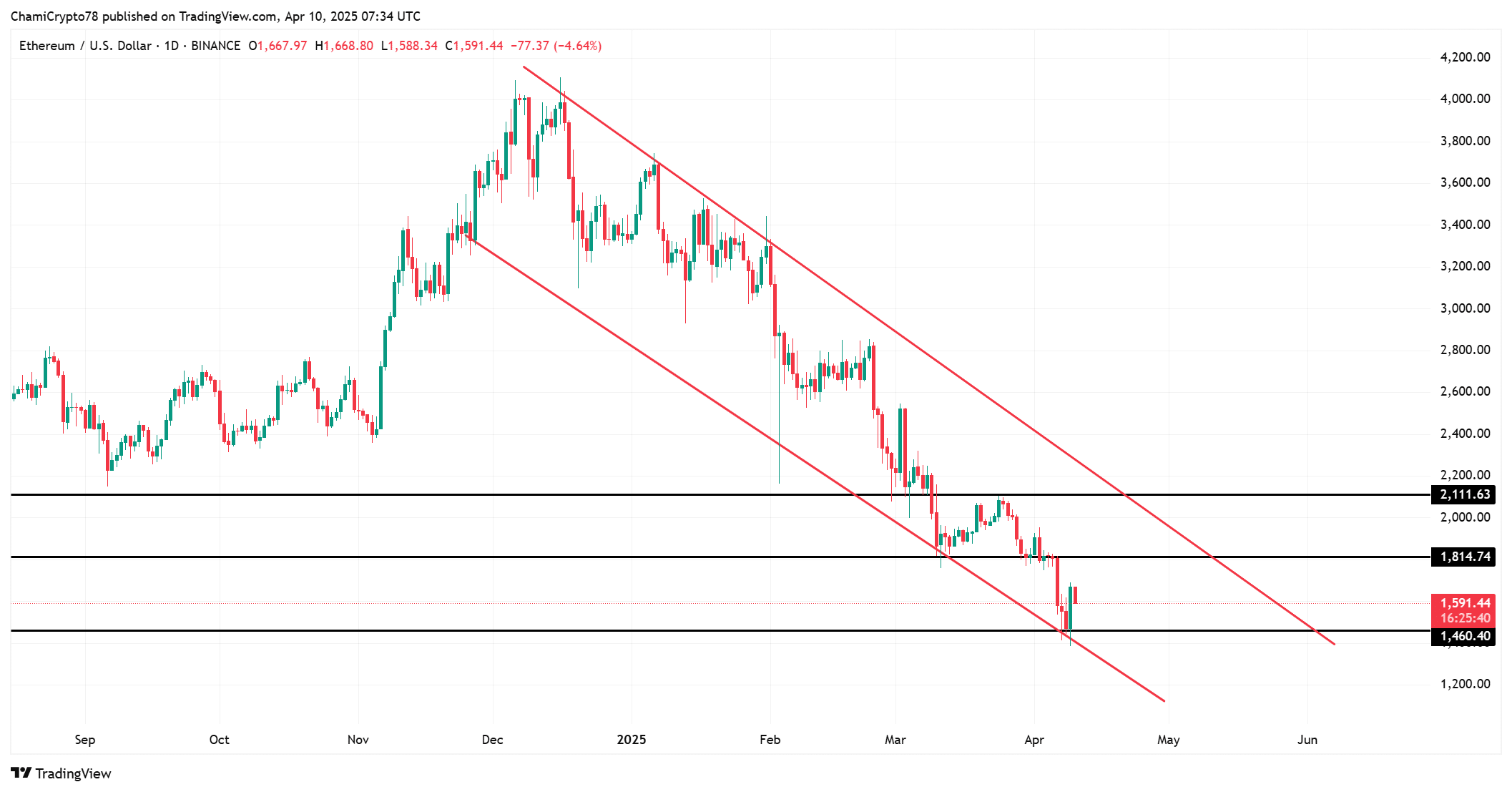

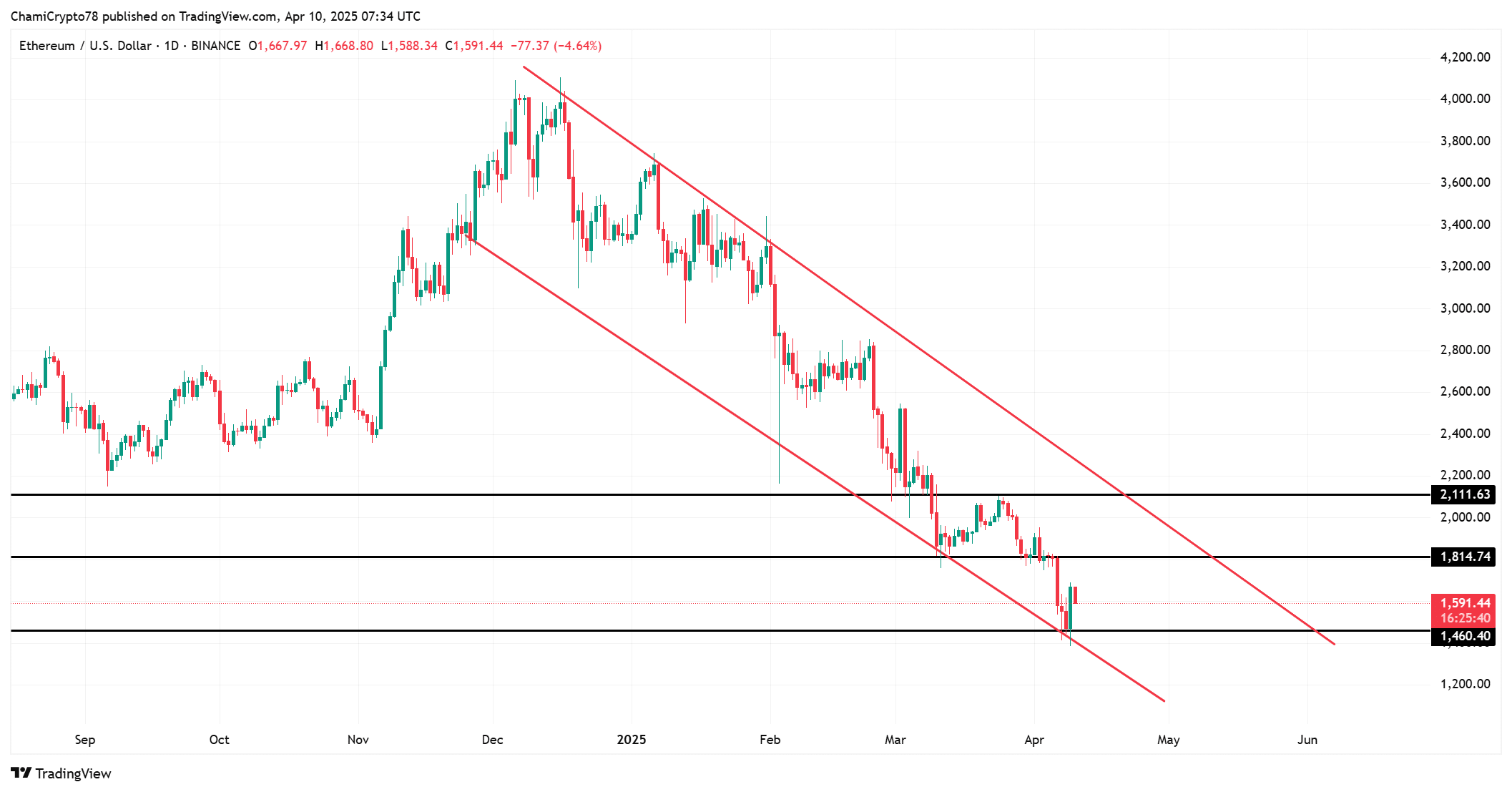

The action of Ethereum prices remains confined to a abrupt decreasing channel, characterized by highly lower ups and hollows since November 2024.

After having rebounded strongly from the $ 1,460 support area, the price is now faced with resistance close to $ 1,815, a level where bears could try to assert control.

That said, if the Bulls manage to recover the level of $ 1,815, this could move the market structure upwards and prepare the ground for a challenge for the resistance of the upper canal.

However, until it occurs, the downward pressure will persist, with potential retains of key support levels if the momentum fades.

Source: tradingView

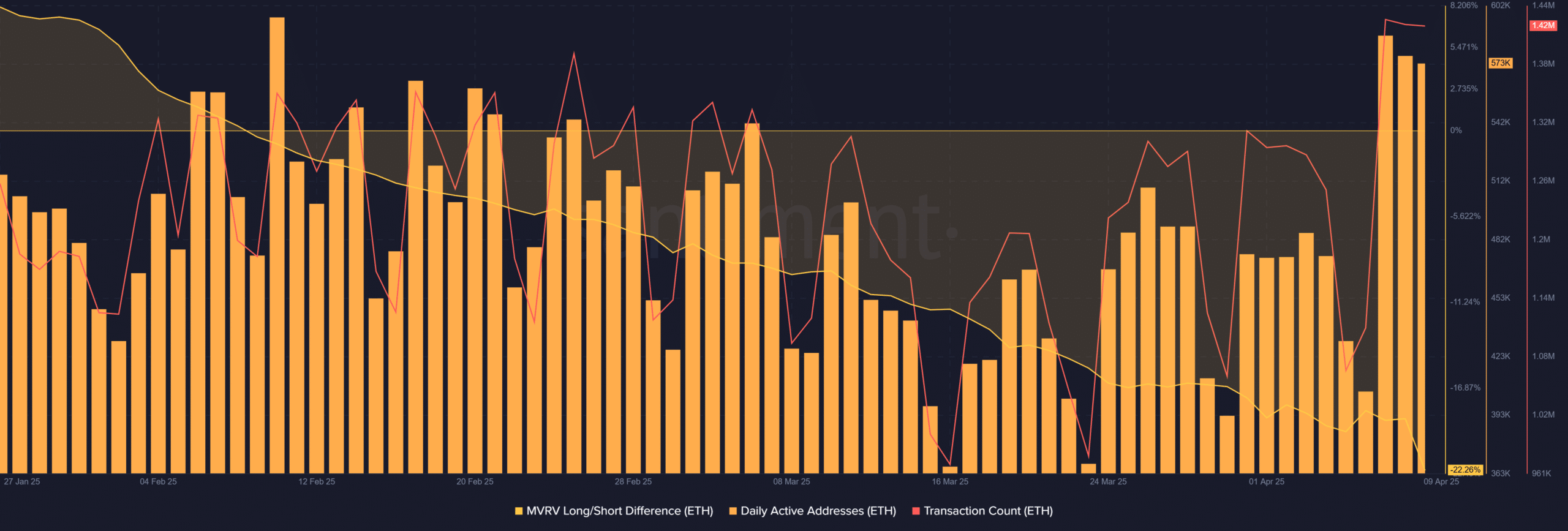

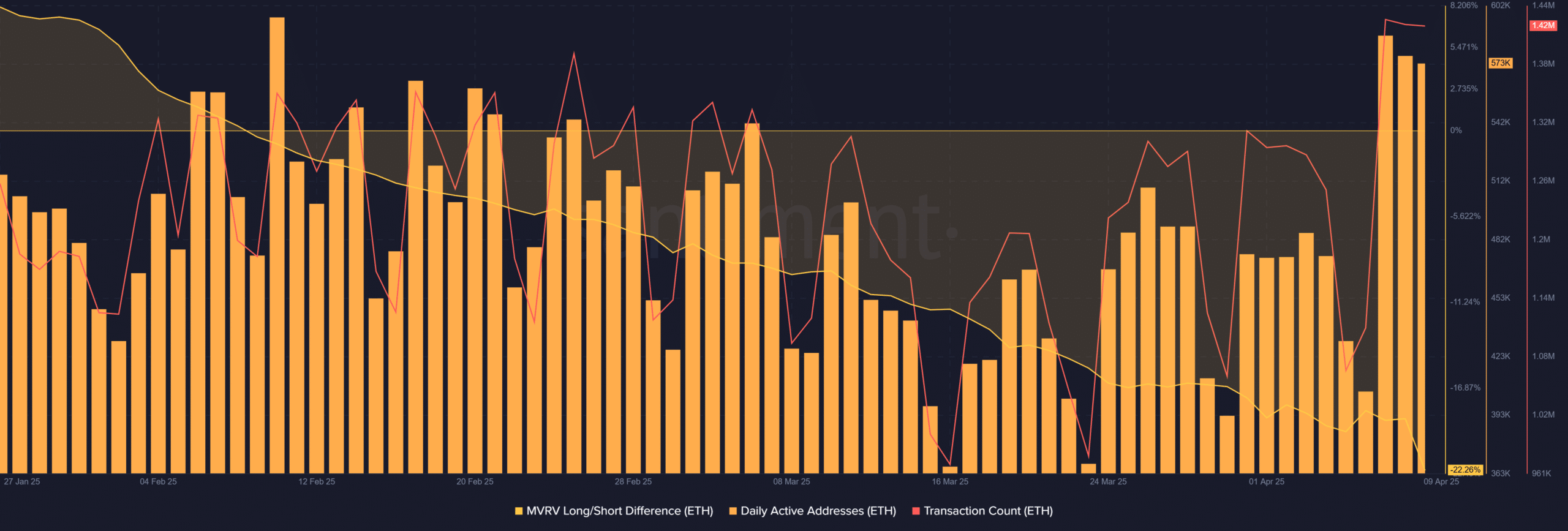

Meanwhile, chain activity tells a different story.

Daily active addresses increased to 573,000 and the number of transactions reached 1.42 million on April 9, marking a significant peak in user engagement.

This increased participation – despite the low price – arouses an increase in interest in the Ethereum ecosystem at reduced prices.

In addition, the long / short MVRV difference fell to -22.26%, a level often associated with maximum pain and ideal accumulation during historical funds.

Source: Santiment

Whale movements and OG sales confirm the risk of capitulation atmosphere

Interestingly, whale behavior has intensified.

More than 530,000 ETH were moved to the main portfolios last week, generally pointing to a strategic accumulation or rebalancing.

Even more revealing is a sleeping ethereum og that acquired ETH in 2016 and discharged 10,702 ETH worth $ 16.86 million at only $ 1,576.

Interesting, tIts whale has still only sold during periods of significant market corrections, even avoiding sales when ETH exceeded $ 4,000.

These actions may indicate outings or attempts at psychological manipulation designed to cause detail, preparing the way for a resumption of the possible market.

Is now the best time to buy Ethereum?

The capitulation of long -term Ethereum support, extreme MVRV readings and the increase in whale activity all point to a conventional accumulation configuration. The use of the network increase adds additional confirmation that the interest remains strong below the surface.

Consequently, despite short -term volatility, all signals indicate that Ethereum is negotiated in a high probability inversion area.

Intelligent investors can consider this as one of the best entry points at risk before the next leg.