CLAYMONT, Delaware, November 19, 2024 (GLOBE NEWSWIRE) — EthosXan innovative derivatives trading platform on blockchain, is reshaping the derivatives trading industry. With the support of leading investors such as Franklin Templeton, Y Combinator, Token Metrics Ventures, Ascensive Assets, Global DeVC and Taisu Ventures (among others), EthosX is tackling the long-standing challenges of complexity and inefficiency of derivatives trading.

Derivatives trading, especially options trading, has always been a complex and opaque process. Retail traders often find it too complex, with limited applications beyond speculative trading. Institutional traders face high costs, including lower trading volumes, and concerns about risks associated with centralized exchanges. Additionally, the existing decentralized derivatives market offers limited products and requires traders to balance capital efficiency and counterparty risk.

EthosX’s solution simplifies derivatives trading through the use of blockchain technology. By eliminate middlemen and automate the entire trade lifecycle – from order matching and clearing to settlement, the platform reduces costs, operational risks and improves transparency and security.

“DeepanshuCEO of EthosX, said: “EthosX is dedicated to democratizing derivatives trading, making it accessible, efficient and secure for all participants. We focus on directly solving problems faced by retail and institutional traders, providing a smooth and transparent trading experience.»

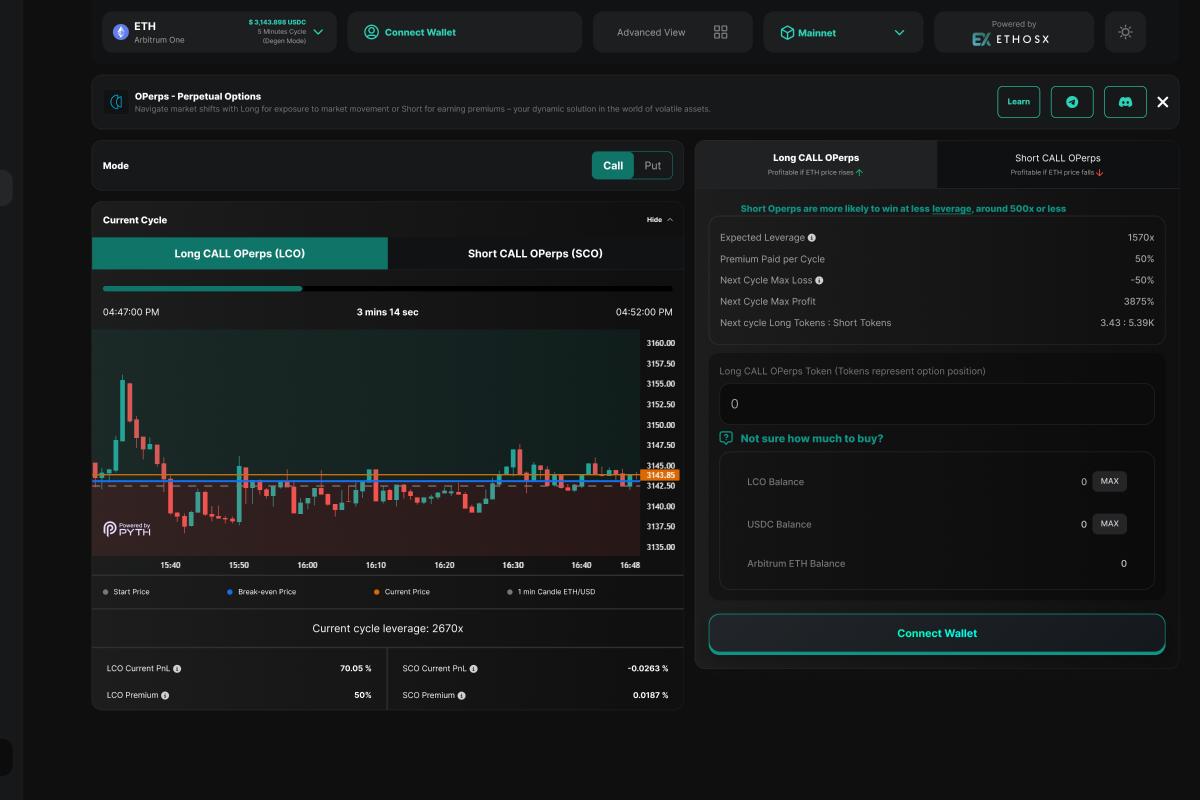

EthosX’s first set of products, Operators (Perpetual Options), is operational on Arbitrum Chain and was launched by EthosX partner Kanalabs on their front-end (operps.kanalabs.io) Operps streamline options trading, allowing users to respond efficiently to market fluctuations. With settlement cycles as short as five minutes and profits paid directly into users’ wallets, Operps offers a dynamic solution for traders navigating the volatile crypto market. The main appeal of Operps is that regardless of leverage, the maximum loss is set at 50% for all users, which completely changes the dynamic of risk and reward.

Operps offer unique features such as lightning-fast trading with 5-minute cycles, accessibility for all trading styles, and a low barrier to entry with examples of successful trades starting with as little as 0, $25.

They are designed to be very user-friendly, even for those new to options trading. They offer two main types of options, “Call the operators“to predict price increases and”Put the operators» to anticipate price drops. Users can enter and exit positions before and after each 5-minute cycle, providing flexibility and control.

The profitability of Operps is influenced by two key factors: leverage And price change.

Leverage acts as a multiplier of potential profits and can be significantly amplified by the number of liquidity providers and long token holders. This active leverage adds an exciting dimension to trading, as it can change each cycle based on market expectations. Operps offers the potential for massive gains even on small price movements due to their high leverage, reaching over 7,000x for some people. Users have made profits over 1000% in a single 5 minute cycle. Even with minimal price changes, less than 1%, returns can be over 200%.

The company is also developing a pioneering solution liquidation protection solution for loan protocols. This innovative feature will allow users to protect their collateralized positions by purchasing options-based protection directly within lending protocols. By automating the protection process and fostering competition among market makers, EthosX aims to provide the most cost-effective liquidation protection available.

EthosX offers a complete range quote request (RFQ) platform for derivative products for institutional clients. This platform, just like the way over-the-counter (OTC) trading works in traditional finance, allows institutions to create and respond to RFPs for highly customizable options and strategies, addressing diverse use cases across all asset classes. While it should be noted that in traditional finance, 80% of derivatives transactions are done over-the-counter and not on exchanges, the crypto market continues to move in this direction. Additionally, EthosX promotes a fair and efficient market for institutional derivatives trading by providing anonymous liquidity and equal access to all traders.

EthosX’s on-chain clearing and settlement mechanism ensures that all derivatives are fully on-chain, eliminating settlement risk and minimizing counterparty risk. The capital efficiency of the platform is enhanced by a ‘on-chain trading center», which facilitates under-guaranteed exchanges and guarantees the continuity of exchanges. This decentralized approach ensures that transactions and assets will not be affected even if EthosX were to cease operations. It provides advanced risk management features to traders such as cross-compensation, on-chain trade auctions in case of defects, several tranches of insurance funds with different risk-reward structures, etc. It’s as if the mighty London Clearing House itself is running on blockchain.

The derivatives market presents a vast opportunity, with the notional the value of traditional derivatives exceeds $600 trillion. The crypto derivatives market is also growing rapidly, with projections indicating a substantial compound annual growth rate (CAGR) through 2030. EthosX is well positioned to capitalize on this expanding market by offering innovative solutions that meet the needs changing traders.

To learn more about EthosX and its platform, visit www.ethosx.finance or connect with the company on X, Discord& LinkedIn.

If you have any questions, please contact

Surbhi Singh

Head of BD

Contact@ethosx.xyz

About EthosX

EthosX is a pioneering platform for derivatives trading on blockchain. The company aims to democratize derivatives trading by making it accessible, efficient and secure for all participants. EthosX offers a range of innovative products and services, including Operps (perpetual options), loan protocol liquidation protection and a derivatives bidding platform for institutional clients. Backed by leading investors and led by a team of experienced professionals, EthosX is spearheading the evolution of on-chain derivatives trading.

Disclaimer: This content is provided by the sponsor. The statements, views and opinions expressed in this column are solely those of the content provider. The information provided in this press release does not constitute an investment solicitation nor is it intended to constitute investment advice, financial advice or trading advice. It is strongly recommended that you perform due diligence, including consulting a professional financial advisor, before investing in or trading cryptocurrencies and securities. Please do your own research and invest at your own risk.

The photos accompanying this announcement are available on