- Nearly tested an opposite pattern of optimistic head and reverse shoulder with high resistance at $ 2.14

- Short liquidations and an increase in social interests alluded to the momentum for a potential escape

Near the protocol (near), At the time of the press, seemed to be showing the signs of a potential rebound, supported by the increase in market capitalization and moderate price gains. In fact, its market capitalization increased by 4.47% to reach $ 2.55 billion – a sign of careful optimism among investors. However, this occurred at a time when its negotiation volume 24 hours a day fell 15.66% to 148.48 million dollars.

At the time of writing the editorial staff, almost $ 2.12, up 4.26%. Despite the rise in prices, however, the drop in volume indicated a low traffic commitment. This also suggests that recent gains can lack resistance necessary to trigger a sustained rally, unless the purchase pressure is increasing significantly.

Can the opposite pattern of the head and shoulders drive a break?

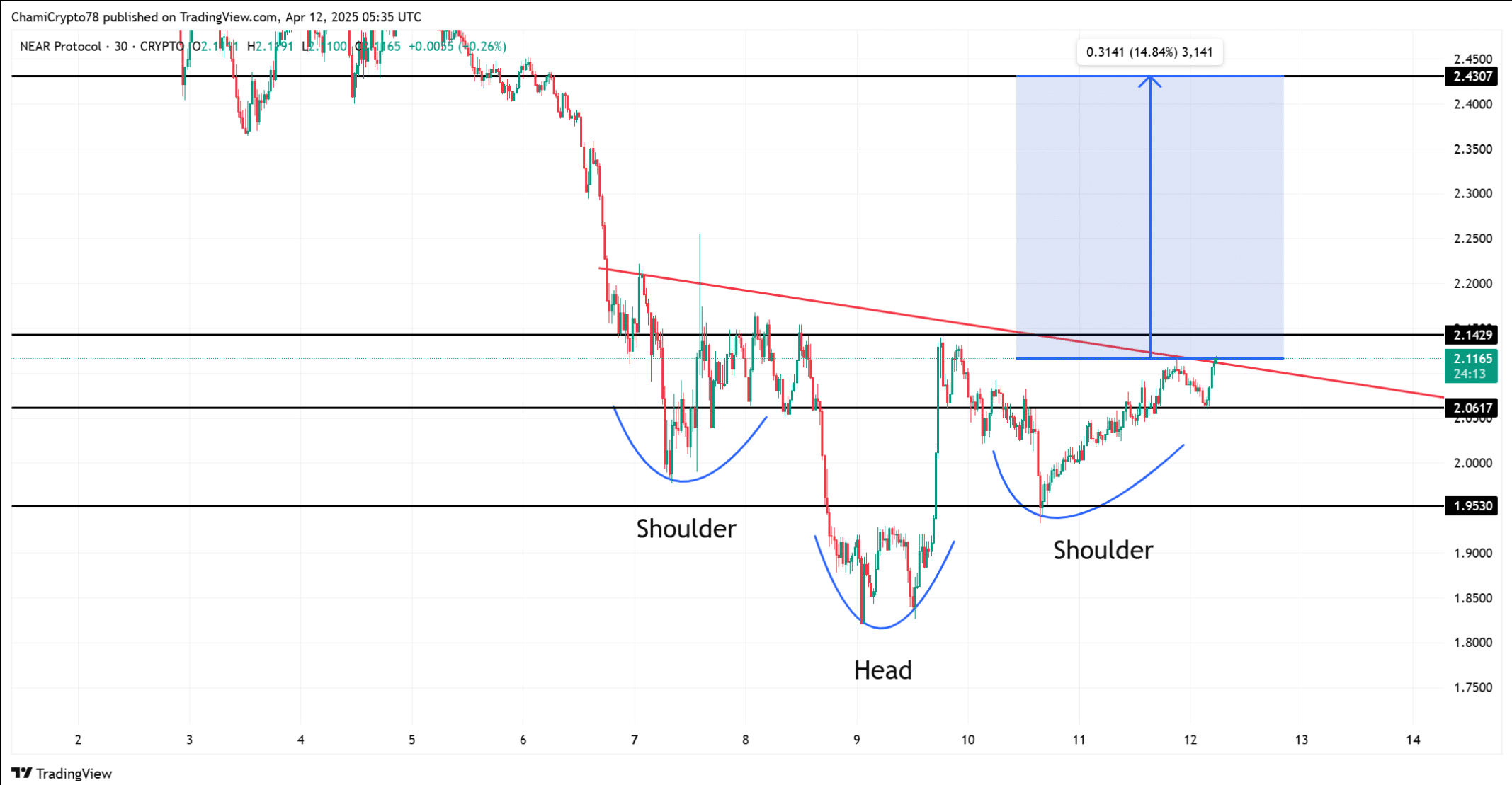

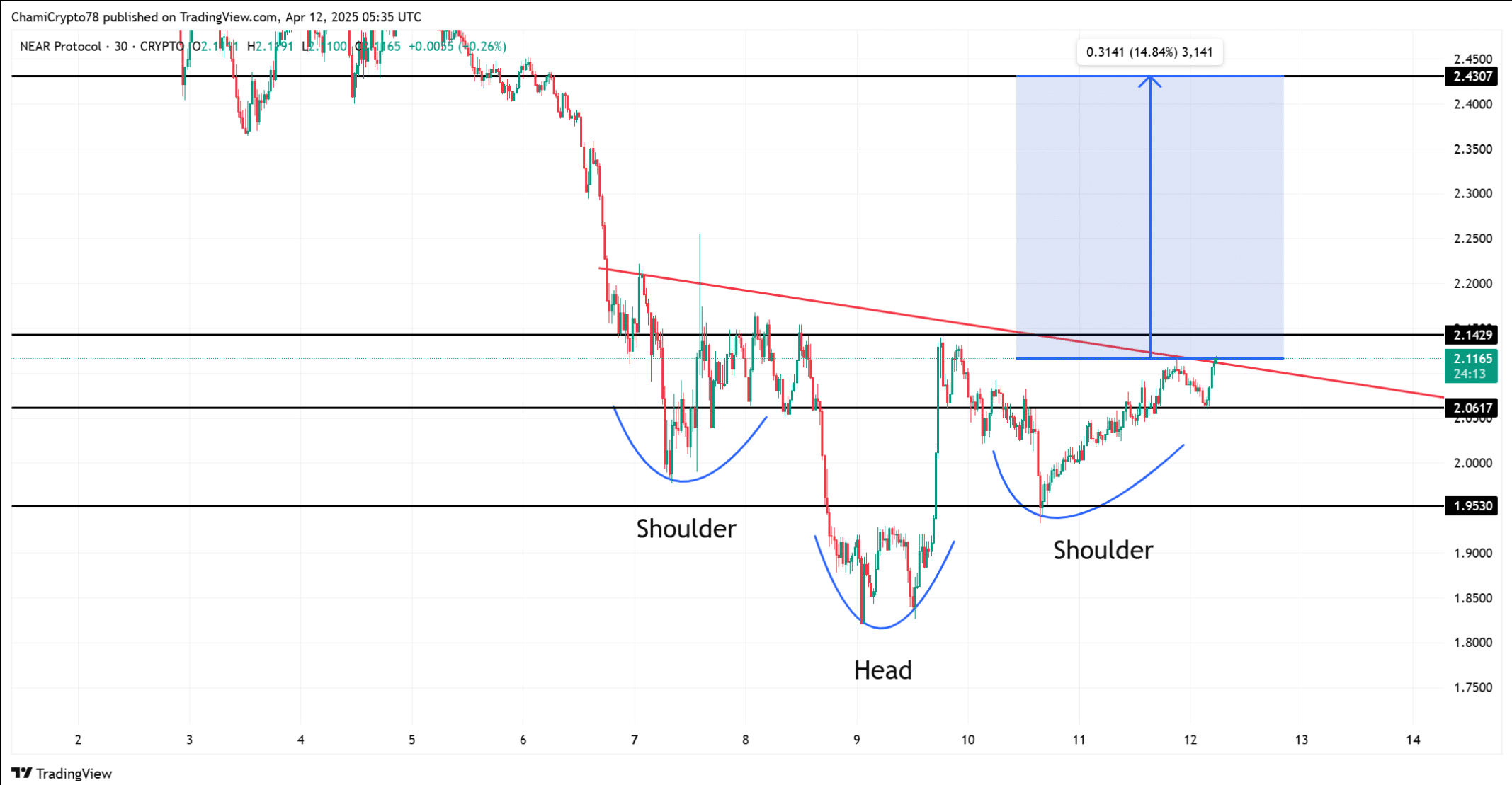

Near’s graph revealed an opposite structure of well -defined head and shoulders – often a sign of a bullish reversal in manufacturing. The neckline was contained just more than $ 2.14, with notable support levels at $ 2.06 and $ 1.95.

The price seemed to test this neckline, and an escape above could feed a movement of 14.84% towards the expected objective of $ 2.43. The symmetry of this model, with clearly formed shoulders and a weak central, improves its reliability.

However, traders should remain cautious because this upward configuration requires a high confirmation of volume. Without such a catalyst, the rally could calm and the model can lose its meaning.

Source: tradingView

Short liquidations go up like baskets

The liquidation data underlined increasing pressure on the open sellers. During the last sessions, short liquidations reached $ 31.42,000, exceeding long liquidations, which only totaled $ 10.46,000. Binance alone represented $ 21.25,000 in short liquidations, which shows that many traders have misunderstood market management.

In addition, Bybit and OKX have also seen notable short -term effits, which suggests that bears are in a hurry as higher price bins. This imbalance in liquidations can act as a hidden engine of the momentum because the forced outings of short positions create sudden price increases.

Source: Coringlass

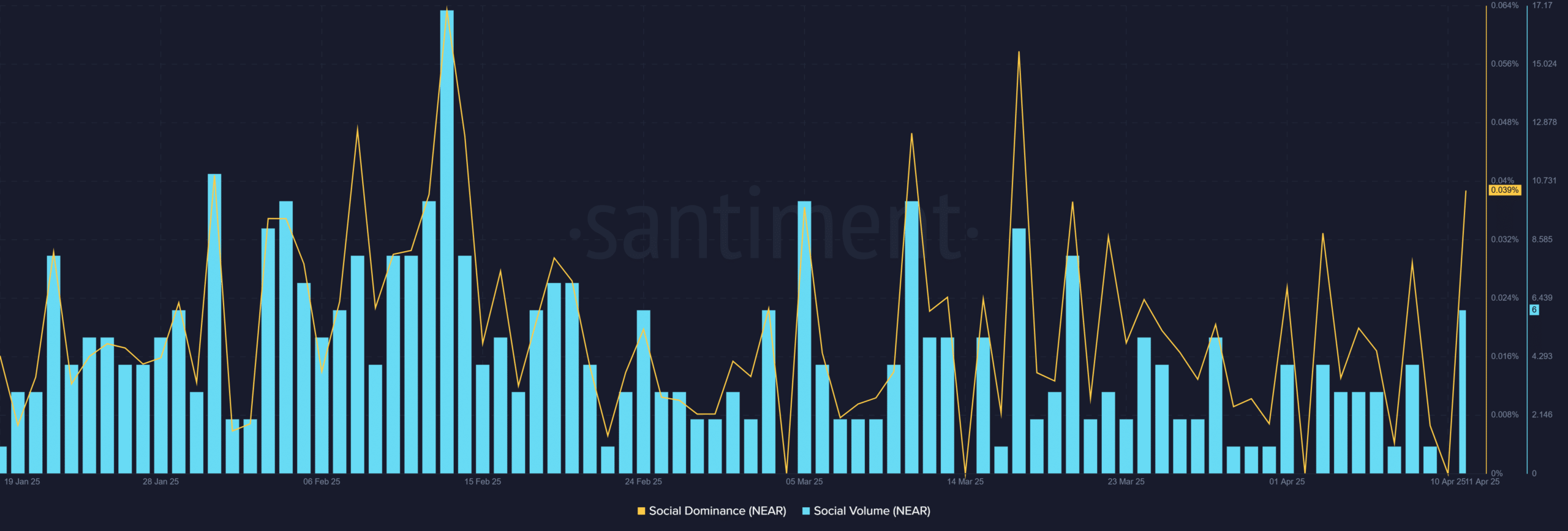

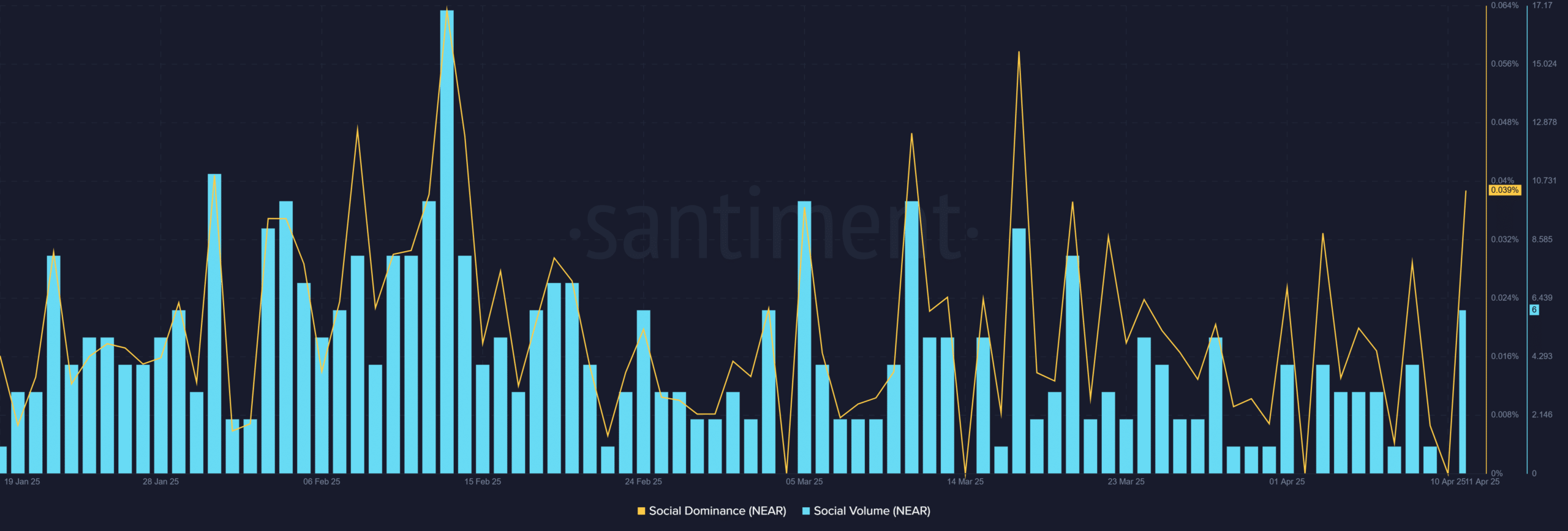

An increase in social volume alludes to an increasing interest

Social metrics also stressed that near the withdrawal of visibility among retail merchants. Social volume has climbed to 6, while domination increased to 0.039% – marking the highest activity in recent weeks.

Although these figures remain moderate, they highlighted a change in feeling that could accelerate whether price action confirms the bullish model. Therefore, if escape materializes, growing chatting on social platforms can help feed demand and buy FOMO purchases from the participants set aside.

Source: Santiment

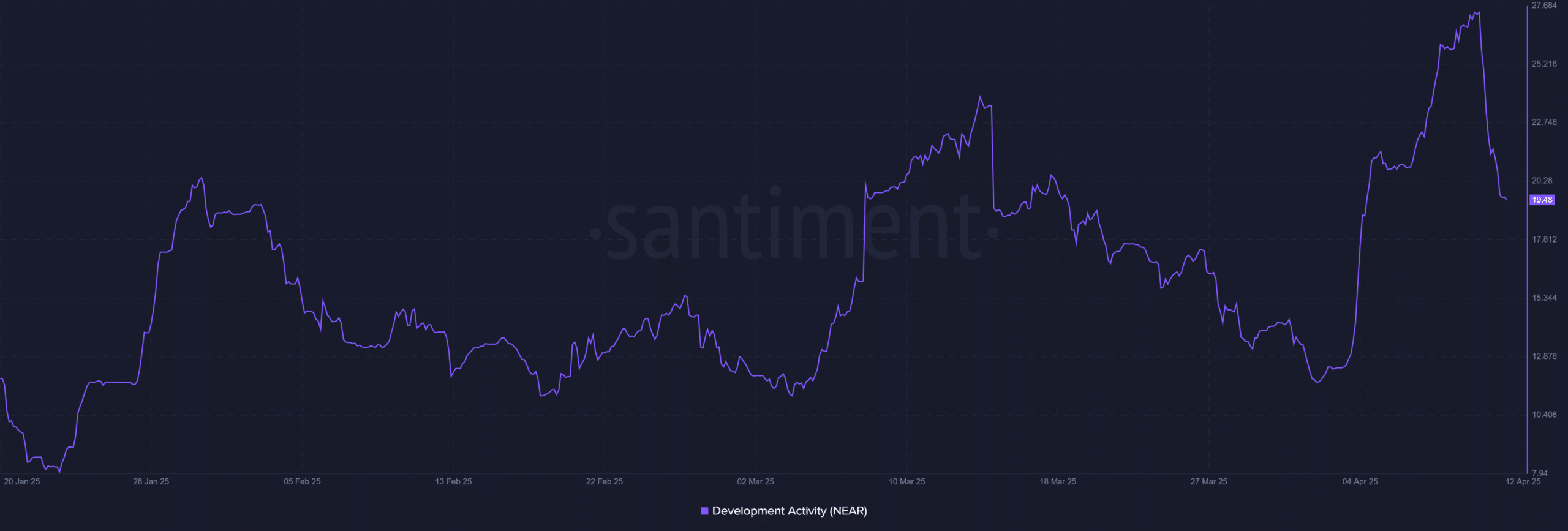

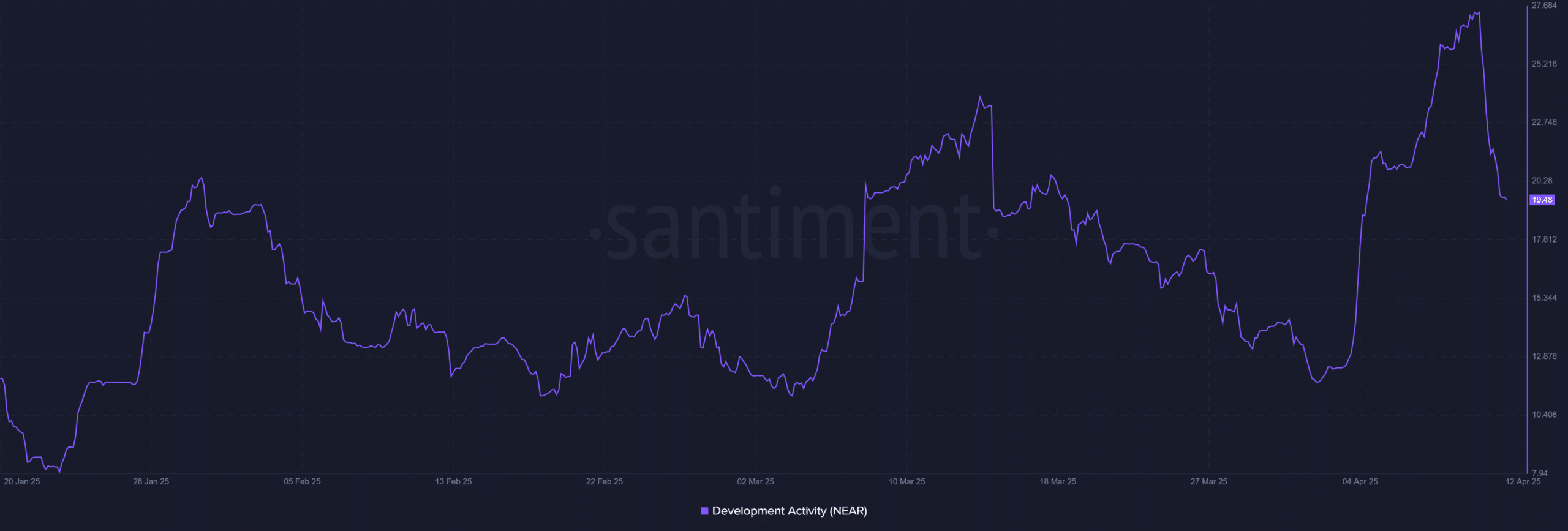

Developers’ activity cools, but remains strong

Finally, chain development measures have revealed a slight slowdown in the manufacturer’s activity. The score of Narge’s development activity went from a peak of 27.68 to 19.48 on April 12. Although this drop can report a temporary break after intense upgrades, it has not yet suggested trend reversal.

In fact, the developers remain actively committed and continue to outdo many projects in its category in terms of contributions at the level of the code. Consequently, any rebound in the activity could further strengthen the confidence of investors in the long -term viability of Narch.

Source: Santiment

Could he prepare for his next major rally?

Near the protocol shapes a bullish structure that could prepare the ground for a break. The reverse scheme of the head and shoulders highlighted a potential movement of 15%, while short -term liquidations and the increase in social commitment alluded to an increasing momentum.

However, the real test lies in the break in the neck of $ 2.14 with a strong volume. If this occurs alongside the renewed commitment of developers and the increase in interest, it could be on the right track for a significant gathering towards $ 2.40.