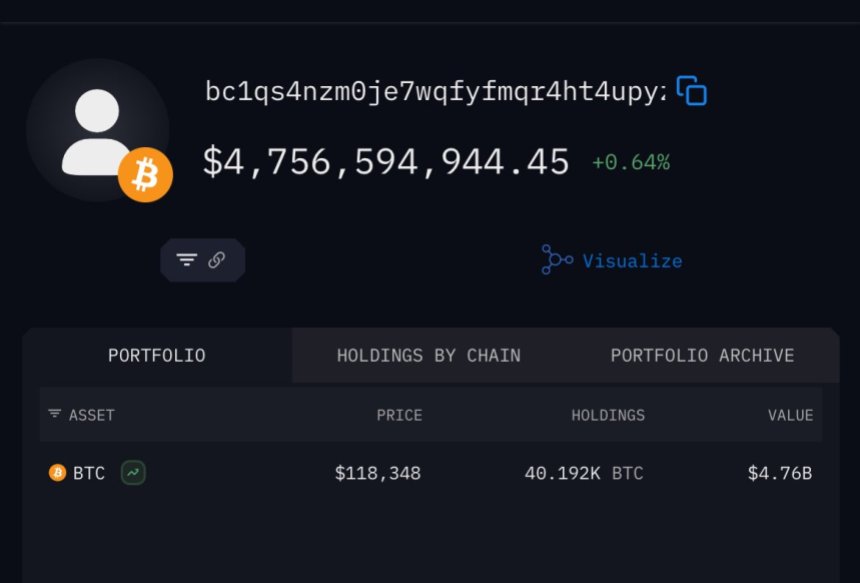

After reaching a record summit of $ 123,200, Bitcoin is now consolidated around the level of $ 118,000. Market players remain under alert, because the Top Darkfost analyst reported a major development involving one of the oldest and most watched portfolios in the history of the crypto. According to the analyst, the other 40,000 BTCs – have estimated about $ 4.75 billion – still held by the Satoshi era whale.

The quarter of work started last night, reporting a renewed activity of the holder of the first Bitcoin. Until now, only half of the whale assets had been moved, while the rest was dormant. This last transfer marks the complete mobilization of all 80,000 BTC formerly controlled by the entity. Although the reason behind the move remains unknown, the market was closely monitored the signs of potential sales or redistribution.

Bitcoin’s ability to maintain above the main levels of support despite this movement with high issues can reflect strong demand and investor confidence. However, with $ 4.75 billion now in motion, traders are preparing for possible future volatility. The market is waiting to see if this event will trigger broader implications – or if it is simply a strategic reshuffle of one of the first whales of the ecosystem.

The BTC of the Satoshi-Se era consolidates a single address

DARKFOST highlighted a major chain development that drew market attention: each of the four portfolios, previously holding 10,000 BTC of the 80K whale, sent their funds to a single destination address BC1QS4NZM0JE7WQFYFMQR4HT4UPYZY57V95NF4AU0. This address now has the entire $ 4.75 billion, raising new questions about the intention of the decision.

According to Darkfost, while the model differs from previous previous sales, the market must remain alert. “I guess these BTCs could also end up hitting the market soon,” he said. This type of movement – in particular from dormant and high value portfolios – often signals a large -scale positioning, which can precede institutional sales or long -term strategic storage.

The timing coincides with the increase in bullish momentum on the cryptography market. Bitcoin consolidating more than $ 118,000 after its more $ 123,200, traders are considering a potential escape. Adding fuel to these prospects, the three key invoices linked to the crypto were adopted by the American house this week, removing significant regulatory uncertainty and authorizing a path for wider adoption.

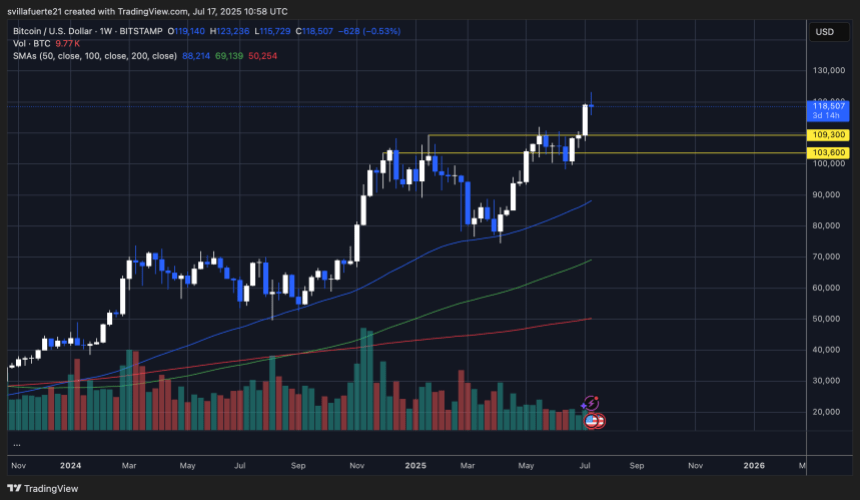

Bitcoin Weekly Chart Signals a fresh impulse

The weekly graph shows that Bitcoin holding hard above $ 118,000 after reaching a summit of $ 123,200. This escape follows prolonged consolidation just below the resistance of $ 110,000, which acted as a ceiling for several months. Now become support, areas of $ 109,300 and $ 103,600 are essential demand levels, offering a firm base for continuation if the bulls maintain control.

The structure of the recent weekly candles reflects upward domination, characterized by strong bodies and relatively small upper locks. This suggests controlled profit and increasing confidence in buyers. Meanwhile, the volume resumes, confirming participation in the escape and referring to the possibility of sustained momentum in the coming weeks.

All the major medium -sized medium -sized – 50 weeks ($ 88,214), 100 weeks ($ 69,139) and 200 weeks ($ 50,254) – are up and are well below current price levels, strengthening a long -term optimistic trend. While Bitcoin is consolidated above the old resistance, this area can now serve as a launch for a transition to the next psychological target at $ 130,000.

Dall-e star image, tradingview graphic