- $600 million moved to Solana in October, over 90% of which came from Ethereum

- Provide more evidence for Solana’s role in DeFi, NFTs and cross-chain innovation

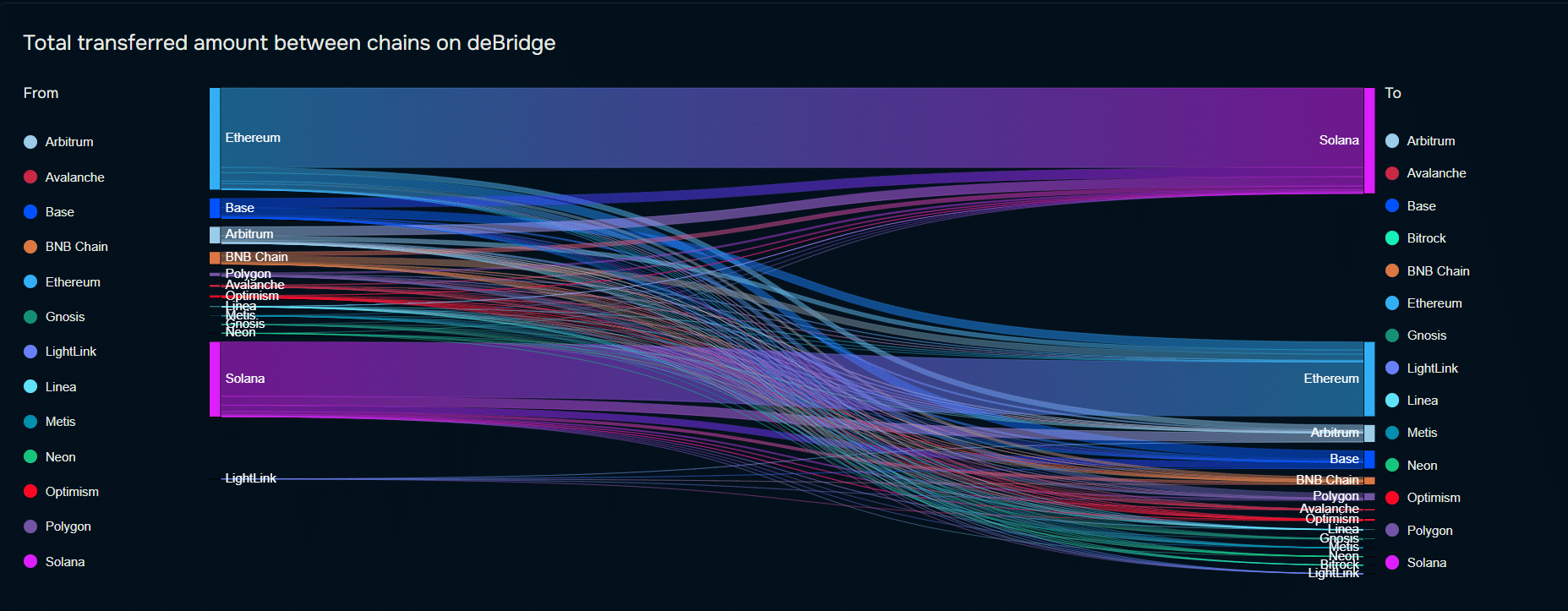

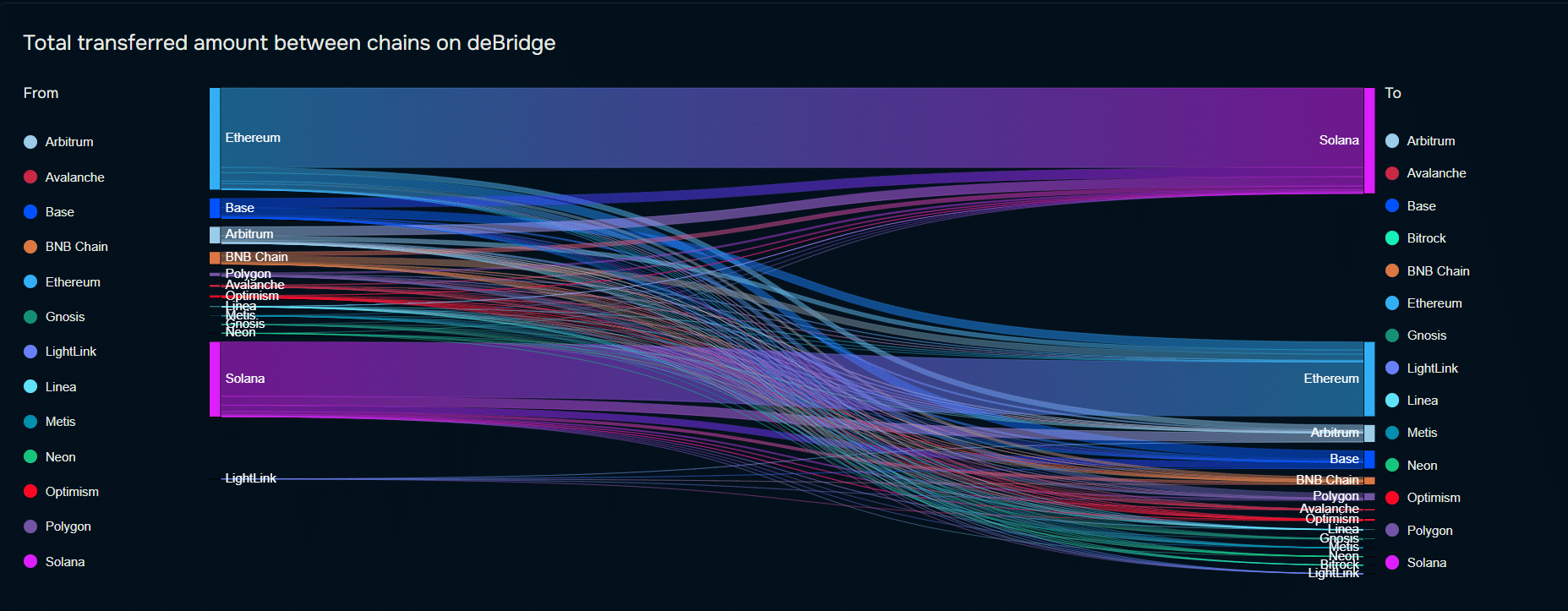

At a time marked by rapid advancements in blockchain technology, October saw over $600 million in digital assets flow into Solana (SOL) from other blockchain networks, with Ethereum (ETH) contributing over 90% of this transfer. This significant move highlights Solana’s growing appeal as a scalable, low-cost alternative for decentralized finance (DeFi), NFTs, and other blockchain-based applications.

As cross-chain interoperability becomes a priority for users seeking access to diverse ecosystems, Solana’s growing liquidity and project development signal its increasingly competitive position. The question now is how this influx will shape Solana’s role in the cryptocurrency landscape.

Bridging and its impact on Solana’s market position

Blockchain bridging refers to the transfer of digital assets across different blockchain networks, allowing tokens from one ecosystem – like Ethereum – to operate on another, like Solana. This process allows users to access services or benefits that might be better suited to their specific needs or generate leads on alternative channels.

Source: deBridge

In October alone, over $600 million flowed into Solana, with Ethereum accounting for over 90% of that flow. This is further evidence of Solana’s position as an increasingly viable ecosystem for decentralized finance and other blockchain-based applications.

This influx of capital strengthens Solana’s competitive advantage. This makes it a terrific choice for projects looking for speed, scalability, and low-cost transactions. Solana’s performance efficiency is increasingly attractive in a market where Ethereum’s fees and transaction times can present obstacles.

This influx of capital not only increases liquidity across the entire ecosystem, but also supports the growing maturity of its infrastructure. This also incentivizes existing projects and new developments to consider Solana as their preferred platform.

Benefits for Solana’s DeFi and NFT projects

The influx of liquidity directly enhances the development and attractiveness of DeFi and NFT projects, areas that continue to show robust growth. Many projects stand to benefit – Marinade Finance, a liquid staking protocol, and Orca, a user-friendly decentralized exchange, to name a few. These projects benefit from immediate access to higher liquidity.

New projects are also positioning themselves on Solana, taking advantage of the chain’s interoperability and better liquidity. For example, Solend, a decentralized lending protocol, reported higher participation rates with new collateral options that appeal to users on other chains.

Recent partnerships and platform expansions by protocols such as Jupiter Aggregator, which aggregate liquidity on decentralized exchanges, have further capitalized on the recent influx to improve user experience and transaction efficiency.

On the NFT side, Solana’s shadow wallet and marketplaces like Magic Eden have welcomed new capital to support creators and collectors. The ecosystem dynamics are also drawing attention to niche NFT projects, such as Tensor and Formfunction. These offer distinctive NFT trading features, meeting a growing demand for diverse digital assets.

Additionally, cross-chain capabilities are a boon for NFT creators on Ethereum. They can now access the Solana audience without abandoning their Ethereum-created projects.

Cross-chain interoperability trends and potential for future growth

The significant movement of assets highlights a broader trend: cross-chain interoperability. As blockchain networks seek to address scalability challenges and user demand for cost-effective solutions, cross-chain mechanisms are crucial for ecosystem growth and resilience.

Protocols such as Wormhole and Allbridge, which facilitate cross-chain asset transfers, are increasingly used as users seek to take advantage of the opportunities offered by Solana’s low-cost, high-throughput environment.

Is your wallet green? Check out the Solana Profit Calculator

Going forward, Solana’s increasing integration with other blockchains, alongside its appeal for high-throughput applications, would mean a strong growth trajectory.