- LINK, at press time, was showing signs of a potential breakout, supported by bullish technical indicators.

- Foreign exchange reserves fell, while prolonged liquidations highlighted strong bullish sentiment

Chainlink (LINK) has made significant progress in recent times, thanks to its technological innovations and notable improvements in its overall market performance. After launching CCIP Private Transactions for banks and integrating Bitcoin, Chainlink is positioning itself as a leader in the settlement of cross-chain tokenized assets.

Thanks to ANZ’s pilot program and an AI-powered initiative to manage unstructured financial data, LINK saw a 4.46% price increase in the last 24 hours. Trading at $11.79 at press time, LINK appeared to be approaching a critical resistance level.

The question now is: can this momentum push him to new heights?

Is LINK ready for a breakout?

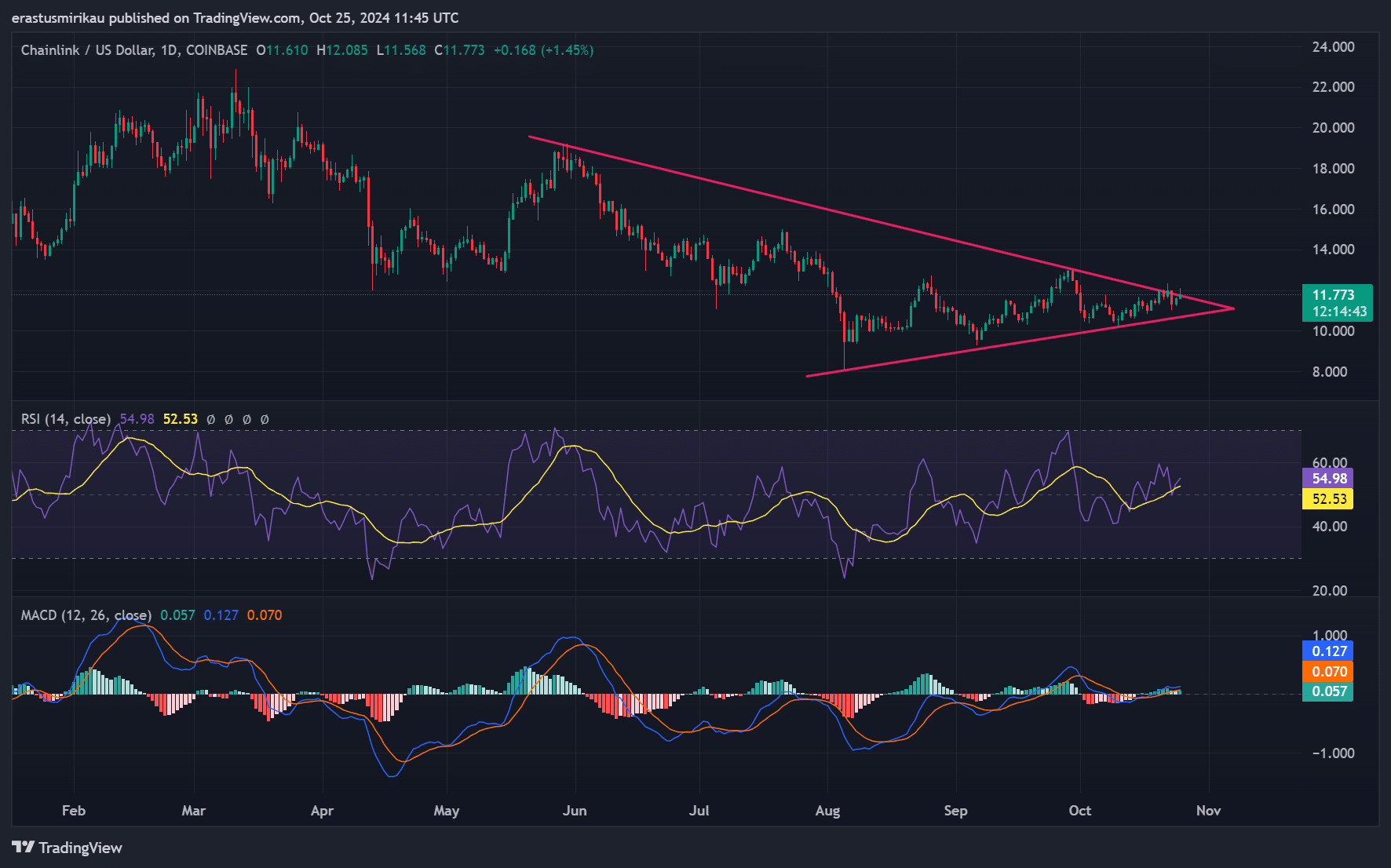

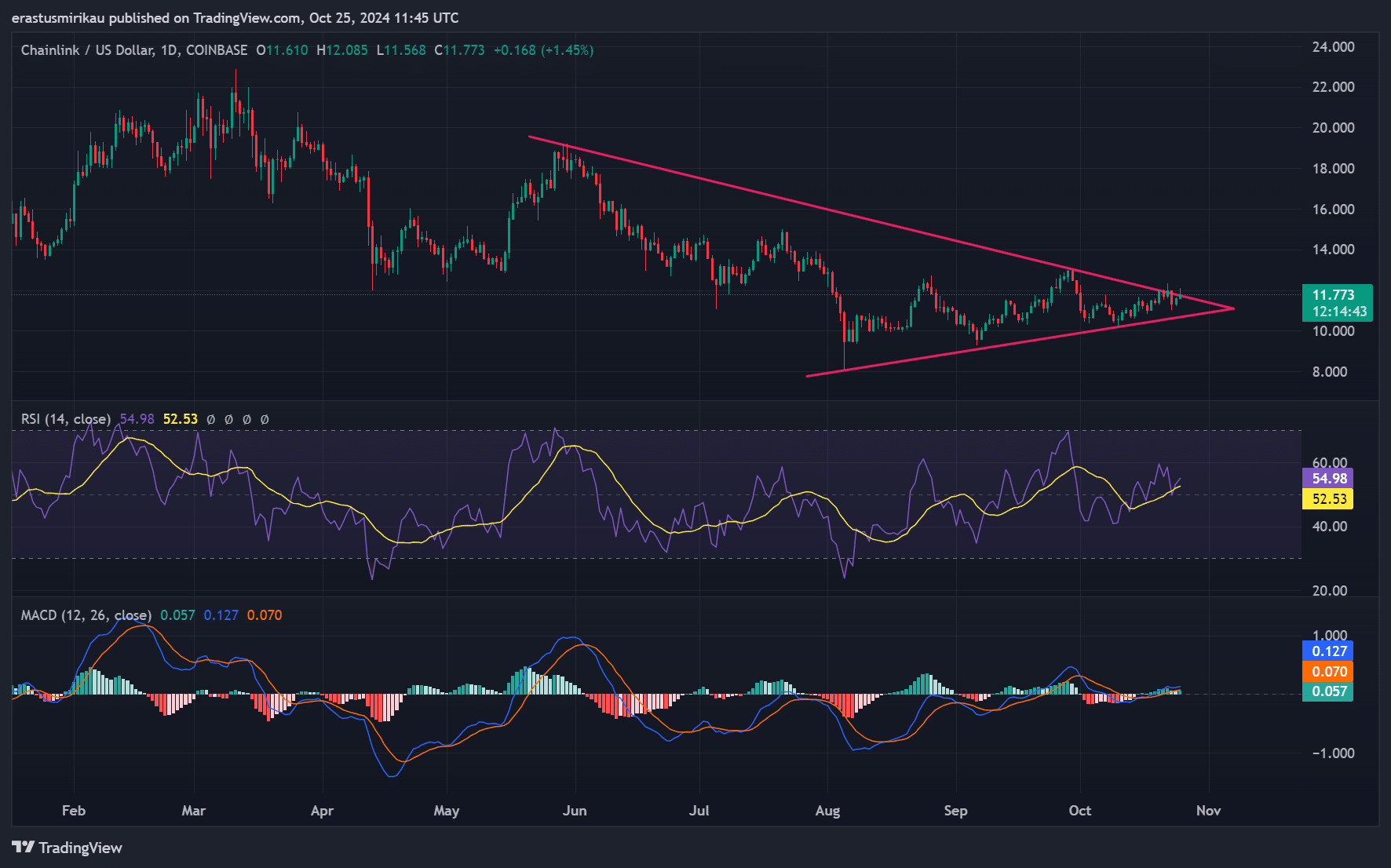

LINK’s chart revealed a symmetrical triangle pattern, which has been tightening since mid-July. At press time, LINK was trading near the top of this triangle, hovering at $11.77. Additionally, the Relative Strength Index (RSI) stood at 54.98, suggesting that LINK has a bullish advantage.

Additionally, the Moving Average Convergence Divergence (MACD) highlighted a recent bullish crossover, which could be a sign of bullish momentum. Therefore, if LINK breaks out of the triangle, its next target could be the psychological level of $13.

Source: TradingView

Strong on-chain signals indicate increased usage

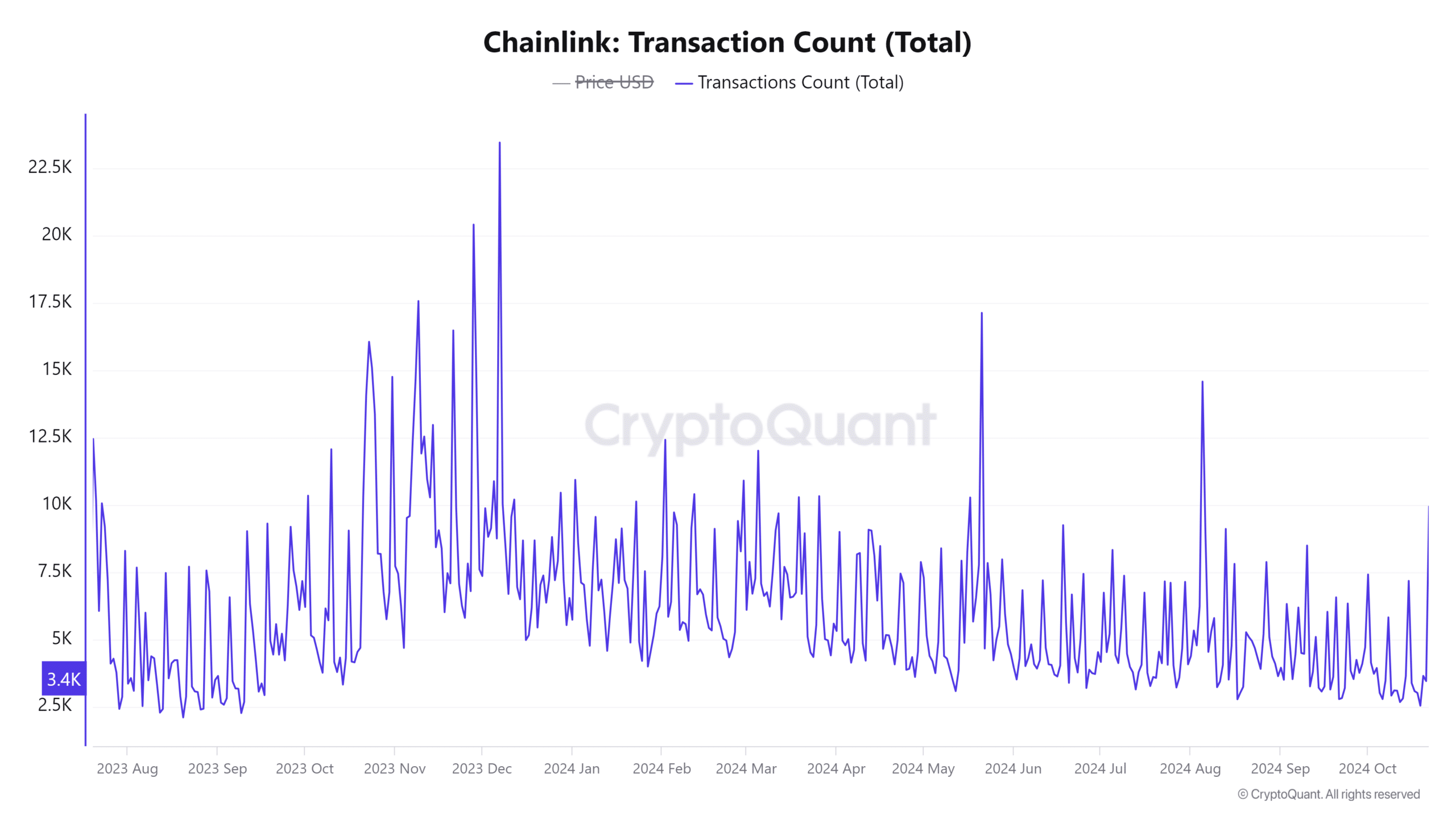

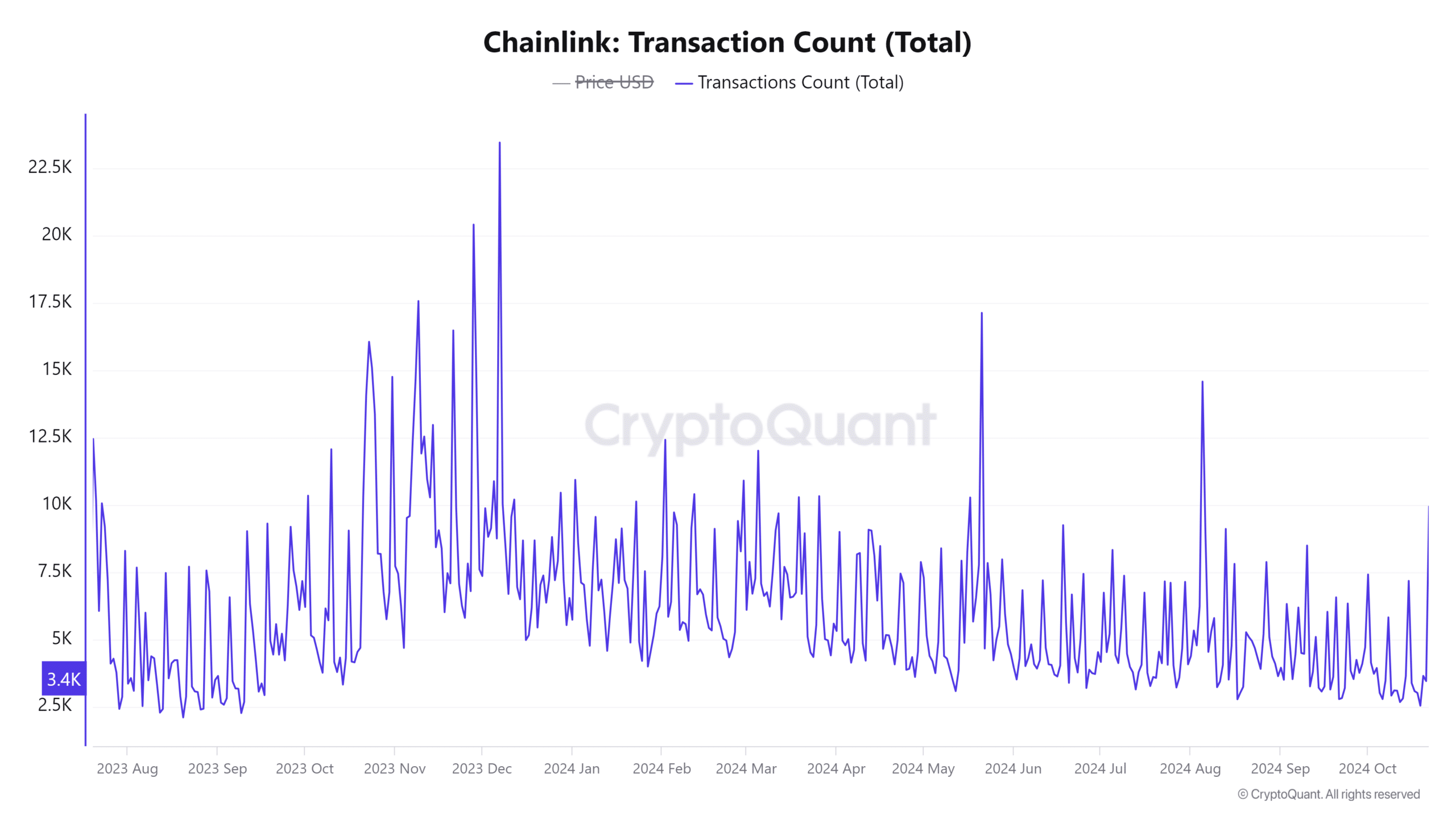

On-chain metrics have painted a promising picture for Chainlink. Active addresses increased by 1.11% in the last 24 hours, climbing to 176.45,000. This can be interpreted as a sign of growing interest and activity within the Chainlink network.

Additionally, the number of transactions increased by 1.18%, reinforcing the idea that more users are using the platform’s decentralized services. Together, these signals supported the bullish narrative, highlighting greater network engagement.

Source: CryptoQuant

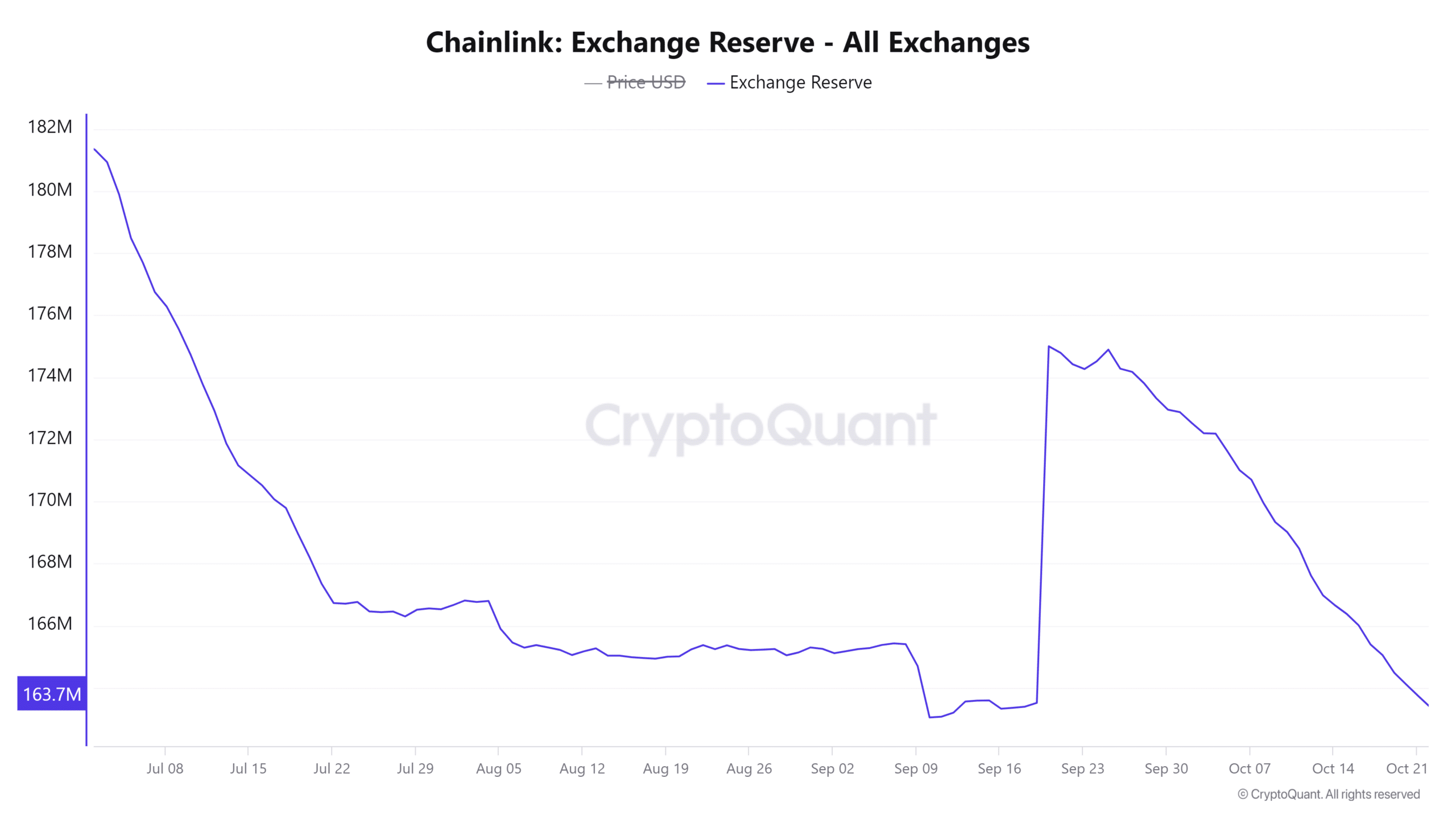

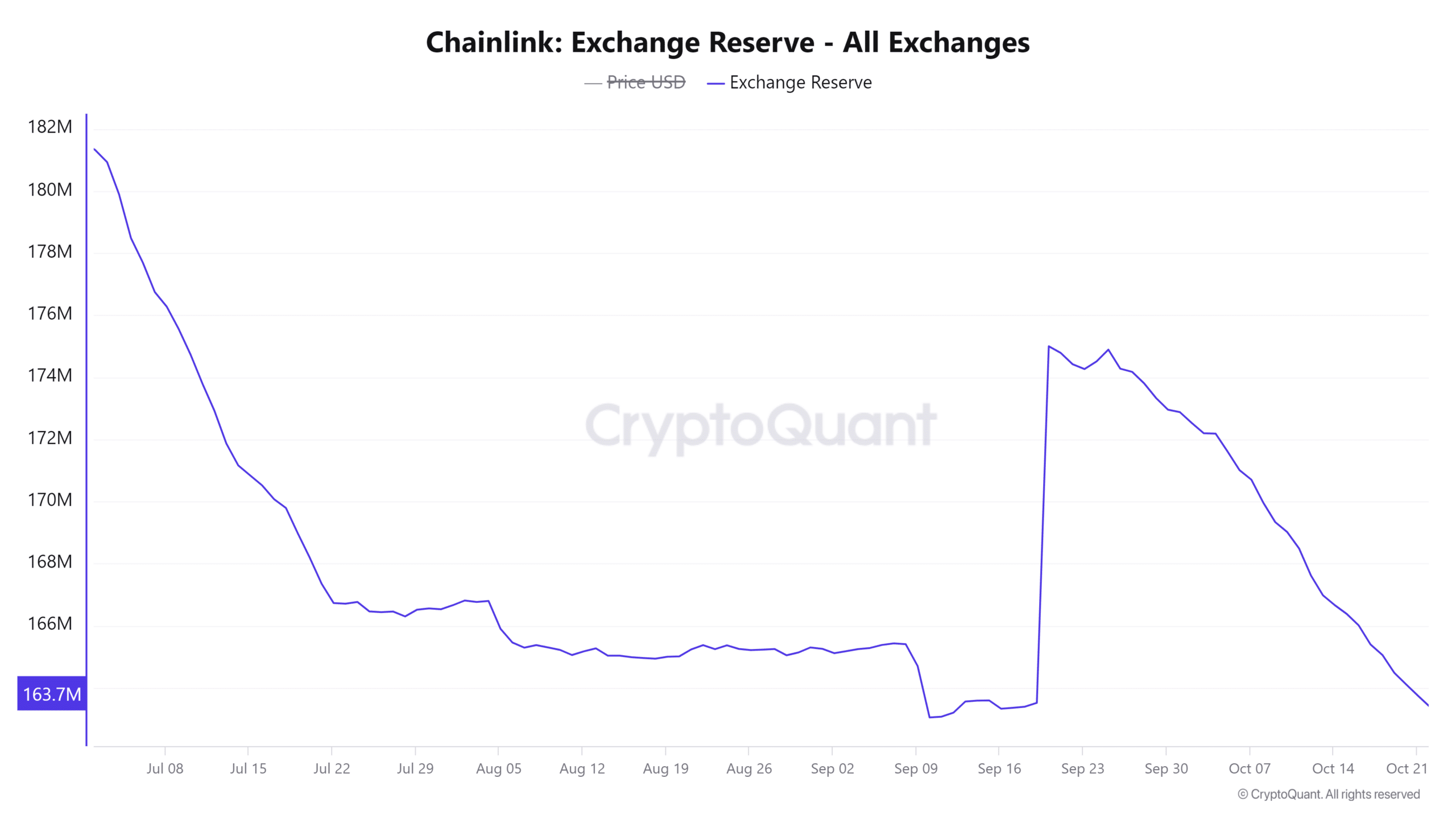

LINK FX Reserves Fall, Indicating Supply Constraints

Interestingly, LINK’s exchange reserves fell by 0.27% over the past seven days, falling to 163.97 million tokens. This decline suggests that investors are moving their holdings from exchanges to private wallets.

This may be a sign of easing selling pressure, which could further push prices higher if demand continues to rise.

Source: CryptoQuant

Long sell-offs fuel the bullish fire

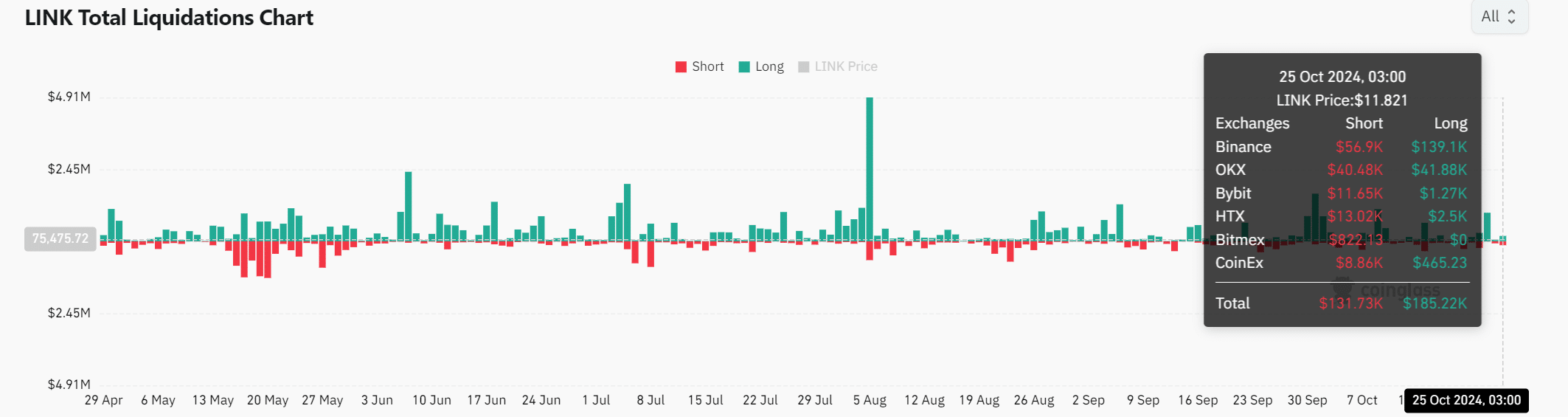

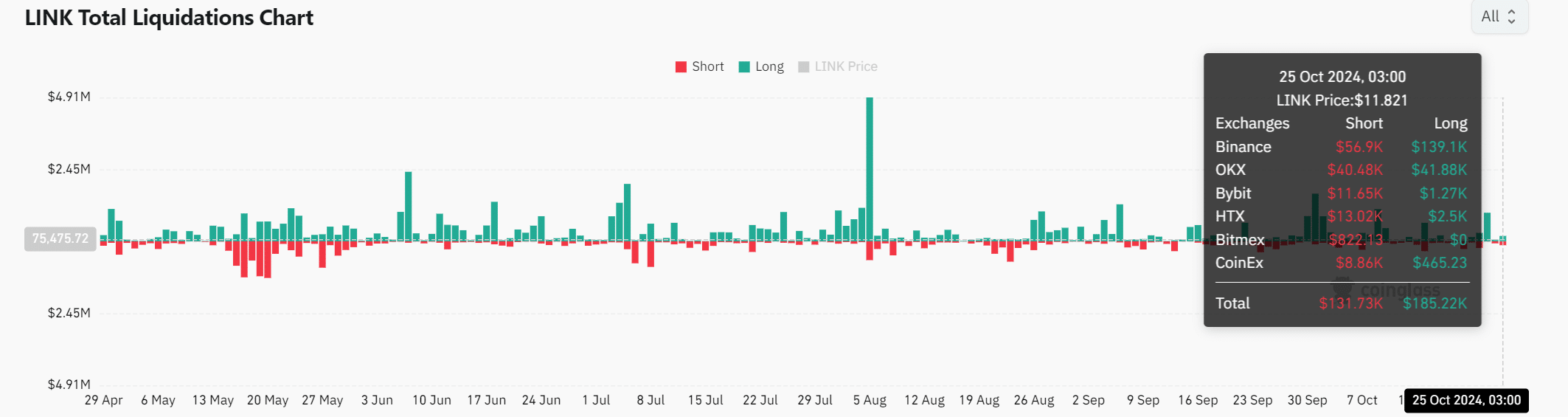

Another contributing factor to LINK’s potential rally is the imbalance between long and short liquidations.

The data revealed that $185.22,000 of long positions were liquidated, compared to $131,730,000 of short positions. This trend of long liquidations highlighted traders’ confidence in a bullish move – accelerating LINK’s price breakout.

Source: Coinglass

Is your wallet green? Check out the LINK Profit Calculator

Right now, Chainlink appears well-positioned for a breakout with increasing network activity, dwindling foreign exchange reserves, and bullish market sentiment.

If it manages to break above $12, it could quickly target higher resistance levels. However, traders should remain cautious as resistance at $12 could trigger a pullback before further gains.