Join our Telegram channel to stay up to date with the latest news

Bitcoin pared some gains after the Federal Reserve kept interest rates steady as expected, retreating from the $90,000 mark after reclaiming it for the first time since last Friday, and falling below $88,000.

The world’s largest cryptocurrency by market capitalization is down 1.2% over the past 24 hours, trading at $87,862 as of 3:53 a.m. EST, with trading activity up 13% and trading volume reaching $49.7 billion.

This decline occurred against a backdrop of a 1.1% decline in the market capitalization of cryptocurrencies. at $3.06 trillion.

Following the sudden move, total liquidations totaled $345.63 million, with long BTC positions at $112.36 million, according to coin mechanism data.

The Fed suspends its interest rate cuts

The US Federal Reserve left interest rates unchanged this month, keeping them between 3.50% and 3.75% following the Fed’s latest meeting, which ended on Wednesday. In December, the Fed cut interest rates by 25 basis points.

Fed officials have recommended a wait-and-see approach given continued inflation and a tight labor market. In most cases, higher interest rates increase the opportunity cost of holding yield-generating assets, such as U.S. Treasury securities.

🚨The FED suspends rate cuts for the first time since mid-2025.

Inflation remains high, uncertainty is high, and the easing cycle is likely coming to an end. pic.twitter.com/HtM1Py2flg

– Wall Street Gold (@WSBGold) January 28, 2026

This in turn reduces the appeal of risky assets such as Bitcoin and stocks, which appears to be the case over the past 24 hours.

On the other hand, lower interest rates generally support non-yielding assets such as Bitcoin by reducing the opportunity cost of holding them.

S&P 500 Index futures, for example, fell 0.52% on January 29, mirroring Bitcoin’s decline on the same day.

Geopolitics adds to risk-averse mood as investors turn to safe-haven assets

Tensions between the United States and Iran escalated this week, after U.S. President Donald Trump told Tehran that time was running out and a huge armada was heading quickly toward the country “with great power, enthusiasm and determination.”

Trump said: “I hope Iran ‘comes quickly to the table’ and negotiates a fair and just deal – NO NUCLEAR WEAPONS – a deal that will be good for all parties. Time is of the essence, it truly is of the essence!”

It’s the clearest indication yet from Trump that he intends to launch some sort of military attack imminently if Iran refuses to negotiate a deal on the future of its nuclear program.

The price of Bitcoin is still in a phase of indecision

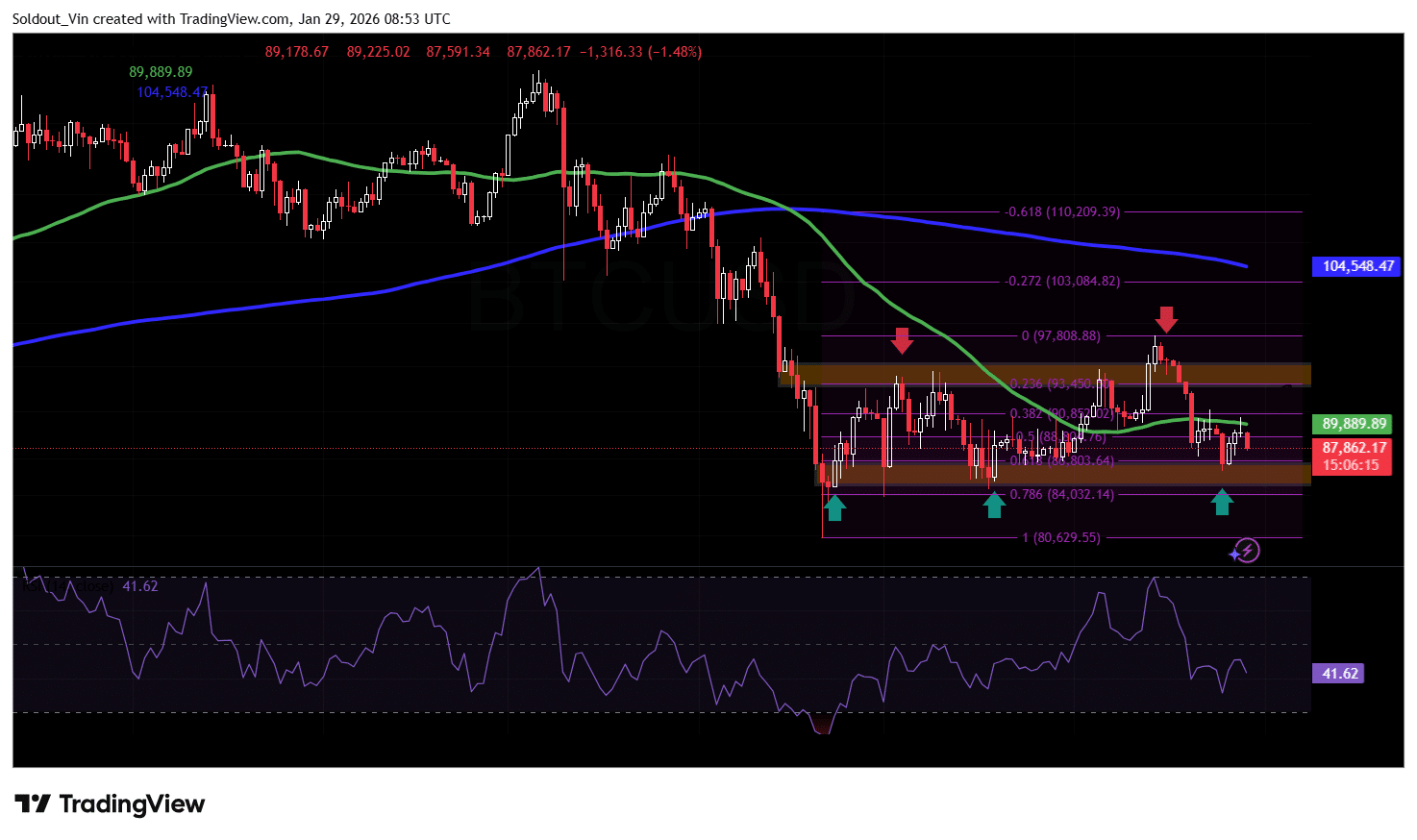

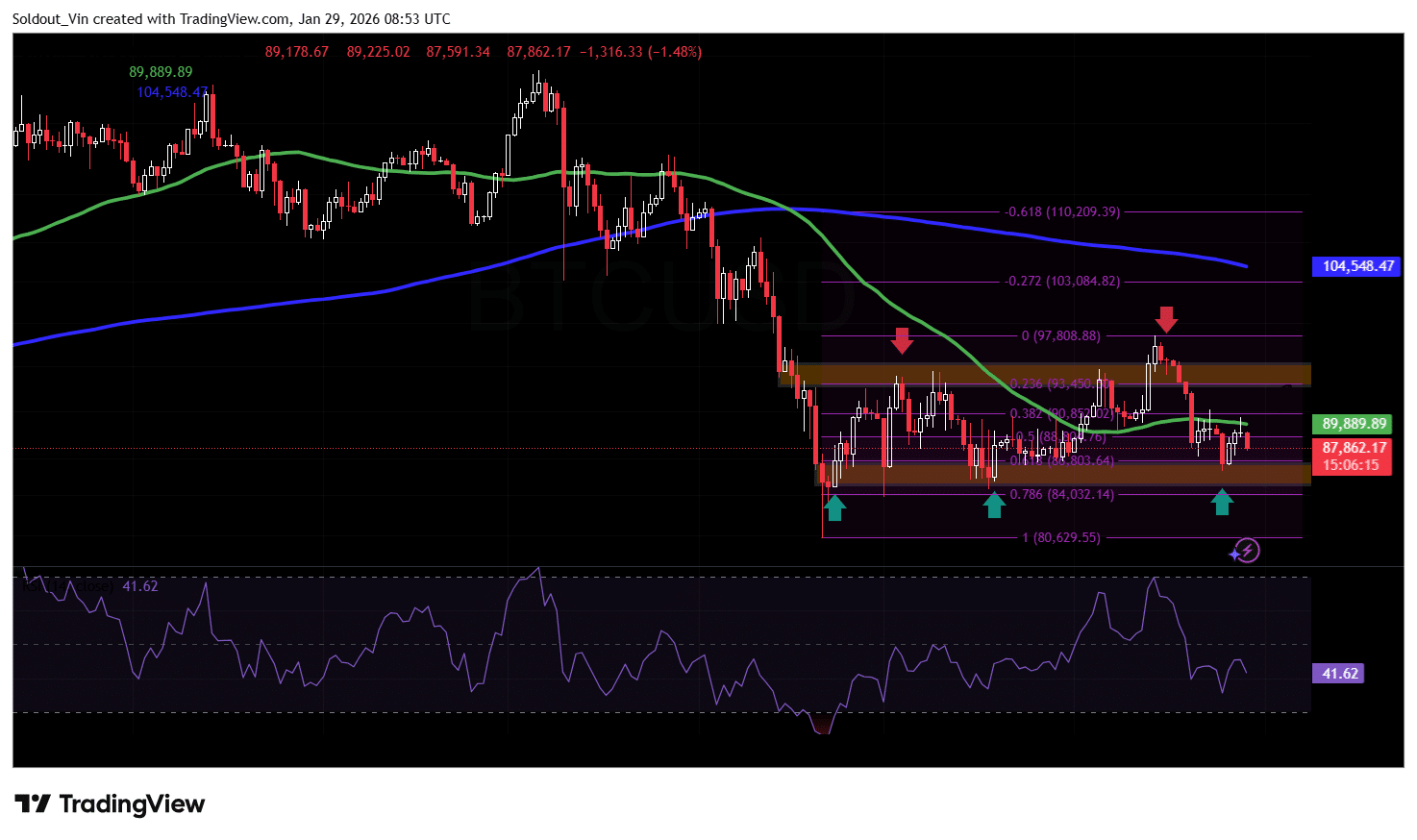

After reaching the all-time high of $126,200 in early October, the Bitcoin Price fell into a sustained decline, reaching the long-term support zone around $80,629. This level then became an area of strong demand, pushing the price towards a recovery around the $95,500 level.

This area now acts as a solid barrier to the upside, serving as a cushion against downward pressure, with BTC price now held in a sideways trend.

After hitting resistance at $97,808 on January 14, Bitcoin pulled back, with the 0.618 Fibonacci level ($86,803) now providing support.

The recent decline pushed BTC price below the 50-day simple moving average (SMA), supporting the current bearish outlook, but still above its current support zone.

Additionally, the Relative Strength Index (RSI) is trading between 37 and 47, indicating continued indecision among investors.

BTC price at a critical moment

Bitcoin appears to be at a critical juncture, with price action consolidating within a range following a sharp corrective move.

The market is currently holding above a key demand zone near lower support, suggesting that buyers are still defending this zone despite the current downside pressure. If BTC manages to stabilize above the 88,000-89,000 area and regain near-term resistance, a relief move towards the 93,000-95,000 area becomes increasingly likely as sellers lose momentum.

Conversely, failure to maintain current support would weaken the consolidation structure and increase the likelihood of continuing towards lower support levels near the previous range lows.

In this case, if BTC falls below the 0.618 Fibonacci level, the next possible support will be at the 0.786 Fibonacci level around $84,302, followed by the $80,629 level.

Related news:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news