- FET remained stable in October, but the bulls continued to consolidate.

- Now he’s ready for an escape, if the right conditions align.

The market was abuzz following the post-election hype, as investors diversified to mitigate risk. This propelled Bitcoin (BTC) to a new all-time high of $77,000. AI tokens were also reaping their rewards, posting impressive weekly gains, with many seeing double-digit increases.

However, Artificial Superintelligence Alliance (FET) remained consolidated despite a 15% gain this week. At press time, it was trading at $1.42, still below its $2 target.

Typically, a bull rally like this would position FET for an exit from its four-month slump. However, its disappointing performance caught the attention of AMBCrypto.

Is FET Ready for a Rebound?

Interestingly, FET has been on a downward trend since October. Despite Bitcoin rising 5%, closing the month near $72,000, this had little to no impact on FET’s price action.

One contributing factor has been the memecoin-led “supercycle,” with significant liquidity flowing into memecoin-based tokens. DOGE, for example, saw an impressive daily gain of 11%.

Unlike previous cycles, this one is marked by a more balanced capital allocation. Small-cap tokens are also seeing double-digit gains, a trend that FET bulls could look to exploit, according to data from CoinMarketCap.

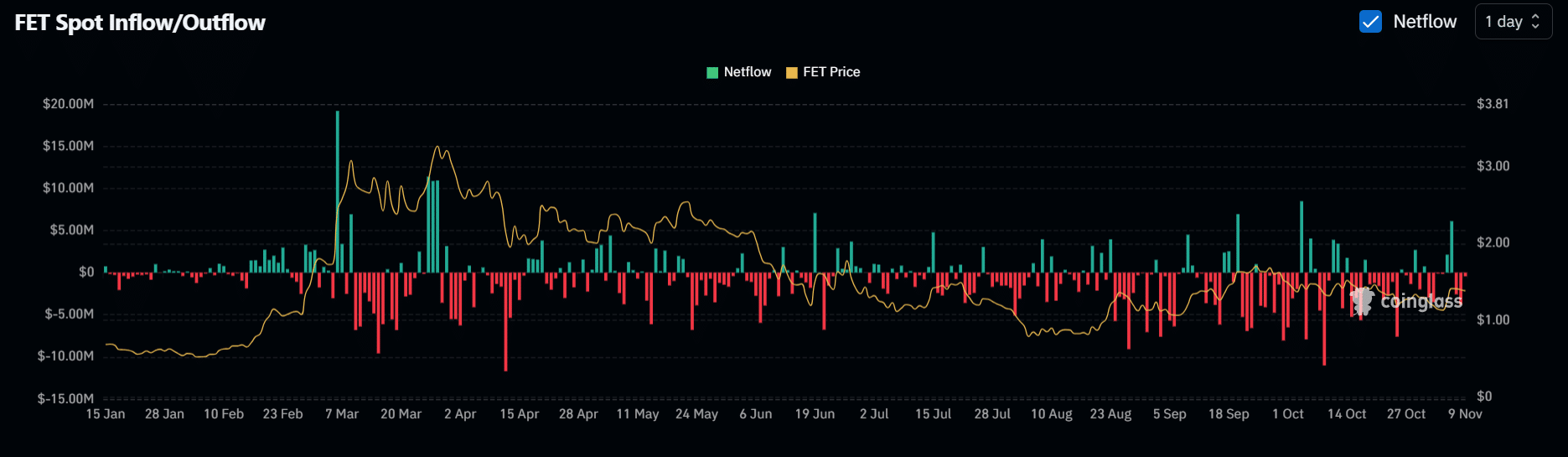

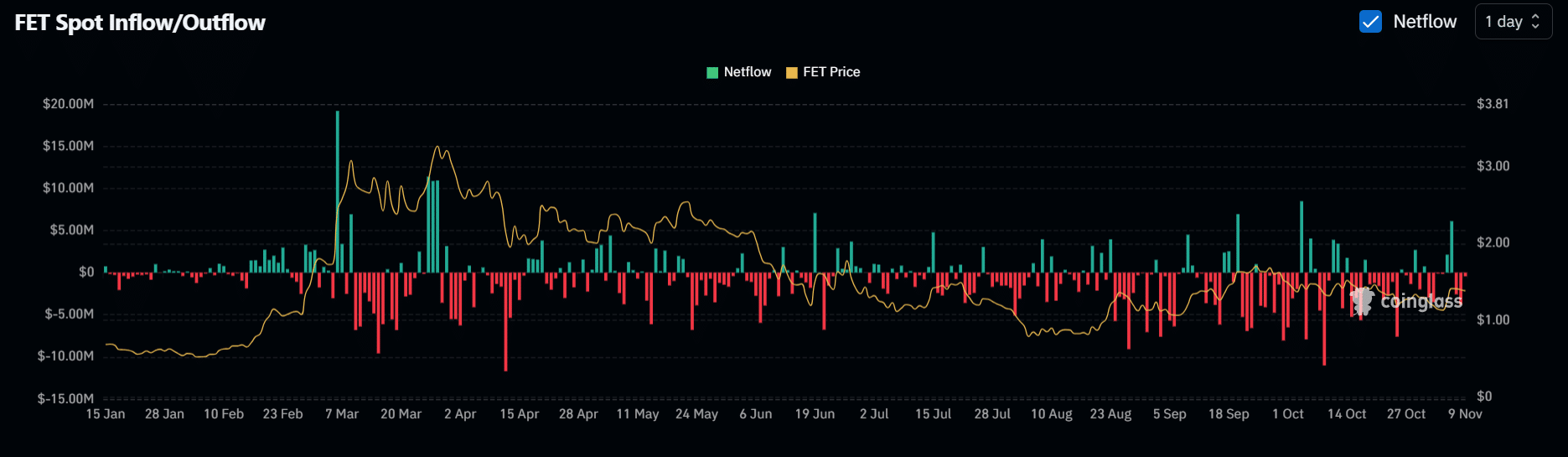

Source: Coinglass

Since mid-June, FET bulls have attempted to break the $0.17 resistance four times, entering an accumulation phase, on-chain data shows.

About a month ago, investors withdrew around $11 million worth of FET tokens from exchanges. This helped keep the FET in a stable range and mitigate potential pullbacks.

However, despite these aggressive buybacks, the expected impact on FET price has not yet materialized, suggesting a possible third buyback.party influence that can counteract the upward momentum.

Short bias could derail the rally

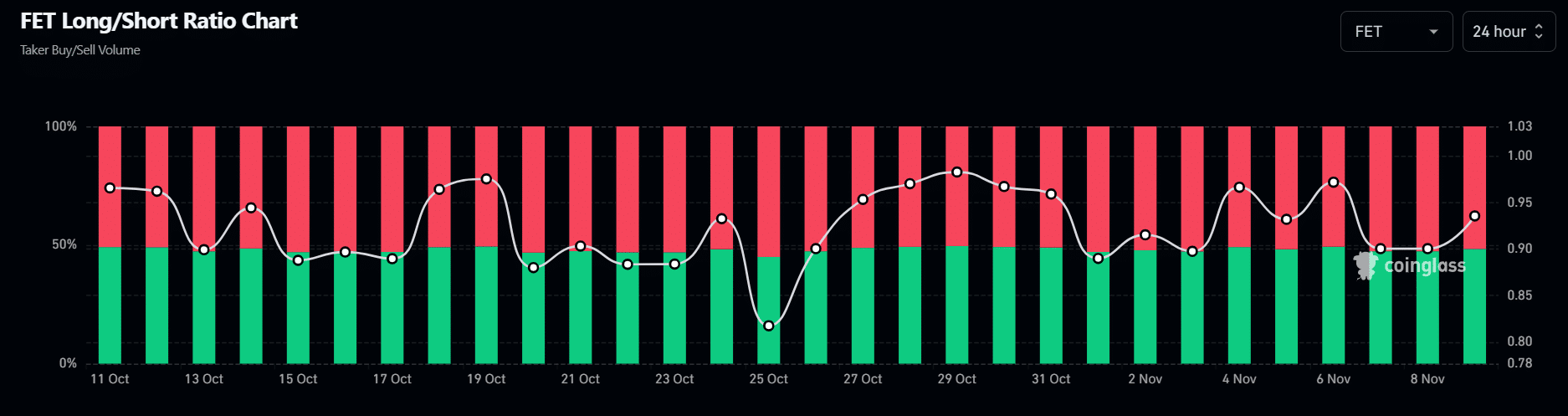

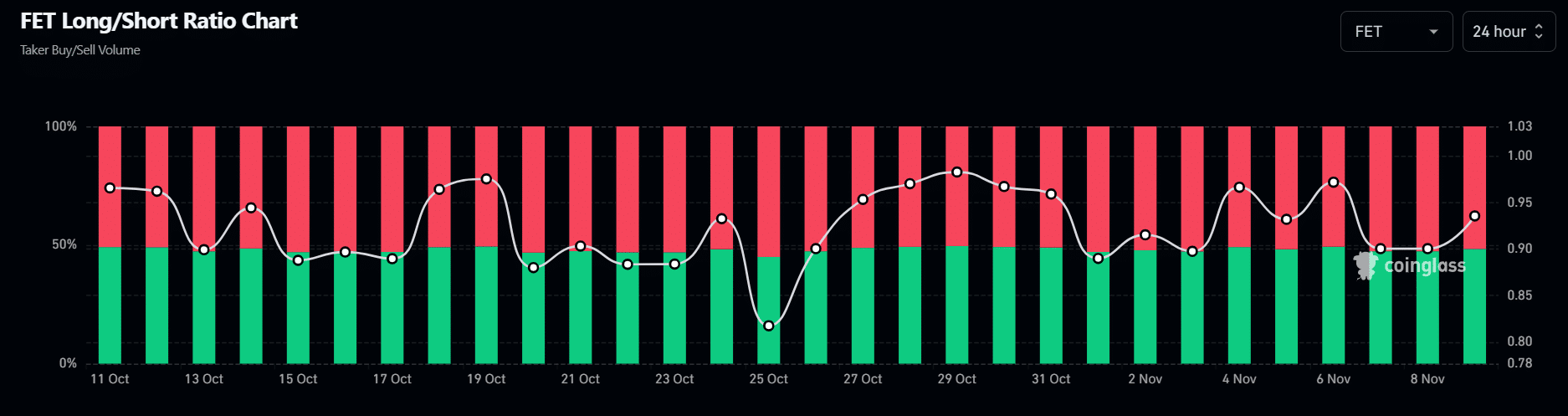

Beyond the inconsistent order book activity of large holders, the FET breakout is largely dependent on the derivatives market, where there is a marked bias towards short selling.

Since October, short sellers have dominated the FET futures market, acting as a significant source of resistance.

However, there is a problem: a large volume of short positions could quickly reverse if market dynamics change against them. And there’s no better time than now.

Source: Coinglass

As mentioned earlier, investors were diversifying their portfolios, with many focusing on small-cap tokens. This trend is notable, especially as BTC approaches a high-risk zone.

Read Artificial Superintelligence Alliance (FET) Price Forecast 2024-2025

While spot traders targeting the downside is a bullish sign, it might not be enough to cause a breakout. For this to happen, large holders must avoid offloading their positions.

This would allow strong buying interest to trigger a short squeeze and set the stage for a bullish rebound.

In other words, FET has the right ingredients for a possible breakout. With the RSI in a neutral phase, a few alignment conditions could push FET above its $0.17 resistance and put it on track towards a $2 target.