The digital asset market organized a significant recovery during last week after the end of September crisis. The interest of investors began to return, driven by a new appetite for security assets due to the uncertainty caused by the first closure of the United States government in six years.

The growing demand for assets with packages can see Bitcoin Btcusd Follow the Gold rally, potentially leading to a new summit of $ 150,000 before the end of the year, according to the founder of Capriole Investments, Charles Edwards. Bitcoin recovered above the $ 120,000 mark on Thursday for the first time since August 14 and continued to be negotiated over $ 120,122 when writing the editorial’s time on Friday.

Elsewhere, the balloon financial deficit of the Central Bank of France can provide another Bitcoin catalyst, because it can lead to “billions of euros” of money printing by the European Central Bank (ECB), signaling a new liquidity flowing in Bitcoin, according to Arthur Hayes, co-founder of Cryptourrency Exchange Bitmex.

Bitcoin $ 120,000 Breakout will lead to a “very fast movement” at $ 150,000: Charles Edwards

Bitcoin can reach a new summit of $ 150,000 before the end of 2025 while investors accumulate in security assets in complete safety alongside gold, according to the founder of Capriole Investments, Charles Edwards.

Bitcoin recovery over the psychological brand of $ 120,000 could lead to a “very fast” escape at a record level of $ 150,000, Edwards told Cointelegraph during an interview with Token2049 in Singapore. “I would not be surprised if we went up to $ 150,000 in a short time, as we have to get out of the range of $ 120,000. But that is probably happening, potentially in the coming days.”

Bitcoin increased by more than 6% last week, recovering above the bar of $ 118,500 for the first time since August 15, according to data.

Edwards’ prospects are more conservative than some other analysts, which provide that the current cycle could push Bitcoin over $ 200,000.

André Dragosch, head of European research at Bitwise Asset Management, told Cintelegraph that the inclusion of the crypto in the United States 401 (K) retirement plans could unlock $ 122 billion in new capital. Even an allowance of 1% by retirement managers, he said, may be sufficient to withdraw bitcoin over $ 200,000 before the end of the year.

Wood cathie: hyperliquid “reminds me Solana in the first days”

Ark Invest CEO, Cathie Wood, compared the hyperliquid to the promise at an early stage of Solana, calling it “the new kid on the block”.

“It’s exciting. It reminds me of Solana in the first days, and Solana has proven its value and is, you know, with the big boys,” said Wood during a recent interview on the “Master Investor” podcast.

Ark Invest currently has three main cryptography assets in its public funds: Bitcoin, Ether (ETH) and Solana (Sol). The company’s exhibition in Solana is done through Breera Sports, which Wood has clarified is linked to the Treasury of Solana and supported by investors from the Middle East. She also noted advisory links with the project through the economist Art Laffer.

Wood did not confirm any position in the hyperliquid, but described the protocol like the one to watch. His remarks intervene as the competition between perpetual term contracts of Dexs has warmed up after Aster launched a token earlier this month and given his trading volume and his open hyperliquid past interest.

Roman Storm is looking for a acquittal of the Tornado cash transmission transmission

Roman Storm, co-founder of Tornado Cash, asked an American federal judge to pay him for his only conviction for transmission of money without license and the counts of a suspended jury for money laundering and infringements to sanctions, arguing that prosecutors did not prove that he intended to help the bad actors to misuse the crypto mixer.

According to legal documents filed on September 30 at the American district court in the South District of New York and examined by Cointtelegraph, the defense of Storm argued that the prosecutors had not proven that he intended to help the bad actors to use the tornado in cash. According to the defense, this would cancel the reasons for his conviction on the basis of an negligent inaction.

“Storm and the bad actors were an assertion that he knew they used tornado money and did not take enough measures to stop them. It is a theory of negligence,” the motion said.

Defense also said that “the lack of affirmative evidence that Mr. Storm had acted with the intention of helping the bad actors”, the government has tried to respond to its office of will by affirming that the defendant did not prevent improper use. “This is an assertion which is contrary to the standard of will and not supported by law,” said the movement.

An acquittal request asked the judge to reject the accusations and the verdict because proof of the accusation, even if it is considered true, is legally insufficient.

The thrust of dry tokens stocks has clear advantages for crypto: Dragonfly Exec

Tokenized actions will be a great advantage for the traditional markets, but may not be a boon for the cryptographic industry that others have predicted, explains Rob Hadick, general partner of the Société de Venture Crypto Dragonfly.

“There is no doubt that this has a great effect on Tradfi,” Hadick told Cointelegraph at the Token 2049 conference in Singapore. “They want 24/7 trading, it’s better for their economy.”

However, he saw clear advantages for the main cryptography players in the tokenization space of real assets, like Ethereum.

The American Securities and Exchange committee would have developed a plan to allow blockchain actions to negotiate crypto exchanges after many financial institutions pushed the regulator to allow markets that are still open.

Hadick said that institutions “did not want to be directly on these chains for general use”, giving Robinhood and Stripe as examples of those who build their own blockchains.

“They don’t want to share the economy. They do not want to share a block space with same. They want to be able to control things like confidentiality (and) which is the set of validators, they want to be able to control what is happening in their execution environment. ”

Centralized exchanges will be defined in 5 to 10 years: 1inch co-founder

The exchanges of centralized crypto could disappear during the next decade while decentralized finance aggregators (DEFI) take over, according to the co-founder of 1Inch Sergej Kunz.

In an interview with Cointtelegraph in Token2049 in Singapore, Kunz predicted that the exchanges will slowly pass in fronetons for decentralized exchanges (DEX). “I think it will take five to 10 years,” he said.

Kunz argued that if centralized exchanges are isolated markets, 1 inch and its aggregator act as a global liquidity center. His comments came while 1INCH announced an agreement with the Crypto Coinbase Crypto Major, integrating its service to provide trading DEX to its users.

Kunz has said that investments in onchain systems through centralized exchanges show their understanding that the technology on which they have “will not remain forever because you have decentralized exchanges and digital finances”.

“They don’t want to miss the train and stay behind, and they adopt our technology, because it is something that, from our point of view, will allow the entire financial industry,” he said.

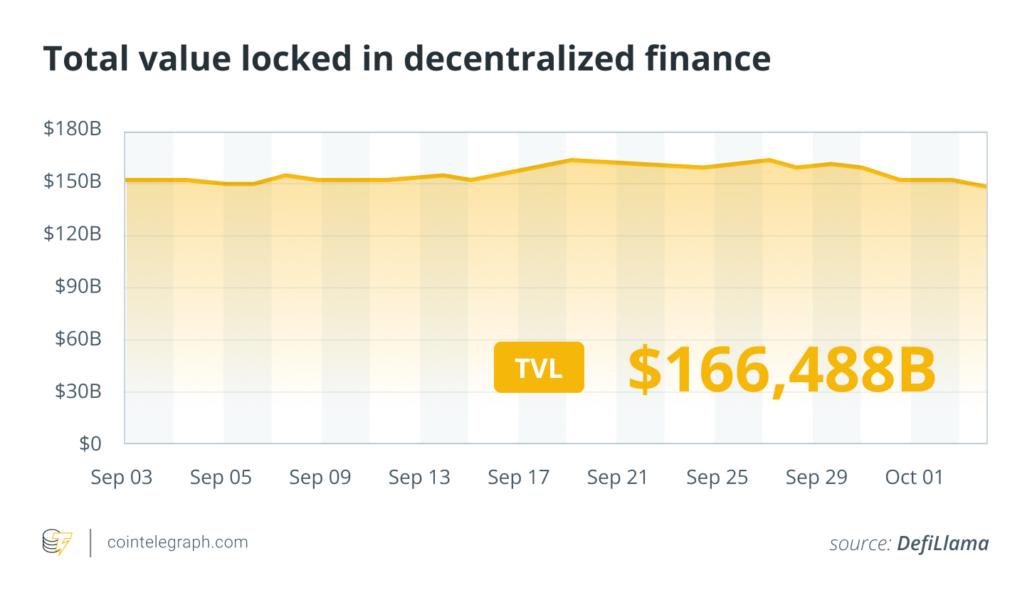

Presentation of the DEFI market

According to Cointelegraph Markets Pro and TradingView data, most of the 100 largest cryptocurrencies by market capitalization ended the week in green.

The ZCASH token (ZEC) preserving confidentiality increased by more than 157% as the largest winner of the week in the top 100, followed by the dexon token (dex) up more than 34% on the weekly graphic.

Thank you for reading our summary of the most impactful DEFI developments this week. Join us next Friday for more stories, information and education concerning this dynamically advanced space.