Cryptocurrency markets showed signs of consolidation during the second week of October, even as investors continued to bet on another “Uptober” rally to new highs.

This week, the news also focused on Bitcoin, worth $11 billion. BTCUSD whale who returned after a two-month hiatus to transfer another $360 million in BTC, signaling a potential rotation to the world’s second-largest cryptocurrency, with another $5 billion remaining in its wallet.

In another potential catalyst for Uptober, the U.S. Securities and Exchange Commission (SEC) received 31 applications for crypto exchange-traded funds (ETFs), including 21 filed in the first eight days of October.

However, the current government shutdown could slow the regulatory response to these requests, with the SEC saying it will operate “under modified conditions” with an “extremely limited number of employees” until a funding bill is passed.

As Democrats and Republicans failed to reach an agreement for the seventh time on Thursday, the government shutdown will extend into next week as the Senate leaves town until Tuesday, CBS News reported.

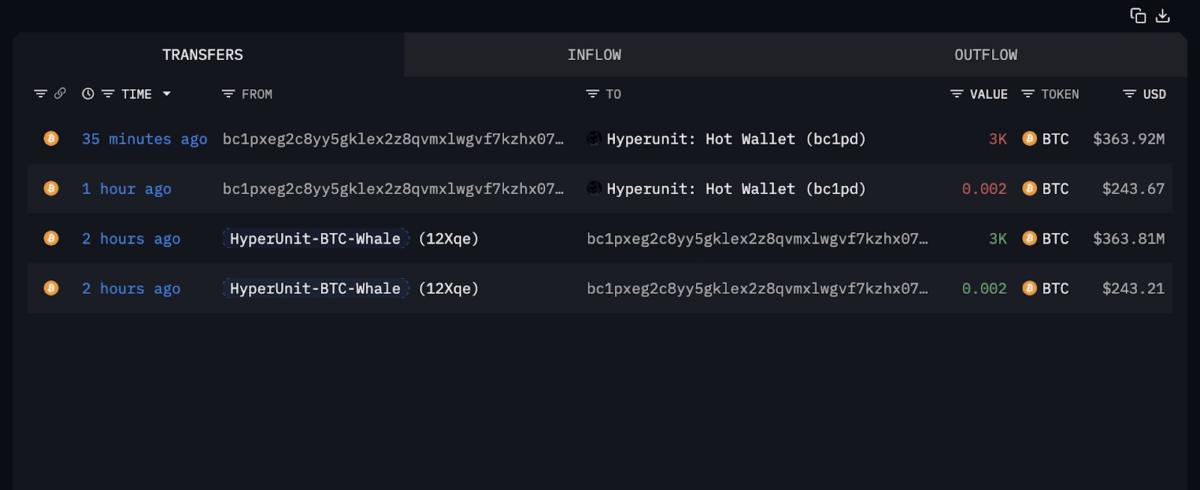

$11 Billion Bitcoin Whale Returns With $360 Million BTC Transfer After Two Months

A Bitcoin whale that held around $11 billion in BTC before turning over $5 billion of its stash into Ether (ETH) two months ago has returned to the cryptocurrency market with an additional transfer of $360 million into Bitcoin.

The whale address moved $360 million worth of Bitcoin into decentralized finance (DeFi) protocol Hyperunit’s hot wallet “bc1pd” on Tuesday. This is their first transfer in two months, according to blockchain data platform Arkham.

The transfer may signal another rotation into Ether, depending on the whale’s transaction patterns.

The $11 billion Bitcoin whale surfaced two months ago and turned around $5 billion worth of BTC into Ether, briefly overtaking the second-largest corporate treasury company, Sharplink, in terms of total ETH holdings, Cointelegraph reported on September 1.

The whale still held more than $5 billion worth of Bitcoin in its main wallet as of Wednesday, signaling stronger potential selling pressure for the world’s top cryptocurrency.

The Bitcoin whale began turning its funds into Ether on August 21 when it sold $2.59 billion worth of BTC for a $2.2 billion spot Ether and a $577 million Ether perpetual long position.

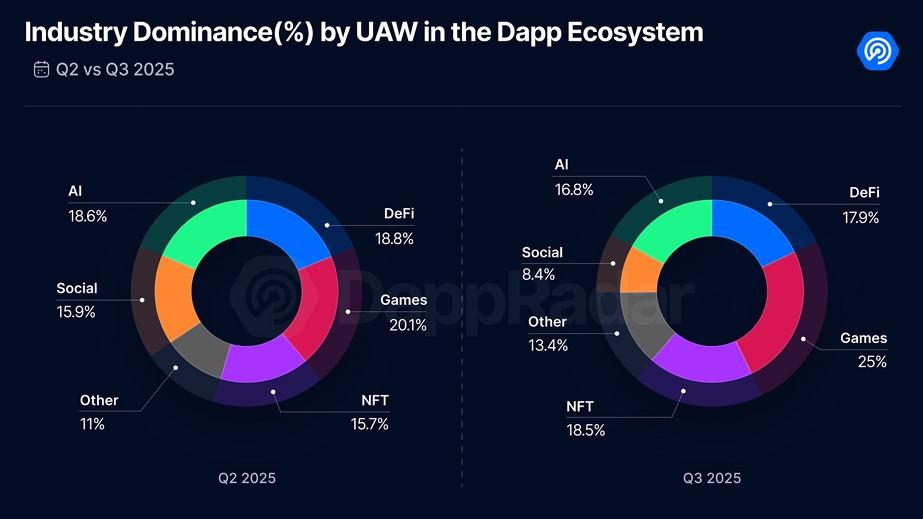

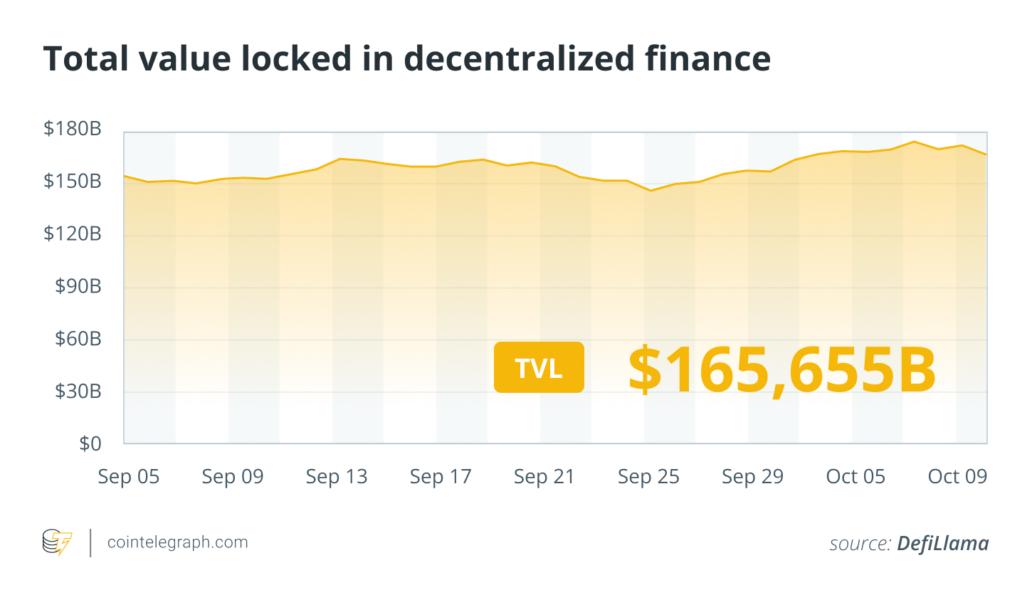

DeFi TVL hits record $237 billion as daily active wallets fall 22% in Q3: DappRadar

The decentralized applications (DApp) sector ended the third quarter of 2025 with mixed results, as decentralized finance (DeFi) liquidity reached an all-time high while user activity fell sharply, according to new data from DappRadar.

In a report sent to Cointelegraph, DappRadar said daily unique active wallets averaged 18.7 million in the third quarter, down 22.4% from the second quarter. Meanwhile, DeFi protocols have collectively locked $237 billion, the highest total value locked (TVL) ever recorded in the space.

The report highlighted a persistent divergence between institutional capital flowing into blockchain-based financial platforms and retail user engagement with DApps. While DeFi TVL reached record liquidity levels, overall activity lagged, suggesting lower retail participation.

“Looking at the quarter as a whole, every category noted a decline in active wallets, but the impact was primarily felt in the Social and AI categories,” DappRadar wrote. AI-focused DApps lost more than 1.7 million users, falling from a daily average of 4.8 million in Q2 to 3.1 million in Q3, while SocialFi DApps fell from 3.8 million to 1.5 million in Q3.

Japan’s new prime minister could boost crypto economy and ‘fine tune’ blockchain regulations

Japan’s newly elected Prime Minister Sanae Takaichi could open the door to more “refined” regulations to boost the country’s cryptocurrency economy, which could become the next global hub for crypto companies.

Takaichi was elected leader of the Liberal Democratic Party (LDP) on Saturday and is expected to become Japan’s first female prime minister when she takes office on October 15.

Experts believe his leadership could usher in a more open stance toward technological experimentation, including blockchain innovation, while maintaining Japan’s rigorous regulatory standards.

Takaichi’s election could have a “material impact on the perception and governance of digital assets in the country,” according to Elisenda Fabrega, general counsel of tokenization platform Brickken.

In previous public positions, Takichi has expressed support for “technological sovereignty,” mentioning the “strategic development of digital infrastructure, including blockchain technology,” Fabrega told Cointelegraph. “From a legal perspective, this suggests that his administration could adopt a posture that is not only permissive but potentially proactive in promoting the digital economy. »

Fabrega added that Takaichi’s political positioning could strengthen Japan’s “commitment to legal certainty in the crypto space” and renew interest in the country as an innovation-friendly crypto hub.

The Japanese government recognizes blockchain as a “pillar of its digital transformation strategy,” said Maarten Henskens, chief operating officer of Startale Group and director of the Astar Foundation.

“A looser monetary outlook under the new leadership could maintain liquidity and fuel investor appetite for alternative assets, including cryptocurrencies,” Henskens told Cointelegraph.

“At Startale and Astar, we view this as a strong environment to continue to advance the Japanese Web3 ecosystem,” he added.

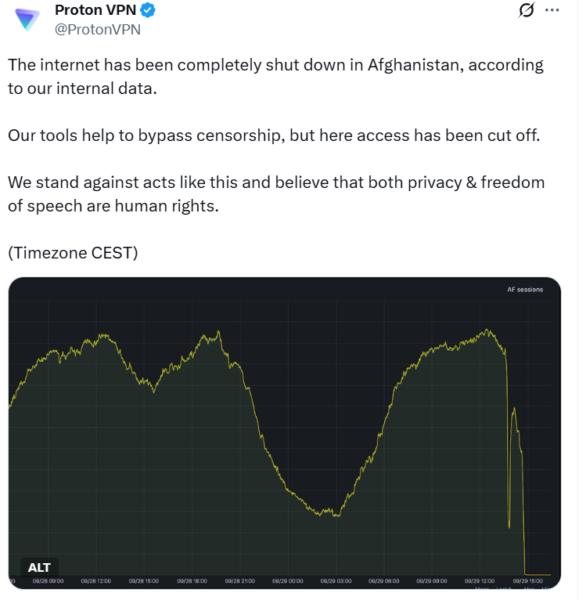

Afghanistan’s internet outage is ‘a wake-up call’ for blockchain decentralization

The recent nationwide internet outage in Afghanistan highlighted a critical weakness of the world’s leading decentralized blockchains: their reliance on centralized internet providers that remain vulnerable to government intervention and technical outages.

The country suffered a near-total internet blackout that lasted about 48 hours before connectivity was restored on October 1, Reuters reported. The disruption was reportedly ordered by the Taliban administration, although officials later blamed “technical problems” with fiber optic cables.

While blockchains aim to provide people with a censorship-resistant public network for value transfers, their reliance on centralized internet providers makes these use cases difficult in the event of an outage.

“The power outage in Afghanistan is not just a regional connectivity crisis: it is a wake-up call,” said Michail Angelov, co-founder of decentralized WiFi platform Roam Network. “When connectivity is monopolized by a handful of centralized providers, the promise of blockchain can collapse overnight,” he added.

The nationwide outage of internet and mobile data services affected approximately 13 million citizens, according to a September report from ABC News. It was the first nationwide internet shutdown under Taliban rule, following regional restrictions imposed earlier in September to curb online activities deemed “immoral”.

The Taliban denied the ban, blaming the internet outage on technical problems, including fiber optic cable problems.

Iran has also faced problems with internet censorship since the start of its conflict with Israel.

The Iranian government shut down internet access for 13 days in June except for domestic messaging apps, prompting Iranians to search for hidden internet proxy links for temporary access, The Guardian reported on June 25.

$10B worth of Ethereum awaits release as validator withdrawals surge

Ethereum recorded its largest validator exit on record this week, with over 2.4 million Ether worth over $10 billion awaiting removal from its proof-of-stake network, but institutional participants are replacing much of that sum in the validator entry queue.

Ethereum’s release queue on Wednesday surpassed 2.4 million Ether, worth over $10 billion. The spike in outputs extended the validator wait time to over 41 days and 21 hours, according to blockchain data from ValidatorQueue.com.

Validators are responsible for adding new blocks and verifying transactions on the Ethereum network, playing a vital role in its operation.

“Large withdrawals always mean there is a chance the tokens could be sold, but that does not necessarily equate to token sales,” said Nicolai Sondergaard, research analyst at crypto intelligence platform Nansen, adding that “there is no need to worry about that alone.”

Although the $10 billion withdrawal queue is large, validators are most likely “consolidating stakes from 32 ETH to 2,048 ETH for operational efficiency,” according to Marcin Kazmierczak, co-founder of Oracle blockchain company RedStone.

This includes increasing entries into liquid staking protocols to improve “capital efficiency,” he told Cointelegraph, adding:

“Much of the withdrawn ETH is redeployed within DeFi, not sold.”

“The withdrawal period of more than 44 days creates a natural brake preventing supply shocks,” he explained, adding that Ether’s daily volume of $50 billion is still five times larger than the validator queue.

DeFi Market Overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the green.

Privacy-preserving token Zcash (ZEC) rose over 68% to become the week’s biggest gainer in the top 100 for the second week in a row. The Mantle token (MNT) rose over 18% in the second best performance of the week.

Thank you for reading our summary of this week’s most notable DeFi developments. Join us next Friday for more stories, ideas and information about this dynamically evolving space.