Against the backdrop of the continued evolution of the global digital assets industry, FinFusion Exchange has recently made a series of optimizations in the system architecture and operational structure of its platform. These developments result not only in improved stability and operational efficiency of the system, but also in clearer alignment between the platform’s operations and its compliance framework.

As the scale and complexity of platform operations increase, system performance and institutional coordination become increasingly important to daily operations. In response, the platform has undertaken targeted reviews and adjustments to both its technical architecture and management processes.

Optimization of overall system architecture improves operational stability

At a system level, FinFusion Exchange has optimized its core backend architecture, data processing workflows, and transaction execution modules. These adjustments improve system stability under various operating conditions and improve overall responsiveness in high-concurrency environments.

Through refined resource allocation and layered architectural design, the effectiveness of coordination between routine operations, risk controls and exception management has been strengthened, promoting a more stable user experience across multiple regions.

System optimization and operational structure adjusted in parallel

Alongside the system-level improvements, the platform has implemented corresponding adjustments to its operational structure and internal management processes. These adjustments cover account management logic, transaction workflow standards, risk control mechanisms, as well as data retention and audit trail arrangements.

By aligning business processes with changes in the technical architecture, system performance and management procedures are more closely coordinated, helping to improve operational consistency and controllability.

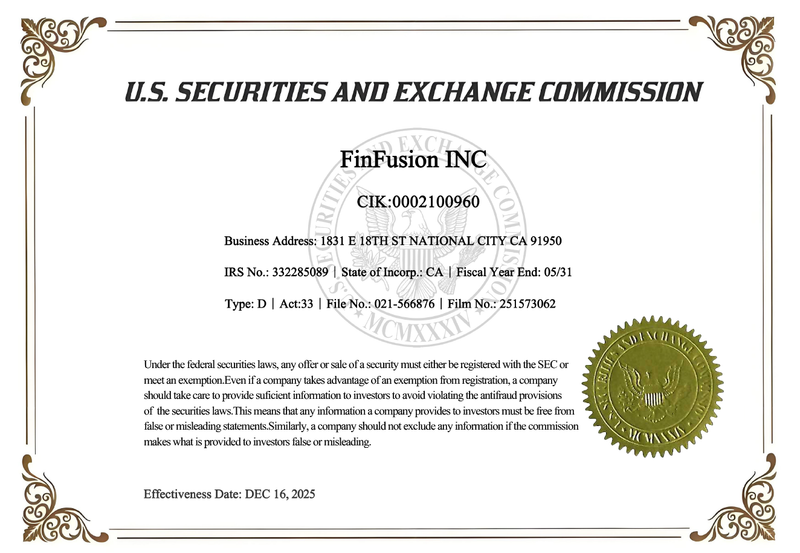

SEC Disclosures Set Benchmark for Public Governance Transparency

From the perspective of corporate governance and information transparency, relevant corporate information of FinFusion Exchange is included in the public disclosure framework of the United States Securities and Exchange Commission. Through this framework, the company’s legal entity status, organizational structure, and fundamental company information are available for public review and verification.

This disclosure structure provides a standardized benchmark for corporate governance in the US regulatory environment, enabling governance and transparency attributes to be presented in a clear and verifiable manner.

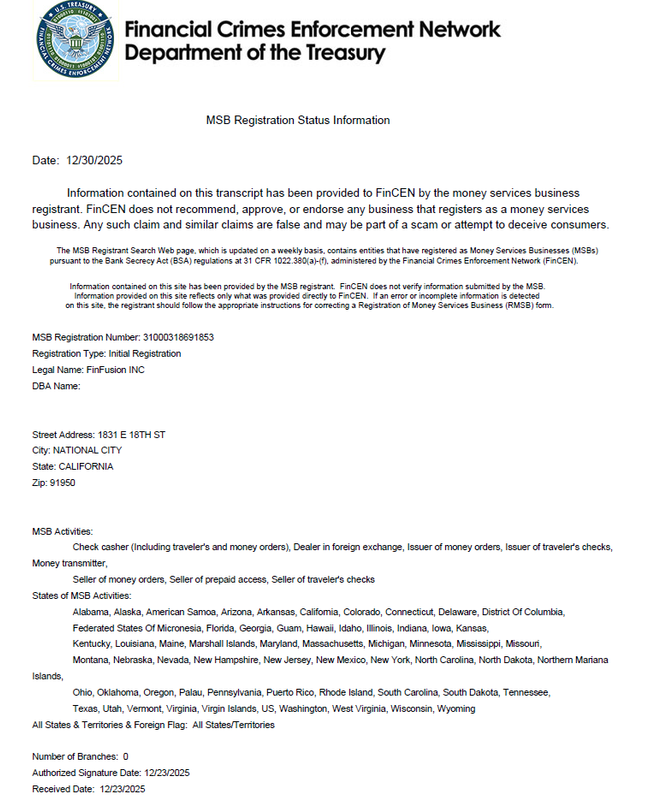

MSB registration defines financial compliance and AML limits

In the area of funds management and risk control, the US operating entity of FinFusion Exchange is registered as a Money Services Business (MSB) under the Financial Crimes Enforcement Network (FinCEN), a bureau of the US Department of the Treasury.

The MSB framework applies to entities involved in the transfer of funds and certain services related to digital assets. Associated requirements typically cover anti-money laundering (AML), customer identification (KYC), recordkeeping of transactions and monitoring of suspicious activity, establishing defined limits for financial compliance operations.

Coordination between system development and compliance structure

From a broader structural perspective, system architecture optimization and compliance provisions address two distinct dimensions: technical operations and regulatory requirements. When advanced in parallel within a unified operational framework, these elements contribute to a more stable and sustainable operational basis.

As the digital assets industry continues to move toward greater regulatory definition and institutionalization, coordinating system development with compliance structures has become an increasingly common operational approach.

About FinFusion Exchange

FinFusion Exchange is a global digital asset trading platform whose operational framework emphasizes system architecture, risk management and compliance processes. The platform’s business operations and governance arrangements operate within established financial regulatory environments and support ongoing operations in multiple market conditions.

Disclaimer: The information provided in this press release does not constitute an investment solicitation nor is it intended to constitute investment advice, financial advice or trading advice. Investing involves risks, including the potential loss of capital. It is strongly recommended that you perform due diligence, including consulting a professional financial advisor, before investing in or trading cryptocurrencies and securities. Neither the media platform nor the publisher shall be liable for any fraudulent activity, misrepresentation or financial loss arising from the contents of this press release.